Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I have the answers for this but i need an explanation as to where the numbers come from to understand the concept. Q1. On December

I have the answers for this but i need an explanation as to where the numbers come from to understand the concept.

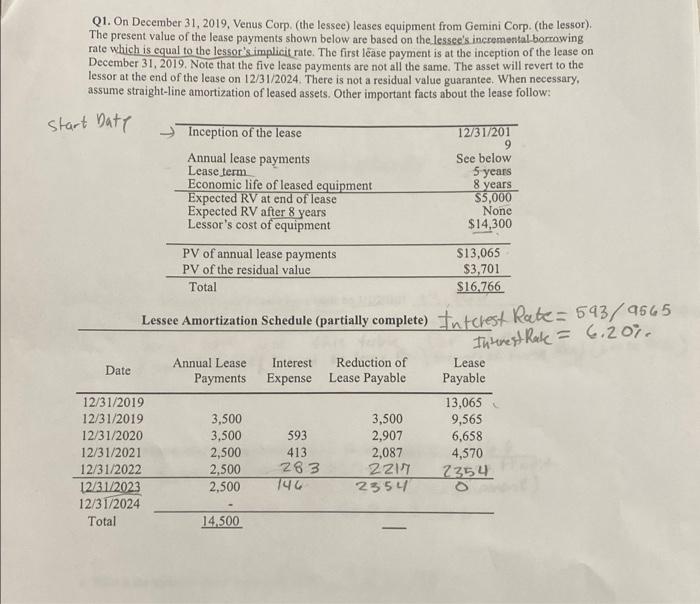

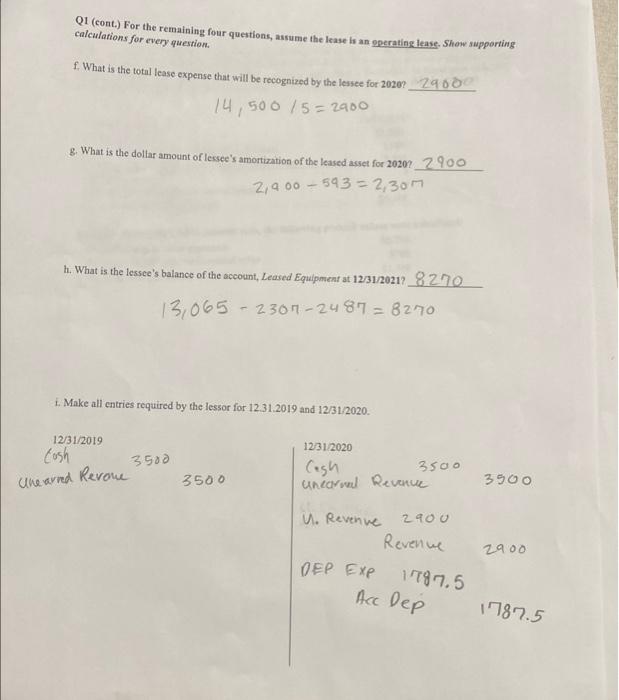

Q1. On December 31, 2019, Venus Corp. (the lessee) leases equipment from Gemini Corp. (the lessor) The present value of the lease payments shown below are based on the lessee's incremental borrowing rate which is equal to the lessor's implicit rate. The first lease payment is at the inception of the lease on December 31, 2019. Note that the five lease payments are not all the same. The asset will revert to the lessor at the end of the lease on 12/31/2024. There is not a residual value guarantee. When necessary, assume straight-line amortization of leased assets. Other important facts about the lease follow: start Date Inception of the lease 12/31/201 9 Annual lease payments See below Lease term 5 years Economic life of leased equipment 8 years Expected RV at end of lease $5,000 Expected RV after 8 years None Lessor's cost of equipment $14,300 PV of annual lease payments $13,065 PV of the residual value $3,701 Total $16,766 Lessee Amortization Schedule (partially complete) Interest Rate = 593/9665 Interest Rate = 6,20%. Annual Lease Interest Reduction of Lease Date Payments Expense Lease Payable Payable 12/31/2019 13,065 12/31/2019 3,500 3,500 9,565 12/31/2020 3,500 593 2,907 6,658 12/31/2021 2,500 413 2,087 4,570 12/31/2022 2,500 263 2217 12/31/2023 2,500 740 2354 12/31/2024 Total 14,500 Q1 (cont.) For the remaining four questions, assume the least is an operating tease. Show supporting calculations for every question. f. What is the total lease expense that will be recognized by the lessee for 2020?_2900 14,500 15=2900 8. What is the dollar amount of lessee's amortization of the leased asset for 20207 2900 2,400 593 = 2,3077 h. What is the lessee's balance of the account, Leased Equipment at 12/31/20212_8270 13,065 - 2301-2487 = 8270 - 1. Make all entries required by the lessor for 12.31.2019 and 12/31/2020. 12/31/2019 Cash 12/31/2020 3500 che warned Revene 3500 Cegh 3500 uneornal Revenue 3900 U. Revenue Revenue 2900 OEP Exp 1787.5 Acc Dep 1787.5

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started