Answered step by step

Verified Expert Solution

Question

1 Approved Answer

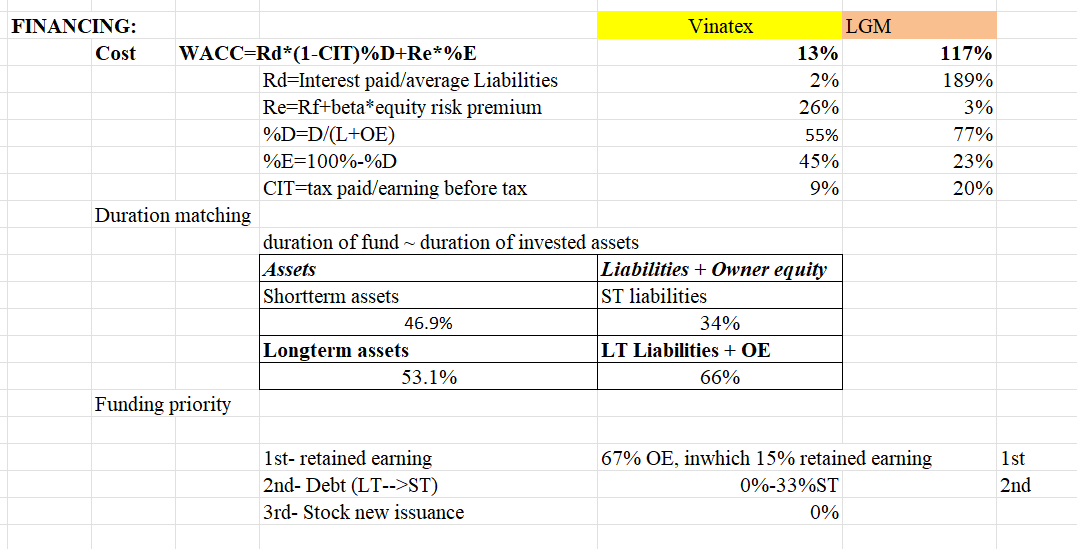

I have the following assignments about financing decision making with the questions: - Clarifying funding structure of the company, giving comments/analysis related to funding priority

I have the following assignments about financing decision making with the questions:

- Clarifying funding structure of the company, giving comments/analysis related to funding priority and maturity matching between financing sources and invested assets - Calculating cost of equity and cost of debt (averaged cost of debt) and Weighted average cost of Capital. How the resulting cost of capital will be considered in the company's future investment.

From the data in the picture, make a comment for the above topic.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started