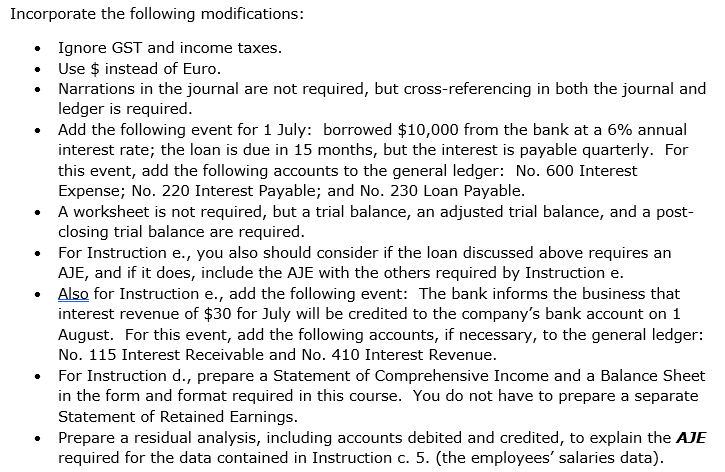

I have to incorporate more into a previous question, this is what needs to be added (PREVIOUS QUESTION IS SECOND PHOTO, ALREADY COMPLETED)

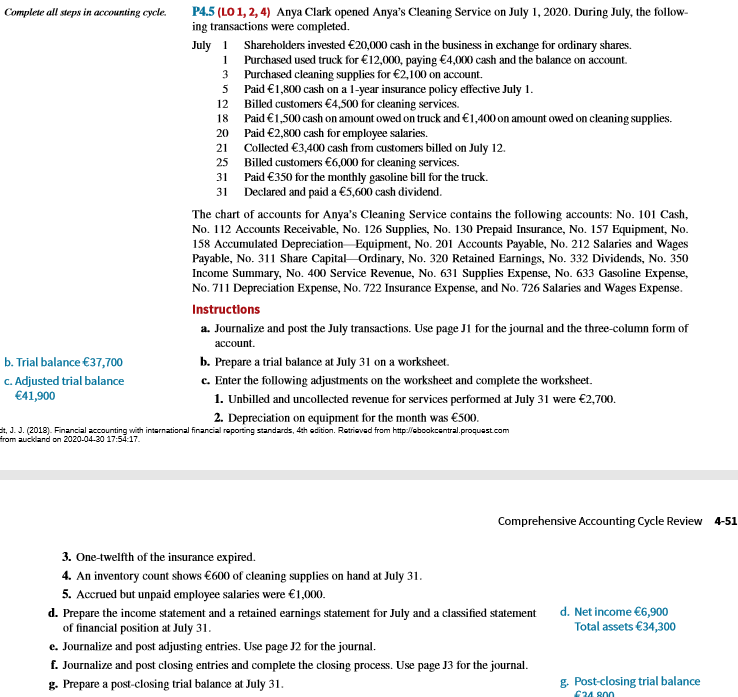

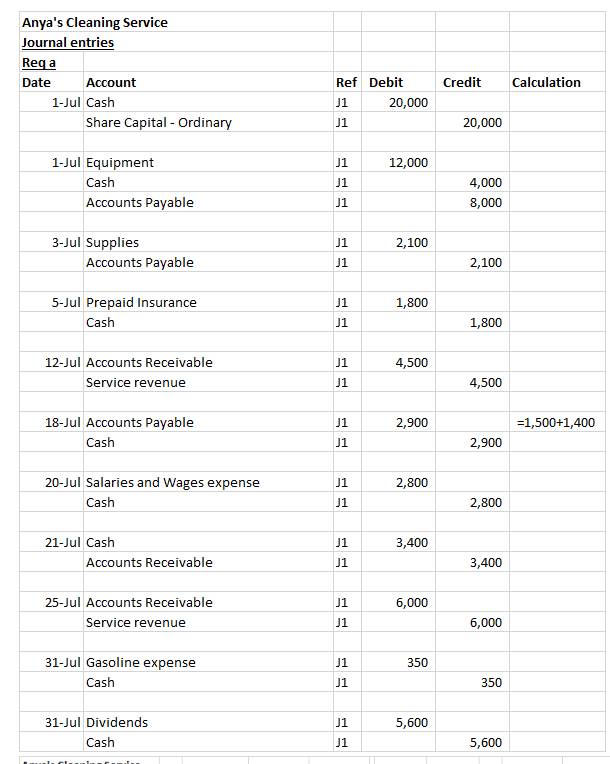

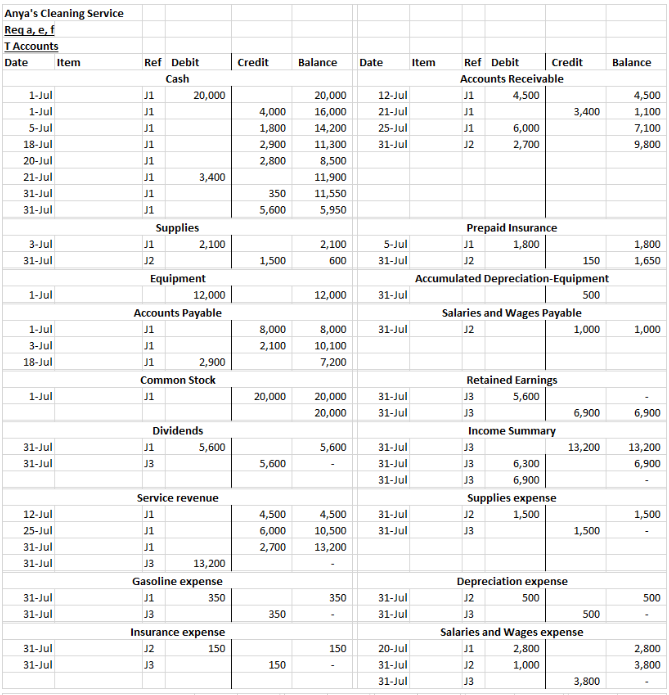

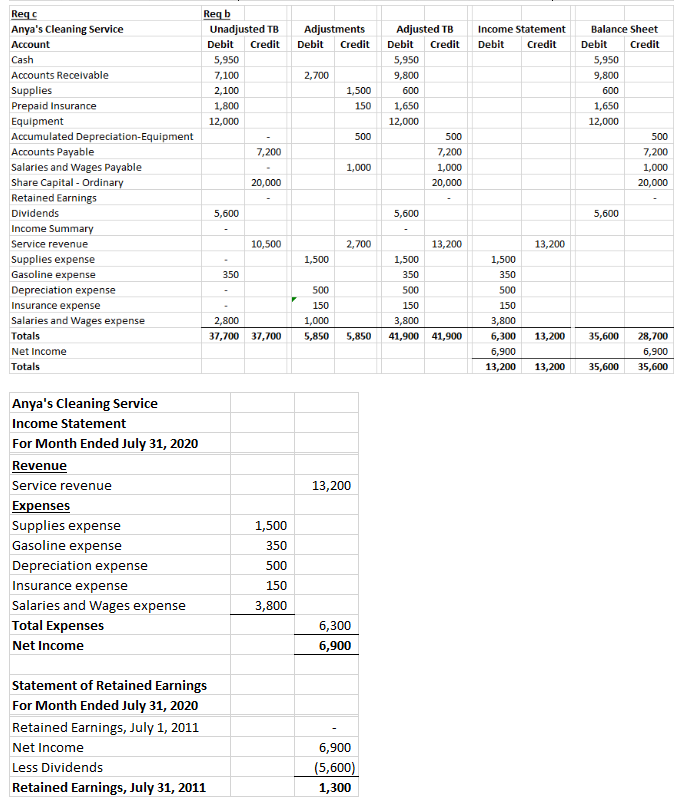

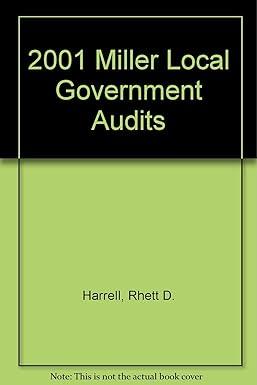

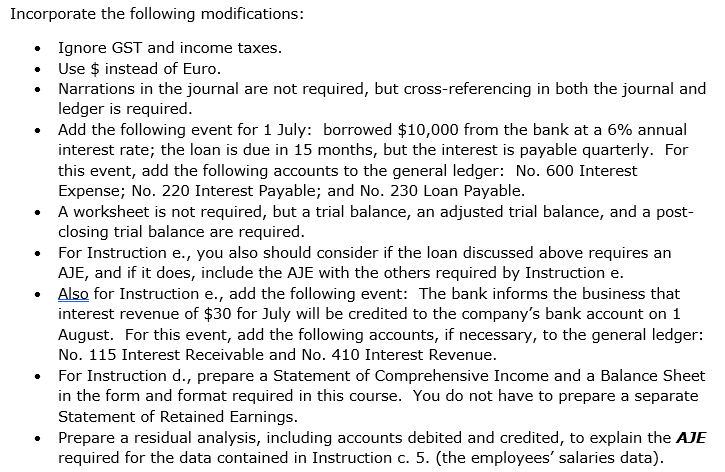

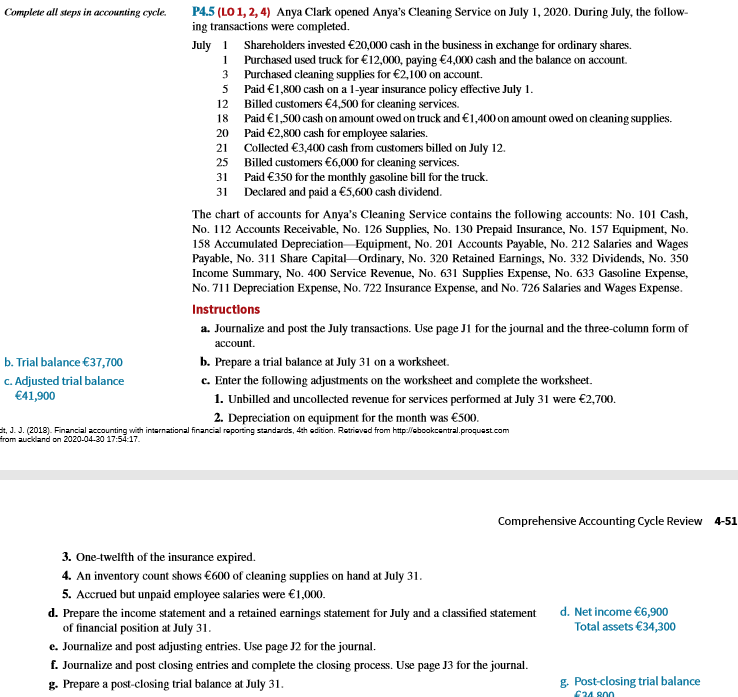

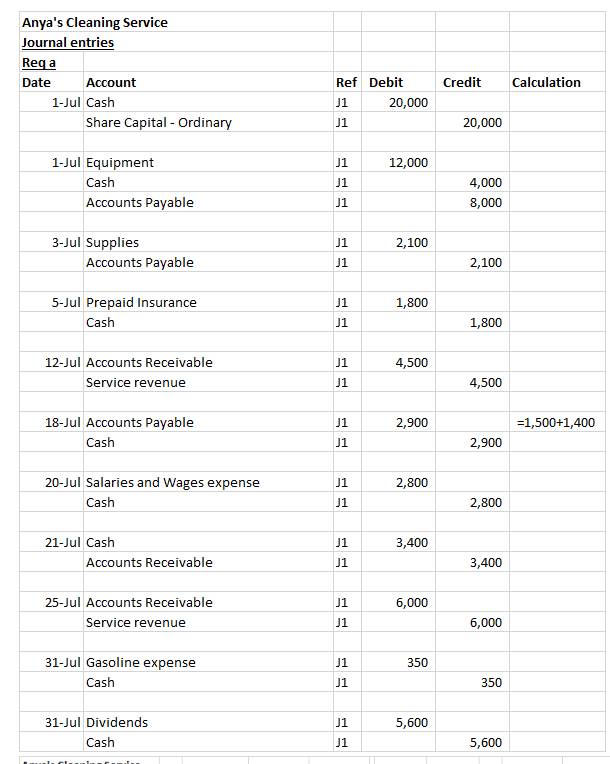

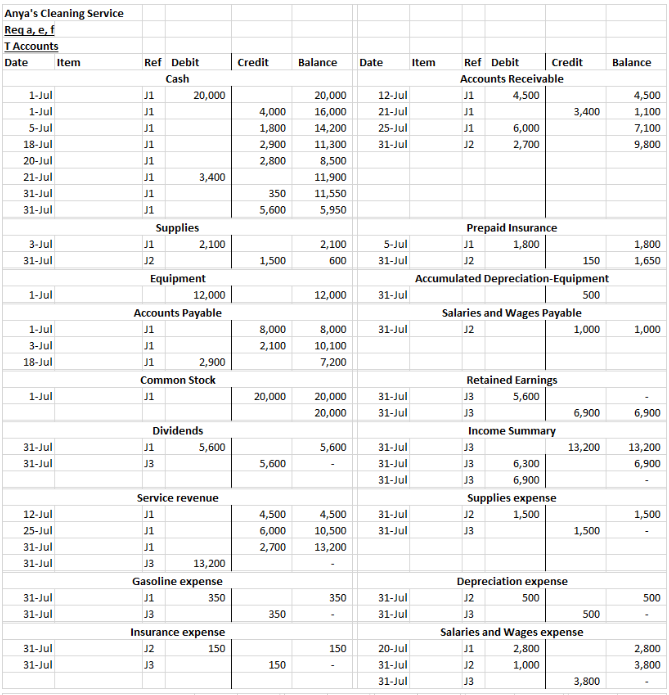

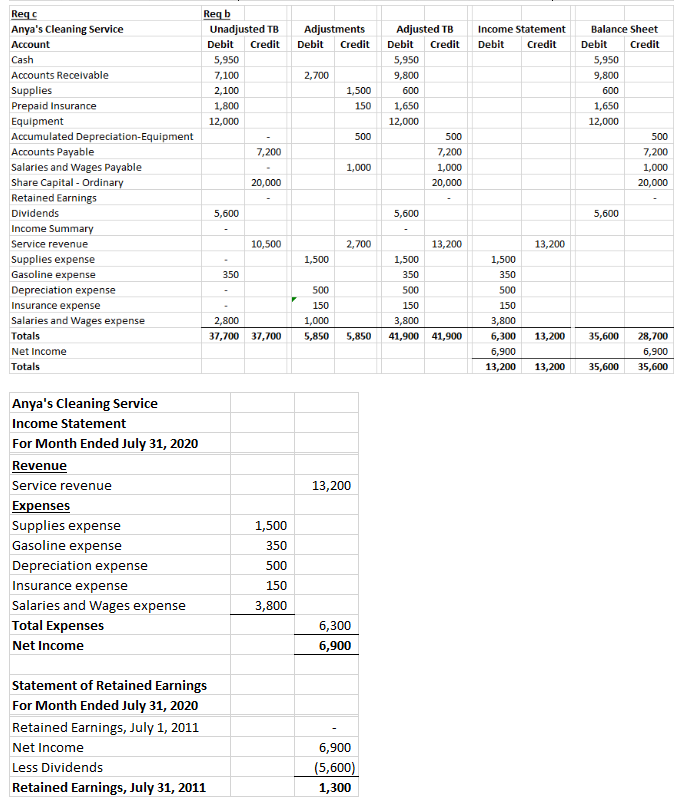

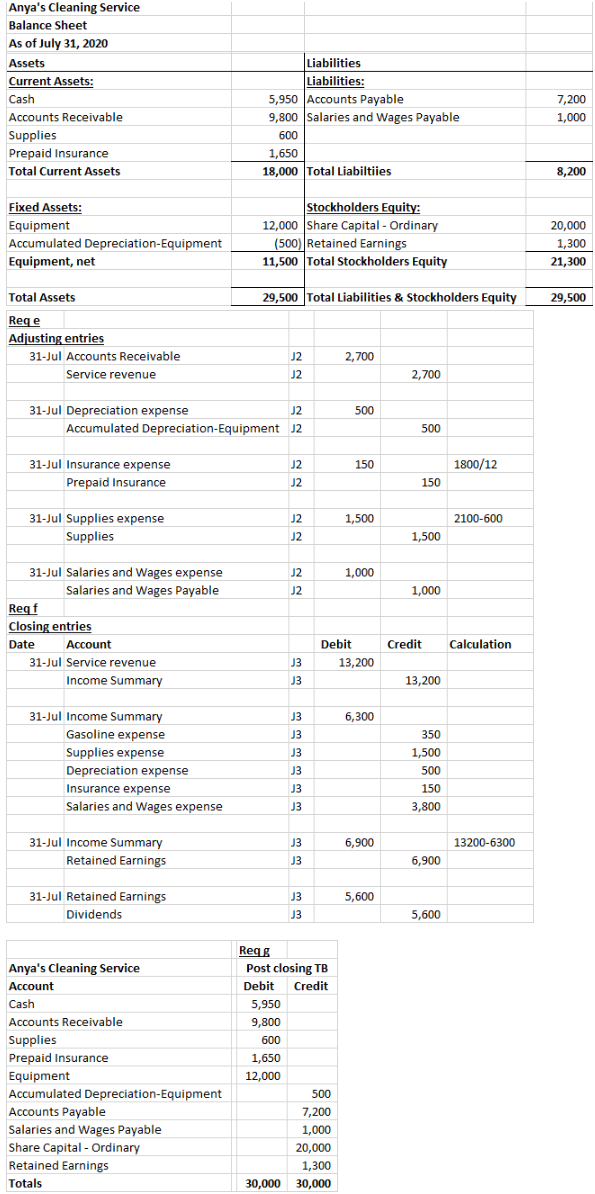

Incorporate the following modifications: Ignore GST and income taxes. Use $ instead of Euro. Narrations in the journal are not required, but cross-referencing in both the journal and ledger is required. Add the following event for 1 July: borrowed $10,000 from the bank at a 6% annual interest rate; the loan is due in 15 months, but the interest is payable quarterly. For this event, add the following accounts to the general ledger: No. 600 Interest Expense; No. 220 Interest Payable; and No. 230 Loan Payable. A worksheet is not required, but a trial balance, an adjusted trial balance, and a post- closing trial balance are required. For Instruction e., you also should consider if the loan discussed above requires an AJE, and if it does, include the AJE with the others required by Instruction e. Also for Instruction e., add the following event: The bank informs the business that interest revenue of $30 for July will be credited to the company's bank account on 1 August. For this event, add the following accounts, if necessary, to the general ledger: No. 115 Interest Receivable and No. 410 Interest Revenue. For Instruction d., prepare a Statement of Comprehensive Income and a Balance Sheet in the form and format required in this course. You do not have to prepare a separate Statement of Retained Earnings. Prepare a residual analysis, including accounts debited and credited, to explain the AJE required for the data contained in Instruction c. 5. (the employees' salaries data). Complete all steps in accounting cycle. P4.5 (L01, 2, 4) Anya Clark opened Anya's Cleaning Service on July 1, 2020. During July, the follow ing transactions were completed. July 1 Shareholders invested 20,000 cash in the business in exchange for ordinary shares. 