Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I have the numbers basically calculated, just having a real hard time understanding where to input them on the forms and why? Form 8829 Department

I have the numbers basically calculated, just having a real hard time understanding where to input them on the forms and why?

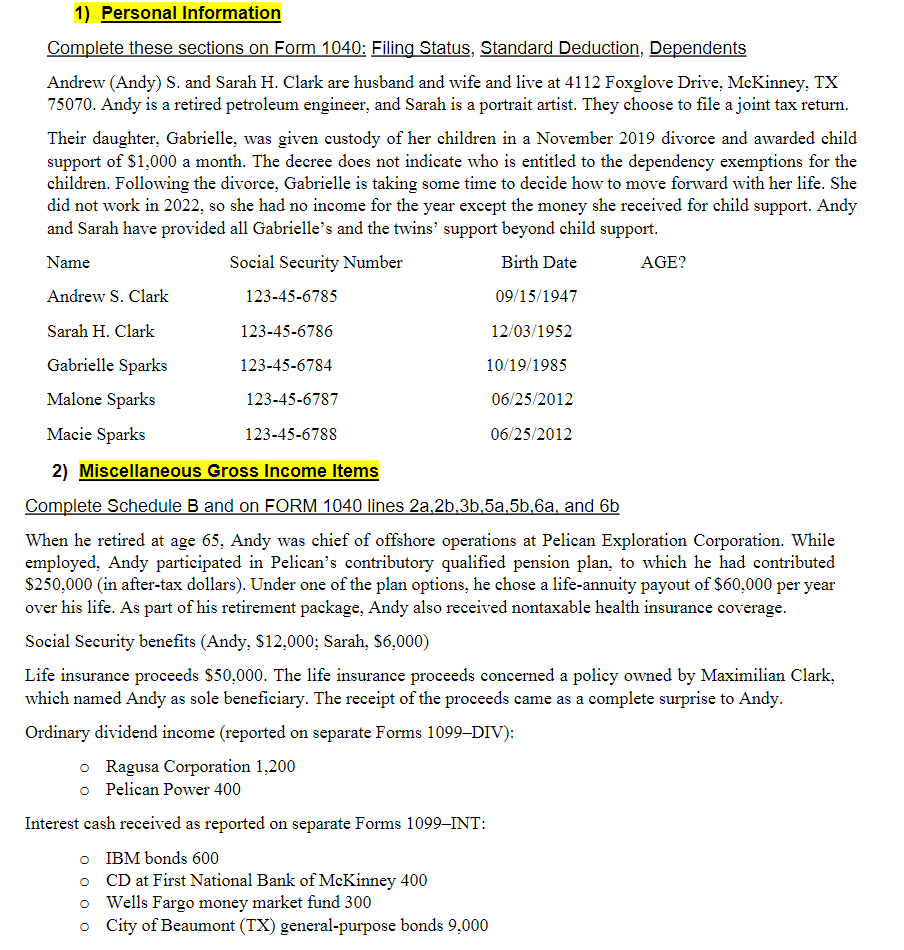

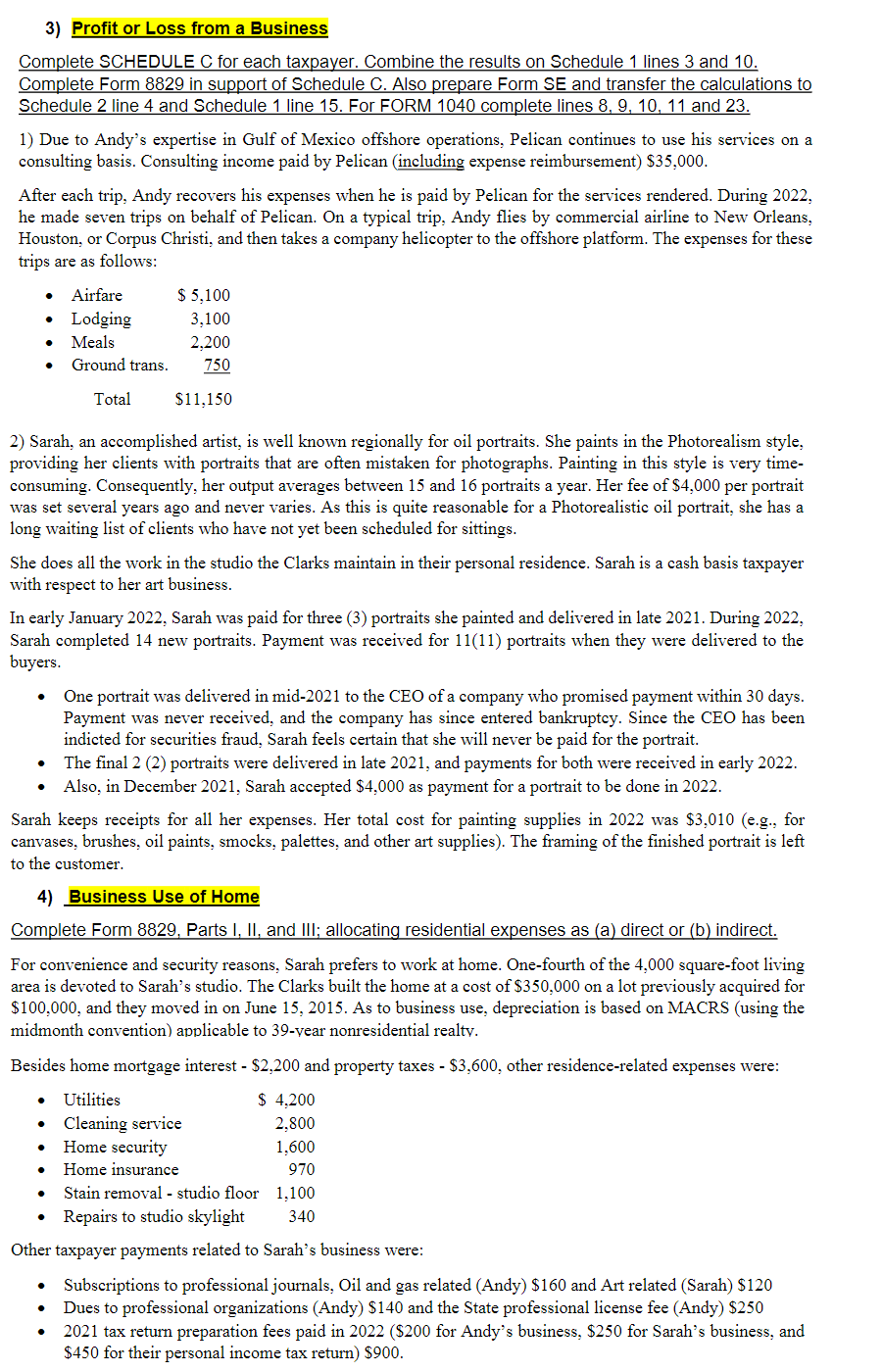

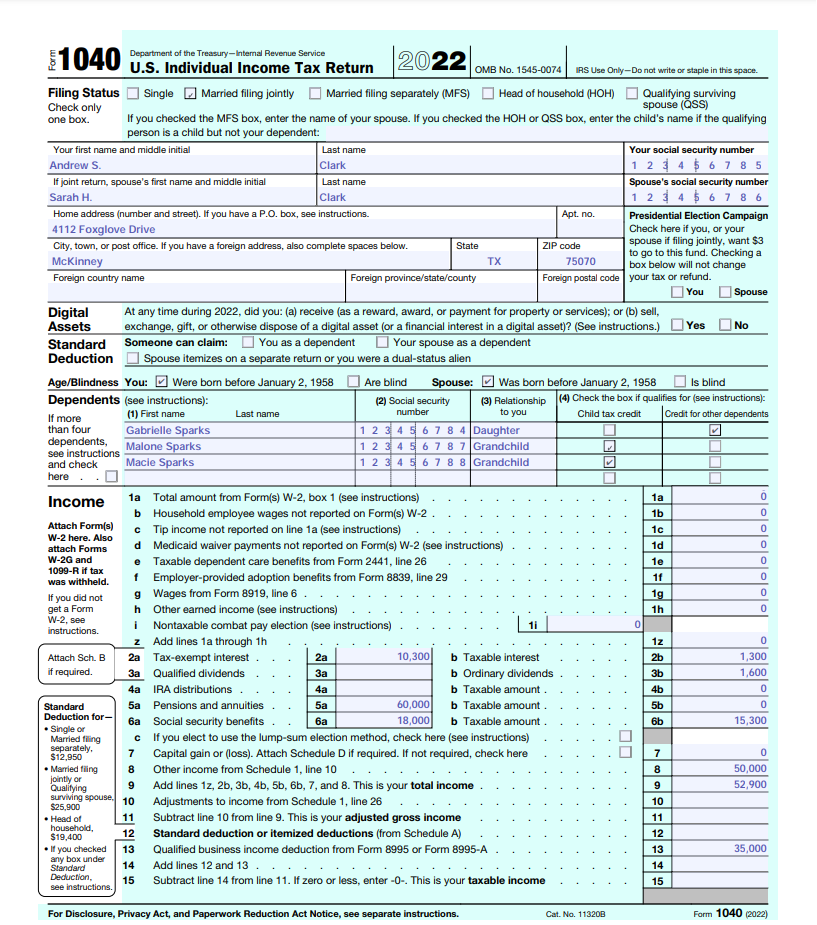

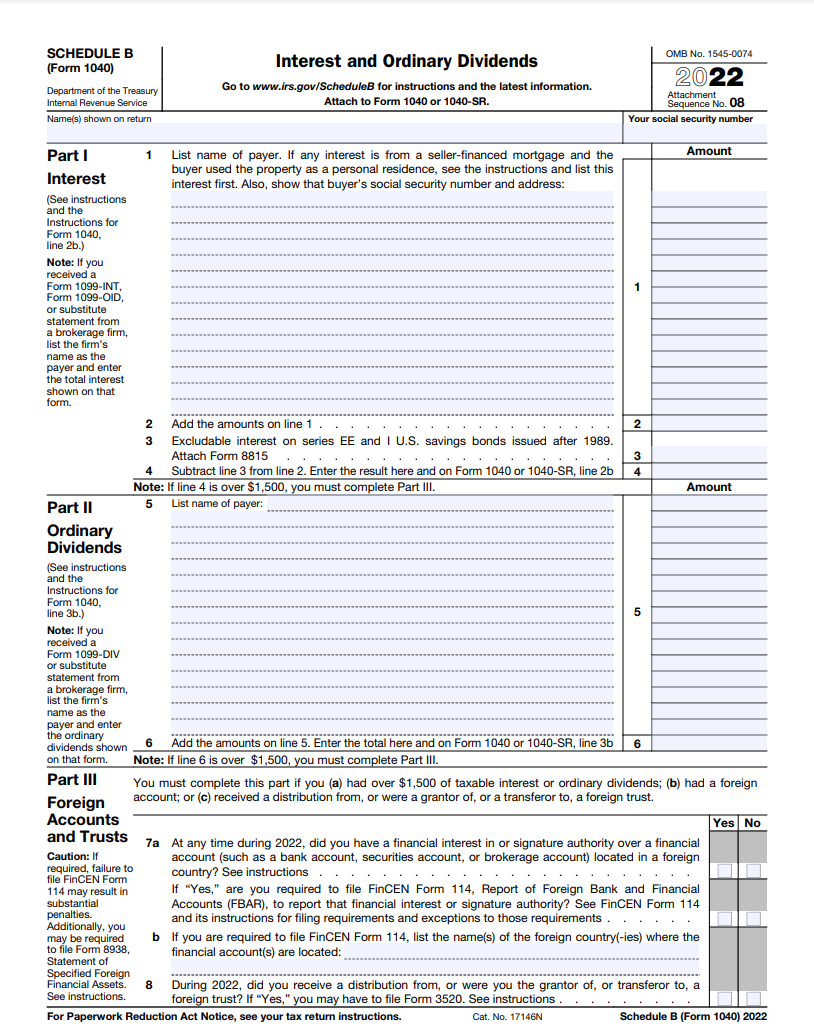

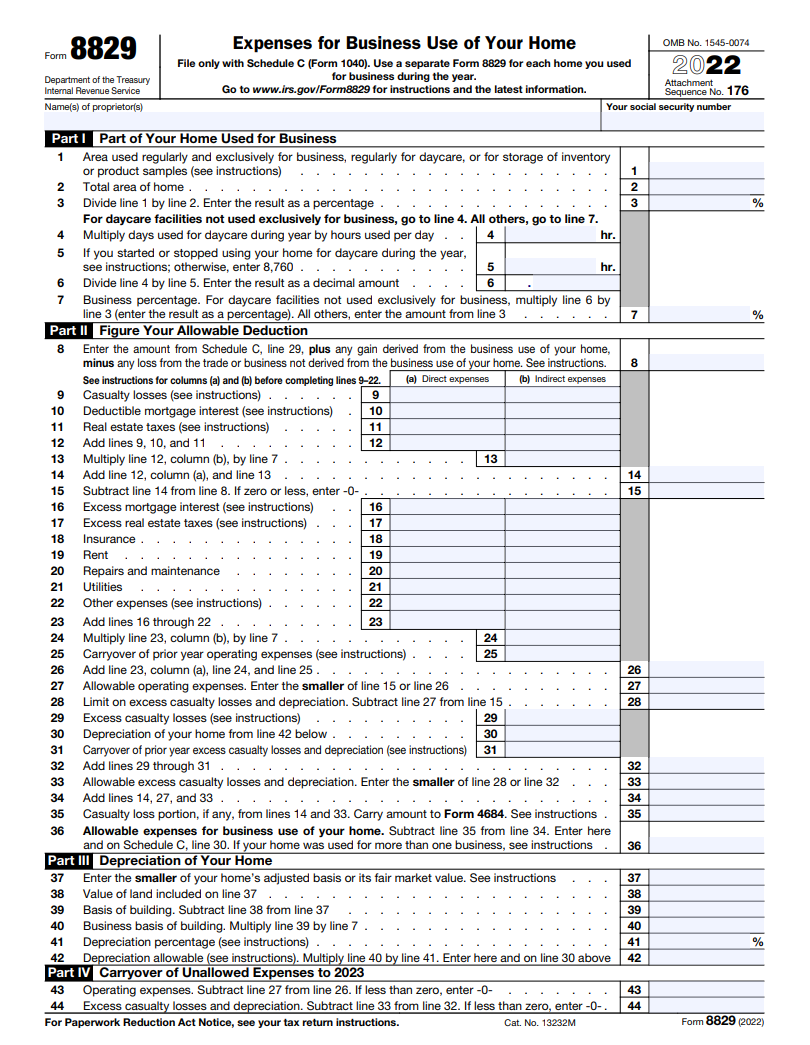

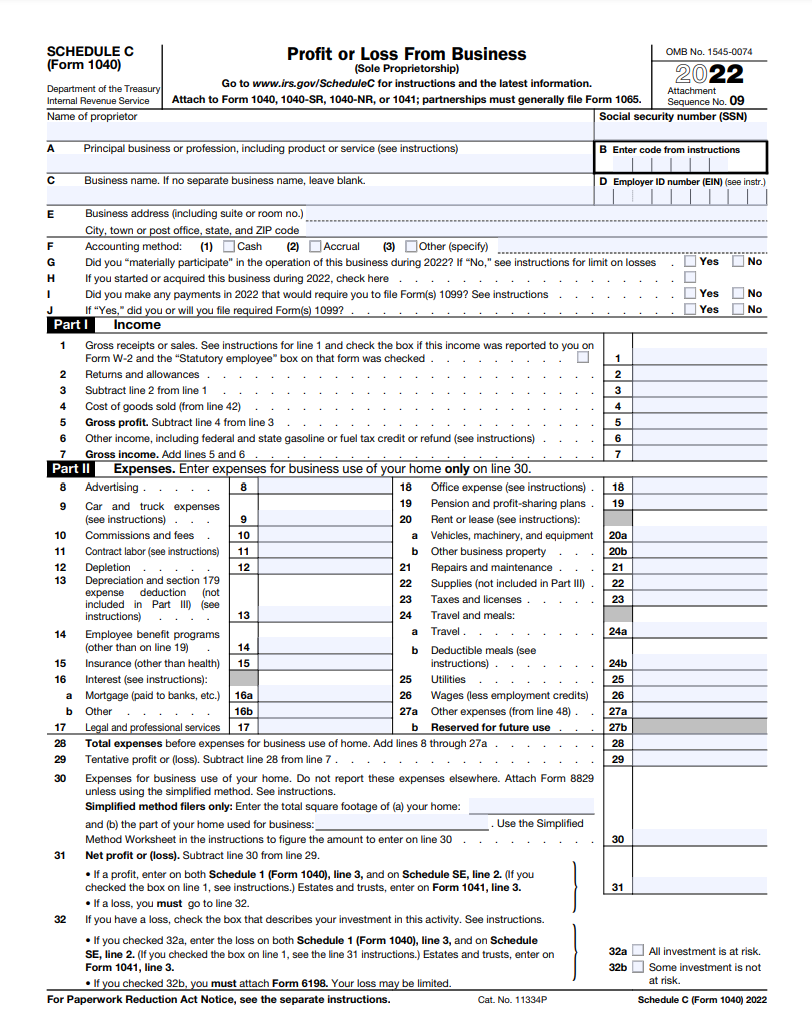

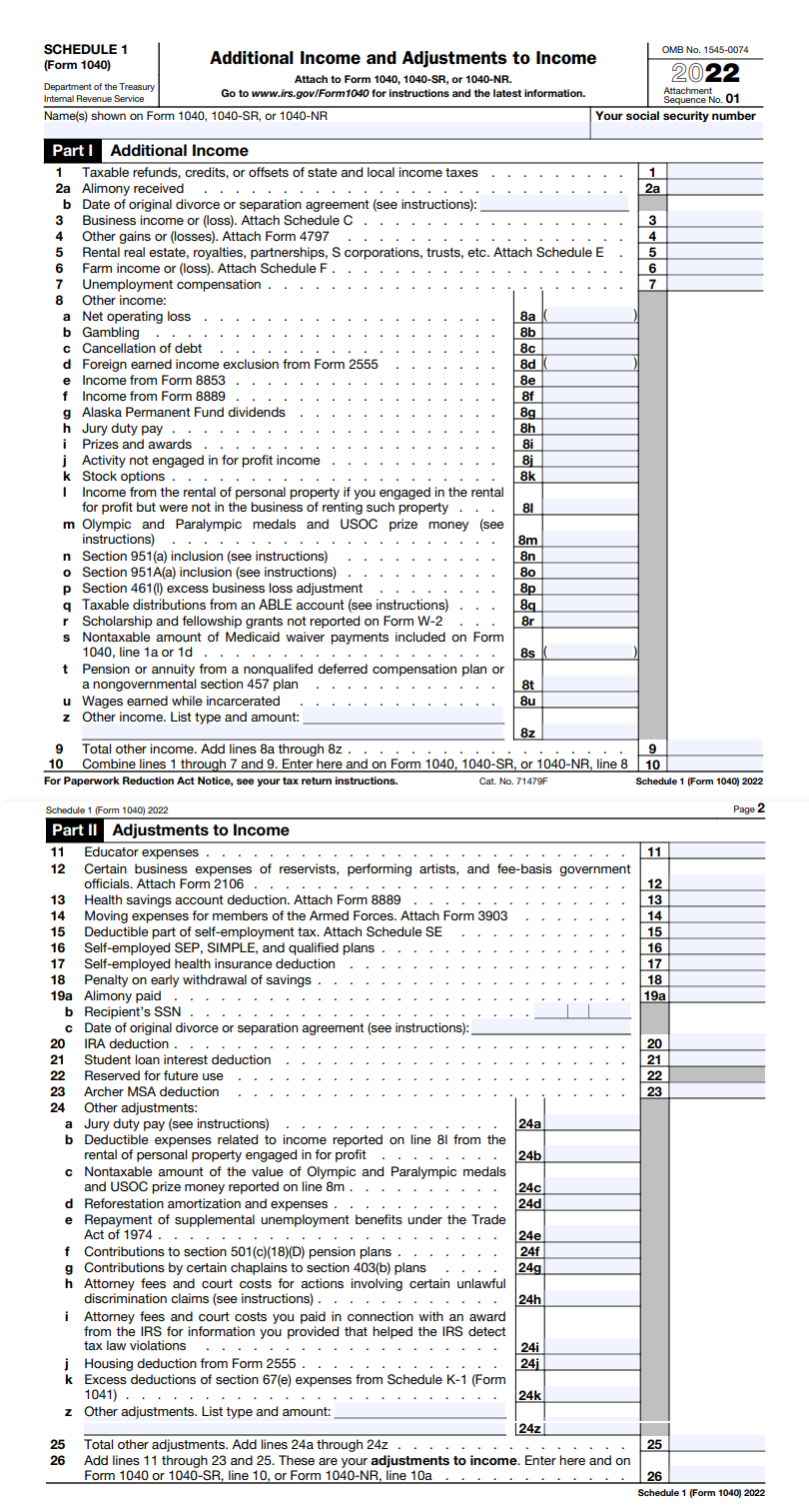

Form 8829 Department of the Treasury Internal Revenue Service Name(s) of proprietor(s) Expenses for Business Use of Your Home File only with Schedule C (Form 1040). Use a separate Form 8829 for each home you used for business during the year. Go to www.irs.gov/Form8829 for instructions and the latest information. \begin{tabular}{|l} OMB No. 1545-0074 \\ \hline \\ AttachmentSequenceNo.176 \\ \hline \end{tabular} Your social security number Part I Part of Your Home Used for Business 1 Area used regularly and exclusively for business, regularly for daycare, or for storage of inventory or product samples (see instructions) 2 Total area of home. 3 Divide line 1 by line 2. Enter the result as a percentage . For daycare facilities not used exclusively for business, go to line 4. All others, go to line 7 . 4 Multiply days used for daycare during year by hours used per day 5 If you started or stopped using your home for daycare during the year, see instructions; otherwise, enter 8,760. 6 Divide line 4 by line 5 . Enter the result as a decimal amount 7 Business percentage. For daycare facilities not used exclusively for business, multiply line 6 by line 3 (enter the result as a percentage). All others, enter the amount from line 3 Part II Figure Your Allowable Deduction 51040 Department of the Treasury-Internal Revenue Service U.S. Individual Income Tax