Answered step by step

Verified Expert Solution

Question

1 Approved Answer

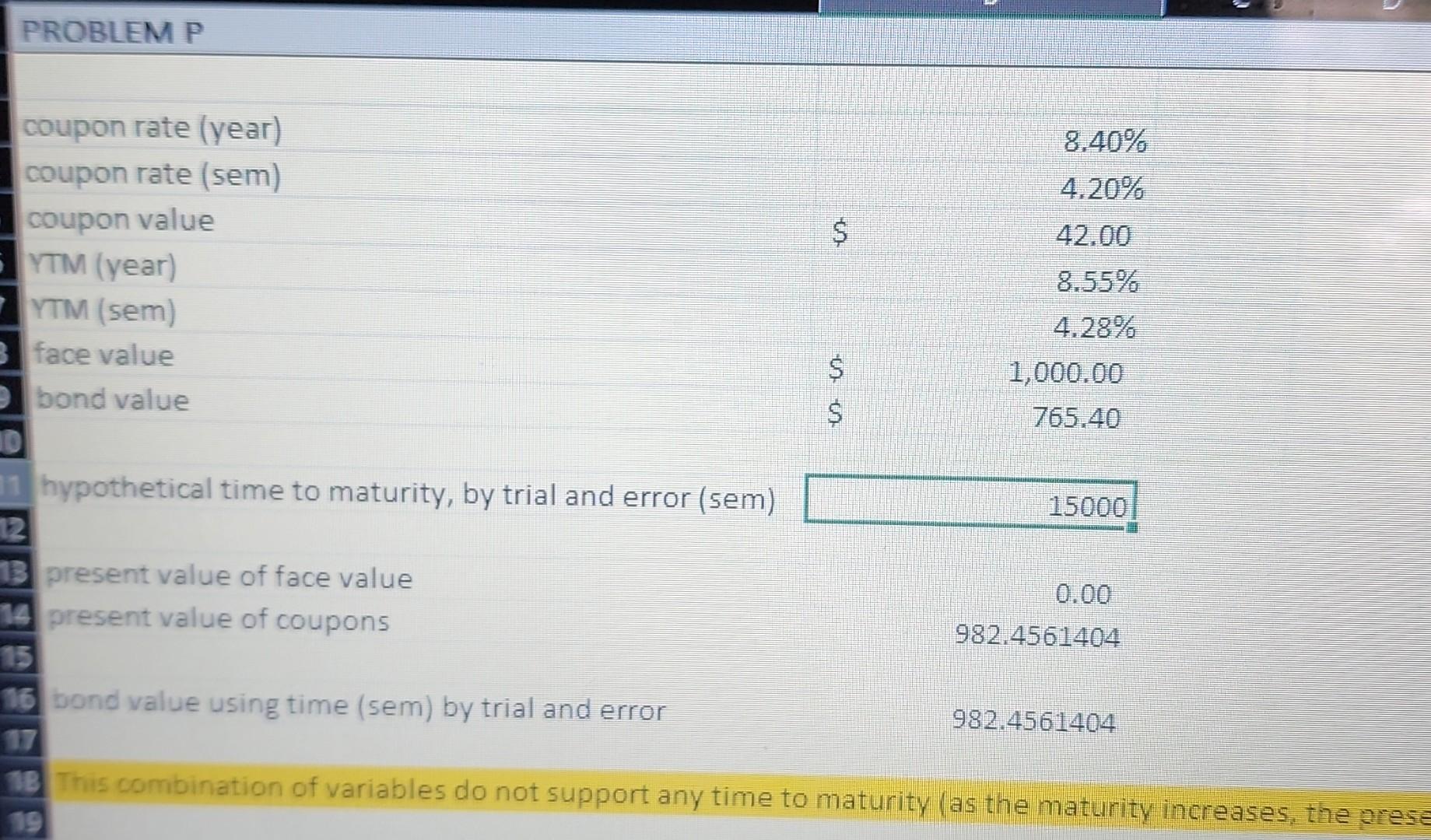

I have the problem and its solution but can anyone explain me how we get the 15000 and what formula to use to get this

I have the problem and its solution but can anyone explain me how we get the "15000" and what formula to use to get this figure? Please explain it clearly and in Excel.

please can anyone answer it.

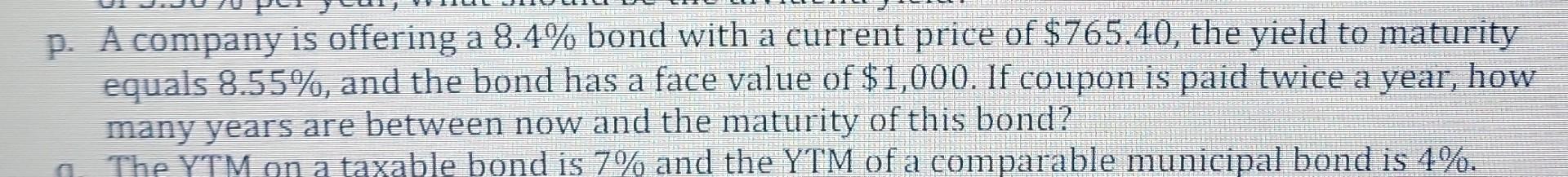

a p. A company is offering a 8.4% bond with a current price of $765.40, the yield to maturity equals 8.55%, and the bond has a face value of $1,000. If coupon is paid twice a year, how many years are between now and the maturity of this bond? The YTM on a taxable bond is 7% and the YTM of a comparable municipal bond is 4%. PROBLEM P $ in en un coupon rate (year) 8.40% coupon rate (sem) 4.20% coupon value 42.00 YTM (year) 8.55% YTM (sem) 4.28% B face value 1,000.00 bond value $ 765.40 10 11 hypothetical time to maturity, by trial and error (sem) 15000 2 1 present value of face value 0.00 14 present value of coupons 982.4561404 15 16 bond value using time (sem) by trial and error 982.4561404 17 1B This combination of variables do not support any time to maturity (as the maturity increases, the prese a p. A company is offering a 8.4% bond with a current price of $765.40, the yield to maturity equals 8.55%, and the bond has a face value of $1,000. If coupon is paid twice a year, how many years are between now and the maturity of this bond? The YTM on a taxable bond is 7% and the YTM of a comparable municipal bond is 4%. PROBLEM P $ in en un coupon rate (year) 8.40% coupon rate (sem) 4.20% coupon value 42.00 YTM (year) 8.55% YTM (sem) 4.28% B face value 1,000.00 bond value $ 765.40 10 11 hypothetical time to maturity, by trial and error (sem) 15000 2 1 present value of face value 0.00 14 present value of coupons 982.4561404 15 16 bond value using time (sem) by trial and error 982.4561404 17 1B This combination of variables do not support any time to maturity (as the maturity increases, the preseStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started