1 Purchased used truck for 12,000, paying 4,000 cash and the balance on account. 3 Purchased cleaning supplies for 2,100 on account. 5 Paid 1,800 cash on a 1-year insurance policy effective July 1. 12 Billed customers 4,500 for cleaning services. 18 Paid 1,500 cash on amount owed on truck and 1.400 on amount owed on cleaning supplies. 20 Paid 2,800 cash for employee salaries. 21 Collected 3,400 cash from customers billed on July 12. 25 Billed customers 6,000 for cleaning services. 31 Paid 350 for the monthly gasoline bill for the truck 31 Declared and paid a 5,600 cash dividend. The chart of accounts for Anya's Cleaning Service contains the following accounts: No. 101 Cash, No. 112 Accounts Receivable, No. 126 Supplies, No. 130 Prepaid Insurance, No. 157 Equipment, No. 158 Accumulated Depreciation Equipment, No. 201 Accounts Payable, No. 212 Salaries and Wages Payable, No. 311 Share Capital Ordinary, No. 320 Retained Earnings, No. 332 Dividends, No. 350 Income Summary, No. 400 Service Revenue, No. 631 Supplies Expense, No. 633 Gasoline Expense, No. 711 Depreciation Expense, No. 722 Insurance Expense, and No. 726 Salaries and Wages Expense. Instructions a. Journalive and post the July transactions. Use page J1 for the journal and the three-column form of account. b. Trial balance 37,700 b. Prepare a trial balance at July 31 on a worksheet. C. Adjusted trial balance c. Enter the following adjustments on the worksheet and complete the worksheet. 41,900 1. Unbilled and uncollected revenue for services performed at July 31 were 2,700. 2. Depreciation on equipment for the month was 500. sit, J.J. (2018). Financial accounting with international financial reporting standards, 4th edition. Retrieved from http://ebookcentral.proquest.com From auckland on 2020-04-30 17:54:17. Comprehensive Accounting Cycle Review 4-51 3. One-twelfth of the insurance expired. 4. An inventory count shows 600 of cleaning supplies on hand at July 31. 