Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I I need help. ACER CH HERPERBESS ARCHI 1 w H RT SIE Theses EVE HE ZAD TUK 3 ha Streda WE CH!! CALL PREMSA

I I need help.

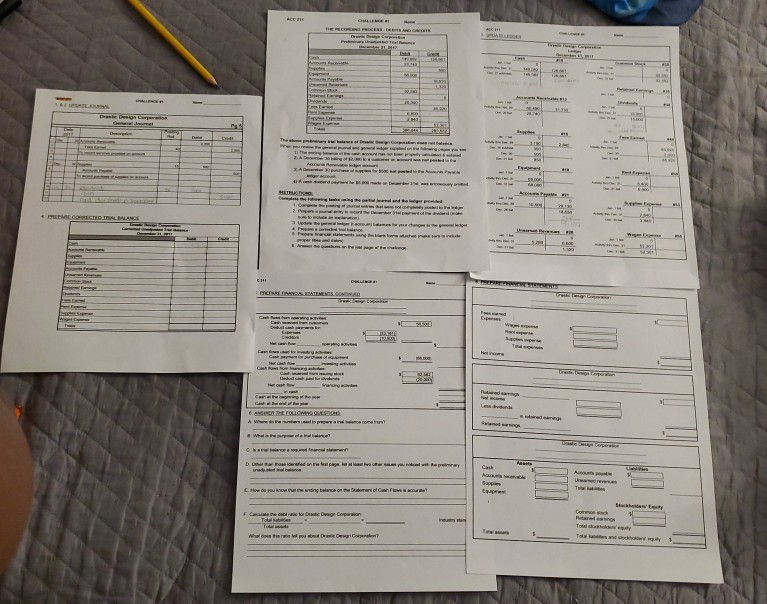

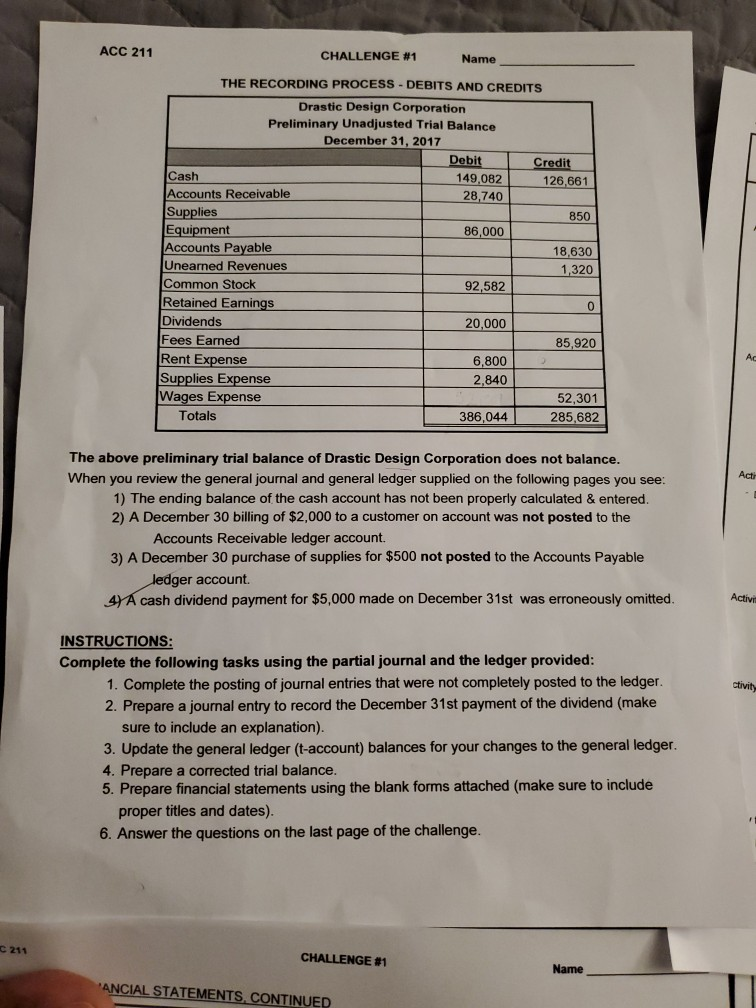

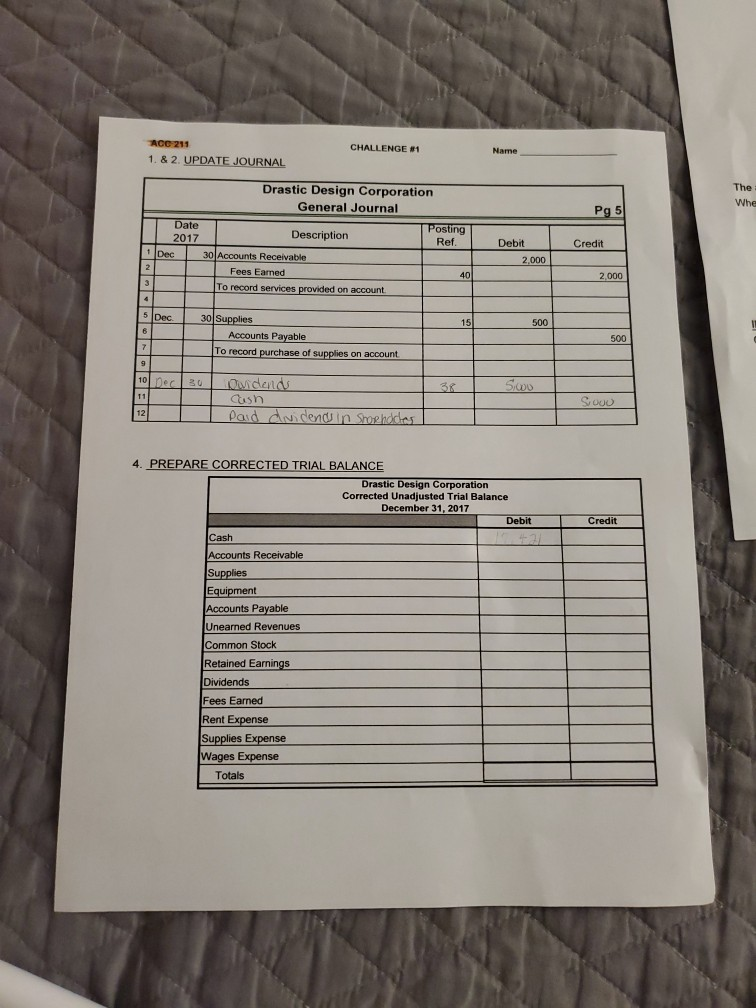

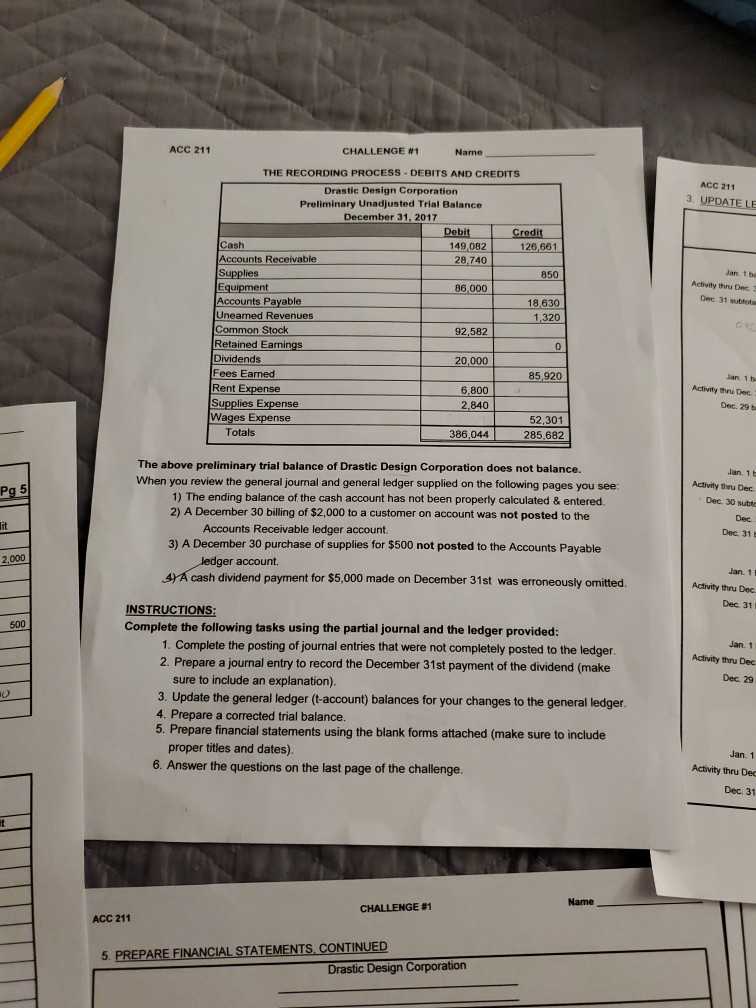

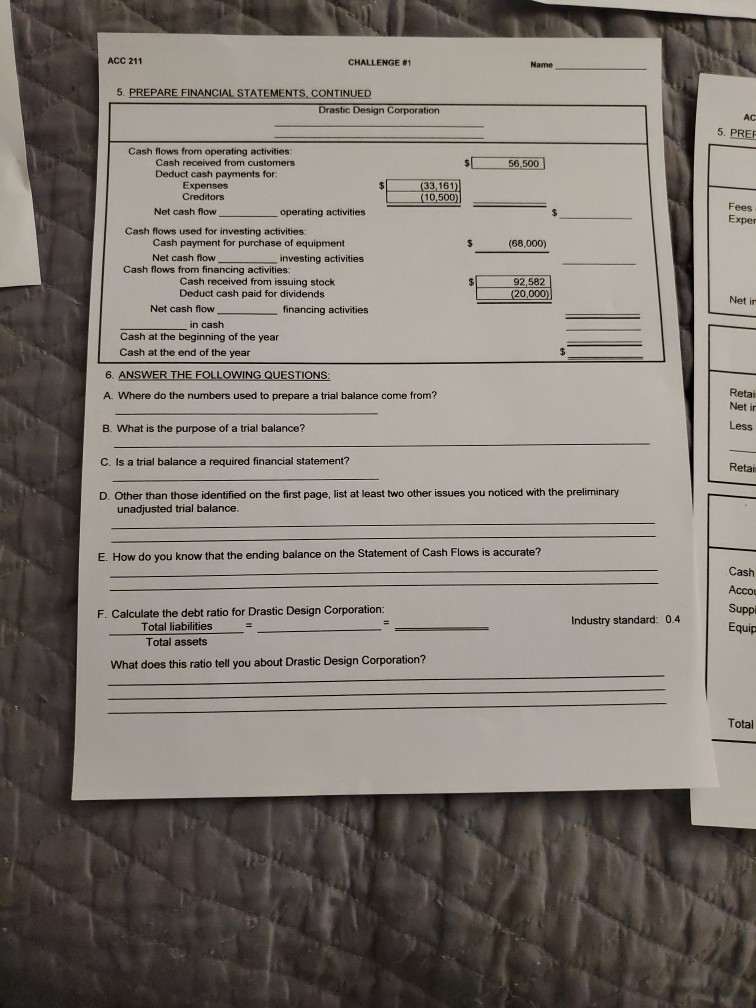

ACER CH HERPERBESS ARCHI 1 w H RT SIE Theses EVE HE ZAD TUK 3 ha Streda WE CH!! CALL PREMSA ATEMENES.COM.CO W face 6 ANGA THEOLLOWING OCH Wholdet appy As Cash Sapp How do you know where now Factor Der Corporation To TI Whether you do? ACC 211 CHALLENGE #1 Name THE RECORDING PROCESS - DEBITS AND CREDITS Drastic Design Corporation Preliminary Unadjusted Trial Balance December 31, 2017 Debit Credit Cash 149,082 126,661 Accounts Receivable 28,740 Supplies 850 Equipment 86,000 Accounts Payable 18,630 Unearned Revenues 1,320 Common Stock 92,582 Retained Earnings 0 Dividends 20,000 Fees Earned 85,920 Rent Expense 6.800 Supplies Expense 2,840 Wages Expense 52,301 Totals 386,044 285,682 Acti The above preliminary trial balance of Drastic Design Corporation does not balance. When you review the general journal and general ledger supplied on the following pages you see: 1) The ending balance of the cash account has not been properly calculated & entered. 2) A December 30 billing of $2,000 to a customer on account was not posted to the Accounts Receivable ledger account. 3) A December 30 purchase of supplies for $500 not posted to the Accounts Payable ledger account 47A cash dividend payment for $5,000 made on December 31st was erroneously omitted. Activi ctivit INSTRUCTIONS: Complete the following tasks using the partial journal and the ledger provided: 1. Complete the posting of journal entries that were not completely posted to the ledger 2. Prepare a journal entry to record the December 31st payment of the dividend (make sure to include an explanation). 3. Update the general ledger (t-account) balances for your changes to the general ledger. 