Return Filing Status Single Married filing jointly Married filing separately (MFS) Head of household (HOH) Qualifying surviving Check only spouse (QSS) one box. If you checked the MFS box, enter the name of your spouse. If you checked the HOH or QSS box, enter the child's name if the qualifying person is a child but not your dependent: For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see separate instructions. Cat. No. 11320B Form 1040 (2022) 3) Profit or Loss from a Business Complete SCHEDULE C for each taxpayer. Combine the results on Schedule 1 lines 3 and 10. Complete Form 8829 in support of Schedule C. Also prepare Form SE and transfer the calculations to Schedule 2 line 4 and Schedule 1 line 15. For FORM 1040 complete lines 8, 9, 10, 11 and 23. 1) Due to Andy's expertise in Gulf of Mexico offshore operations, Pelican continues to use his services on a consulting basis. Consulting income paid by Pelican (including expense reimbursement) $35,000. After each trip, Andy recovers his expenses when he is paid by Pelican for the services rendered. During 2022, he made seven trips on behalf of Pelican. On a typical trip, Andy flies by commercial airline to New Orleans, Houston, or Corpus Christi, and then takes a company helicopter to the offshore platform. The expenses for these trips are as follows: 2) Sarah, an accomplished artist, is well known regionally for oil portraits. She paints in the Photorealism style, providing her clients with portraits that are often mistaken for photographs. Painting in this style is very timeconsuming. Consequently, her output averages between 15 and 16 portraits a year. Her fee of $4,000 per portrait was set several years ago and never varies. As this is quite reasonable for a Photorealistic oil portrait, she has a long waiting list of clients who have not yet been scheduled for sittings. She does all the work in the studio the Clarks maintain in their personal residence. Sarah is a cash basis taxpayer with respect to