please help me fill in the yellow boxes!!

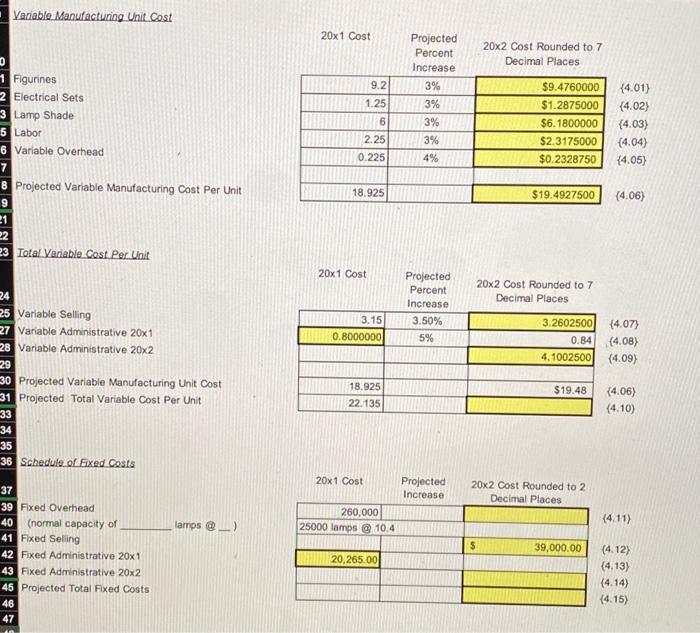

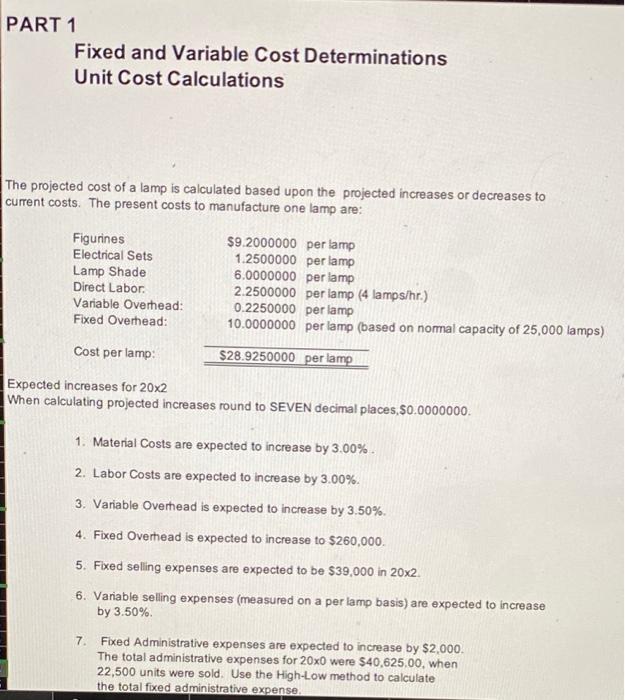

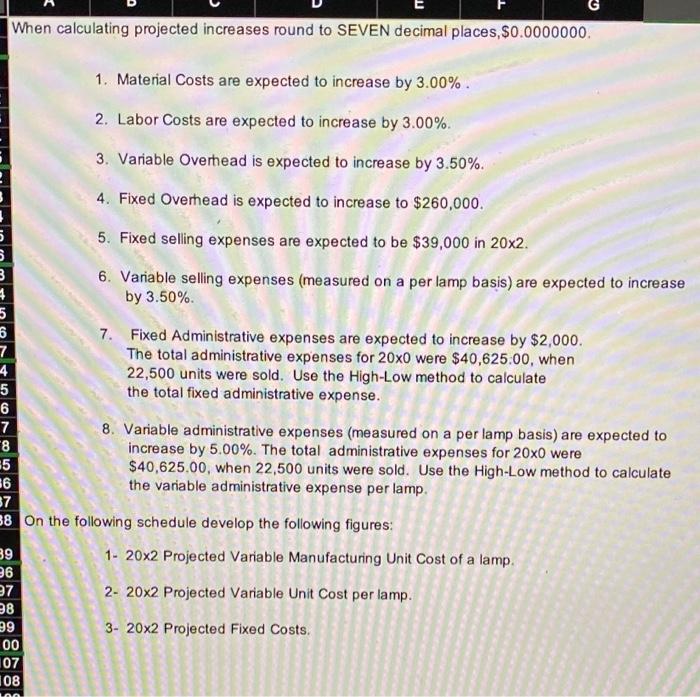

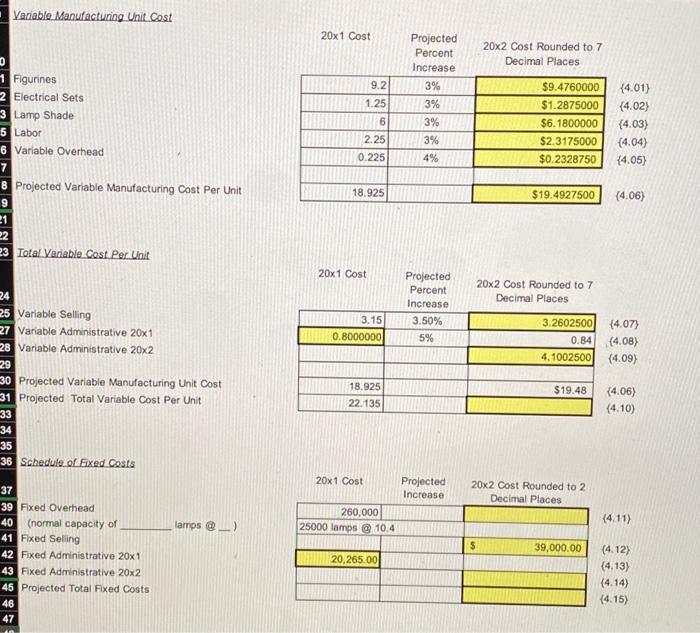

PART 1 Fixed and Variable Cost Determinations Unit Cost Calculations The projected cost of a lamp is calculated based upon the projected increases or decreases to current costs. The present costs to manufacture one lamp are: Figurines Electrical Sets Lamp Shade Direct Labor Variable Overhead: Fixed Overhead: $9.2000000 per lamp 1.2500000 per lamp 6.0000000 per lamp 2.2500000 per lamp (4 lamps/hr.) 0.2250000 per lamp 10.0000000 per lamp (based on normal capacity of 25,000 lamps) Cost per lamp $28.9250000 per lamp Expected increases for 20x2 When calculating projected increases round to SEVEN decimal places, 50.0000000 1. Material Costs are expected to increase by 3.00% 2. Labor Costs are expected to increase by 3.00% 3. Variable Overhead is expected to increase by 3.50% 4. Fixed Overhead is expected to increase to $260,000 5. Fixed selling expenses are expected to be $39,000 in 20x2. 6. Variable selling expenses (measured on a per lamp basis) are expected to increase by 3.50% 7 Fixed Administrative expenses are expected to increase by $2,000. The total administrative expenses for 20x0 were $40,625.00, when 22,500 units were sold. Use the High-Low method to calculate the total fixed administrative expense. When calculating projected increases round to SEVEN decimal places, $0.0000000 1. Material Costs are expected to increase by 3.00%. 2. Labor Costs are expected to increase by 3.00%. 3. Variable Overhead is expected to increase by 3.50%. 4. Fixed Overhead is expected to increase to $260,000. 5. Fixed selling expenses are expected to be $39,000 in 20x2. 3 6. Variable selling expenses (measured on a per lamp basis) are expected to increase by 3.50%. 5 6 7. Fixed Administrative expenses are expected to increase by $2,000. 