4. Prepare a corrected trial balance. 5. Prepare financial statements using the blank forms attached (make sure to include proper titles and dates). 6. Answer the questions on the last page of the challenge. C211 CHALLENGE #1 Name "ANCIAL STATEMENTS, CONTINUED CHALLENGE #1 ACC 211 1. & 2. UPDATE JOURNAL Name Drastic Design Corporation General Journal The Whe Pg 5 Posting Ref. . Debit Credit Dec Date Description 2017 30 Accounts Receivable Fees Earned To record services provided on account 2.000 2 40 2,000 3 3 4 5 Dec 15 500 6 30 Supplies Accounts Payable To record purchase of supplies on account 500 7 9 10 Dec 30 500 11 Dvidend Cash paid dividends in shorhocles Sood 12 Credit 4. PREPARE CORRECTED TRIAL BALANCE Drastic Design Corporation Corrected Unadjusted Trial Balance December 31, 2017 Debit Cash Accounts Receivable Supplies Equipment Accounts Payable Unearned Revenues Common Stock Retained Earnings Dividends Fees Earned Rent Expense Supplies Expense Wages Expense Totals ACC 211 CHALLENGE #1 Name ACC 211 3. UPDATE LE THE RECORDING PROCESS - DEBITS AND CREDITS Drastic Design Corporation Preliminary Unadjusted Trial Balance December 31, 2017 Debit Credit Cash 149,082 126,661 Accounts Receivable 28,740 Supplies 850 Equipment 86,000 Accounts Payable 18,630 Unearned Revenues 1,320 Common Stock 92,582 Retained Earnings 0 Dividends 20,000 Fees Earned 85,920 Rent Expense 6,800 Supplies Expense 2.840 Wages Expense 52,301 Totals 386,044 285,682 Jan 1b Activity thru Dec Dec 31 suot Jan 1 te Adivity thru Dec Dec. 29 Pg 5 The above preliminary trial balance of Drastic Design Corporation does not balance. When you review the general journal and general ledger supplied on the following pages you see 1) The ending balance of the cash account has not been properly calculated & entered 2) A December 30 billing of $2,000 to a customer on account was not posted to the Accounts Receivable ledger account. 