Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I have to submit my homework within 10 minutes, so I want the answer as soon as possible. I hope you will give me the

I have to submit my homework within 10 minutes, so I want the answer as soon as possible. I hope you will give me the answer now, I need it now, please.

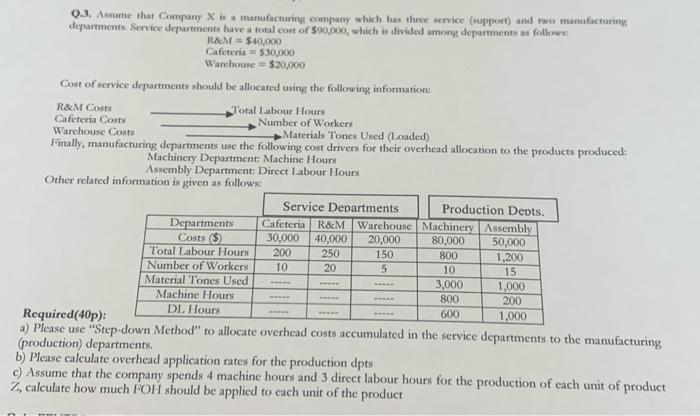

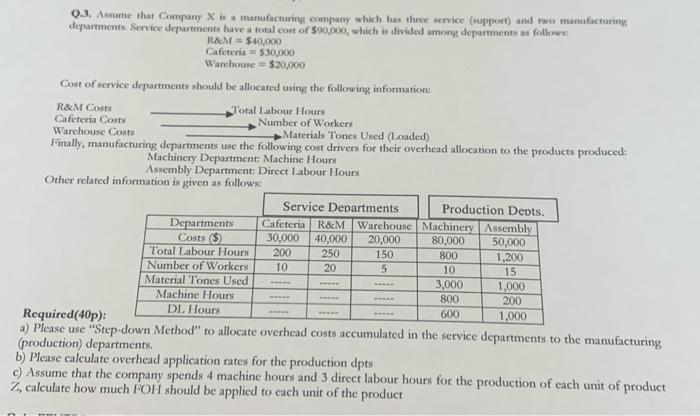

Q.3. Assume that Company X is a manufacturing company which has three service (auppori) and two manufacturing departments Service departments have a total cont of $90,000, which is divided ameng departments as followe: RaM=540,000 Cafeteria =$30,000 Warchouse =$20,000 Cost of service departments whould be allocuted using the following information: Wafeteria Costr Warchouse Costs Machinery Department Machine Hours Asscmbly Department Direct l abour Hours Other relared information is given as follows: Required (40p) : a) Please use "Step-down Method" to allocate overhead costs accumulared in the service departments to the manufacturing (production) departments. b) Please calculate overhead application rates for the production dpts c) Assume that the company spends 4 machine hours and 3 direct labour hours for the production of each unit of product 7, calculate how much FOH should be applicd to each unit of the product

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started