Question: I have the answer for #1 and #2. Please help me on #3. 1. Answer the questions below using the DSS model: a) When fixed

I have the answer for #1 and #2. Please help me on #3.

1. Answer the questions below using the DSS model:

a) When fixed cost is 1000, unit variable cost is 4, unit price is 10, and sales quantity is 800, what are the total cost, total revenue, net profit, and break-even quantity?

b) When fixed cost is 1500, unit variable cost is 6, unit price is 14, and sales quantity is 1000, what are the total cost, total revenue, net profit, and break-even quantity?

c) When fixed cost is 2000, unit variable cost is 10, unit price is 8, and sales quantity is 500, what are the total cost, total revenue, net profit, and break-even quantity?

2. Goal Seeking Analysis: Set Fixed Cost 500, Unit Cost 5, Sales Quantity 500; Set Cell: G10 (net profit) to Value: 2000, By Changing Cell: C8. What is the Unit Price?

2. Goal Seeking Analysis: Set Fixed Cost 500, Unit Cost 5, Sales Quantity 500; Set Cell: G10 (net profit) to Value: 2000, By Changing Cell: C8. What is the Unit Price?

a) With fixed cost of $700, unit variable cost of $6, and unit price of $9, what the sales quantity would be in order to make a net profit of $2,000?

b) With fixed cost of $700, unit variable cost of $6, what the unit price would be in order to have a break-even quantity of 100?

3. What-if Analysis: Low Cost Scenario: Fixed Cost (C4) = $500, Variable Cost (C6) = $2; High Cost Scenario: Fixed Cost (C4) = $1,500, Variable Cost (C6) = $8

a) With unit price of $6, what the break-even quantity would be under low-cost scenario?

b) With unit price of $6, what the break-even quantity would be under high-cost scenario?

