I have the correct answer shown, but I do not know how to solve? Please explain in clear and simple terms. Thanks

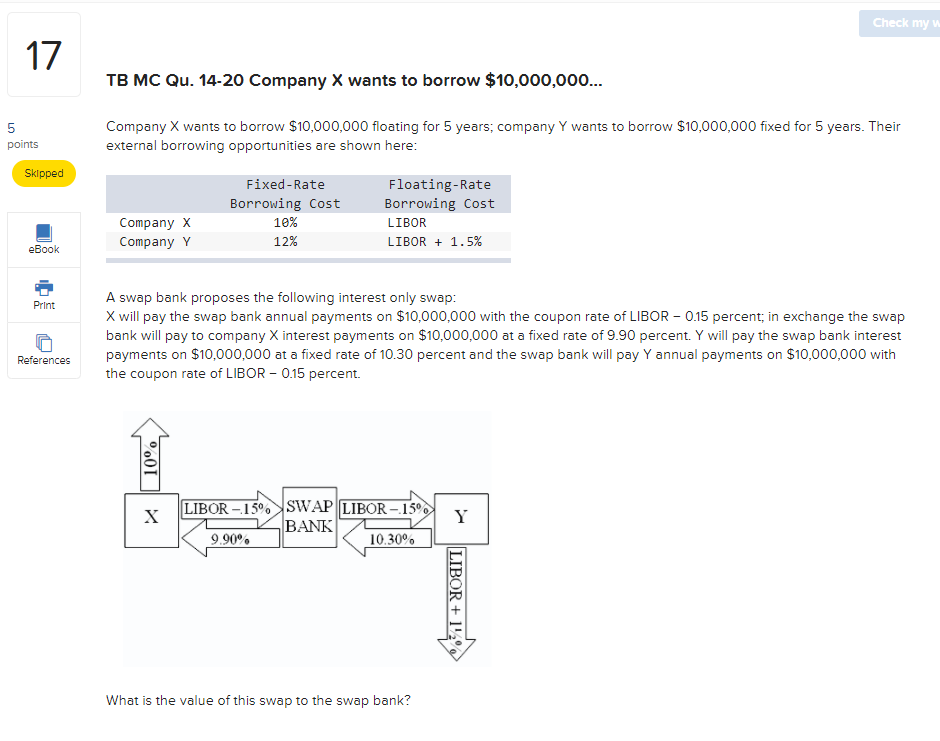

Check my 17 TB MC Qu. 14-20 Company X wants to borrow $10,000,000... 5 points Company X wants to borrow $10,000,000 floating for 5 years; company Y wants to borrow $10,000,000 fixed for 5 years. Their external borrowing opportunities are shown here: Skipped Fixed-Rate Borrowing Cost 10% 12% Floating-Rate Borrowing Cost LIBOR LIBOR + 1.5% Company X Company Y eBook Print A swap bank proposes the following interest only swap: X will pay the swap bank annual payments on $10,000,000 with the coupon rate of LIBOR -0.15 percent; in exchange the swap bank will pay to company X interest payments on $10,000,000 at a fixed rate of 9.90 percent. Y will pay the swap bank interest payments on $10,000,000 at a fixed rate of 10.30 percent and the swap bank will pay Y annual payments on $10,000,000 with the coupon rate of LIBOR -0.15 percent. References 10 X LIBOR - 15% SWAP LIBOR - 150 BANK 9.90% 10.30 Y LIBOR + 1'300 What is the value of this swap to the swap bank? Multiple Choice The swap bank will lose money on the deal. The swap bank will earn 40 basis points per year on $10,000,000 = $40,000 per year. The swap bank will break even. none of the options Check my 17 TB MC Qu. 14-20 Company X wants to borrow $10,000,000... 5 points Company X wants to borrow $10,000,000 floating for 5 years; company Y wants to borrow $10,000,000 fixed for 5 years. Their external borrowing opportunities are shown here: Skipped Fixed-Rate Borrowing Cost 10% 12% Floating-Rate Borrowing Cost LIBOR LIBOR + 1.5% Company X Company Y eBook Print A swap bank proposes the following interest only swap: X will pay the swap bank annual payments on $10,000,000 with the coupon rate of LIBOR -0.15 percent; in exchange the swap bank will pay to company X interest payments on $10,000,000 at a fixed rate of 9.90 percent. Y will pay the swap bank interest payments on $10,000,000 at a fixed rate of 10.30 percent and the swap bank will pay Y annual payments on $10,000,000 with the coupon rate of LIBOR -0.15 percent. References 10 X LIBOR - 15% SWAP LIBOR - 150 BANK 9.90% 10.30 Y LIBOR + 1'300 What is the value of this swap to the swap bank? Multiple Choice The swap bank will lose money on the deal. The swap bank will earn 40 basis points per year on $10,000,000 = $40,000 per year. The swap bank will break even. none of the options