I have this almost done but need help with the ones marked incorrect in red. Thanks in advance!

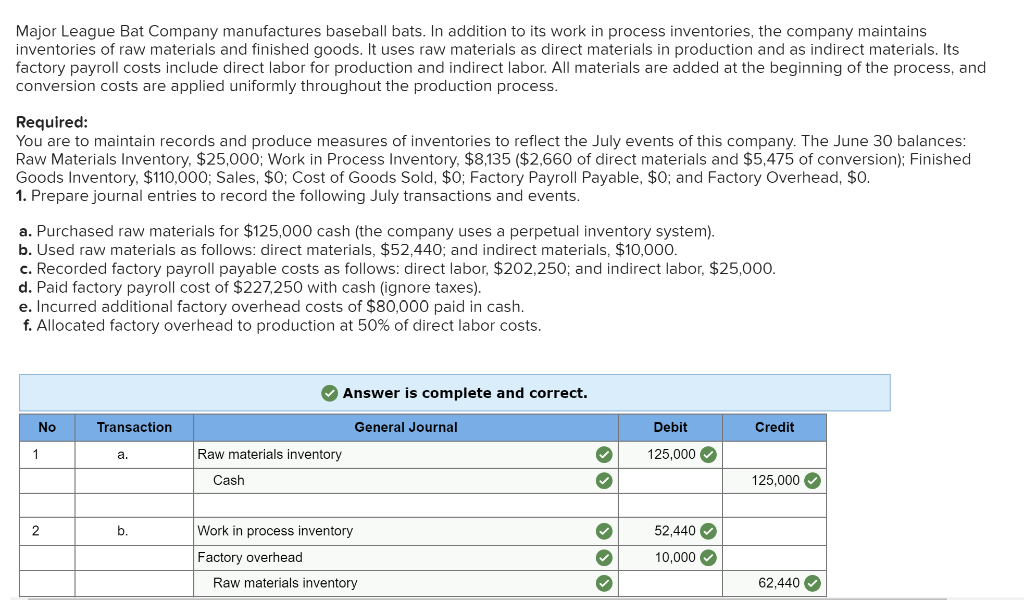

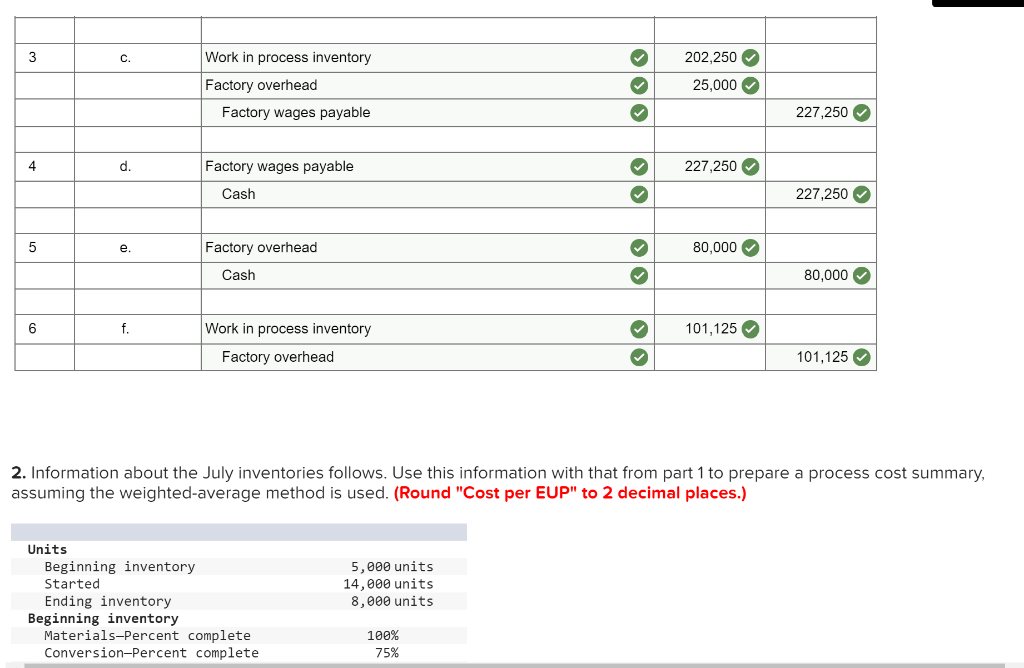

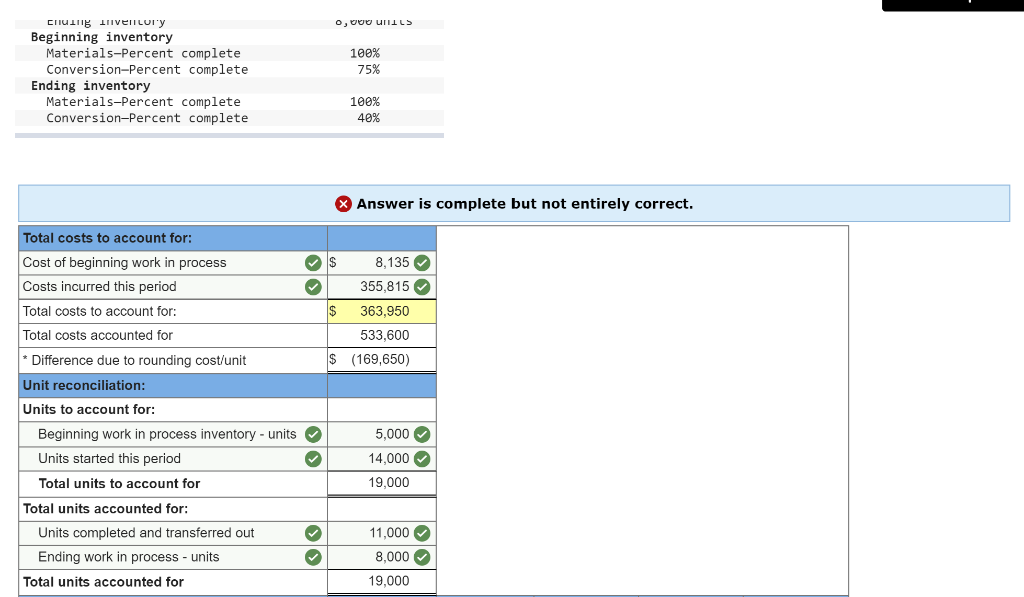

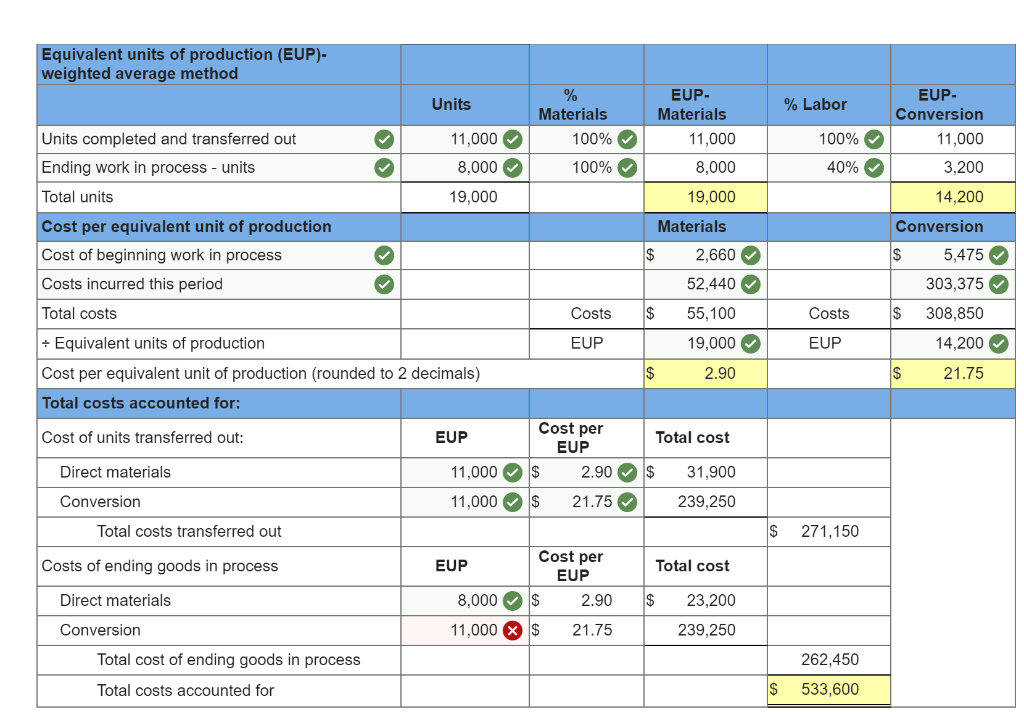

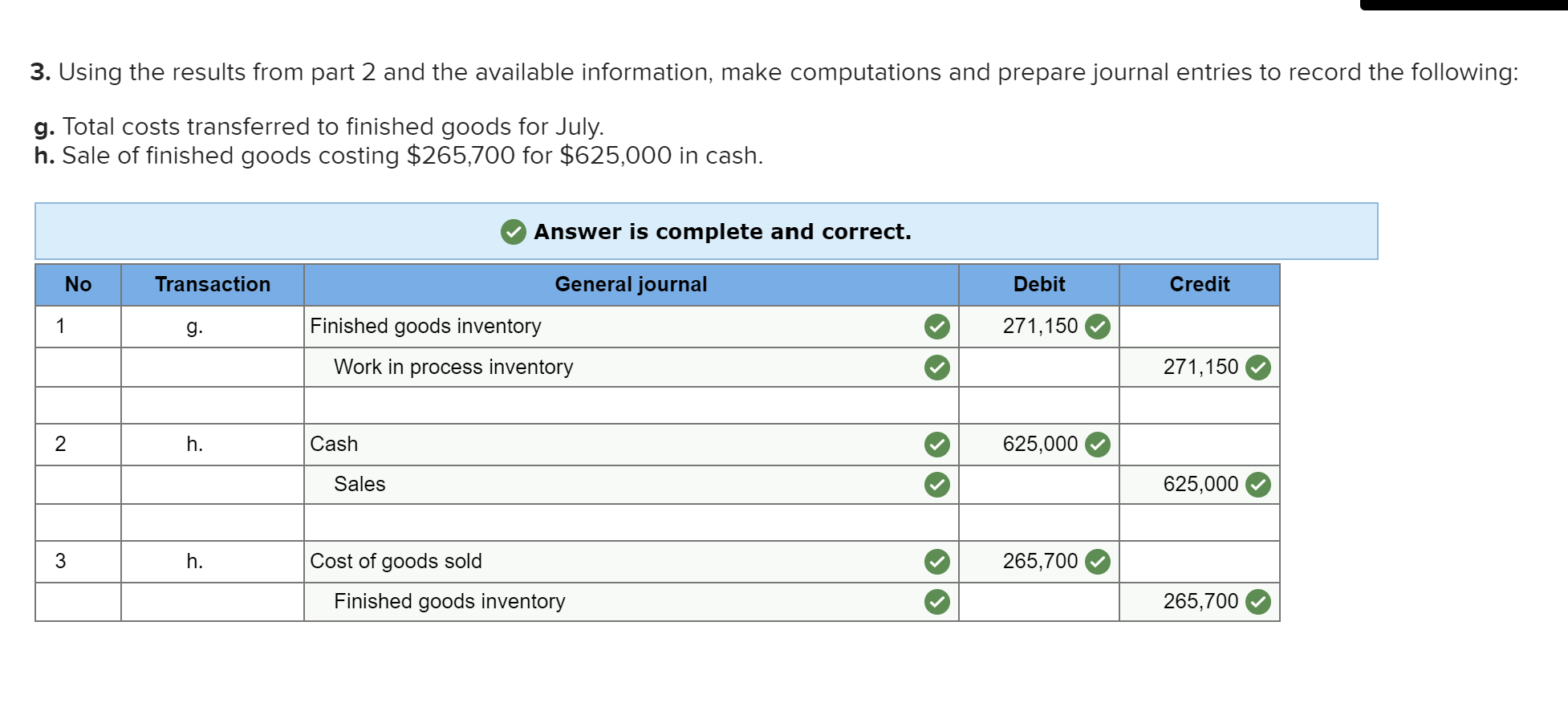

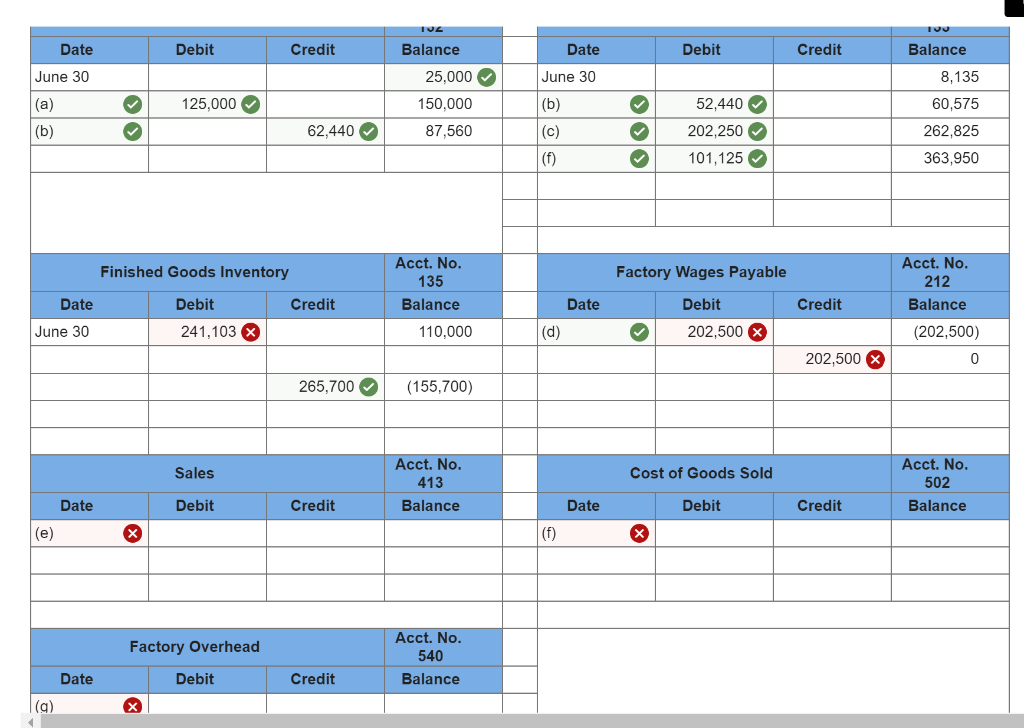

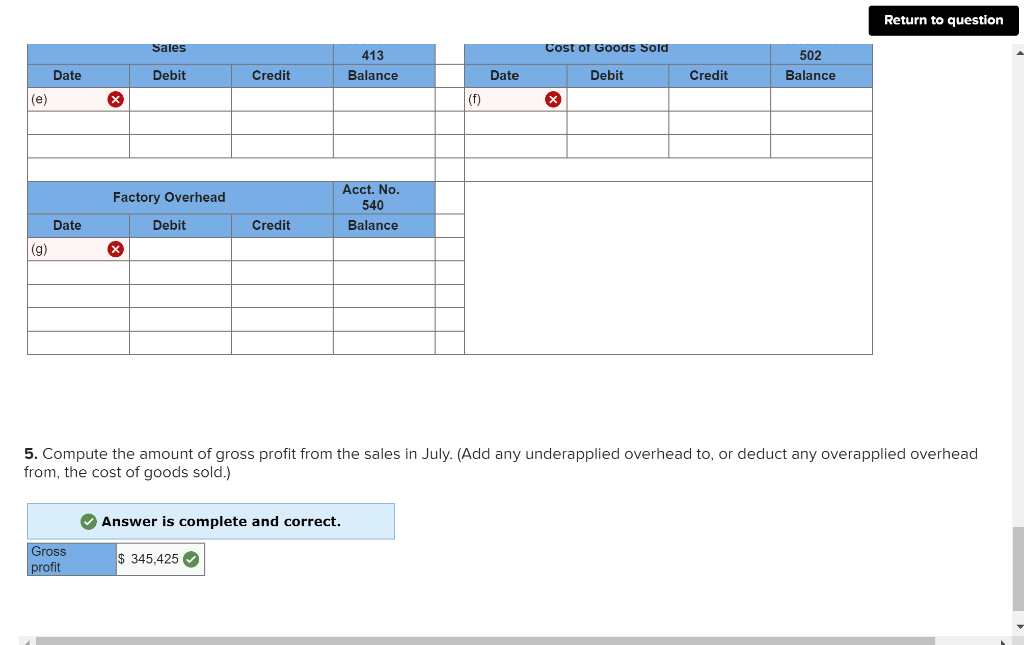

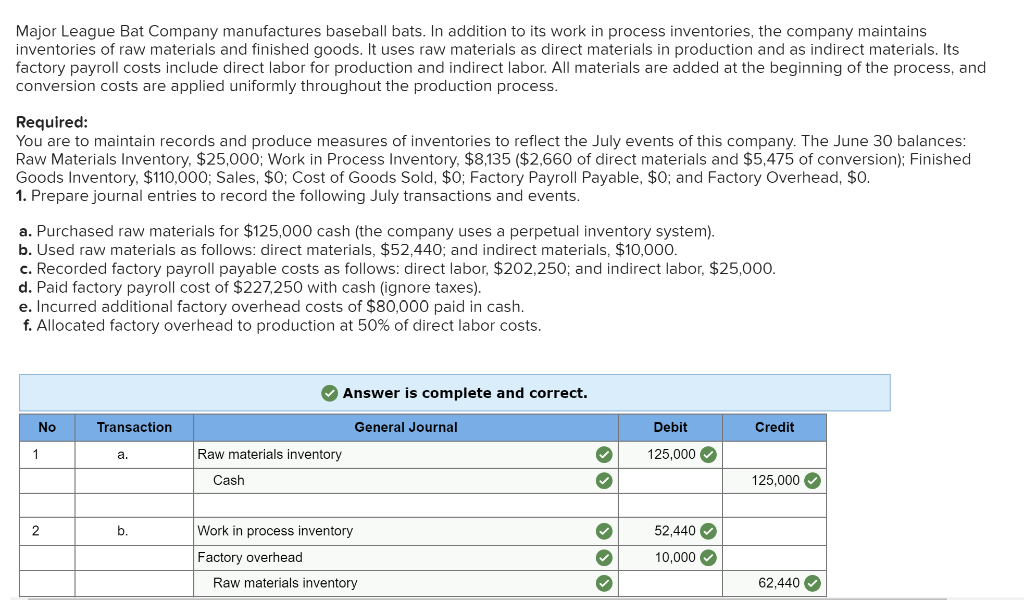

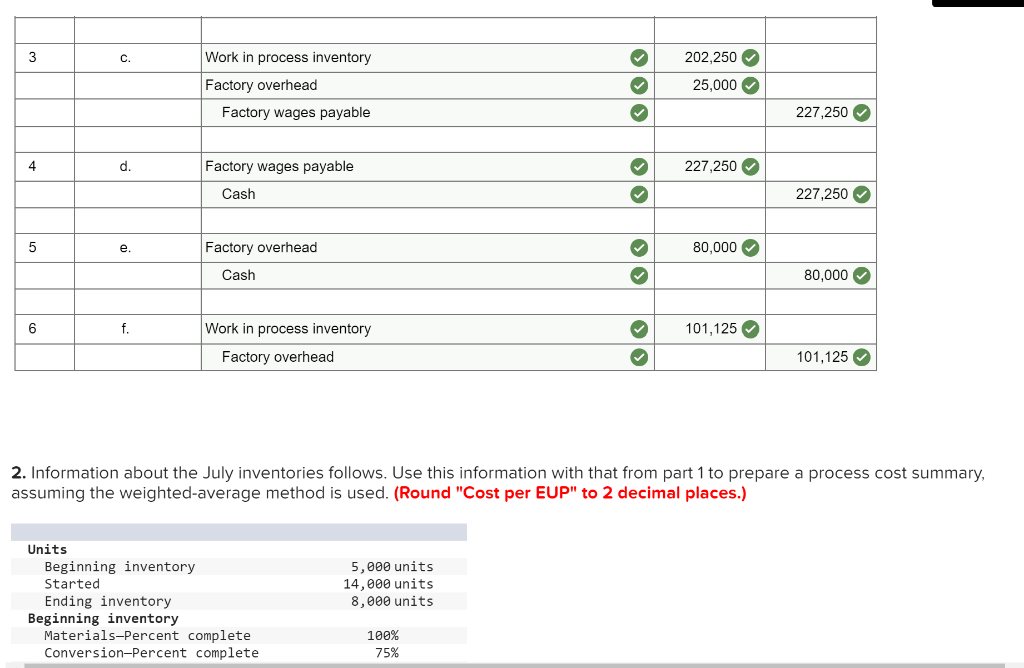

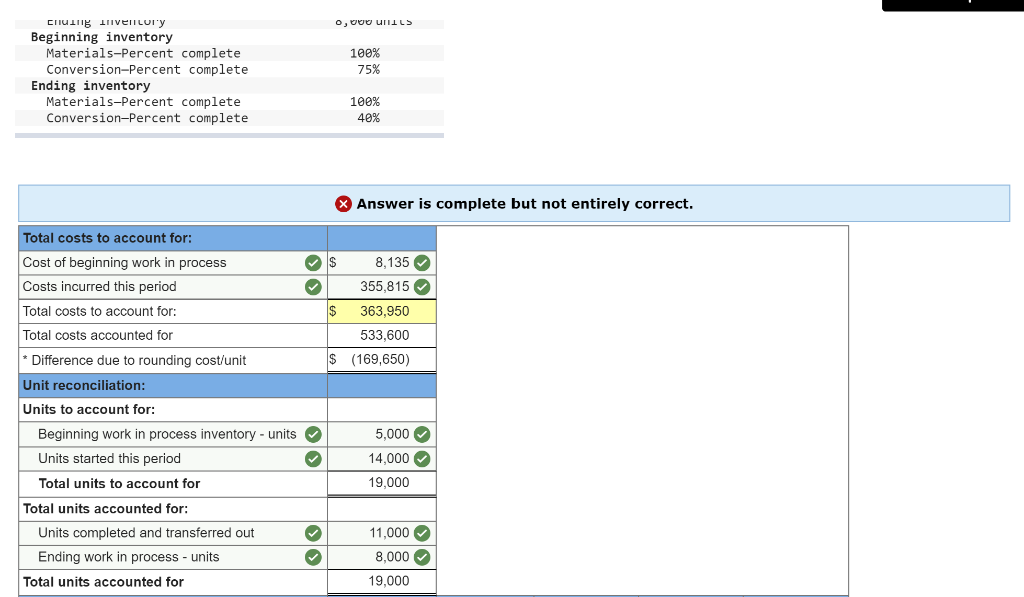