5. Accrued but unpaid employee salaries were 1,000. d. Prepare the income statement and a retained earnings statement for July and a classified statement of financial position at July 31. e. Journalive and post adjusting entries. Use page J2 for the journal. f. Journalive and post closing entries and complete the closing process. Use page 13 for the journal. g. Prepare a post-closing trial balance at July 31. d. Net income 6,900 Total assets 34,300 g. Post-closing trial balance C24 on Anya's Cleaning Service Journal entries Reqa Date Account 1-Jul Cash Share Capital - Ordinary Credit Calculation Ref Debit J1 20,000 20,000 12,000 1-Jul Equipment Cash Accounts Payable 4,000 8,000 2,100 3-Jul Supplies Accounts Payable 2,100 1,800 5-Jul Prepaid Insurance Cash 1,800 4,500 12-Jul Accounts Receivable Service revenue 4,500 2,900 =1,500+1,400 18-Jul Accounts Payable Cash 2,900 2,800 20-Jul Salaries and Wages expense Cash 2,800 3,400 21-Jul Cash Accounts Receivable 3,400 6,000 25-Jul Accounts Receivable Service revenue 6,000 350 31-Jul Gasoline expense Cash 350 5,600 31-Jul Dividends Cash 5,600 Anya's Cleaning Service Rega, e, f T Accounts Date Item Credit Balance Date Item Balance Ref Debit Cash 20,000 Ref Debit Credit Accounts Receivable 4,500 3,400 6,000 2,700 12-Jul 21-Jul 25-Jul 31-Jul 4,000 1,800 2,900 2,800 1-Jul 1-Jul 5-Jul 18-Jul 20-Jul 21.Jul 31-Jul 31-Jul 4,500 1,100 7,100 9,800 20,000 16,000 14,200 11,300 8,500 11,900 11,550 5,950 3,400 350 5,600 Supplies J12,100 3.Jul 31-Jul 2,100 600 1,800 1,650 J2 1,500 J2 Prepaid Insurance 5-Jul 1 1 ,800 31-Jul 150 Accumulated Depreciation-Equipment 31-Jul Salaries and Wages Payable 1,000 Equipment 12,000 Accounts Payable 1-Jul 12,000 500 31.Jul 1,000 1.Jul 3-Jul 18-Jul 8,000 2,100 8,000 10,100 7,200 2,900 Common Stock Retained Earnings J3 5,600 1-Jul 20,000 20,000 20,000 31-Jul 31-Jul 6,900 6,900 Income Summary Dividends J1 5,600 5,600 J3 13,200 31-Jul 31-Jul 31-Jul 31-Jul 31-Jul 13,200 6,900 5,600 J3 33 6,300 6,900 Supplies expense J2 1,500 3 1,500 12-Jul 25-Jul 31-Jul 31-Jul 4,500 6,000 2,700 31-Jul 31-Jul Service revenue J1 J1 J1 13,200 Gasoline expense J1 4,500 10,500 13,200 1,500 350 350 2 500 31-Jul 31-Jul 31-Jul 31-Jul 350 Insurance expense Depreciation expense 500 J3 500 Salaries and Wages expense 2,800 1,000 3,800 J2 150 150 31-Jul 31-Jul 20-Jul 31-Jul 31-Jul 2,800 3,800 150 Adjustments Debit Credit Income Statement Debit Credit Reqb Unadjusted TB Debit Credit 5,950 7,100 2,100 1,800 12.000 Adjusted TB Debit Credit 5,950 9,800 2,700 Balance Sheet Debit Credit 5,950 9,800 600 1,650 12,000 600 1,500 150 1,650 12,000 500 500 7,200 500 7,200 1,000 20,000 1,000 7,200 1,000 20,000 20,000 Reqc