7 The total administrative expenses for 20x0 were $40,625.00, when 4 22,500 units were sold. Use the High-Low method to calculate 5 the total fixed administrative expense. 6 7 8. Variable administrative expenses (measured on a per lamp basis) are expected to 8 increase by 5.00%. The total administrative expenses for 20x0 were 5 $40,625.00, when 22,500 units were sold. Use the High-Low method to calculate 36 the variable administrative expense per lamp 37 38 On the following schedule develop the following figures: 39 1- 20x2 Projected Variable Manufacturing Unit Cost of a lamp. 36 37 2- 20x2 Projected Variable Unit Cost per lamp. 28 99 3- 20x2 Projected Fixed Costs. 00 107 108 Variable Manufacturing Unit Cost 20x 1 Cost 20x2 Cost Rounded to 7 Decimal Places 0 9.2 1 Figurines 2 Electrical Sets 3 Lamp Shade 5 Labor 6 Variable Overhead 7 8 Projected Variable Manufacturing Cost Per Unit 9 Projected Percent Increase 3% 3% 3% 3% 4% 1.25 6 2.25 0.225 $9.4760000 $1.2875000 $6.1800000 $2.3175000 $0.2328750 {4.01) {4.02) {4.03) (4.04) {4.05) 18.925 $19.4927500 (4.06) 22 23 Total Variable Cost Per Unit 20x 1 Cost Projected Percent Increase 3.50% 20x2 Cost Rounded to 7 Decimal Places 24 25 Variable Selling 27 Variable Administrative 20x1 28 Variable Administrative 20x2 3.15 0.80000001 5% 3.2602500 {4.07) 0.84 (4.08) 4.1002500 (4.09) 29 18.925 22.135 $19.48 (4.06) (4.10) 230 Projected Variable Manufacturing Unit Cost 31 Projected Total Variable Cost Per Unit 33 34 35 36 Schedule of Fixed Costs 20x 1 Cost Projected Increase 20x2 Cost Rounded to 2 Decimal Places 260,000 25000 lamps @ 10,4 (4.11) lamps $ 39,000.00 37 39 Fixed Overhead 40 (normal capacity of 41 Fxed Selling 42 Fixed Administrative 20x1 43 Fixed Administrative 20x2 45 Projected Total Fixed Costs 46 47 20,265.00 (4.12) (4.13) (4.14) (4.15)

please help me fill in the yellow boxes!!

please help me fill in the yellow boxes!!