Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I have the right answer but I am confused about the percentage number how do I get this percentage number? need explanation.. Hutch, Inc., uses

I have the right answer but I am confused about the percentage number how do I get this percentage number? need explanation..

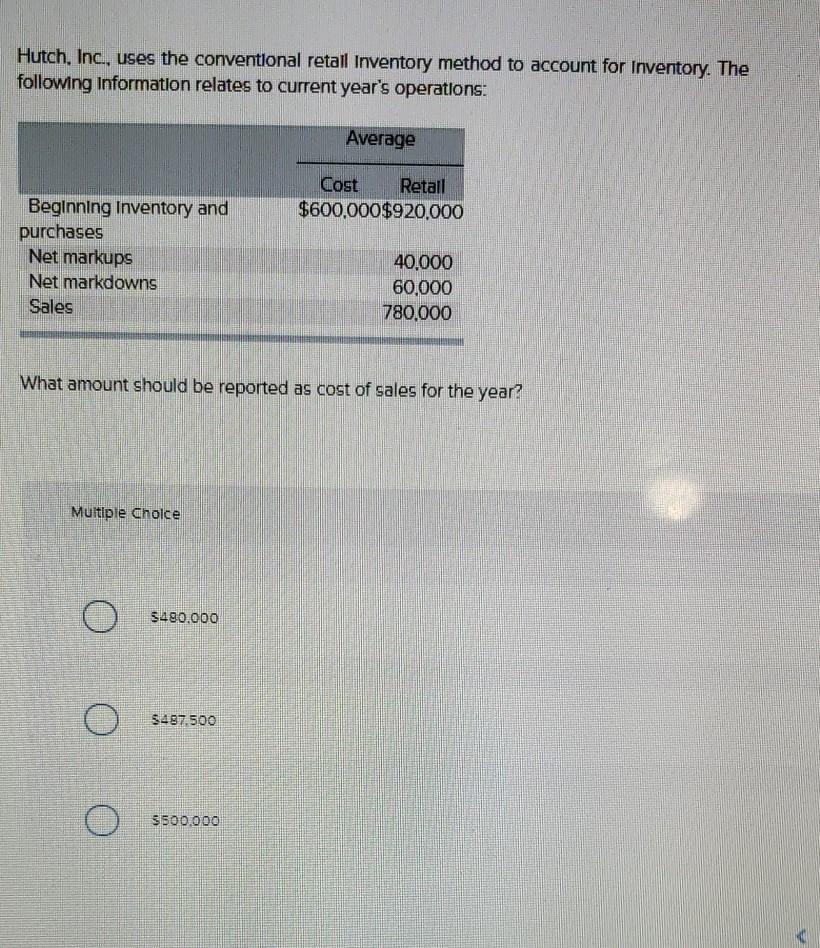

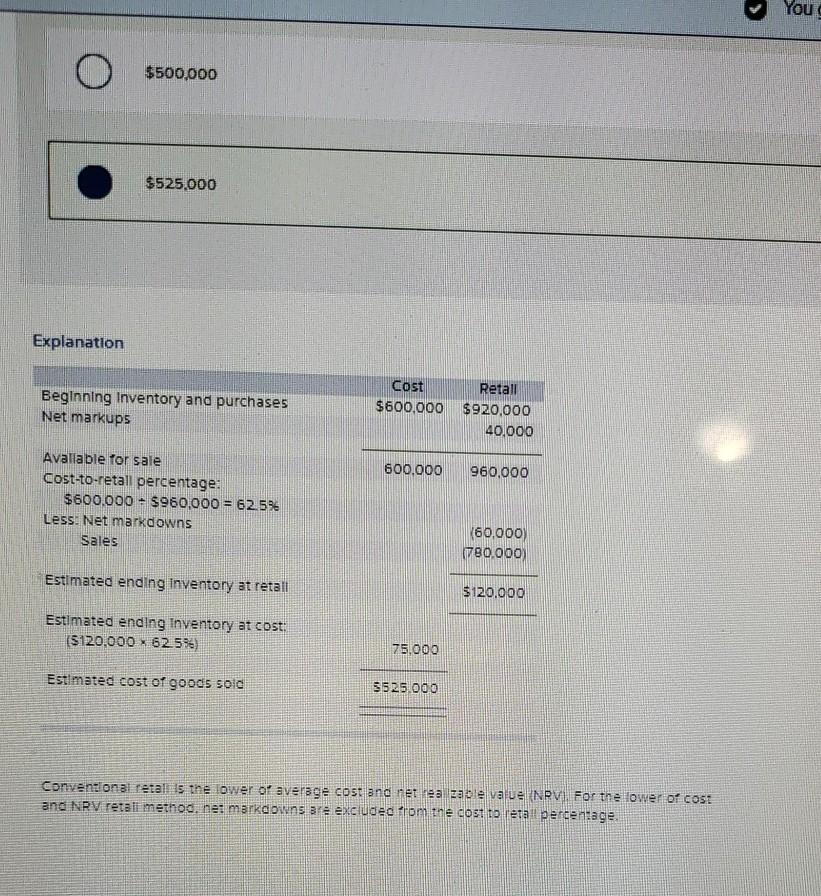

Hutch, Inc., uses the conventional retall Inventory method to account for Inventory. The following Information relates to current year's operations: Average Cost Retail $600,000$920,000 Beginning Inventory and purchases Net markups Net markdowns Sales 40.000 60.000 780,000 What amount should be reported as cost of sales for the year? Multiple Choice $480.000 5497.500 O 5500.000 You O O $500,000 $525.000 Explanation Beginning Inventory and purchases Net markups Cost Retall $600,000 $920,000 40.000 600.000 960.000 Available for sale Cost-to-retall percentage: $600,000 = $960,000 = 62.5% Less. Net markdowns Sales (60,000) 780,000) Estimated ending Inventory st retall $120.000 Estimated ending Inventory at cost: ($120.000 - 62.5) 75.000 Estimated cost of goods sold 5525.000 Conventional retalls the lower or average cost and netreazale value NRVI. For the lower of cost and NRV retalt method, net markdowns are excluded from the cost to reta perceniageStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started