Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I have wasted three posts. No one can get this right. Can someone please answer this right. LUVFINANCE, Inc. is estimating its WACC. It is

I have wasted three posts. No one can get this right. Can someone please answer this right.

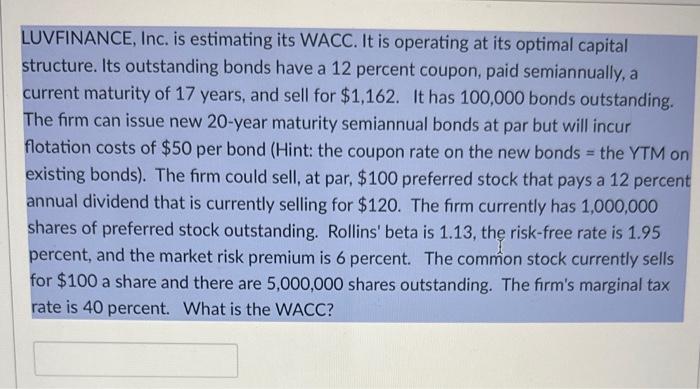

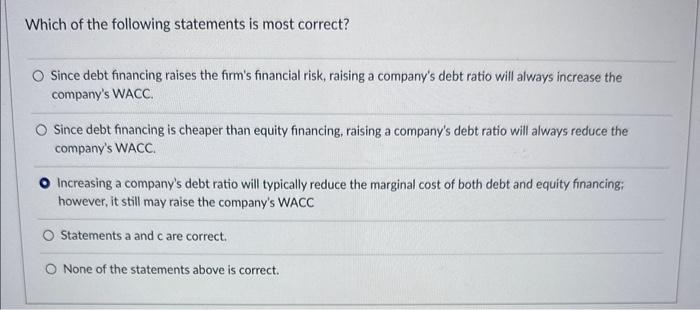

LUVFINANCE, Inc. is estimating its WACC. It is operating at its optimal capital structure. Its outstanding bonds have a 12 percent coupon, paid semiannually, a current maturity of 17 years, and sell for $1,162. It has 100,000 bonds outstanding. The firm can issue new 20 -year maturity semiannual bonds at par but will incur flotation costs of $50 per bond (Hint: the coupon rate on the new bonds = the YTM on existing bonds). The firm could sell, at par, $100 preferred stock that pays a 12 percent annual dividend that is currently selling for $120. The firm currently has 1,000,000 shares of preferred stock outstanding. Rollins' beta is 1.13, the risk-free rate is 1.95 percent, and the market risk premium is 6 percent. The common stock currently sells for $100 a share and there are 5,000,000 shares outstanding. The firm's marginal tax rate is 40 percent. What is the WACC? Which of the following statements is most correct? Since debt financing raises the firm's financial risk, raising a company's debt ratio will always increase the company's WACC. Since debt financing is cheaper than equity financing, raising a company's debt ratio will always reduce the company's WACC. Increasing a company's debt ratio will typically reduce the marginal cost of both debt and equity financing: however, it still may raise the company's WACC Statements a and c are correct. None of the statements above is correct

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started