her art business. In early January 2022, Sarah was paid for three (3) portraits she painted and delivered in late 2021. During 2022, Sarah completed 14 new portraits. Payment was received for 11(11) portraits when they were delivered to the buyers. - One portrait was delivered in mid-2021 to the CEO of a company who promised payment within 30 days. Payment was never received, and the company has since entered bankruptcy. Since the CEO has been indicted for securities fraud, Sarah feels certain that she will never be paid for the portrait. - The final 2 (2) portraits were delivered in late 2021, and payments for both were received in early 2022. - Also, in December 2021, Sarah accepted $4,000 as payment for a portrait to be done in 2022 . Sarah keeps receipts for all her expenses. Her total cost for painting supplies in 2022 was $3,010 (e.g., for canvases, brushes, oil paints, smocks, palettes, and other art supplies). The framing of the finished portrait is left to the customer. 4) Business Use of Home Complete Form 8829, Parts I, II, and III; allocating residential expenses as (a) direct or (b) indirect. For convenience and security reasons, Sarah prefers to work at home. One-fourth of the 4,000 square-foot living area is devoted to Sarah's studio. The Clarks built the home at a cost of $350,000 on a lot previously acquired for $100,000, and they moved in on June 15,2015 . As to business use, depreciation is based on MACRS (using the midmonth convention) applicable to 39 -vear nonresidential realty. Besides home mortgage interest - $2,200 and property taxes - $3,600, other residence-related expenses were: Other taxpayer payments related to Sarah's business were: - Subscriptions to professional journals, Oil and gas related (Andy) $160 and Art related (Sarah) $120 - Dues to professional organizations (Andy) $140 and the State professional license fee (Andy) $250 - 2021 tax return preparation fees paid in 2022 (\$200 for Andy's business, $250 for Sarah's business, and $450 for their personal income tax return) $900. 