Anya's Cleaning Service Account Cash Accounts Receivable Supplies Prepaid Insurance Equipment Accumulated Depreciation Equipment Accounts Payable Salaries and Wages Payable Share Capital - Ordinary Retained Earnings Dividends Income Summary Service revenue Supplies expense Gasoline expense Depreciation expense Insurance expense Salaries and Wages expense Totals Net Income Totals 5,600 5,600 5,600 10,500 2,700 13,200 13,200 1,500 350 1,500 350 500 500 150 1,500 350 500 150 3,800 6,300 6,900 13,200 150 1,000 5,850 2,800 37,700 3,800 41,900 37,700 5,850 41,900 13,200 35,600 28,700 6,900 35,600 13,200 35,600 13,200 Anya's Cleaning Service Income Statement For Month Ended July 31, 2020 Revenue Service revenue Expenses Supplies expense Gasoline expense Depreciation expense Insurance expense Salaries and Wages expense Total Expenses Net Income 1,500 350 500 150 3,800 6,300 6,900 Statement of Retained Earnings For Month Ended July 31, 2020 Retained Earnings, July 1, 2011 Net Income Less Dividends Retained Earnings, July 31, 2011 6,900 (5,600) 1,300 Anya's Cleaning Service Balance Sheet As of July 31, 2020 Assets Current Assets: Cash Accounts Receivable Supplies Prepaid Insurance Total Current Assets Liabilities Liabilities: 5,950 Accounts Payable 9,800 Salaries and Wages Payable 600 1,650 18,000 Total Liabiltiies 7,200 1,000 8,200 Fixed Assets: Equipment Accumulated Depreciation Equipment Equipment, net Stockholders Equity: 12,000 Share Capital - Ordinary (500) Retained Earnings 11,500 Total Stockholders Equity 20,000 1,300 21,300 Total Assets 29,500 Total Liabilities & Stockholders Equity 29,500 Rege Adjusting entries 31-Jul Accounts Receivable Service revenue J2 2,700 J2 2,700 500 31-Jul Depreciation expense Accumulated Depreciation-Equipment J2 500 150 1800/12 31-Jul Insurance expense Prepaid Insurance 150 1,500 2100-600 31-Jul Supplies expense Supplies 1,500 1,000 1,000 31-Jul Salaries and Wages expense Salaries and Wages Payable Reqf Closing entries Date Account 31-Jul Service revenue Income Summary Credit Calculation Debit 13,200 13 13,200 6,300 31-Jul Income Summary Gasoline expense Supplies expense Depreciation expense Insurance expense Salaries and Wages expense 350 1,500 500 150 3,800 6,900 13200-6300 31-Jul Income Summary Retained Earnings 6,900 5,600 31-Jul Retained Earnings Dividends 13 J3 5,600 Anya's