I have the answers, but I don't know how to do. Please explain it (what I have circle).

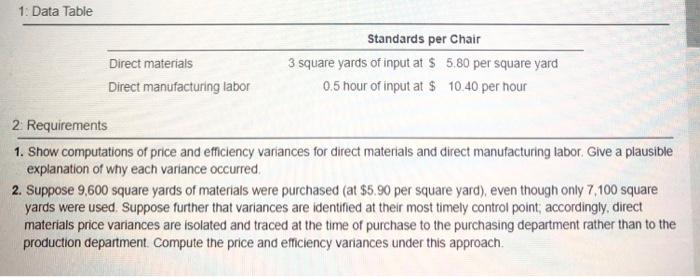

The datas and requirements:

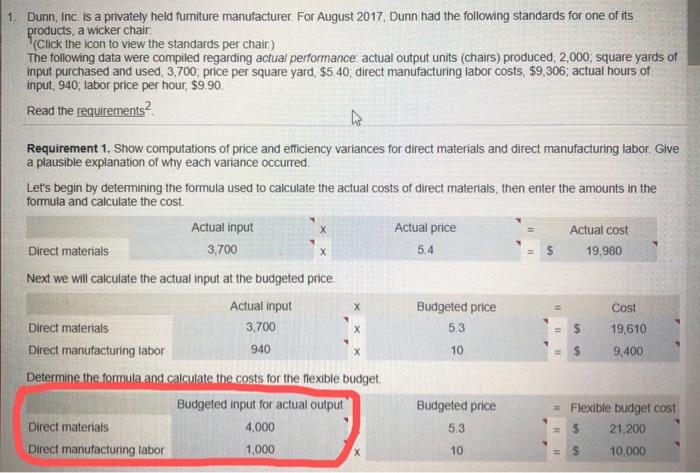

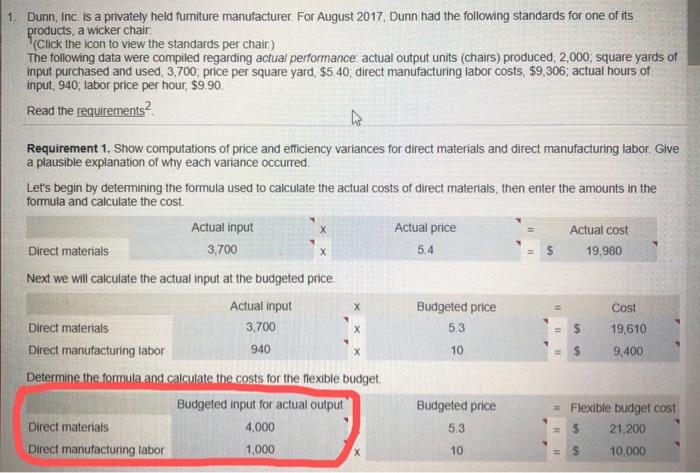

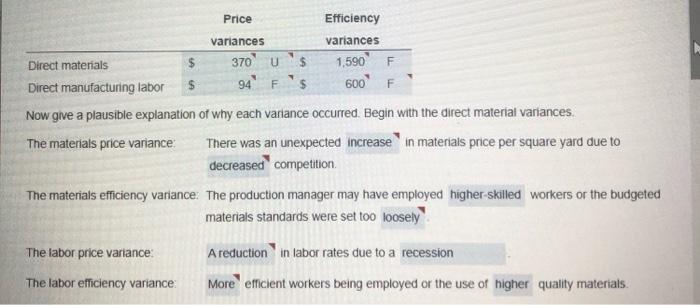

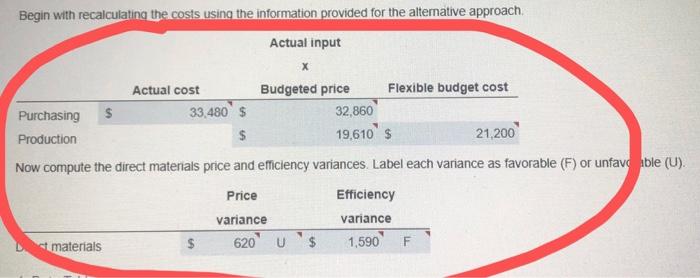

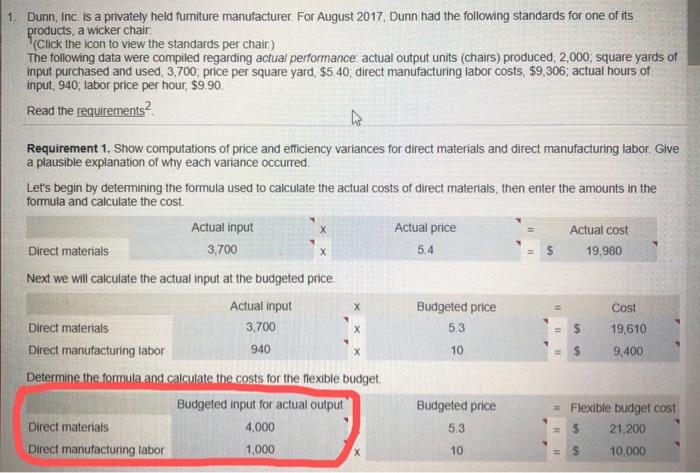

1. Dunn, Inc. is a privately held furniture manufacturer. For August 2017, Dunn had the following standards for one of its products, a wicker chair (Click the icon to view the standards per chair.) The following data were compiled regarding actual performance actual output units (chairs) produced, 2,000 square yards of input purchased and used, 3,700, price per square yard. $5.40, direct manufacturing labor costs, $9,306, actual hours of input, 940; labor price per hour $9.90 Read the requirements 5.4 Requirement 1. Show computations of price and efficiency variances for direct materials and direct manufacturing labor. Give a plausible explanation of why each variance occurred. Let's begin by determining the formula used to calculate the actual costs of direct materials, then enter the amounts in the formula and calculate the cost. Actual input Actual price Actual cost Direct materials 3,700 19,980 Next we will calculate the actual input at the budgeted price. Actual input Budgeted price Cost Direct materials 3,700 5.3 19,610 Direct manufacturing labor 940 10 9,400 Determine the formula and calculate the costs for the flexible budget Budgeted input for actual output Budgeted price = Flexible budget cost Direct materials 4.000 5.3 21,200 Direct manufacturing labor 1,000 10 10,000 Il Price Efficiency variances variances Direct materials 370 Us 1,590 F Direct manufacturing labor 