3) A December 30 purchase of supplies for $500 not posted to the Accounts Payable ledger account 47A cash dividend payment for $5,000 made on December 31st was erroneously omitted. Jan 15 Activity Thu Dec Dec 30 sub Dee Dec. 31 Tit 2,000 Jan 1 Activity thru Dec Dec 31 500 Jan 1 Activity thru Dec Dec. 29 0 INSTRUCTIONS: Complete the following tasks using the partial journal and the ledger provided: 1. Complete the posting of journal entries that were not completely posted to the ledger 2. Prepare a journal entry to record the December 31st payment of the dividend (make sure to include an explanation). 3. Update the general ledger (t-account) balances for your changes to the general ledger 4. Prepare a corrected trial balance. 5. Prepare financial statements using the blank forms attached (make sure to include proper titles and dates). 6. Answer the questions on the last page of the challenge Jan. 1 Activity thru Dec Dec. 31 Name CHALLENGE #1 ACC 211 5. PREPARE FINANCIAL STATEMENTS CONTINUED Drastic Design Corporation ACC 211 CHALLENGE #1 Name 5. PREPARE FINANCIAL STATEMENTS, CONTINUED Drastic Design Corporation AC 5. PRER 56,500 Fees Exper $ (68,000) Cash flows from operating activities: Cash received from customers Deduct cash payments for Expenses (33,161) Creditors (10,500) Net cash flow operating activities Cash flows used for investing activities: Cash payment for purchase of equipment Net cash flow investing activities Cash flows from financing activities: Cash received from issuing stock Deduct cash paid for dividends Net cash flow financing activities in cash Cash at the beginning of the year Cash at the end of the year 6. ANSWER THE FOLLOWING QUESTIONS A. Where do the numbers used to prepare a trial balance come from? $1 92,582 (20,000) Net ir Retai Net ir B. What is the purpose of a trial balance? Less C. Is a trial balance a required financial statement? Retai D. Other than those identified on the first page, list at least two other issues you noticed with the preliminary unadjusted trial balance. E. How do you know that the ending balance on the Statement of Cash Flows is accurate? Cash Accou Suppl F. Calculate the debt ratio