Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I I have all the questions answered except I need help with #9. The article below should help. Grede Article Summary Questions Inside the Black

I

I have all the questions answered except I need help with #9. The article below should help.

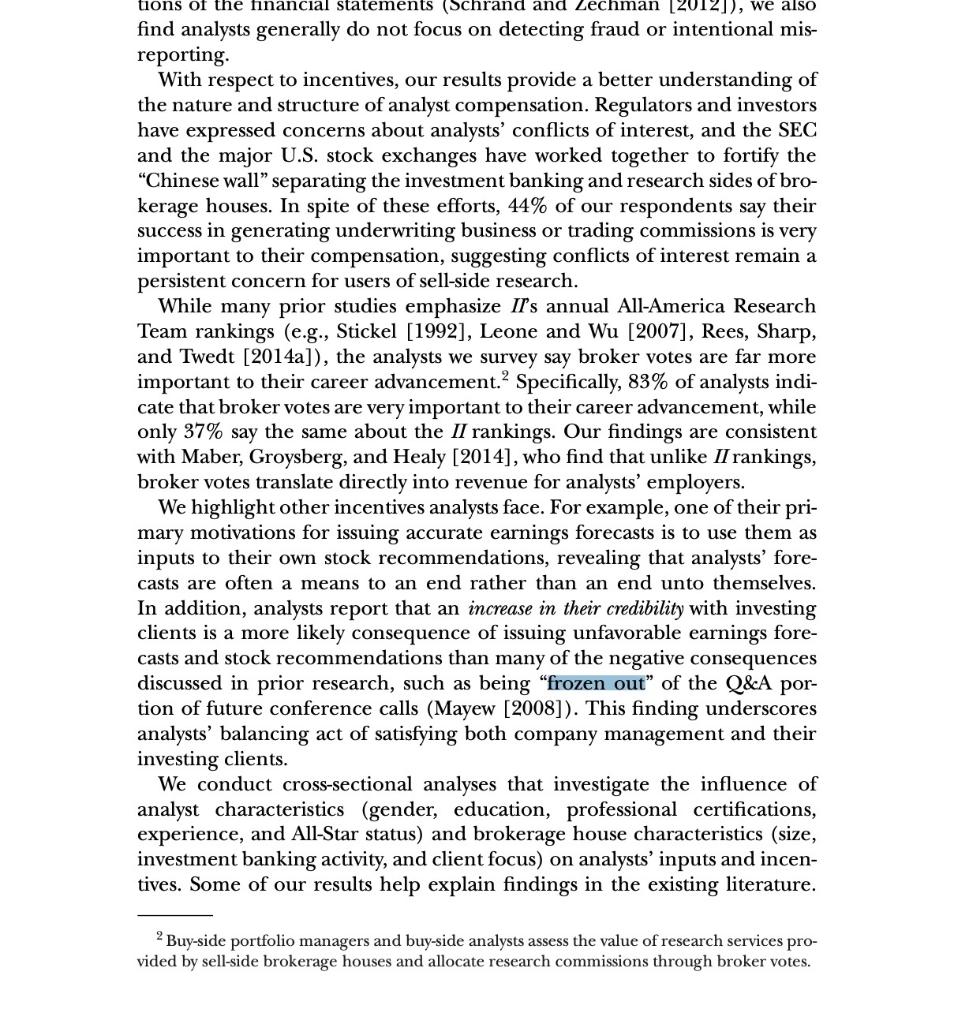

Grede Article Summary Questions Inside the "Black Box" of Sell-Side Financial Analysts - Lawrence Brown, Andrew Nathan Sharp 1. What is the role of a Sell-Side analyst? 2. How important is communication with management for the analysts in this content they provide? 3. Compare and contrast the views of earnings quality from that of the analy of the firm? 4. What is the role of the sell-side analyst in each of the following setting the brokerage house setting, and the overall market setting? 5. What do analysts view as the most critical tools for coming up with th mendations? 6. What is Regulation Fair Disclosure and how has it changed the Analy 7. Do sell-side analysts view this piece of legislation as effective? 8. Does management strategically talk with sell-side analysts? If so ho 9. What does it mean for a sell side analyst to be "Frozen Out"? 10. What is the "Chinese Wall"? find analysts generally do not focus on detecting fraud or intentional misreporting. With respect to incentives, our results provide a better understanding of the nature and structure of analyst compensation. Regulators and investors have expressed concerns about analysts' conflicts of interest, and the SEC and the major U.S. stock exchanges have worked together to fortify the "Chinese wall" separating the investment banking and research sides of brokerage houses. In spite of these efforts, 44% of our respondents say their success in generating underwriting business or trading commissions is very important to their compensation, suggesting conflicts of interest remain a persistent concern for users of sell-side research. While many prior studies emphasize IIs annual All-America Research Team rankings (e.g., Stickel [1992], Leone and Wu [2007], Rees, Sharp, and Twedt [2014a]), the analysts we survey say broker votes are far more important to their career advancement. 2 Specifically, 83% of analysts indicate that broker votes are very important to their career advancement, while only 37% say the same about the II rankings. Our findings are consistent with Maber, Groysberg, and Healy [2014], who find that unlike II rankings, broker votes translate directly into revenue for analysts' employers. We highlight other incentives analysts face. For example, one of their primary motivations for issuing accurate earnings forecasts is to use them as inputs to their own stock recommendations, revealing that analysts' forecasts are often a means to an end rather than an end unto themselves. In addition, analysts report that an increase in their credibility with investing clients is a more likely consequence of issuing unfavorable earnings forecasts and stock recommendations than many of the negative consequences discussed in prior research, such as being "frozen out" of the Q\&A portion of future conference calls (Mayew [2008]). This finding underscores analysts' balancing act of satisfying both company management and their investing clients. We conduct cross-sectional analyses that investigate the influence of analyst characteristics (gender, education, professional certifications, experience, and All-Star status) and brokerage house characteristics (size, investment banking activity, and client focus) on analysts' inputs and incentives. Some of our results help explain findings in the existing literature. 2 Buy-side portfolio managers and buy-side analysts assess the value of research services provided by sell-side brokerage houses and allocate research commissions through broker votes. For example, we find that female analysts are more motivated to issue accurate earnings forecasts so they can use them as inputs to their stock recommendations, providing a partial explanation for Kumar's [2010] result that female analysts issue superior earnings forecasts. Other cross-sectional results add texture to our interviews and deepen our understanding of the main findings. For instance, our finding that analysts at large brokerage houses are more likely to indicate that private communication with management is a useful input to their stock recommendations is consistent with a potential information advantage for these analysts (Clement [1999]). We make several contributions to the literature. A survey allows us to ask analysts questions about their inputs and incentives that would be difficult to address with archival data, enabling us to provide the literature with new insights. Some of our findings strengthen the extant literature. For example, Soltes [2014] uses field evidence from a single large-cap firm to show that private communication with management is valuable to sell-side analysts. We validate this finding with a broad sample of analysts following many firms from multiple industries and add context by assessing the value of private communication relative to other inputs analysts employ. We also highlight areas where analysts' survey responses diverge from the findings of prior research (e.g., the contrast between analysts' and CFOs' views on earnings quality), and we provide direction for future research. For example, we address issues not considered by prior studies, such as the benefits to analysts of issuing relatively pessimistic earnings forecasts and stock recommendations. In general, our findings underscore the challenge analysts face when trying to maintain good relationships with firm management while also satisfying the demands of their investing clients. Our study is relevant to investors who use analysts' earnings forecasts and stock recommendations in their investing decisions, managers of companies followed by analysts, and analysts wishing to benchmark their practices and research against a broad set ofStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started