1) Personal Information Complete these sections on Form 1040: Filing Status, Standard Deduction, Dependents Andrew (Andy) S. and Sarah H. Clark are husband and wife and live at 4112 Foxglove Drive, McKinney, TX 75070. Andy is a retired petroleum engineer, and Sarah is a portrait artist. They choose to file a joint tax return. Their daughter, Gabrielle, was given custody of her children in a November 2019 divorce and awarded child support of $1,000 a month. The decree does not indicate who is entitled to the dependency exemptions for the children. Following the divorce, Gabrielle is taking some time to decide how to move forward with her life. She did not work in 2022, so she had no income for the year except the money she received for child support. Andy and Sarah have provided all Gabrielle's and the twins' support beyond child support. $250,000 (in after-tax dollars). Under one of the plan options, he chose a life-annuity payout of $60,000 per year over his life. As part of his retirement package, Andy also received nontaxable health insurance coverage. Social Security benefits (Andy, \$12,000; Sarah, \$6,000) Life insurance proceeds $50,000. The life insurance proceeds concerned a policy owned by Maximilian Clark, which named Andy as sole beneficiary. The receipt of the proceeds came as a complete surprise to Andy. Ordinary dividend income (reported on separate Forms 1099-DIV): Ragusa Corporation 1,200 Pelican Power 400 Interest cash received as reported on separate Forms 1099-INT: IBM bonds 600 CD at First National Bank of McKinney 400 Wells Fargo money market fund 300 City of Beaumont (TX) general-purpose bonds 9,000 For Paperwork Reduction Act Notice, see your tax return instructions. Cat. No. 17146N Schedule B (Form 1040) 2022 SCHEDULE 1 (Form 1040) Department of the Treasury Department of the Treasur \begin{tabular}{ll} Internal Revenue Service & Go to www.irs.gov/F \\ \hline Name(s) shown