for Drastic Design Corporation: Total liabilities Total assets = Industry standard: 0.4 Equip What does this ratio tell you about Drastic Design Corporation? Total ACER CH HERPERBESS ARCHI 1 w H RT SIE Theses EVE HE ZAD TUK 3 ha Streda WE CH!! CALL PREMSA ATEMENES.COM.CO W face 6 ANGA THEOLLOWING OCH Wholdet appy As Cash Sapp How do you know where now Factor Der Corporation To TI Whether you do? ACC 211 CHALLENGE #1 Name THE RECORDING PROCESS - DEBITS AND CREDITS Drastic Design Corporation Preliminary Unadjusted Trial Balance December 31, 2017 Debit Credit Cash 149,082 126,661 Accounts Receivable 28,740 Supplies 850 Equipment 86,000 Accounts Payable 18,630 Unearned Revenues 1,320 Common Stock 92,582 Retained Earnings 0 Dividends 20,000 Fees Earned 85,920 Rent Expense 6.800 Supplies Expense 2,840 Wages Expense 52,301 Totals 386,044 285,682 Acti The above preliminary trial balance of Drastic Design Corporation does not balance. When you review the general journal and general ledger supplied on the following pages you see: 1) The ending balance of the cash account has not been properly calculated & entered. 2) A December 30 billing of $2,000 to a customer on account was not posted to the Accounts Receivable ledger account. 3) A December 30 purchase of supplies for $500 not posted to the Accounts Payable ledger account 47A cash dividend payment for $5,000 made on December 31st was erroneously omitted. Activi ctivit INSTRUCTIONS: Complete the following tasks using the partial journal and the ledger provided: 1. Complete the posting of journal entries that were not completely posted to the ledger 2. Prepare a journal entry to record the December 31st payment of the dividend (make sure to include an explanation). 3. Update the general ledger (t-account) balances for your changes to the general ledger. 4. Prepare a corrected trial balance. 5. Prepare financial statements using the blank forms attached (make sure to include proper titles and dates). 