Cleaning Service Account Cash Accounts Receivable Supplies Prepaid Insurance Equipment Accumulated Depreciation Equipment Accounts Payable Salaries and Wages Payable Share Capital - Ordinary Retained Earnings Totals Reqs Post closing TB Debit Credit 5,950 9,800 600 1,650 12,000 500 7,200 1,000 20,000 1,300 30,000 30,000 Incorporate the following modifications: Ignore GST and income taxes. Use $ instead of Euro. Narrations in the journal are not required, but cross-referencing in both the journal and ledger is required. Add the following event for 1 July: borrowed $10,000 from the bank at a 6% annual interest rate; the loan is due in 15 months, but the interest is payable quarterly. For this event, add the following accounts to the general ledger: No. 600 Interest Expense; No. 220 Interest Payable; and No. 230 Loan Payable. A worksheet is not required, but a trial balance, an adjusted trial balance, and a post- closing trial balance are required. For Instruction e., you also should consider if the loan discussed above requires an AJE, and if it does, include the AJE with the others required by Instruction e. Also for Instruction e., add the following event: The bank informs the business that interest revenue of $30 for July will be credited to the company's bank account on 1 August. For this event, add the following accounts, if necessary, to the general ledger: No. 115 Interest Receivable and No. 410 Interest Revenue. For Instruction d., prepare a Statement of Comprehensive Income and a Balance Sheet in the form and format required in this course. You do not have to prepare a separate Statement of Retained Earnings. Prepare a residual analysis, including accounts debited and credited, to explain the AJE required for the data contained in Instruction c. 5. (the employees' salaries data). Complete all steps in accounting cycle. P4.5 (L01, 2, 4) Anya Clark opened Anya's Cleaning Service on July 1, 2020. During July, the follow ing transactions were completed. July 1 Shareholders invested 20,000 cash in the business in exchange for ordinary shares. 1 Purchased used truck for 12,000, paying 4,000 cash and the balance on account. 3 Purchased cleaning supplies for 2,100 on account. 5 Paid 1,800 cash on a 1-year insurance policy effective July 1. 12 Billed customers 4,500 for cleaning services. 