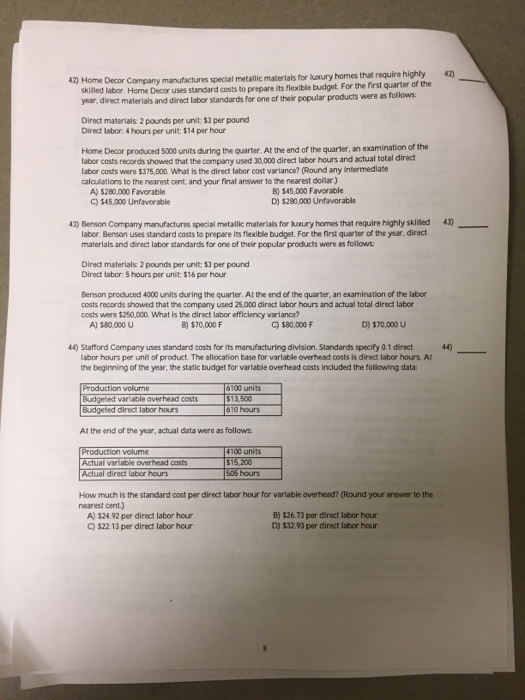

I highly ) 47) Home Decor Company manufactures special metallic materials for luxury homes that requirne first quarter of the skilled labor. Home Decor uses standard costs to prepare its flexible budget. For the year, direct materials and direct labor standards for one of their popular products were as follows Direct materials 2 pounds per unit $3 per pound Direct labor: 4 hours per unit; $14 per hour Home Decor produced 5000 units during the quarter. At the end of the quarter, an examination of the laber costs records showed that the company used 30.000 direct labor hours and actual total abor costs were $375,000. What is the direct labor cost variance? (Round any intermediate calculations to the nearest cent, and your final answer to the nearest dolilar.) A) $280 ,000 Favorable C) $45,000 Unfavorable B) $45,000 Favorable D) $280,000 Unfavorabla 43) Benson Company manufactures special metallic materials for kuxury homes that require highly skililed 43) laber. Benson uses standard costs to prepare its flexible budget. For the first quarter of the year, direct materials and direct labor standards for one of their popular products were as follows Diredt materials 2 pounds per unit; $3 per pound Direct labor: 5 hours per unit: $16 per hour Benson produced 4000 units during the quarter. At the end of the quarter, an examination of the labor costs records showed that the company used 25,000 direct labor hours and actual total direct labor costs were $250,000. What is the direct labor efficiency variance? A) $80,000 U B) $70,000 F C) $80,000 F D)$70,000 u 44) Stafford Company uses standard costs for its manufacturing division. Standards specify 0.1 direct 44) labor hours per unit of product. The allocation base for variable overhead costs is direct labor hours. At the beginning of the year, the static budget for variable overhead costs included the folilowing data: Production volume Budgeted direct labor hours At the end of the year, actual data were as follows 6100 units costs 610 hours 4100 units Production velume Actual variable overhead costs Actual direct labor hours 505 hours How much is the standard cost per direct labor hour for variable overhead? (Round your answer to the nearest cent.) A) $24.92 per direct labor hour C) $22.13 per direct labor hour B) $26.73 per direct labor hour D) $3293 per direct labor hour