6. Answer the questions on the last page of the challenge. C211 CHALLENGE #1 Name "ANCIAL STATEMENTS, CONTINUED CHALLENGE #1 ACC 211 1. & 2. UPDATE JOURNAL Name Drastic Design Corporation General Journal The Whe Pg 5 Posting Ref. . Debit Credit Dec Date Description 2017 30 Accounts Receivable Fees Earned To record services provided on account 2.000 2 40 2,000 3 3 4 5 Dec 15 500 6 30 Supplies Accounts Payable To record purchase of supplies on account 500 7 9 10 Dec 30 500 11 Dvidend Cash paid dividends in shorhocles Sood 12 Credit 4. PREPARE CORRECTED TRIAL BALANCE Drastic Design Corporation Corrected Unadjusted Trial Balance December 31, 2017 Debit Cash Accounts Receivable Supplies Equipment Accounts Payable Unearned Revenues Common Stock Retained Earnings Dividends Fees Earned Rent Expense Supplies Expense Wages Expense Totals ACC 211 CHALLENGE #1 Name ACC 211 3. UPDATE LE THE RECORDING PROCESS - DEBITS AND CREDITS Drastic Design Corporation Preliminary Unadjusted Trial Balance December 31, 2017 Debit Credit Cash 149,082 126,661 Accounts Receivable 28,740 Supplies 850 Equipment 86,000 Accounts Payable 18,630 Unearned Revenues 1,320 Common Stock 92,582 Retained Earnings 0 Dividends 20,000 Fees Earned 85,920 Rent Expense 6,800 Supplies Expense 2.840 Wages Expense 52,301 Totals 386,044 285,682 Jan 1b Activity thru Dec Dec 31 suot Jan 1 te Adivity thru Dec Dec. 29 Pg 5 The above preliminary trial balance of Drastic Design Corporation does not balance. When you review the general journal and general ledger supplied on the following pages you see 1) The ending balance of the cash account has not been properly calculated & entered 2) A December 30 billing of $2,000 to a customer on account was not posted to the Accounts Receivable ledger account. 3) A December 30 purchase of supplies for $500 not posted to the Accounts Payable ledger account 47A cash dividend payment for $5,000 made on December 31st was erroneously omitted. Jan 15 Activity Thu Dec Dec 30 sub Dee Dec. 31 Tit 2,000 Jan 1 Activity thru Dec Dec 31 500 Jan 1 Activity thru Dec Dec. 29 0 INSTRUCTIONS: Complete the following tasks using the partial journal and the ledger provided: 1. Complete the posting of journal entries that were not completely posted to the ledger 2. Prepare a journal entry to record the December 31st payment of the dividend (make sure to include an explanation). 