Question

I hope that the answer is written without paper or handwriting because other similar answers are not clear The following balances are extracted from the

I hope that the answer is written without paper or handwriting because other similar answers are not clear

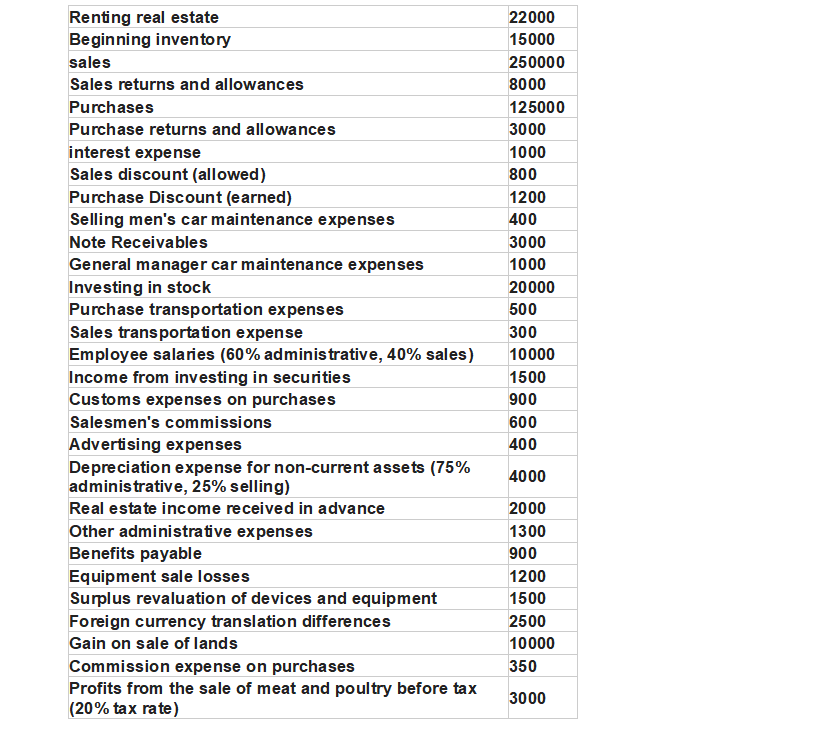

The following balances are extracted from the trial balance of Al-Ettifaq Company as on 31/12/2021 If you know the following:

1. The end-of-period merchandise was estimated at cost at 15,000 and at market price at 18,000 dinars. 2. The company's capital at the beginning of the year consisted of 250,000 shares with a nominal value of 1 dinars, and on 7/1, 50,000 ordinary shares with a par value of 1 dinars were issued and a premium of 3 dinars. Required: 1. Preparing a multi-step comprehensive income statement according to international accounting standards. (10 marks) 2. Calculate the basic earnings (loss) per share, earnings per share (loss) per share from continuing operations, and earnings per share (loss) from discontinued operations for the year 2021, explaining the differences between those values. (5 marks) 3. Preparing the one-step income statement, explaining the reasons for the difference with Requirement No. 1, if any. (10 marks)

\begin{tabular}{|l|l|} \hline Renting real estate & 22000 \\ \hline Beginning inventory & 15000 \\ \hline sales & 250000 \\ \hline Sales returns and allowances & 8000 \\ \hline Purchases & 125000 \\ \hline Purchase returns and allowances & 3000 \\ \hline interest expense & 1000 \\ \hline Sales discount (allowed) & 800 \\ \hline Purchase Discount (earned) & 1200 \\ \hline Selling men's car maintenance expenses & 400 \\ \hline Note Receivables & 3000 \\ \hline General manager car maintenance expenses & 1000 \\ \hline Investing in stock & 20000 \\ \hline Purchase transportation expenses & 500 \\ \hline Sales transportation expense & 300 \\ \hline Employee salaries (60\% administrative, 40% sales) & 10000 \\ \hline Income from investing in securities & 1500 \\ \hline Customs expenses on purchases & 900 \\ \hline Salesmen's commissions & 600 \\ \hline Advertising expenses & 400 \\ \hline Depreciation expense for non-current assets (75\% & 4000 \\ \hline administrative, 25% selling) & 2000 \\ \hline Real estate income received in advance & 1300 \\ \hline Other administrative expenses & 900 \\ \hline Benefits payable & 1200 \\ \hline Equipment sale losses & 1500 \\ \hline Surplus revaluation of devices and equipment & 2500 \\ \hline Foreign currency translation differences & 10000 \\ \hline Gain on sale of lands & 350 \\ \hline Commission expense on purchases & 3000 \\ \hline Profits from the sale of meat and poultry before tax & \\ \hline (20\% tax rate) & 1000 \\ \hline & 1000 \\ \hline \end{tabular} \begin{tabular}{|l|l|} \hline Renting real estate & 22000 \\ \hline Beginning inventory & 15000 \\ \hline sales & 250000 \\ \hline Sales returns and allowances & 8000 \\ \hline Purchases & 125000 \\ \hline Purchase returns and allowances & 3000 \\ \hline interest expense & 1000 \\ \hline Sales discount (allowed) & 800 \\ \hline Purchase Discount (earned) & 1200 \\ \hline Selling men's car maintenance expenses & 400 \\ \hline Note Receivables & 3000 \\ \hline General manager car maintenance expenses & 1000 \\ \hline Investing in stock & 20000 \\ \hline Purchase transportation expenses & 500 \\ \hline Sales transportation expense & 300 \\ \hline Employee salaries (60\% administrative, 40% sales) & 10000 \\ \hline Income from investing in securities & 1500 \\ \hline Customs expenses on purchases & 900 \\ \hline Salesmen's commissions & 600 \\ \hline Advertising expenses & 400 \\ \hline Depreciation expense for non-current assets (75\% & 4000 \\ \hline administrative, 25% selling) & 2000 \\ \hline Real estate income received in advance & 1300 \\ \hline Other administrative expenses & 900 \\ \hline Benefits payable & 1200 \\ \hline Equipment sale losses & 1500 \\ \hline Surplus revaluation of devices and equipment & 2500 \\ \hline Foreign currency translation differences & 10000 \\ \hline Gain on sale of lands & 350 \\ \hline Commission expense on purchases & 3000 \\ \hline Profits from the sale of meat and poultry before tax & \\ \hline (20\% tax rate) & 1000 \\ \hline & 1000 \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started