on Form 1040, 1040-SR, or 1040-NR \end{tabular} Additional Income and Adjustments to Income Attach to Form 1040, 1040-SR, or 1040-NR. orm 1040 for instructions and the latest information. Part I Additional Income Schedule 1 (Form 1040) 2022 Page 2 Part II Adjustments to Income Form 8829 Department of the Treasury Internal Revenue Service Name(s) of proprietor(s) Expenses for Business Use of Your Home File only with Schedule C (Form 1040). Use a separate Form 8829 for each home you used for business during the year. Go to www.irs.gov/Form8829 for instructions and the latest information. \begin{tabular}{|l} OMB No. 1545-0074 \\ \hline \\ AttachmentSequenceNo.176 \\ \hline \end{tabular} Your social security number Part I Part of Your Home Used for Business 1 Area used regularly and exclusively for business, regularly for daycare, or for storage of inventory or product samples (see instructions) 2 Total area of home. 3 Divide line 1 by line 2. Enter the result as a percentage . For daycare facilities not used exclusively for business, go to line 4. All others, go to line 7 . 4 Multiply days used for daycare during year by hours used per day 5 If you started or stopped using your home for daycare during the year, see instructions; otherwise, enter 8,760. 6 Divide line 4 by line 5 . Enter the result as a decimal amount 7 Business percentage. For daycare facilities not used exclusively for business, multiply line 6 by line 3 (enter the result as a percentage). All others, enter the amount from line 3 Part II Figure Your Allowable Deduction 51040 Department of the Treasury-Internal Revenue Service U.S. Individual Income Tax Return Filing Status Single Married filing jointly Married filing separately (MFS) Head of household (HOH) Qualifying surviving Check only spouse (QSS) one box. If you checked the MFS box, enter the name of your spouse. If you checked the HOH or QSS box, enter the child's name if the qualifying person is a child but not your dependent: For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see separate instructions. Cat. No. 11320B Form 1040 (2022) 3) Profit or Loss from a Business Complete SCHEDULE C for each taxpayer. Combine the results on Schedule 1 lines 3 and 10. Complete Form 8829 in support of Schedule C. Also prepare Form SE and transfer the calculations to Schedule 2 line 4 and Schedule 1 line 15. For FORM 1040 complete lines 8, 9, 10, 11 and 23. 1) Due to Andy's expertise in Gulf of Mexico offshore operations, Pelican continues to use his services on a consulting basis. Consulting income paid by Pelican (including expense reimbursement) $35,000. After each trip, Andy recovers his expenses when he is paid by Pelican for the services rendered. During 2022, he made seven trips on behalf of Pelican. On a typical trip, Andy flies by commercial airline to New Orleans, Houston, or Corpus Christi, and then takes a company helicopter to the offshore platform. The expenses for these trips are as follows: 2) Sarah, an accomplished artist, is well known regionally for oil portraits. She paints in the Photorealism style, providing her clients with portraits that are often mistaken for photographs. Painting in this style is very timeconsuming. Consequently, her output averages between 15 and 16 portraits a year. Her fee of $4,000 per portrait was set several years ago and never varies. As this is quite reasonable for a Photorealistic oil portrait, she has a long waiting list of clients who have not yet been scheduled for sittings. She does all the work in the studio the Clarks maintain in their personal residence. Sarah is a cash basis taxpayer with respect to her art business. In early January 2022, Sarah was paid for three (3) portraits she painted and delivered in late 2021. During 2022, Sarah completed 14 new portraits. Payment was received for 11(11) portraits when they were delivered to the buyers. - One portrait was delivered in mid-2021 to the CEO of a company who promised payment within 