Question

I HOPE u can help me. Thank You in advance 1 HOUR GIVEN TIME TO FINISH THE TASK Giving UPVOTE and GOOD comment I HOPE

I HOPE u can help me. Thank You in advance

1 HOUR GIVEN TIME TO FINISH THE TASK

Giving UPVOTE and GOOD comment

I HOPE u can help me. Thank You in advance

1 HOUR GIVEN TIME TO FINISH THE TASK

Giving UPVOTE and GOOD comment

PLEASE HELP ME IT WILL BE VERY MUCH APPRECIATED

PLEASE ANSWER ALL GIVEN QUESTIONS FOR THE GOOD MARKS.

FINANCIAL ANALYSIS AND REPORTING >> ACCOUNTING >> FINANCIAL ANALYSIS AND REPORTING >> ACCOUNTING

FINANCIAL ANALYSIS AND REPORTING >> ACCOUNTING >> FINANCIAL ANALYSIS AND REPORTING >> ACCOUNTING

FINANCIAL ANALYSIS AND REPORTING >> ACCOUNTING >> FINANCIAL ANALYSIS AND REPORTING >> ACCOUNTING

/////QUESTION

|

|

|

|

/////QUESTION

ADDITIONAL ITEMS THAT CAN HELP FOR ANSWERING THE QUESTIONS --------------------------------------------

PLEASE ANSWER ALL GIVEN QUESTION, WILL GIVE UPVOTE AND GOOD COMMENT....

PLEASE ANSWER ALL GIVEN QUESTION, WILL GIVE UPVOTE AND GOOD COMMENT....

PLEASE ANSWER ALL GIVEN QUESTION, WILL GIVE UPVOTE AND GOOD COMMENT....

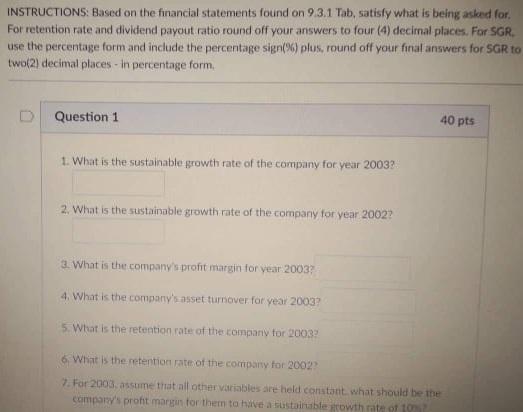

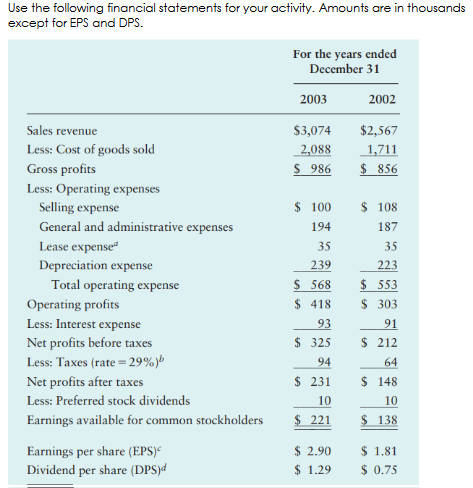

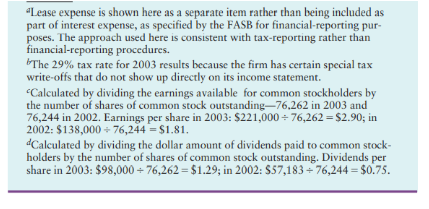

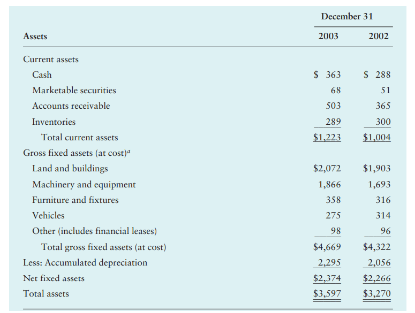

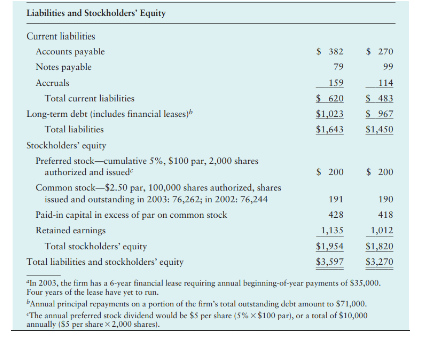

INSTRUCTIONS: Based on the financial statements found on 9.3.1 Tab, satisfy what is being asked for. For retention rate and dividend payout ratio round off your answers to four (4) decimal places. Far SGR. use the percentage form and include the percentage sign(\%) plus, round off your final answers for 5GR to two(2) decimal places - in percentage form. Question 1 40pts 1. What is the sustainable growth rate of the company for year 2003 ? 2. What is the sustainable growth rate of the company for year 2002 ? 3. What is the company's profit margin for vear 2003 ? 4. What is the compary's asset turnover for year 2003 ? 5. What is the reteation rate of the company for 2003? 6. Whit is the retentioc rate of the compary for 2002 ? 7. For 2003 , assume that ail other variables are held constant what should be the compary's profit margin for them ta haive a sisstainable frowth rite of tom? e) "Lease expense is shown here as a separate item rather than being included as part of interest expense, as specified by the FASB for financial-reporting purposes. The approach used here is consistent with tax-reporting rather than financial-reporting procedures. 6 The 29% tax rate for 2003 results because the firm has certain special tax write-offs that do not show up directly on its income statement. 'Calculated by dividing the earnings available for common stockholders by the number of shares of common stock outstanding 76.262 in 2003 and 76,244 in 2002. Earnings per share in 2003: $221,00076,262=$2.90; in 2002: $138,00076,244=$1.81. "Calculated by dividing the dollar amount of dividends paid to common stockholders by the number of shares of common stock outstanding. Dividends per share in 2003: $98,00076,262=$1.29; in 2002: $57,18376,244=$0.75. Liabilities and Stockholders' Equity

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started