i have the journalized entires done already i just need the T accounts balanced off and the trial balance

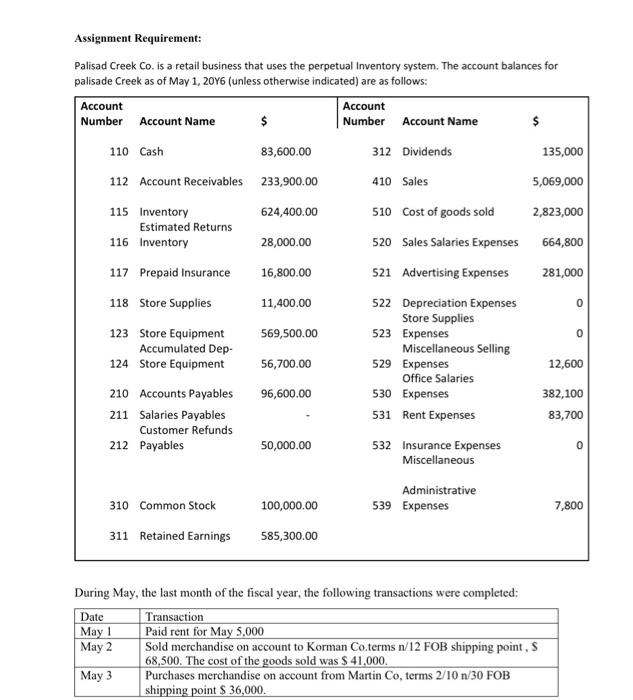

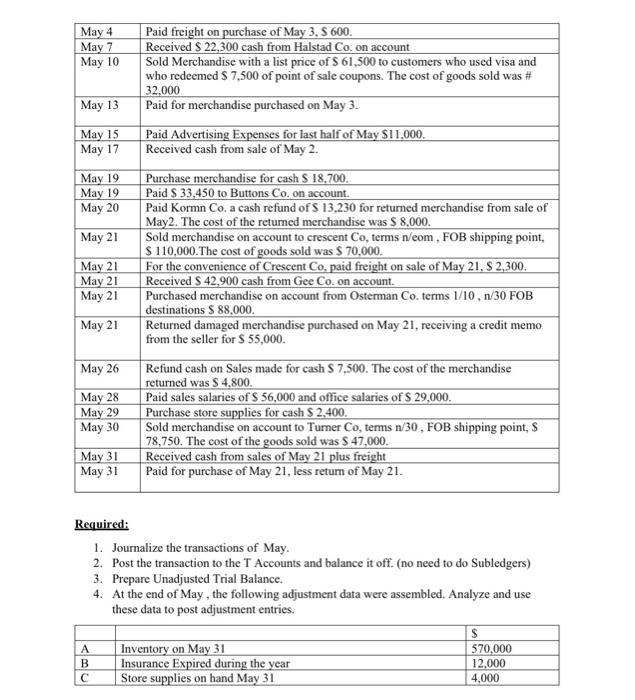

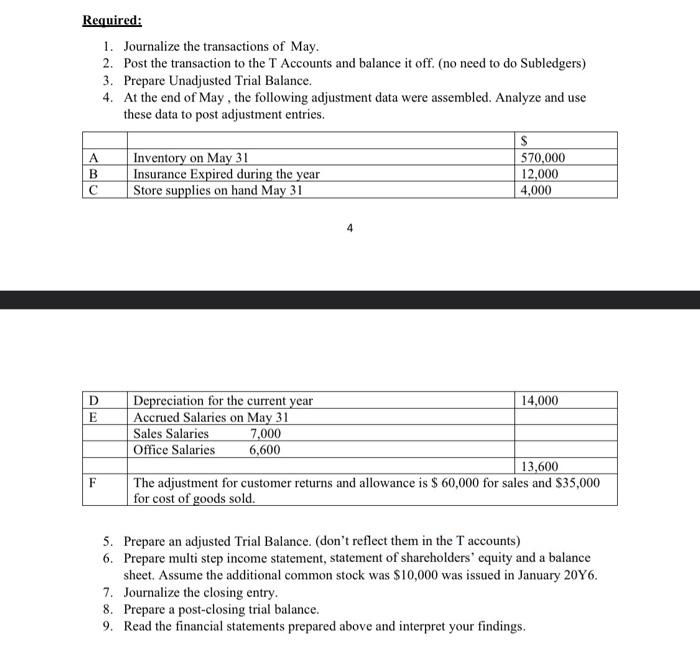

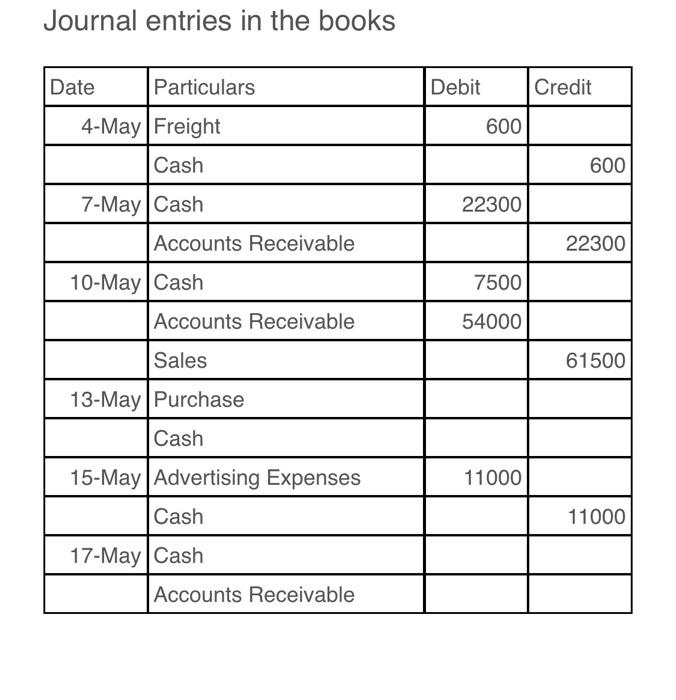

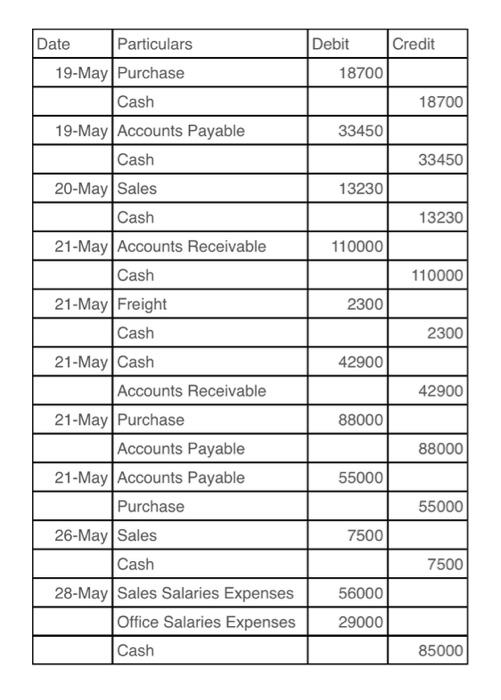

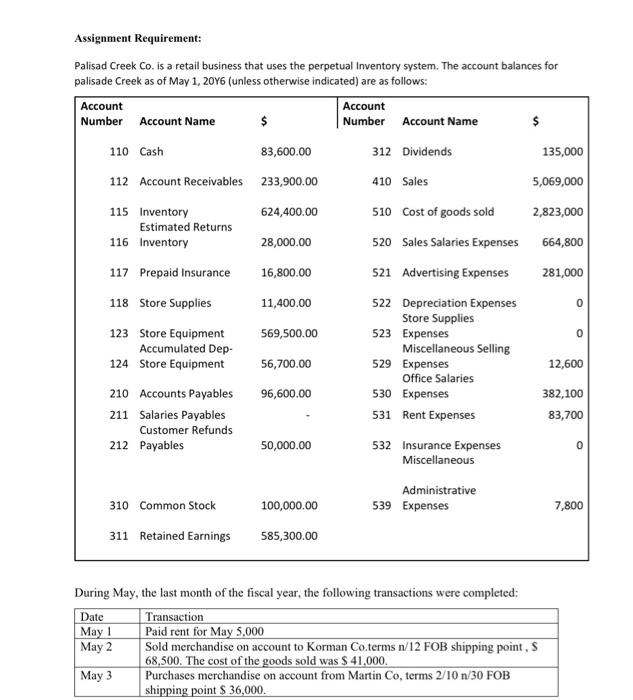

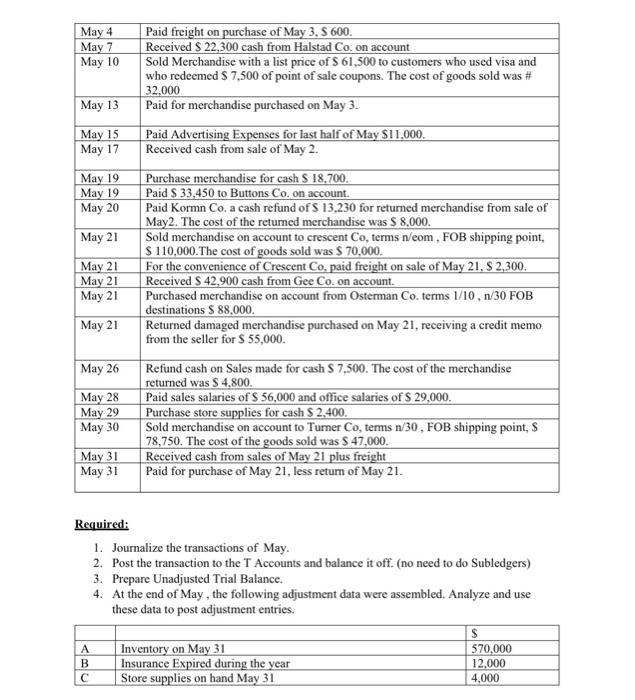

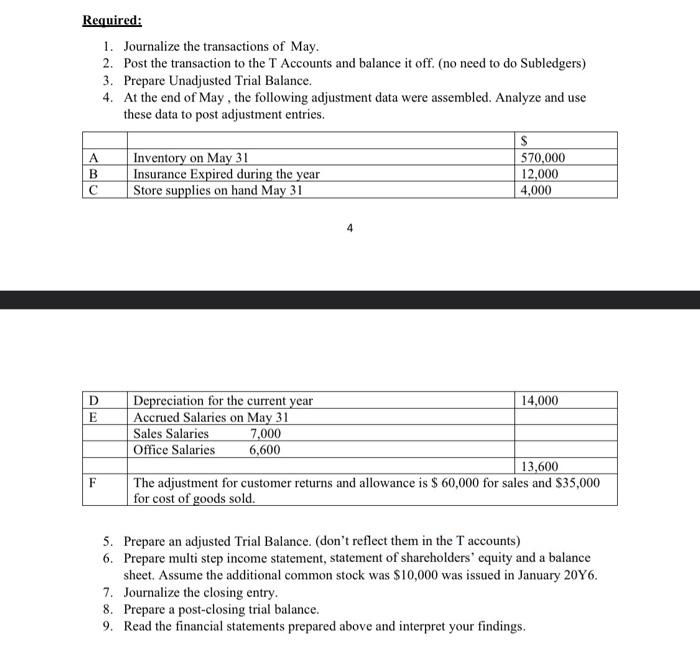

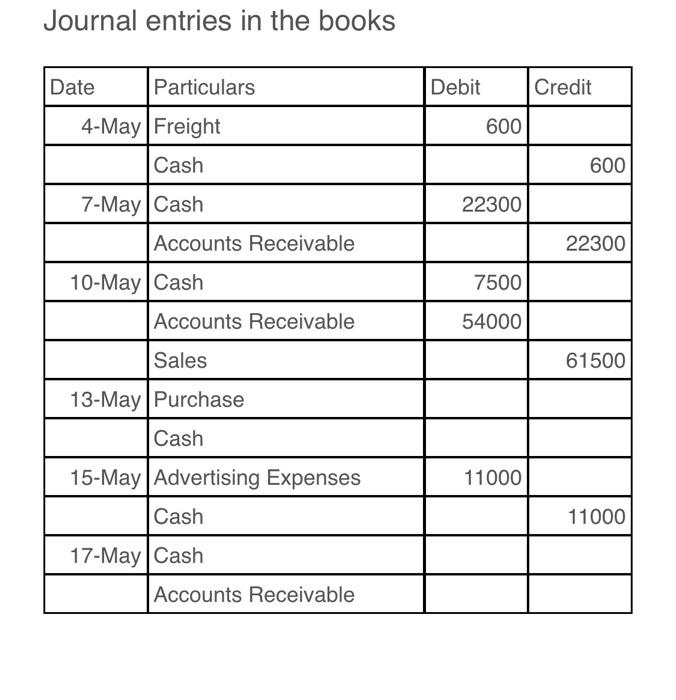

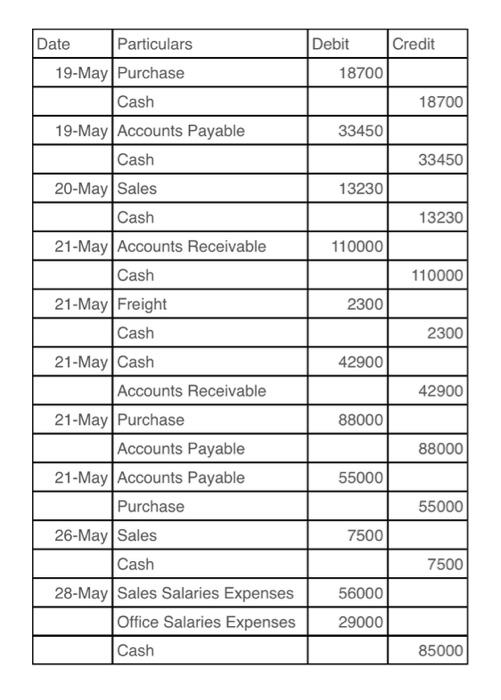

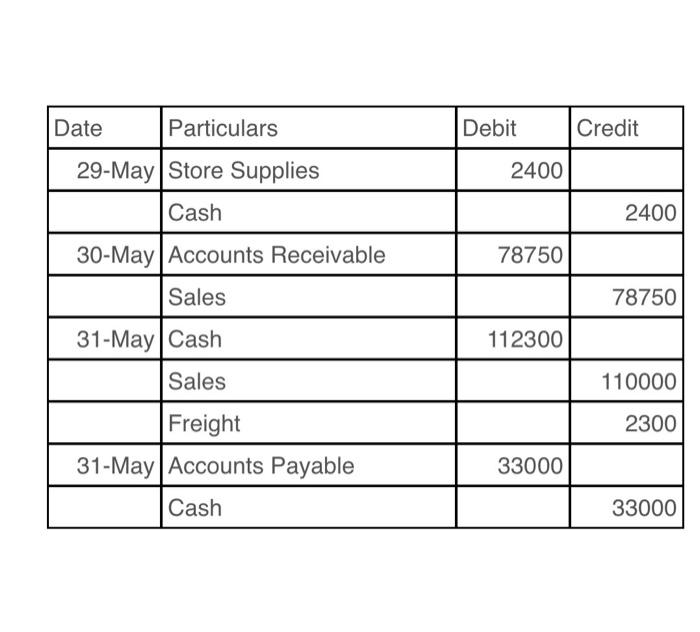

Assignment Requirement: Palisad Creek Co. is a retail business that uses the perpetual Inventory system. The account balances for During May, the last month of the fiscal year, the following transactions were completed: Required: 1. Journalize the transactions of May. 2. Post the transaction to the T Accounts and balance it off. (no need to do Subledgers) 3. Prepare Unadjusted Trial Balance. 4. At the end of May, the following adjustment data were assembled. Analyze and use these data to post adjustment entries. Required: 1. Journalize the transactions of May. 2. Post the transaction to the T Accounts and balance it off. (no need to do Subledgers) 3. Prepare Unadjusted Trial Balance. 4. At the end of May, the following adjustment data were assembled. Analyze and use these data to post adjustment entries. 4 5. Prepare an adjusted Trial Balance. (don't reflect them in the T accounts) 6. Prepare multi step income statement, statement of shareholders' equity and a balance sheet. Assume the additional common stock was $10,000 was issued in January 20Y6. 7. Journalize the closing entry. 8. Prepare a post-closing trial balance. 9. Read the financial statements prepared above and interpret your findings. Journal entries in the books \begin{tabular}{|c|l|r|r|} \hline Date & Particulars & \multicolumn{1}{|l|}{ Debit } & \multicolumn{1}{l|}{ Credit } \\ \hline 19-May & Purchase & 18700 & \\ \hline & Cash & & 18700 \\ \hline 19-May & Accounts Payable & 33450 & \\ \hline & Cash & & 33450 \\ \hline 20-May & Sales & 13230 & \\ \hline & Cash & & 13230 \\ \hline 21-May & Accounts Receivable & 110000 & \\ \hline & Cash & & 110000 \\ \hline 21-May & Freight & 2300 & \\ \hline & Cash & & \\ \hline 21-May & Cash & 42900 & \\ \hline & Accounts Receivable & & 42900 \\ \hline & Cash & 88000 & \\ \hline 21-May & Purchase & & 88000 \\ \hline & Accounts Payable & & \\ \hline 28-May & Sales Salaries Expenses & 56000 & \\ \hline & Office Salaries Expenses & 29000 & \\ \hline & Purchase & & 85000 \\ \hline \end{tabular} \begin{tabular}{|r|l|r|r|} \hline \multicolumn{1}{|l|}{ Date } & Particulars & \multicolumn{1}{|l|}{ Debit } & \multicolumn{1}{l|}{ Credit } \\ \hline 29-May & Store Supplies & 2400 & \\ \hline & Cash & & 2400 \\ \hline 30-May & Accounts Receivable & 78750 & \\ \hline & Sales & & 78750 \\ \hline 31-May & Cash & 112300 & \\ \hline & Sales & & 110000 \\ \hline & Freight & & 2300 \\ \hline 31-May & Accounts Payable & 33000 & \\ \hline & Cash & & 33000 \\ \hline \end{tabular} Assignment Requirement: Palisad Creek Co. is a retail business that uses the perpetual Inventory system. The account balances for During May, the last month of the fiscal year, the following transactions were completed: Required: 1. Journalize the transactions of May. 2. Post the transaction to the T Accounts and balance it off. (no need to do Subledgers) 3. Prepare Unadjusted Trial Balance. 