30 days. Payment was never received, and the company has since entered bankruptcy. Since the CEO has been indicted for securities fraud, Sarah feels certain that she will never be paid for the portrait. - The final 2 (2) portraits were delivered in late 2021, and payments for both were received in early 2022. - Also, in December 2021, Sarah accepted $4,000 as payment for a portrait to be done in 2022 . Sarah keeps receipts for all her expenses. Her total cost for painting supplies in 2022 was $3,010 (e.g., for canvases, brushes, oil paints, smocks, palettes, and other art supplies). The framing of the finished portrait is left to the customer. 4) Business Use of Home Complete Form 8829, Parts I, II, and III; allocating residential expenses as (a) direct or (b) indirect. For convenience and security reasons, Sarah prefers to work at home. One-fourth of the 4,000 square-foot living area is devoted to Sarah's studio. The Clarks built the home at a cost of $350,000 on a lot previously acquired for $100,000, and they moved in on June 15,2015 . As to business use, depreciation is based on MACRS (using the midmonth convention) applicable to 39 -vear nonresidential realty. Besides home mortgage interest - $2,200 and property taxes - $3,600, other residence-related expenses were: Other taxpayer payments related to Sarah's business were: - Subscriptions to professional journals, Oil and gas related (Andy) $160 and Art related (Sarah) $120 - Dues to professional organizations (Andy) $140 and the State professional license fee (Andy) $250 - 2021 tax return preparation fees paid in 2022 (\$200 for Andy's business, $250 for Sarah's business, and $450 for their personal income tax return) $900. 