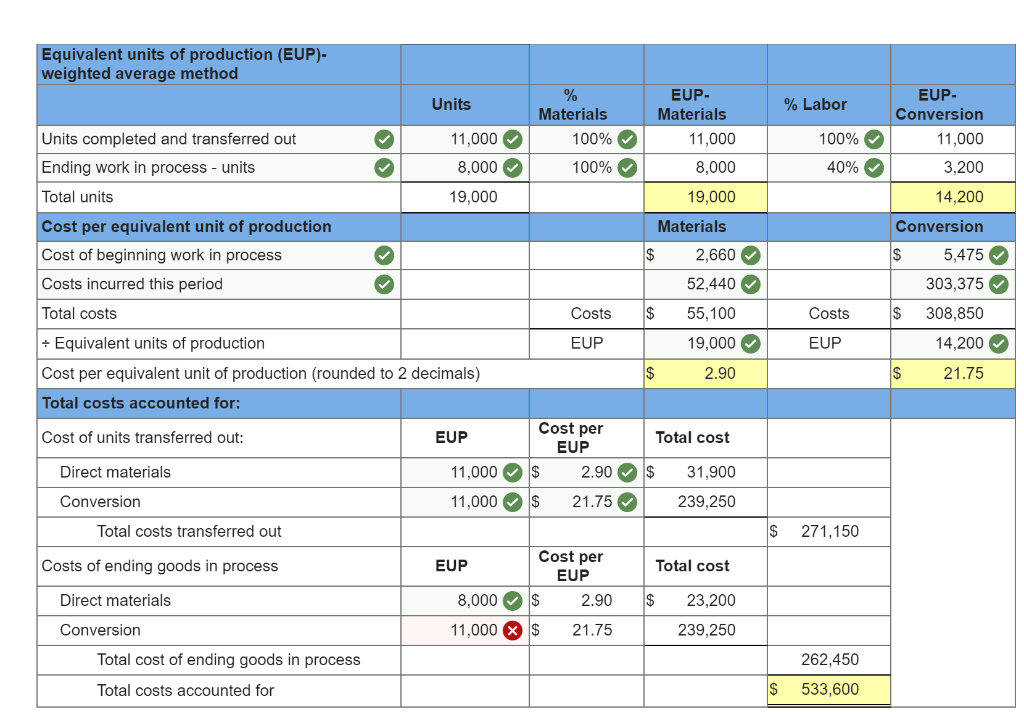

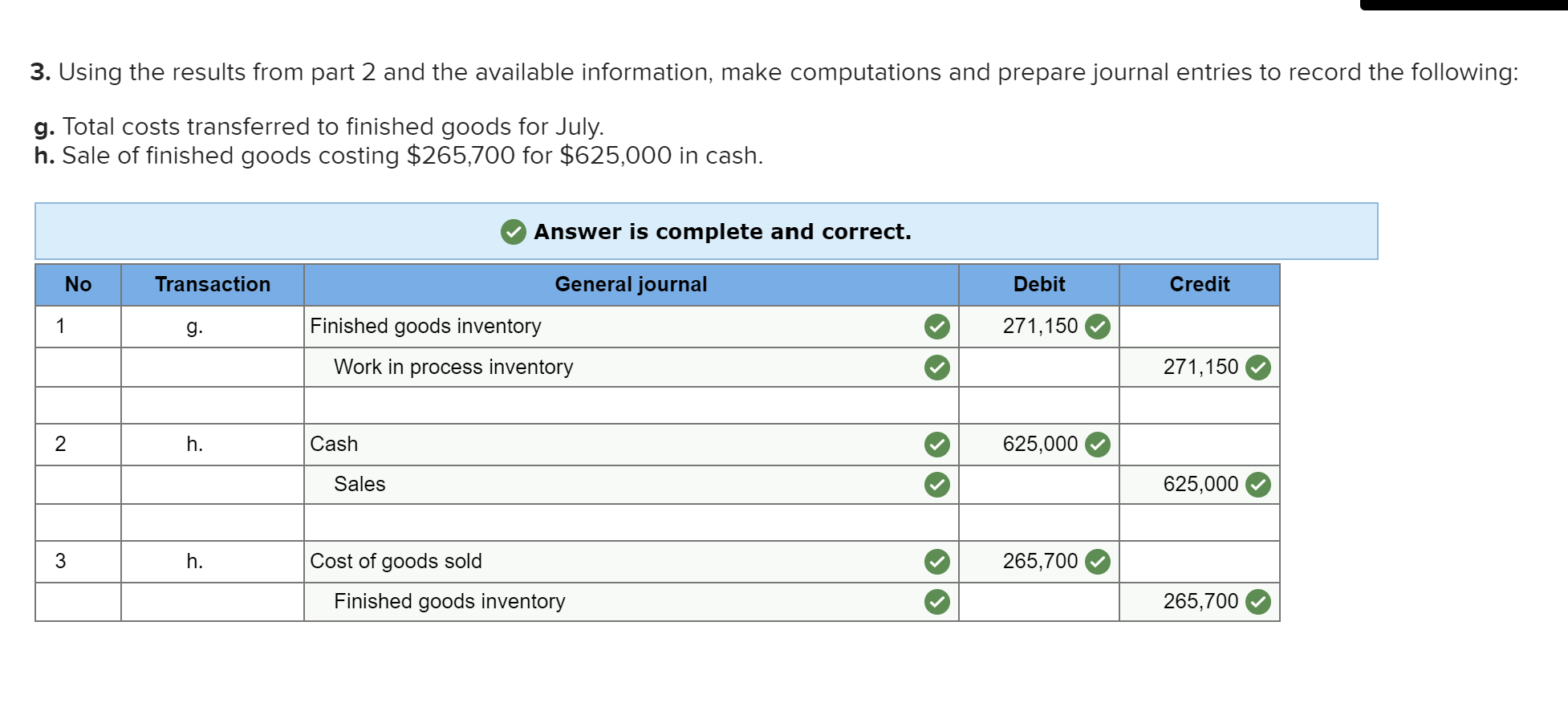

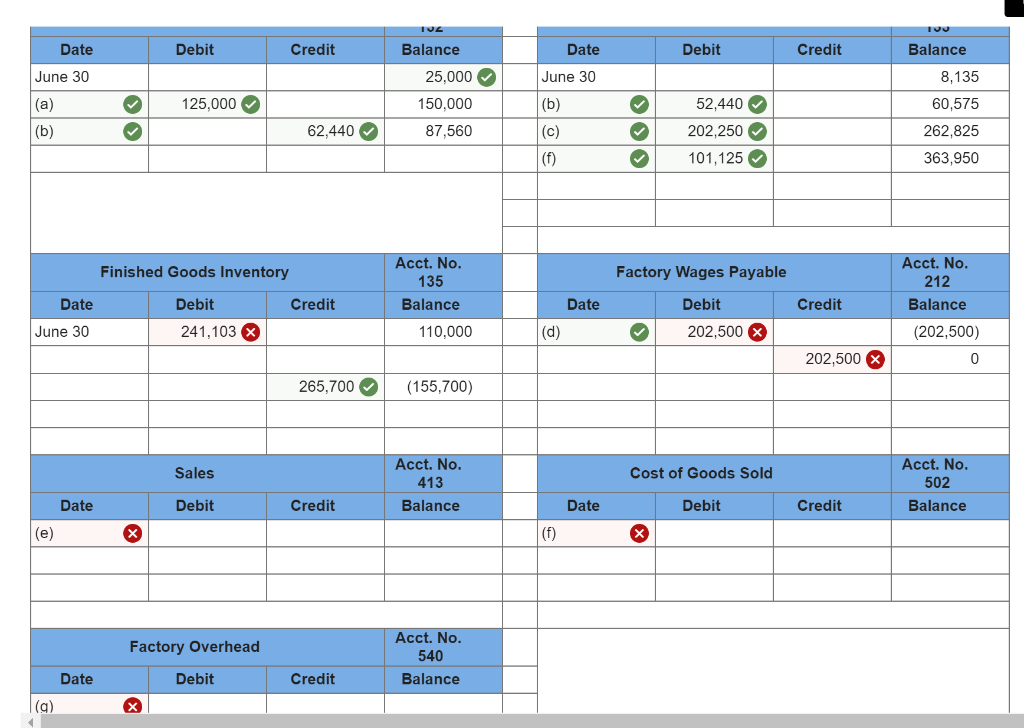

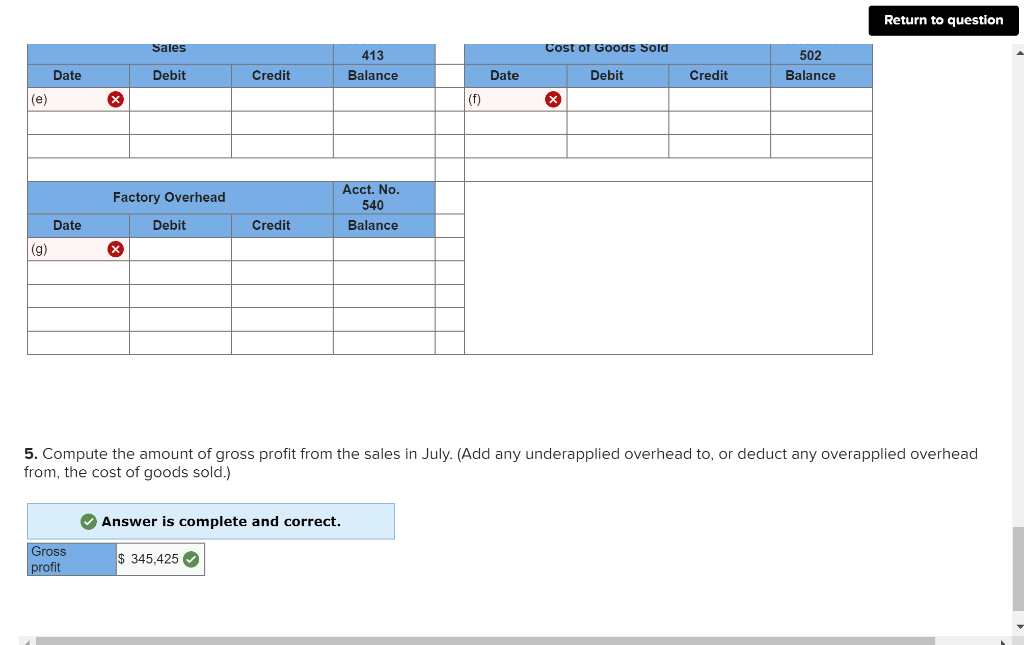

Major League Bat Company manufactures baseball bats. In addition to its work in process inventories, the company maintains inventories of raw materials and finished goods. It uses raw materials as direct materials in production and as indirect materials. Its factory payroll costs include direct labor for production and indirect labor. All materials are added at the beginning