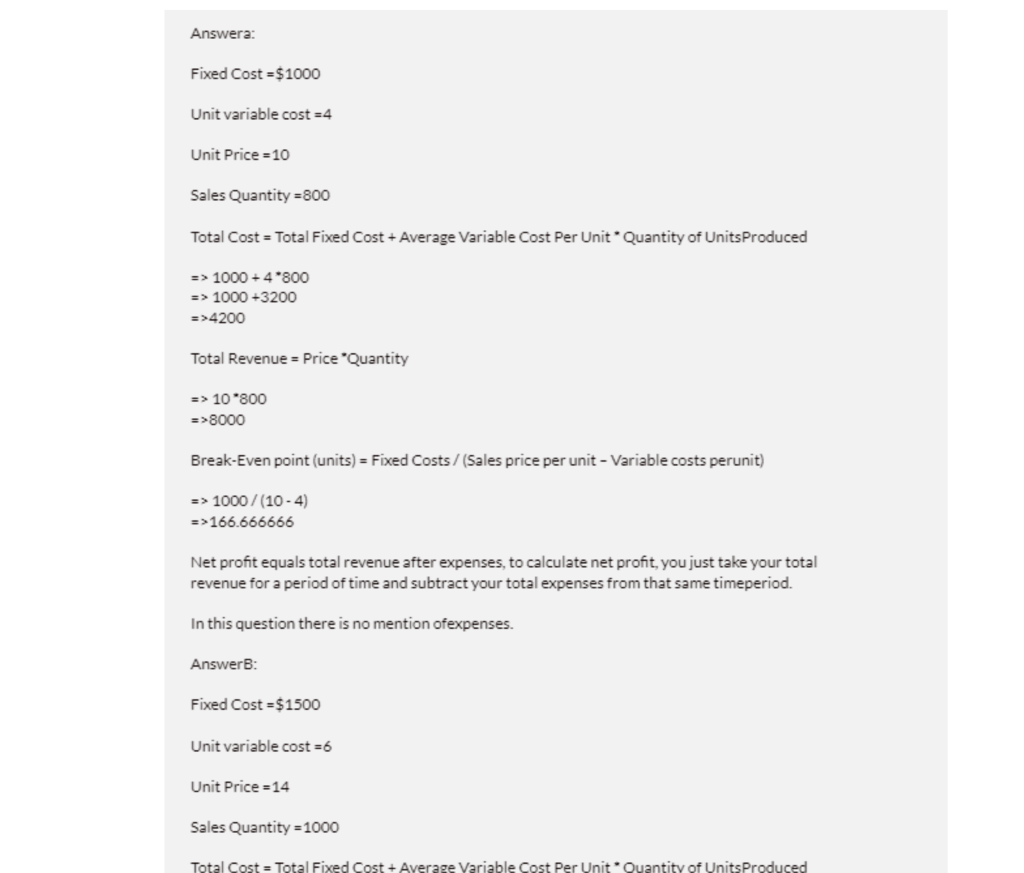

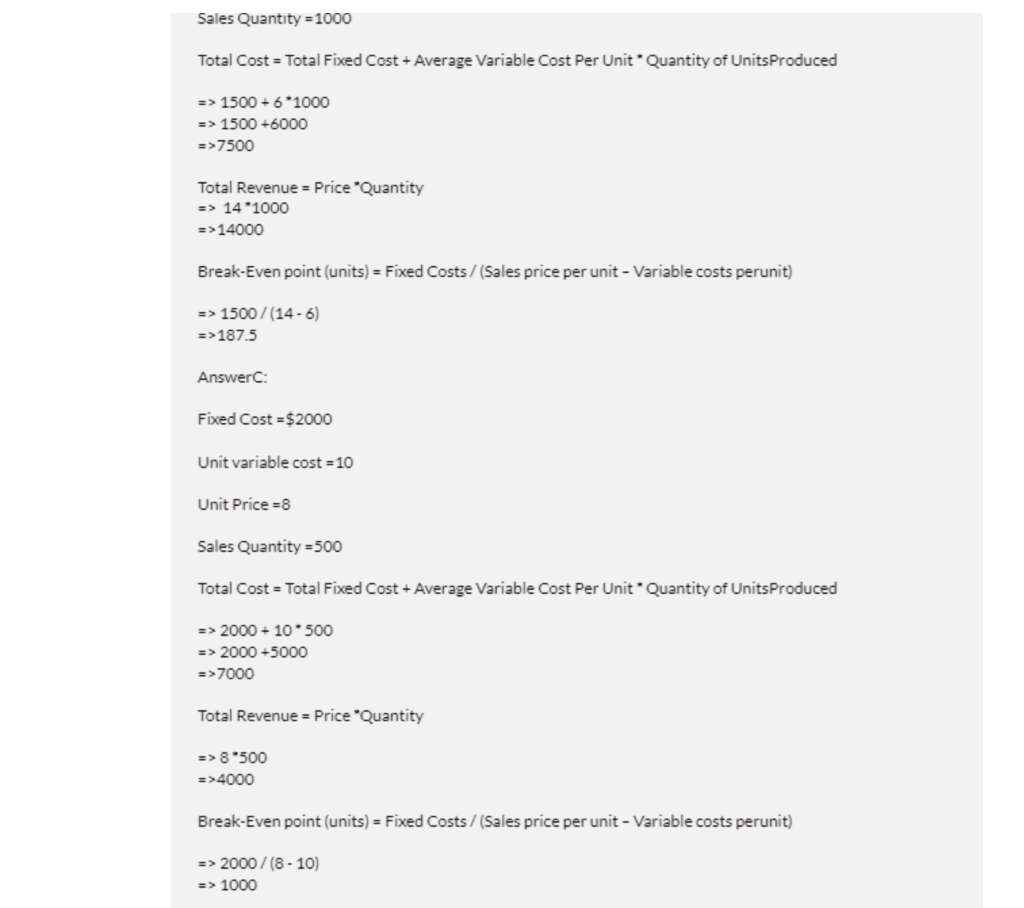

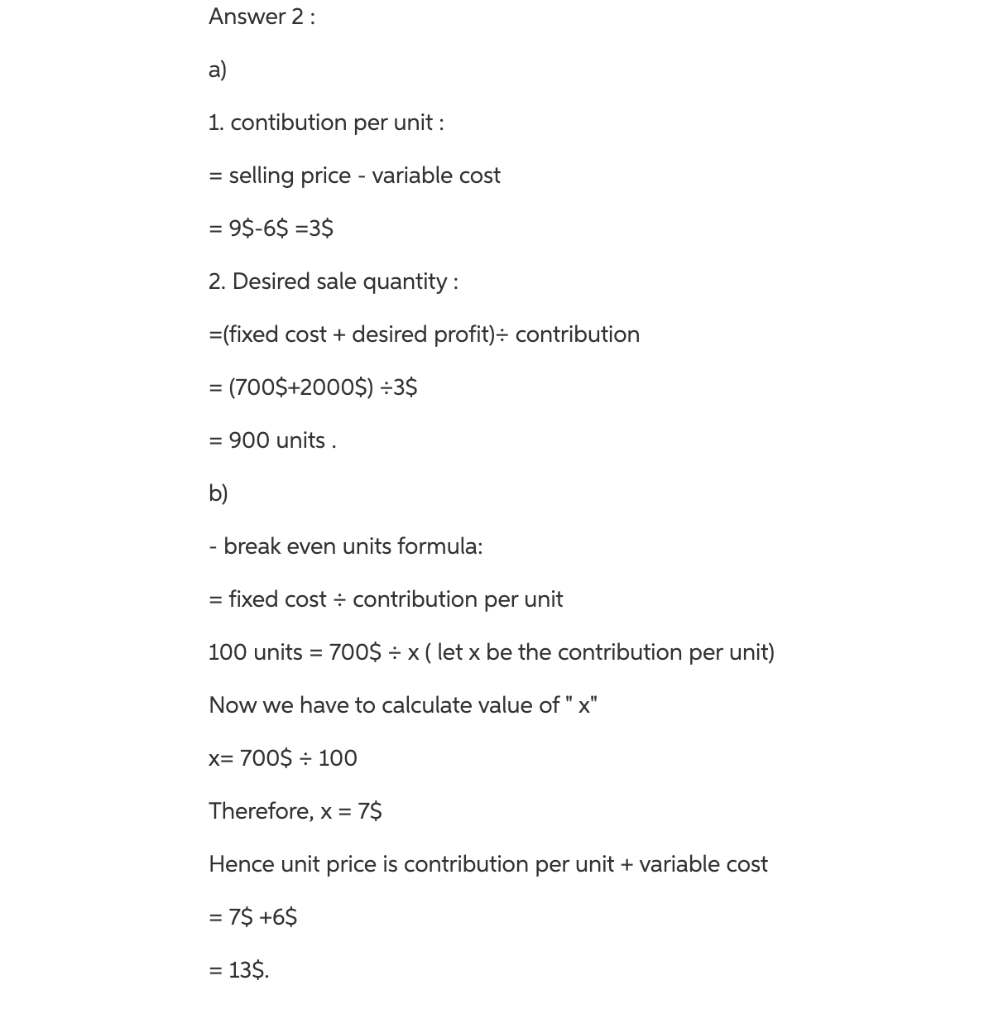

Answera: Fixed Cost = $1000 Unit variable cost=4 Unit Price = 10 Sales Quantity=800 Total Cost = Total Fixed Cost + Average Variable Cost Per Unit. Quantity of Units Produced => 1000 +4*800 => 1000+3200 => 4200 Total Revenue = Price Quantity => 10800 => 8000 Break-Even point (units) = Fixed Costs/(Sales price per unit - Variable costs perunit) => 1000/(10-4) => 166.666666 Net profit equals total revenue after expenses, to calculate net profit, you just take your total revenue for a period of time and subtract your total expenses from that same timeperiod. In this question there is no mention ofexpenses. Answer: Fixed Cost = $1500 Unit variable cost =6 Unit Price = 14 Sales Quantity = 1000 Total Cost = Total Fixed Cost + Average Variable Cost Per Unit Ouantity of Units Produced Sales Quantity = 1000 Total Cost = Total Fixed Cost + Average Variable Cost Per Unit Quantity of Units Produced => 1500 + 6*1000 => 1500-6000 => 7500 Total Revenue = Price Quantity => 14*1000 => 14000 Break-Even point (units) = Fixed Costs/(Sales price per unit - Variable costs perunit) => 1500/(14-6) => 187.5 Answer: Fixed Cost = $2000 Unit variable cost = 10 Unit Price = 8 Sales Quantity =500 Total Cost = Total Fixed Cost + Average Variable Cost Per Unit Quantity of Units Produced => 2000 + 10 * 500 => 2000 +5000 => 7000 Total Revenue = Price Quantity => 8500 =>4000 Break-Even point (units) - Fixed Costs/(Sales price per unit - Variable costs perunit) => 2000/08 - 10) => 1000 Answer 2 : a) 1. contibution per unit: = selling price - variable cost = 9$-6$ = 3$ 2. Desired sale quantity : =(fixed cost + desired profit) = contribution = (700$+2000$) =3$ = 900 units. b) - break even units formula: = fixed cost = contribution per unit 100 units = 700$ = x( let x be the contribution per unit) Now we have to calculate value of "X" x= 700$ = 100 Therefore, x = 7$ Hence unit price is contribution per unit + variable cost = 7$ +6$ = 13$Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts