I have this answered. This just goes with the question I have. I have the journal entries but on the next two pages I just need the numbers on for the journal entries.

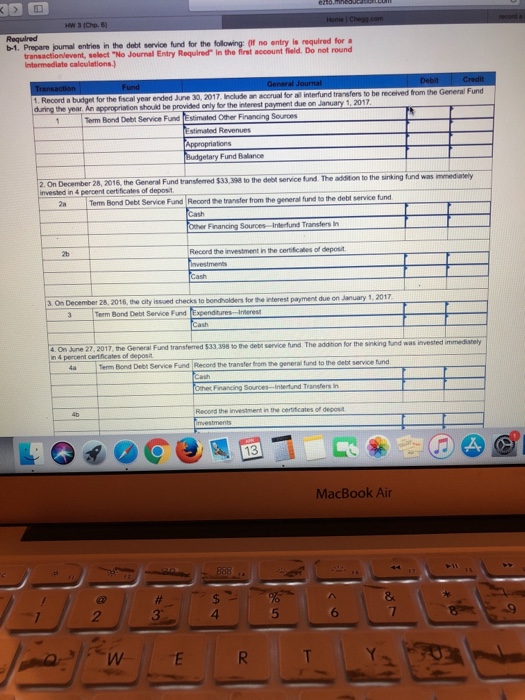

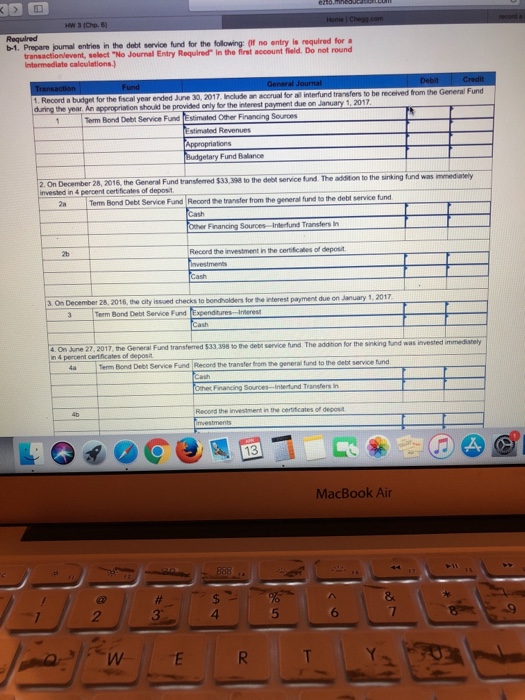

First page of journal entries.

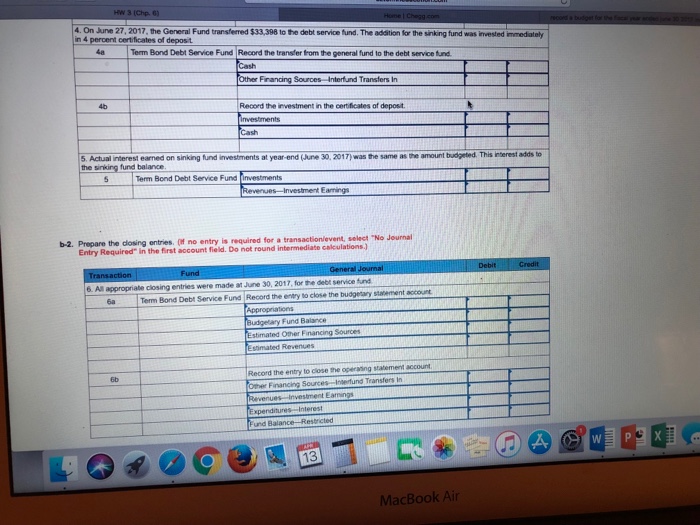

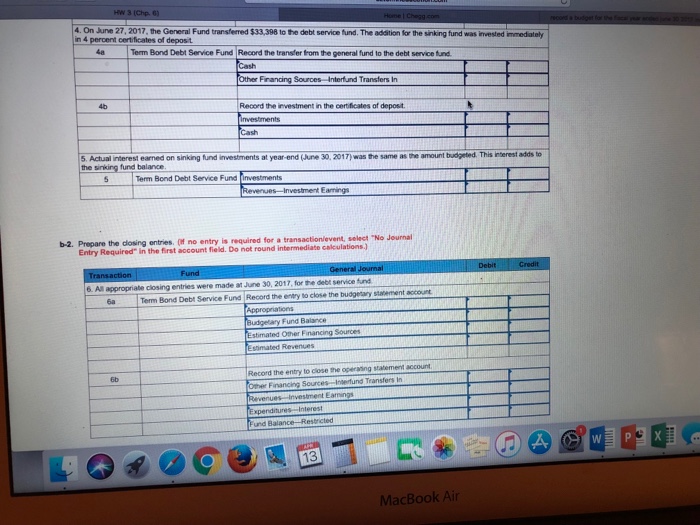

Second page of journal entries. Just need the numbers.

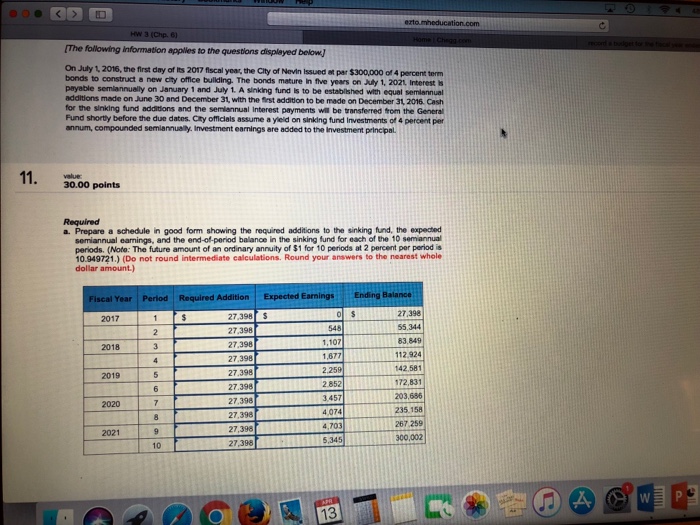

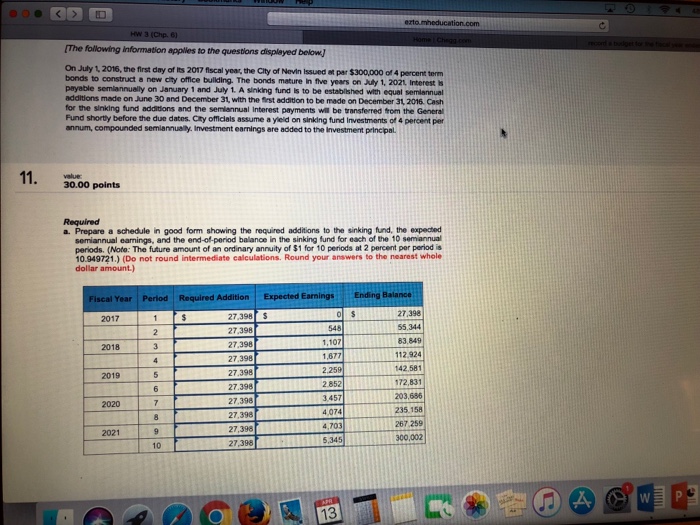

The following information applies to the questlons displeyed below On July 1, 2016, the first day of its 2017 fiscal yoar, the City of Nevin Issued at par $300,000 of 4 percent term bonds to construct a new cty office building. The bonds mature in five years on July 1, 2021 Interest s payable semiannually on January 1 and July 1. A sinking fund Is to be established with equal semiannual additions made on June 30 and December 31, with the irst addition to be made on December 31 2016. Cash for the siniking fund additions and the semiannual Interest payments wll be transferred from the General Fund shorty before the due dates. City officials assume a yieid on sinking fund Investments of 4 percent per annum, compounded semiannuelly. Investment earnings are aoded to the Investment principal. 30.00 points Required a. Prepare a schedule in good form showing the required additions to the sinking fund, the expected semiannual earnings, and the end-of-period balance in the sinking fund for each of the 10 semannual periods. (Noto: The future amount of an ordinary annuity of $1 for 10 periods at 2 percent per period is 10.949721) (Do not round intermediate calculations. Round your answers to the nearest whole dollar amount) Fiscal Year Perlod Required Addition Expected EarningsEnding Balance 27,398 55,344 83,849 12,924 42,581 172,831 203,686 235.158 267 259 300,002 2017 27.398 S 7.398 27.398 27.398 27.398 27.398 27,398 27,398 27,398 27,398 548 2018 1,67 2.25 2.852 3,457 4,074 4,703 5,345 2019 2020 2021 10 13 The following information applies to the questlons displeyed below On July 1, 2016, the first day of its 2017 fiscal yoar, the City of Nevin Issued at par $300,000 of 4 percent term bonds to construct a new cty office building. The bonds mature in five years on July 1, 2021 Interest s payable semiannually on January 1 and July 1. A sinking fund Is to be established with equal semiannual additions made on June 30 and December 31, with the irst addition to be made on December 31 2016. Cash for the siniking fund additions and the semiannual Interest payments wll be transferred from the General Fund shorty before the due dates. City officials assume a yieid on sinking fund Investments of 4 percent per annum, compounded semiannuelly. Investment earnings are aoded to the Investment principal. 30.00 points Required a. Prepare a schedule in good form showing the required additions to the sinking fund, the expected semiannual earnings, and the end-of-period balance in the sinking fund for each of the 10 semannual periods. (Noto: The future amount of an ordinary annuity of $1 for 10 periods at 2 percent per period is 10.949721) (Do not round intermediate calculations. Round your answers to the nearest whole dollar amount) Fiscal Year Perlod Required Addition Expected EarningsEnding Balance 27,398 55,344 83,849 12,924 42,581 172,831 203,686 235.158 267 259 300,002 2017 27.398 S 7.398 27.398 27.398 27.398 27.398 27,398 27,398 27,398 27,398 548 2018 1,67 2.25 2.852 3,457 4,074 4,703 5,345 2019 2020 2021 10 13

I have this answered. This just goes with the question I have. I have the journal entries but on the next two pages I just need the numbers on for the journal entries.

I have this answered. This just goes with the question I have. I have the journal entries but on the next two pages I just need the numbers on for the journal entries.  First page of journal entries.

First page of journal entries.  Second page of journal entries. Just need the numbers.

Second page of journal entries. Just need the numbers.