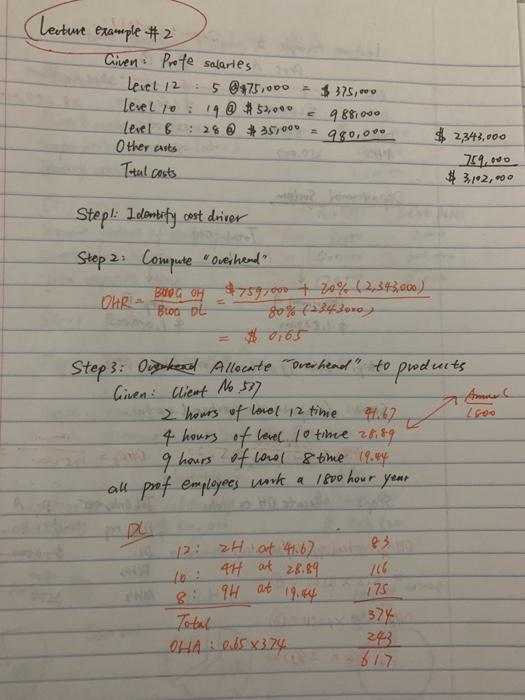

I have the question answer, but I just forgot how the orange numbers be caculated on step 3. I am not quite understand the question 2

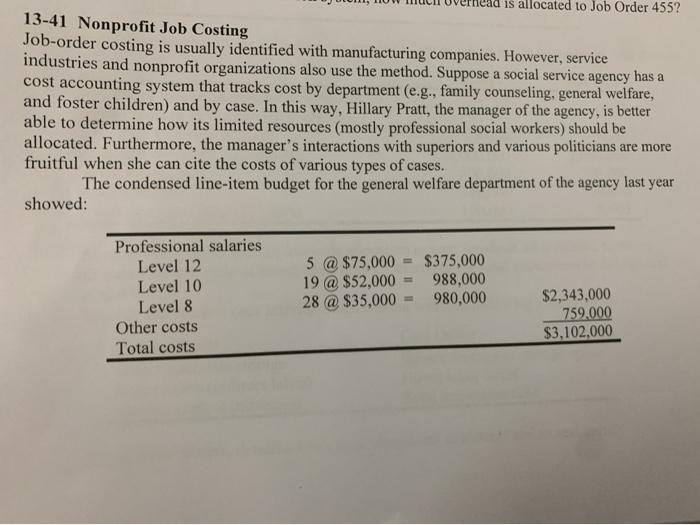

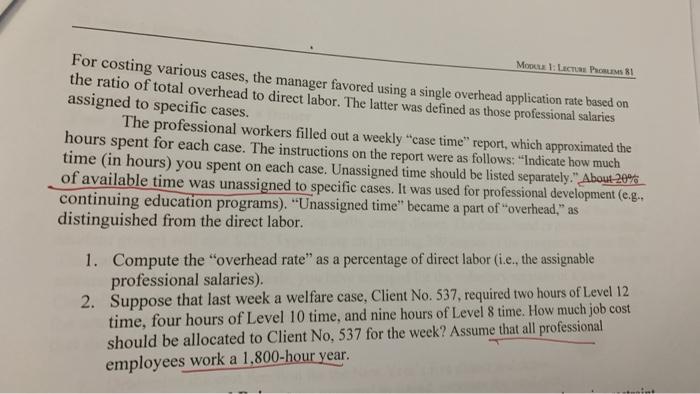

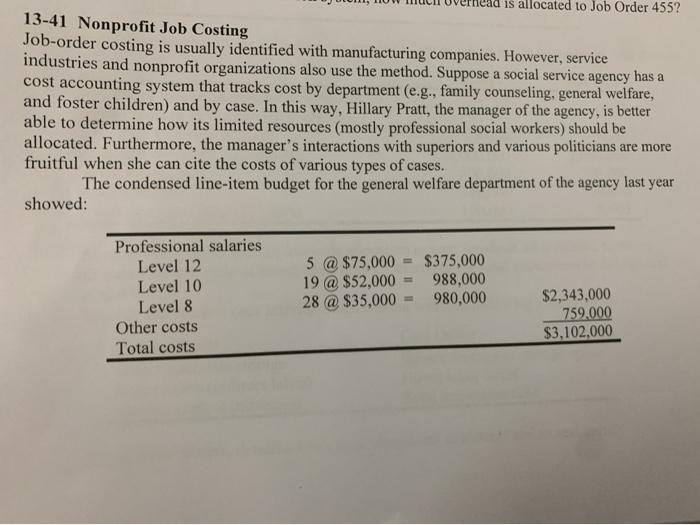

ad is allocated to Job Order 455? 13-41 Nonprofit Job Costing Job-order costing is usually identified with manufacturing companies. However, service industries and nonprofit organizations also use the method. Suppose a social service agency has a cost accounting system that tracks cost by department (e.g., family counseling, general welfare, and foster children) and by case. In this way, Hillary Pratt, the manager of the agency, is better able to determine how its limited resources (mostly professional social workers) should be allocated. Furthermore, the manager's interactions with superiors and various politicians are more fruitful when she can cite the costs of various types of cases. The condensed line-item budget for the general welfare department of the agency last year showed: Professional salaries Level 12 Level 10 Level 8 Other costs Total costs 5 @ $75,000 19 @ $52,000 28 @ $35,000 $375,000 988,000 980,000 $2,343,000 759,000 $3,102,000 Moxua 1: Lactomi Paomam 61 For costing various cases, the manager favored using a single overhead application rate based on the ratio of total overhead to direct labor. The latter was defined as those professional salaries assigned to specific cases. The professional workers filled out a weekly "case time" report, which approximated the hours spent for each case. The instructions on the report were as follows: "Indicate how much time (in hours) you spent on each case. Unassigned time should be listed separately." About 20% of available time was unassigned to specific cases. It was used for professional development (e.g.. continuing education programs). "Unassigned time" became a part of overhead." as distinguished from the direct labor. 1. Compute the "overhead rate" as a percentage of direct labor (.e. the assignable professional salaries). 2. Suppose that last week a welfare case, Client No. 537, required two hours of Level 12 time, four hours of Level 10 time, and nine hours of Level 8 time. How much job cost should be allocated to Client No. 537 for the week? Assume that all professional employees work a 1.800-hour year. Lecture example #2 Criven Profe salaries Level 12 5 $75,000 - $375,6 Level 10: 14 @ $52,000 59881000 Level & : 28 @ #387,000 = 980,00 Other casts $ 2343,000 79,00 # 3.1.2, Total costs Stepl: Identity cost driver Step 2: Compute "overhead? OhB BHOG OF $7597000 + 20% 42,343.000) Bon L 80% (1343oro fruits 1600 Step 3: Overland Allocate Overhead" to produ liven: Client No 537 2 hours of lovel 12 time 4 hours of level 10 time 28,89 9 hours of low 8 time 19.04 -all prof employees work a 1800 hour year HO 12: ZH auf 41.67 44 at 28.89 9H at 175 37% 243 OHA : 65x374 617