18 Paid 1,500 cash on amount owed on truck and 1.400 on amount owed on cleaning supplies. 20 Paid 2,800 cash for employee salaries. 21 Collected 3,400 cash from customers billed on July 12. 25 Billed customers 6,000 for cleaning services. 31 Paid 350 for the monthly gasoline bill for the truck 31 Declared and paid a 5,600 cash dividend. The chart of accounts for Anya's Cleaning Service contains the following accounts: No. 101 Cash, No. 112 Accounts Receivable, No. 126 Supplies, No. 130 Prepaid Insurance, No. 157 Equipment, No. 158 Accumulated Depreciation Equipment, No. 201 Accounts Payable, No. 212 Salaries and Wages Payable, No. 311 Share Capital Ordinary, No. 320 Retained Earnings, No. 332 Dividends, No. 350 Income Summary, No. 400 Service Revenue, No. 631 Supplies Expense, No. 633 Gasoline Expense, No. 711 Depreciation Expense, No. 722 Insurance Expense, and No. 726 Salaries and Wages Expense. Instructions a. Journalive and post the July transactions. Use page J1 for the journal and the three-column form of account. b. Trial balance 37,700 b. Prepare a trial balance at July 31 on a worksheet. C. Adjusted trial balance c. Enter the following adjustments on the worksheet and complete the worksheet. 41,900 1. Unbilled and uncollected revenue for services performed at July 31 were 2,700. 2. Depreciation on equipment for the month was 500. sit, J.J. (2018). Financial accounting with international financial reporting standards, 4th edition. Retrieved from http://ebookcentral.proquest.com From auckland on 2020-04-30 17:54:17. Comprehensive Accounting Cycle Review 4-51 3. One-twelfth of the insurance expired. 4. An inventory count shows 600 of cleaning supplies on hand at July 31. 5. Accrued but unpaid employee salaries were 1,000. d. Prepare the income statement and a retained earnings statement for July and a classified statement of financial position at July 31. e. Journalive and post adjusting entries. Use page J2 for the journal. f. Journalive and post closing entries and complete the closing process. Use page 13 for the journal. g. Prepare a post-closing trial balance at July 31. d. Net income 6,900 Total assets 34,300 g. Post-closing trial balance C24 on Anya's Cleaning Service Journal entries Reqa Date Account 1-Jul Cash Share Capital - Ordinary Credit Calculation Ref Debit J1 20,000 20,000 12,000 1-Jul Equipment Cash