Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I hope it will be resolved in less than an hour Question 15 Not yet answered Marked out of 7 P Flag question The following

I hope it will be resolved in less than an hour

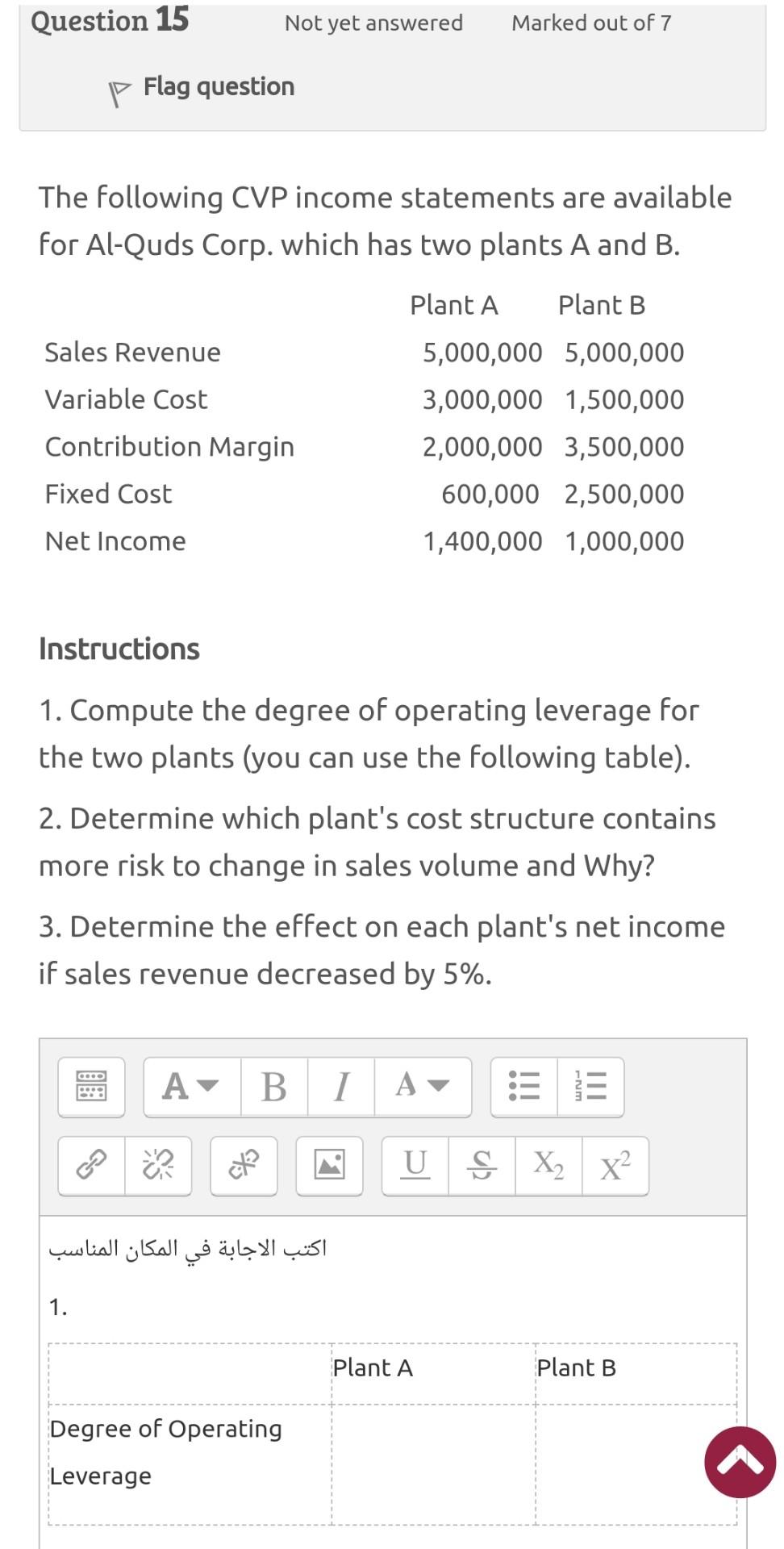

Question 15 Not yet answered Marked out of 7 P Flag question The following CVP income statements are available for Al-Quds Corp. which has two plants A and B. Plant A Plant B Sales Revenue 5,000,000 5,000,000 Variable Cost 3,000,000 1,500,000 Contribution Margin 2,000,000 3,500,000 Fixed Cost 600,000 2,500,000 Net Income 1,400,000 1,000,000 Instructions 1. Compute the degree of operating leverage for the two plants (you can use the following table). 2. Determine which plant's cost structure contains more risk to change in sales volume and Why? 3. Determine the effect on each plant's net income if sales revenue decreased by 5%. A B. 1 III U to S XX2 S 1. Plant A Plant B Degree of Operating LeverageStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started