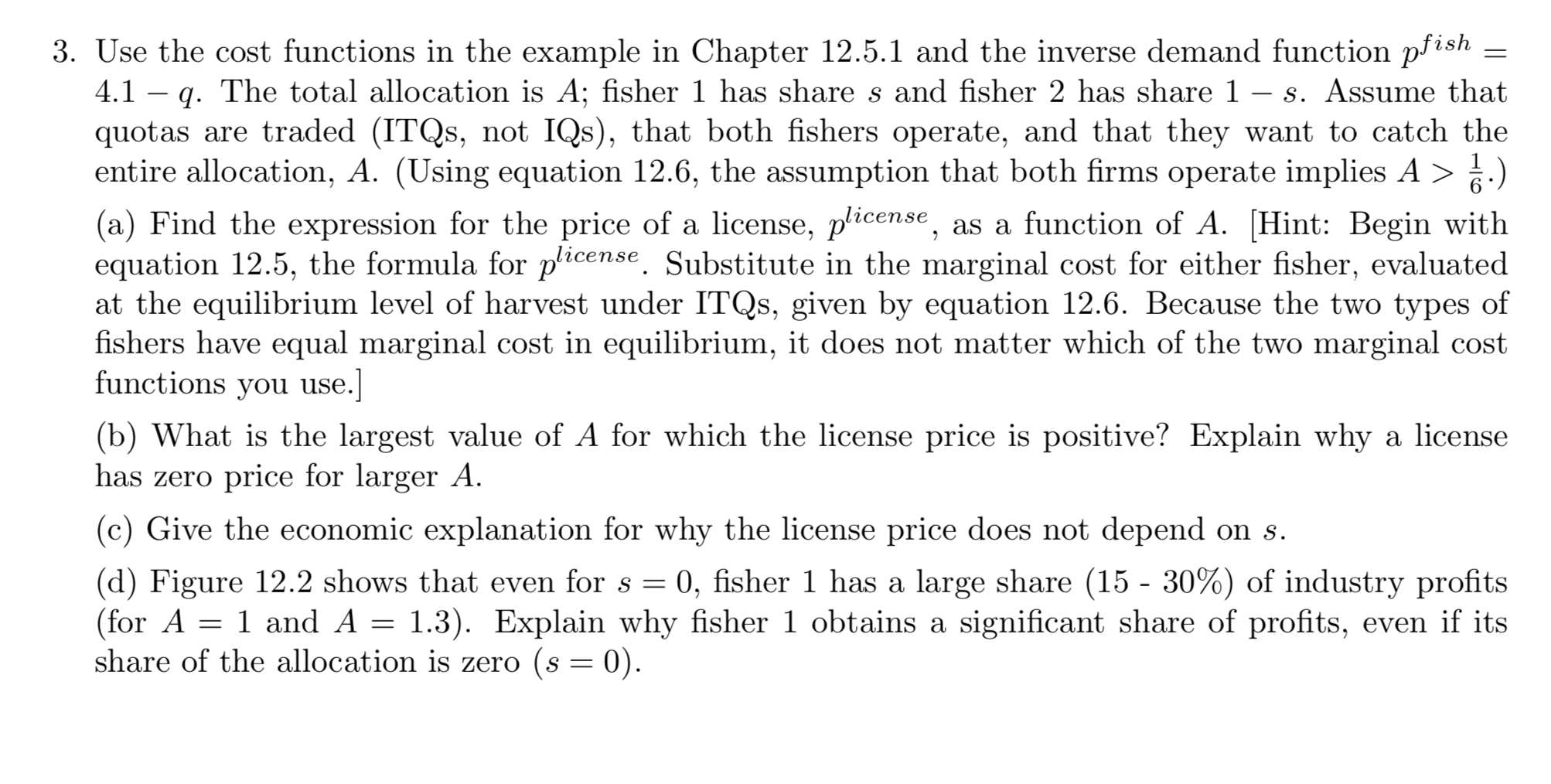

I have the physical copy but was able to access the library reserve. Hope this helps. Example An example with two fishers (or two groups of fishers) having different harvest cost functions makes these observations concrete. Fishers 1 and 2 have harvest costs ci(91) = 91 + 9; and c2(q2) =0.592 + 1.543. The TAC is A, and fishers 1 and 2 have shares s and 1 - s, respectively. Assume that the price of fish is high enough that they both want to catch their limit when trade is not allowed (IQs are used, not ITQs). Then the industry cost is CO(A) = CI(s A) + c2((1 -s)A) = (0.5s +0.5) + (2.5s2 - 3.0s + 1.5)A A. If the fishers are allowed to buy and sell permits, we saw above that if they both harvest a positive quantity, then they harvest to the point where their marginal costs are equal. This equality requires 1 + 2q1 = 0.5 + 3q2. The reallocation of harvest never increases (and except for a knife-edge case strictly decreases) total costs. Therefore, the assumption that the fishers want to catch the limit in the absence of quota trade means that they also want to catch the limit under trade; thus, q1 + q2 = A. Temporarily ignoring the non-negativity constraint on catch, we solve the last two equations to obtain 91 =0.6A -0.1, and 92 =0.4A +0.1 => 1 =0.6 -- 0.1 A A (12.6) The first equation in 12.6 shows that the non-negativity constraint is not binding if and only if A2 4. The last equation in 12.6 shows that equality of marginal cost levels requires the share of harvest to vary with the total harvest, A, but not with the allocation, s. For A> ], both fishers are active, and industry cost equals CITO(A) = CI (0.6A -0.1) + c2(0.4A +0.1)= -0.025 +0.8A +0.6A?.3. Use the cost functions in the example in Chapter 12.5.1 and the inverse demand function pfish = 4.1 - q. The total allocation is A; fisher 1 has share s and fisher 2 has share 1 - s. Assume that quotas are traded (ITQs, not IQs), that both fishers operate, and that they want to catch the entire allocation, A. (Using equation 12.6, the assumption that both firms operate implies A > .) (a) Find the expression for the price of a license, plicense, as a function of A. Hint: Begin with equation 12.5, the formula for plicense. Substitute in the marginal cost for either fisher, evaluated at the equilibrium level of harvest under ITQs, given by equation 12.6. Because the two types of fishers have equal marginal cost in equilibrium, it does not matter which of the two marginal cost functions you use.] (b) What is the largest value of A for which the license price is positive? Explain why a license has zero price for larger A. (c) Give the economic explanation for why the license price does not depend on s. (d) Figure 12.2 shows that even for s = 0, fisher 1 has a large share (15 - 30%) of industry profits (for A = 1 and A = 1.3). Explain why fisher 1 obtains a significant share of profits, even if its share of the allocation is zero (s = 0).(e) Use Figure 12.2. Suppose that fisher 1 has the share of quotas s1 = 0.2. The regulator announces the efficient trajectory of allowable catch, which increases over time from A = 1 to A = 1.3. If fisher 1 were able to perturb (= change) this trajectory, would she want to do so? Why