Accounts Payable 4,000 8,000 2,100 3-Jul Supplies Accounts Payable 2,100 1,800 5-Jul Prepaid Insurance Cash 1,800 4,500 12-Jul Accounts Receivable Service revenue 4,500 2,900 =1,500+1,400 18-Jul Accounts Payable Cash 2,900 2,800 20-Jul Salaries and Wages expense Cash 2,800 3,400 21-Jul Cash Accounts Receivable 3,400 6,000 25-Jul Accounts Receivable Service revenue 6,000 350 31-Jul Gasoline expense Cash 350 5,600 31-Jul Dividends Cash 5,600 Anya's Cleaning Service Rega, e, f T Accounts Date Item Credit Balance Date Item Balance Ref Debit Cash 20,000 Ref Debit Credit Accounts Receivable 4,500 3,400 6,000 2,700 12-Jul 21-Jul 25-Jul 31-Jul 4,000 1,800 2,900 2,800 1-Jul 1-Jul 5-Jul 18-Jul 20-Jul 21.Jul 31-Jul 31-Jul 4,500 1,100 7,100 9,800 20,000 16,000 14,200 11,300 8,500 11,900 11,550 5,950 3,400 350 5,600 Supplies J12,100 3.Jul 31-Jul 2,100 600 1,800 1,650 J2 1,500 J2 Prepaid Insurance 5-Jul 1 1 ,800 31-Jul 150 Accumulated Depreciation-Equipment 31-Jul Salaries and Wages Payable 1,000 Equipment 12,000 Accounts Payable 1-Jul 12,000 500 31.Jul 1,000 1.Jul 3-Jul 18-Jul 8,000 2,100 8,000 10,100 7,200 2,900 Common Stock Retained Earnings J3 5,600 1-Jul 20,000 20,000 20,000 31-Jul 31-Jul 6,900 6,900 Income Summary Dividends J1 5,600 5,600 J3 13,200 31-Jul 31-Jul 31-Jul 31-Jul 31-Jul 13,200 6,900 5,600 J3 33 6,300 6,900 Supplies expense J2 1,500 3 1,500 12-Jul 25-Jul 31-Jul 31-Jul 4,500 6,000 2,700 31-Jul 31-Jul Service revenue J1 J1 J1 13,200 Gasoline expense J1 4,500 10,500 13,200 1,500 350 350 2 500 31-Jul 31-Jul 31-Jul 31-Jul 350 Insurance expense Depreciation expense 500 J3 500 Salaries and Wages expense 2,800 1,000 3,800 J2 150 150 31-Jul 31-Jul 20-Jul 31-Jul 31-Jul 2,800 3,800 150 Adjustments Debit Credit Income Statement Debit Credit Reqb Unadjusted TB Debit Credit 5,950 7,100 2,100 1,800 12.000 Adjusted TB Debit Credit 5,950 9,800 2,700 Balance Sheet Debit Credit 5,950 9,800 600 1,650 12,000 600 1,500 150 1,650 12,000 500 500 7,200 500 7,200 1,000 20,000 1,000 7,200 1,000 20,000 20,000 Reqc Anya's Cleaning Service Account Cash Accounts Receivable Supplies Prepaid Insurance Equipment Accumulated Depreciation Equipment Accounts Payable Salaries and Wages Payable Share Capital - Ordinary Retained Earnings Dividends Income Summary Service revenue Supplies expense Gasoline expense Depreciation expense Insurance