Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I have the answer to the question, but I need hep understanding how a portion of the problem works. Please explain step by step how

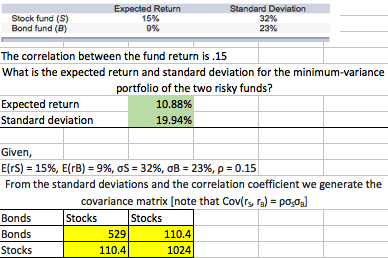

I have the answer to the question, but I need hep understanding how a portion of the problem works. Please explain step by step how the bonds and stocks were calculated from the covariance matrix formula. How was the 529, 110.4, 110.4 and 1024 calculated please.

Expected Return 15% 9% 32% 23% Stock fund (S) Bond fund (B) The correlation between the fund return is.15 What is the expected return and standard deviation for the minimum-variance olio of the two risky funds? Expected return Standard deviation 10.88% 19.94% Given, E(rS) = 15%, E(rB) = 9%, oS = 32%, oB = 2396, = 0.15 From the standard deviations and the correlation coefficient we generate the covariance matrix [note that Cov(rs, ra)po oa Stocks Bonds Bonds Stocks Stocks 529 110.4 110.4 1024

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started