4. At the end of May, the following adjustment data were assembled. Analyze and use these data to post adjustment entries. Required: 1. Journalize the transactions of May. 2. Post the transaction to the T Accounts and balance it off. (no need to do Subledgers) 3. Prepare Unadjusted Trial Balance. 4. At the end of May, the following adjustment data were assembled. Analyze and use these data to post adjustment entries. 4 5. Prepare an adjusted Trial Balance. (don't reflect them in the T accounts) 6. Prepare multi step income statement, statement of shareholders' equity and a balance sheet. Assume the additional common stock was $10,000 was issued in January 20Y6. 7. Journalize the closing entry. 8. Prepare a post-closing trial balance. 9. Read the financial statements prepared above and interpret your findings. Journal entries in the books \begin{tabular}{|c|l|r|r|} \hline Date & Particulars & \multicolumn{1}{|l|}{ Debit } & \multicolumn{1}{l|}{ Credit } \\ \hline 19-May & Purchase & 18700 & \\ \hline & Cash & & 18700 \\ \hline 19-May & Accounts Payable & 33450 & \\ \hline & Cash & & 33450 \\ \hline 20-May & Sales & 13230 & \\ \hline & Cash & & 13230 \\ \hline 21-May & Accounts Receivable & 110000 & \\ \hline & Cash & & 110000 \\ \hline 21-May & Freight & 2300 & \\ \hline & Cash & & \\ \hline 21-May & Cash & 42900 & \\ \hline & Accounts Receivable & & 42900 \\ \hline & Cash & 88000 & \\ \hline 21-May & Purchase & & 88000 \\ \hline & Accounts Payable & & \\ \hline 28-May & Sales Salaries Expenses & 56000 & \\ \hline & Office Salaries Expenses & 29000 & \\ \hline & Purchase & & 85000 \\ \hline \end{tabular} \begin{tabular}{|r|l|r|r|} \hline \multicolumn{1}{|l|}{ Date } & Particulars & \multicolumn{1}{|l|}{ Debit } & \multicolumn{1}{l|}{ Credit } \\ \hline 29-May & Store Supplies & 2400 & \\ \hline & Cash & & 2400 \\ \hline 30-May & Accounts Receivable & 78750 & \\ \hline & Sales & & 78750 \\ \hline 31-May & Cash & 112300 & \\ \hline & Sales & & 110000 \\ \hline & Freight & & 2300 \\ \hline 31-May & Accounts Payable & 33000 & \\ \hline & Cash & & 33000 \\ \hline \end{tabular}