of the process, and conversion costs are applied uniformly throughout the production process. Required: You are to maintain records and produce measures of inventories to reflect the July events of this company. The June 30 balances: Raw Materials Inventory, $25,000; Work in Process Inventory, $8,135 ($2,660 of direct materials and $5,475 of conversion); Finished Goods Inventory, $110,000; Sales, $0; Cost of Goods Sold, $0; Factory Payroll Payable, $0; and Factory Overhead, $0. 1. Prepare journal entries to record the following July transactions and events. a. Purchased raw materials for $125,000 cash (the company uses a perpetual inventory system). b. Used raw materials as follows: direct materials, $52,440, and indirect materials, $10,000. c. Recorded factory payroll payable costs as follows: direct labor, $202,250; and indirect labor, $25,000. d. Paid factory payroll cost of $227,250 with cash (ignore taxes). e. Incurred additional factory overhead costs of $80,000 paid in cash. f. Allocated factory overhead to production at 50% of direct labor costs. Answer is complete and correct. No Transaction General Journal Credit Debit 125,000 Raw materials inventory Cash 125,000 Work in process inventory Factory overhead Raw materials inventory 52,440 10,000 62,440 3 C. Work in process inventory Factory overhead Factory wages payable 202,250 25,000 227,250 d. 227,250 Factory wages payable Cash 227,250 80,000 Factory overhead Cash 80,000 6 f. 101,125 Work in process inventory Factory overhead 101,125 2. Information about the July inventories follows. Use this information