Answered step by step

Verified Expert Solution

Question

1 Approved Answer

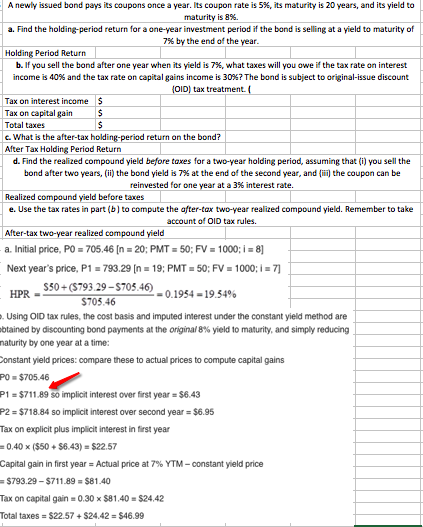

I have the question and answer. I need help indetifying a part of the problem. Please help me understand where does the $711.89 come from

I have the question and answer. I need help indetifying a part of the problem. Please help me understand where does the $711.89 come from ? how was it calculated.

A newly issued bond pays its coupons once a year. Its coupon rate is 5%, its maturity is 20 years, and its yield to maturity is 8%. a. Find the holding-period return for a one-year investment period if the bond is selling at a yield to maturity of 7% by the end of the year Holding Period Return b. If you sell the bond after one year when its yield is 7%, what taxes will you owe if the tax rate on interest income is 40% and the tax rate on capital gains income is 30%? The bond is subject to original-issue discount tax treatment Tax on interest income Tax on capital gain S Total taxes c. What is the after-tax holding-period return on the bond? After Tax Holding Period Return d. Find the realized compound yield before taxes for a two-year holding period, assuming that (i) you sell the bond after two years, (ii) the bond yield is 7% at the end of the second year, and (iii) the coupon can be reinvested for one year at a 3% interest rate. Realized compound yield before taxes e. Use the tax rates in part (b) to compute the after-tax two-year realized compound yield. Remember to take After-tax two-year realized compound yield a. Initial price. P0-705.46 [n: 20: PINT 50: FV-1000: 8] Next year's price, P1a 793.29 19: PMT-50: FV-000: i 7] account of OID tax rules. S50+ (S793.29-$705.46 705.46 HPR -0.1954-19.54% . Using OID tax rules, the cost basis and imputed iterest under the constant yield method are btained by discounting bond payments at the original 8% yield to maturity, and simply reducing naturity by one year at a time: onstant yield prices: compare these to actual prices to compute capital gains PO $705.46 1 $711 .89 so implicit interest over first year S6.43 F2 $718.84 so implicit interest over second year $6.95 Tax on explicit plus implicit interest in first year -040 x ($50 + $6.43) = $22.57 Capital gain in first year = Actual price at 7% YTM-constant yield price $793.29-$711.89 = $81.40 Tax on capital gain 0.30 S81.40-$24.42 Total taxes = $22.57 + $24.42 = $46.99

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started