expense Salaries and Wages expense Totals Net Income Totals 5,600 5,600 5,600 10,500 2,700 13,200 13,200 1,500 350 1,500 350 500 500 150 1,500 350 500 150 3,800 6,300 6,900 13,200 150 1,000 5,850 2,800 37,700 3,800 41,900 37,700 5,850 41,900 13,200 35,600 28,700 6,900 35,600 13,200 35,600 13,200 Anya's Cleaning Service Income Statement For Month Ended July 31, 2020 Revenue Service revenue Expenses Supplies expense Gasoline expense Depreciation expense Insurance expense Salaries and Wages expense Total Expenses Net Income 1,500 350 500 150 3,800 6,300 6,900 Statement of Retained Earnings For Month Ended July 31, 2020 Retained Earnings, July 1, 2011 Net Income Less Dividends Retained Earnings, July 31, 2011 6,900 (5,600) 1,300 Anya's Cleaning Service Balance Sheet As of July 31, 2020 Assets Current Assets: Cash Accounts Receivable Supplies Prepaid Insurance Total Current Assets Liabilities Liabilities: 5,950 Accounts Payable 9,800 Salaries and Wages Payable 600 1,650 18,000 Total Liabiltiies 7,200 1,000 8,200 Fixed Assets: Equipment Accumulated Depreciation Equipment Equipment, net Stockholders Equity: 12,000 Share Capital - Ordinary (500) Retained Earnings 11,500 Total Stockholders Equity 20,000 1,300 21,300 Total Assets 29,500 Total Liabilities & Stockholders Equity 29,500 Rege Adjusting entries 31-Jul Accounts Receivable Service revenue J2 2,700 J2 2,700 500 31-Jul Depreciation expense Accumulated Depreciation-Equipment J2 500 150 1800/12 31-Jul Insurance expense Prepaid Insurance 150 1,500 2100-600 31-Jul Supplies expense Supplies 1,500 1,000 1,000 31-Jul Salaries and Wages expense Salaries and Wages Payable Reqf Closing entries Date Account 31-Jul Service revenue Income Summary Credit Calculation Debit 13,200 13 13,200 6,300 31-Jul Income Summary Gasoline expense Supplies expense Depreciation expense Insurance expense Salaries and Wages expense 350 1,500 500 150 3,800 6,900 13200-6300 31-Jul Income Summary Retained Earnings 6,900 5,600 31-Jul Retained Earnings Dividends 13 J3 5,600 Anya's Cleaning Service Account Cash Accounts Receivable Supplies Prepaid Insurance Equipment Accumulated Depreciation Equipment Accounts Payable Salaries and Wages Payable Share Capital - Ordinary Retained Earnings Totals Reqs Post closing TB Debit Credit 5,950 9,800 600 1,650 12,000 500 7,200 1,000 20,000 1,300 30,000 30,000