1) Personal Information Complete these sections on Form 1040: Filing Status, Standard Deduction, Dependents Andrew (Andy) S. and Sarah H. Clark are husband and wife and live at 4112 Foxglove Drive, McKinney, TX 75070. Andy is a retired petroleum engineer, and Sarah is a portrait artist. They choose to file a joint tax return. Their daughter, Gabrielle, was given custody of her children in a November 2019 divorce and awarded child support of $1,000 a month. The decree does not indicate who is entitled to the dependency exemptions for the children. Following the divorce, Gabrielle is taking some time to decide how to move forward with her life. She did not work in 2022, so she had no income for the year except the money she received for child support. Andy and Sarah have provided all Gabrielle's and the twins' support beyond child support. $250,000 (in after-tax dollars). Under one of the plan options, he chose a life-annuity payout of $60,000 per year over his life. As part of his retirement package, Andy also received nontaxable health insurance coverage. Social Security benefits (Andy, \$12,000; Sarah, \$6,000) Life insurance proceeds $50,000. The life insurance proceeds concerned a policy owned by Maximilian Clark, which named Andy as sole beneficiary. The receipt of the proceeds came as a complete surprise to Andy. Ordinary dividend income (reported on separate Forms 1099-DIV): Ragusa Corporation 1,200 Pelican Power 400 Interest cash received as reported on separate Forms 1099-INT: IBM bonds 600 CD at First National Bank of McKinney 400 Wells Fargo money market fund 300 City of Beaumont (TX) general-purpose bonds 9,000 For Paperwork Reduction Act Notice, see your tax return instructions. Cat. No. 17146N Schedule B (Form 1040) 2022 SCHEDULE 1 (Form 1040) Department of the Treasury Department of the Treasur \begin{tabular}{ll} Internal Revenue Service & Go to www.irs.gov/F \\ \hline Name(s) shown on Form 1040, 1040-SR, or 1040-NR \end{tabular} Additional Income and Adjustments to Income Attach to Form 1040, 1040-SR, or 1040-NR. orm 1040 for instructions and the latest information. Part I Additional Income Schedule 1 (Form 1040) 2022 Page 2 Part II Adjustments to IncomeStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started