with that from part 1 to prepare a process cost summary, assuming the weighted-average method is used. (Round "Cost per EUP" to 2 decimal places.) Units Beginning inventory Started Ending inventory Beginning inventory Materials-Percent complete Conversion-Percent complete 5,000 units 14,000 units 8,000 units 100% 75% o, vuU UNTILS Cluing livenlurry Beginning inventory Materials-Percent complete Conversion-Percent complete Ending inventory Materials-Percent complete Conversion-Percent complete 100% 75% 100% 40% Answer is complete but not entirely correct. $ $ Total costs to account for: Cost of beginning work in process Costs incurred this period Total costs to account for: Total costs accounted for * Difference due to rounding cost/unit Unit reconciliation: Units to account for: Beginning work in process inventory - units Units started this period Total units to account for 8,135 355,815 363,950 533,600 (169,650) $ 5,000 14,000 19,000 Total units accounted for: Units completed and transferred out Ending work in process - units Total units accounted for 11,000 8,000 19,000 3. Using the results from part 2 and the available information, make computations and prepare journal entries to record the following: g. Total costs transferred to finished goods for July. h. Sale of finished goods costing $265,700 for $625,000 in cash. Answer is complete and correct. General journal Credit No 1 Transaction g. Debit 271,150 Finished goods inventory Work in process inventory 271,150 2 h. 625,000 Cash Sales 625,000 h. 265,700 Cost of goods sold Finished goods inventory 265,700