Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I have transcribed below; thank you Suppose as an investor you are considering purchasing a bond issued by BANK with the current price of Tshs

I have transcribed below; thank you

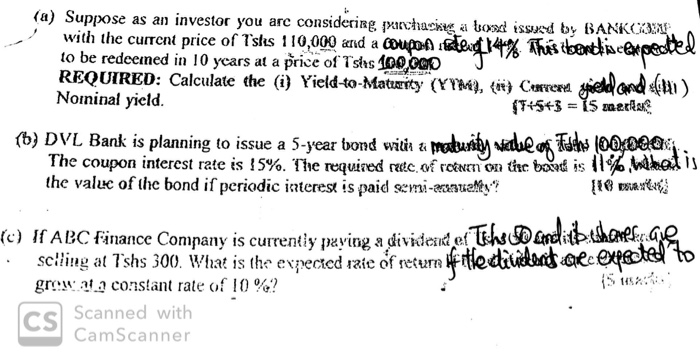

- Suppose as an investor you are considering purchasing a bond issued by BANK with the current price of Tshs 110,000 and a coupon rate of 14% This bond is expected to be redeemed in 10 years at a price of Tshs 100,000

REQUIRED: Calculate the (i) Yield-to-Maturity (YTM), (i) Current Yield and Nominal yield.

- DVL Bank is planning to issue a 5-year bond with a maturity value of Tsh 100,000. The coupon interest rate is 15%. The required rate of return is 11%. What is the value of the bond if periodic interest is paid semi- annually?

(c) If ABC Finance Company is currently paying a dividend of Tshs 50 and its shares are selling at Tshs 300. What is the expected rate of return if the dividend are expected to grow at a constant rate of 10%?

(a) Suppose as an investor you are considering xachacing a boys issued by BANK with the current price of Tshs 110,000 and a coupofteid 14% This sentencexpec to be redeemed in 10 years at a price of Tshs 100,000 3 REQUIRED: Calculate the (i) Yield-to-Maturity (YYM), (i) Cerer goed and Nominal yield. (55+3 = 15 merce ) (6) DVL Bank is planning to issue a 5-year bond witir si maturity Neel cos Tasche (00000 The coupon interest rate is 15%. The required rate of roenen on disc band is ll . Wokalis the value of the bond if periodic interest is paid semi- ents? {te nemuerte . C tanance Company is currently paving a dividend er the endlitbchoterae sciling at Tshs 300. What is the expected sale of return irtle dividend are expected to grow at a constant rate of 100? 15 . Scanned with CamScannerStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started