94" f's 6000 F Now give a plausible explanation of why each variance occurred. Begin with the direct material variances. The materials price variance There was an unexpected increase in materials price per square yard due to decreased competition The materials efficiency variance: The production manager may have employed higher-skilled workers or the budgeted materials standards were set too loosely The labor price variance A reduction in labor rates due to a recession More efficient workers being employed or the use of higher quality materials. The labor efficiency variance Begin with recalculating the costs using the information provided for the alternative approach Actual input Actual cost Budgeted price Flexible budget cost Purchasing $ 33.480 $ 32,860 Production $ 19,610's 21,200 Now compute the direct materials price and efficiency variances Label each variance as favorable (F) or unfavg able (U). Price Efficiency variance variance st materials $ 620' U'$ 1,590 F 1. Data Table Direct materials Direct manufacturing labor Standards per Chair 3 square yards of input at $ 5,80 per square yard 0.5 hour of input at $ 10.40 per hour 2. Requirements 1. Show computations of price and efficiency variances for direct materials and direct manufacturing labor. Give a plausible explanation of why each variance occurred 2. Suppose 9,600 square yards of materials were purchased (at $5.90 per square yard), even though only 7.100 square yards were used. Suppose further that variances are identified at their most timely control point, accordingly, direct materials price variances are isolated and traced at the time of purchase to the purchasing department rather than to the production department Compute the price and efficiency variances under this approach