3. Update the general ledger (t-account) balances for your changes to the general ledger 4. Prepare a corrected trial balance. 5. Prepare financial statements using the blank forms attached (make sure to include proper titles and dates). 6. Answer the questions on the last page of the challenge Jan. 1 Activity thru Dec Dec. 31 Name CHALLENGE #1 ACC 211 5. PREPARE FINANCIAL STATEMENTS CONTINUED Drastic Design Corporation ACC 211 CHALLENGE #1 Name 5. PREPARE FINANCIAL STATEMENTS, CONTINUED Drastic Design Corporation AC 5. PRER 56,500 Fees Exper $ (68,000) Cash flows from operating activities: Cash received from customers Deduct cash payments for Expenses (33,161) Creditors (10,500) Net cash flow operating activities Cash flows used for investing activities: Cash payment for purchase of equipment Net cash flow investing activities Cash flows from financing activities: Cash received from issuing stock Deduct cash paid for dividends Net cash flow financing activities in cash Cash at the beginning of the year Cash at the end of the year 6. ANSWER THE FOLLOWING QUESTIONS A. Where do the numbers used to prepare a trial balance come from? $1 92,582 (20,000) Net ir Retai Net ir B. What is the purpose of a trial balance? Less C. Is a trial balance a required financial statement? Retai D. Other than those identified on the first page, list at least two other issues you noticed with the preliminary unadjusted trial balance. E. How do you know that the ending balance on the Statement of Cash Flows is accurate? Cash Accou Suppl F. Calculate the debt ratio for Drastic Design Corporation: Total liabilities Total assets = Industry standard: 0.4 Equip What does this ratio tell you about Drastic Design Corporation? Total

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started