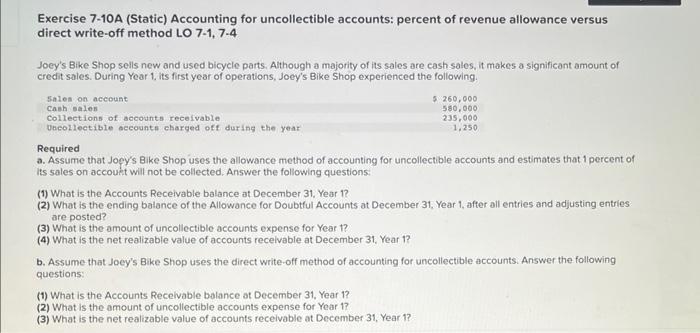

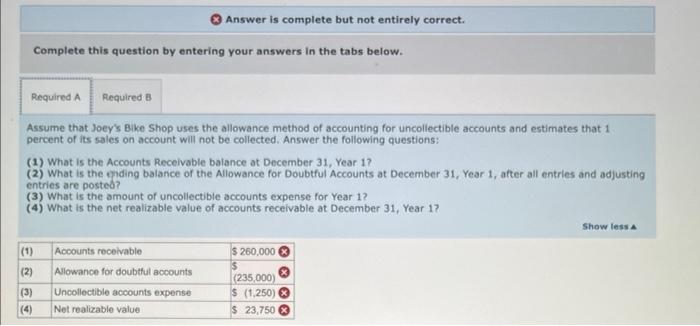

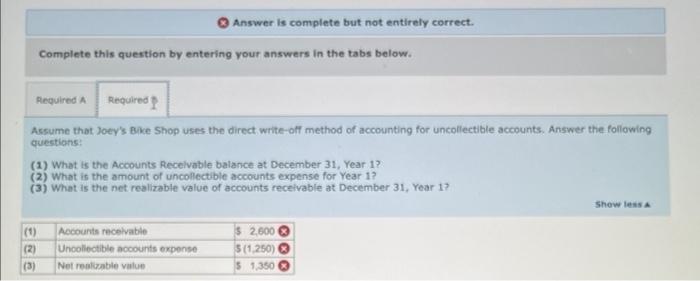

Exercise 7-10A (Static) Accounting for uncollectible accounts: percent of revenue allowance versus direct write-off method LO 7-1, 7-4 Jocy's Bike Shop sells new and used bicycle parts. Although a majority of its sales are cash sales, it makes a significant amount of credit sales. During Year 1 , its first year of operations, Joey's Bike Shop experienced the following. Required a. Assume that Jogy's Bike Shop uses the allowance method of accounting for uncollectible accounts and estimates that 1 percent of its sales on accoult will not be collected. Answer the following questions: (1) What is the Accounts Receivable balance at December 31, Year 1 ? (2) What is the ending balance of the Allowance for Doubtful Accounts at December 31 , Year 1, after all entries and adjusting entries are posted? (3) What is the amount of uncollectible accounts expense for Year t? (4) What is the net realizable value of accounts recelvable at December 31, Year 1 ? b. Assume that Joey's Bike Shop uses the direct write-off method of accounting for uncollectible accounts. Answer the following questions: (1) What is the Accounts Recelvable bolance at December 31, Year 1? (2) What is the amount of uncollectible accounts expense for Year 1 ? (3) What is the net realizable value of accounts recelvable at December 31, Year 1 ? Complete this question by entering your answers in the tabs below. Assume that Joey's Bike Shop uses the allowance method of accounting for uncollectible accounts and estimates that 1 percent of its sales on account will not be collected. Answer the following questions: (1) What is the Accounts Recelvable balance at December 31, Year 1? (2) What is the thding balance of the Allowance for Doubtful Accounts at December 31, Year 1, after all entries and adjusting entries are posted? (3) What is the amount of uncoliectible accounts expense for Year 1? (4) What is the net realizable value of accounts receivable at December 31, Year 1 ? Complete this question by entering your answers in the tabs below. Assume that Joey's Bake Shog uses the direct write-off method of accounting for uncollectible accounts. Answer the following questions: (1) What is the Acoounts Recelvable balance at December 31, Year 1 ? (2) What is the amount of uncollectible accounts expense for Year 1 ? (3) What is the net realizable value of accounts recelvable at December 31 , Year 1