Answered step by step

Verified Expert Solution

Question

1 Approved Answer

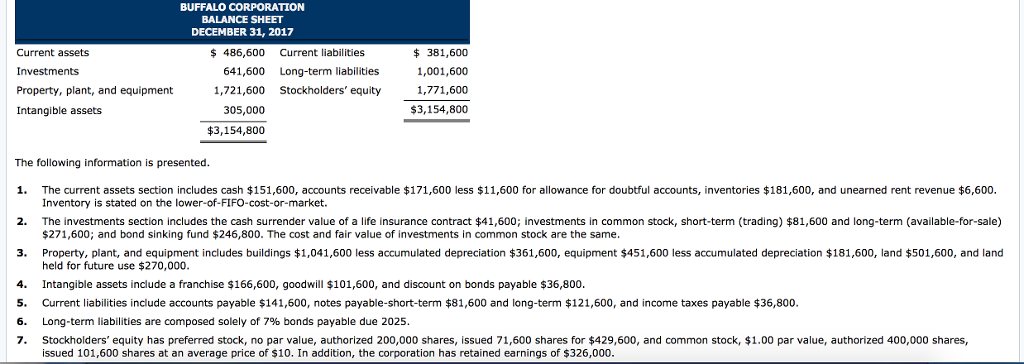

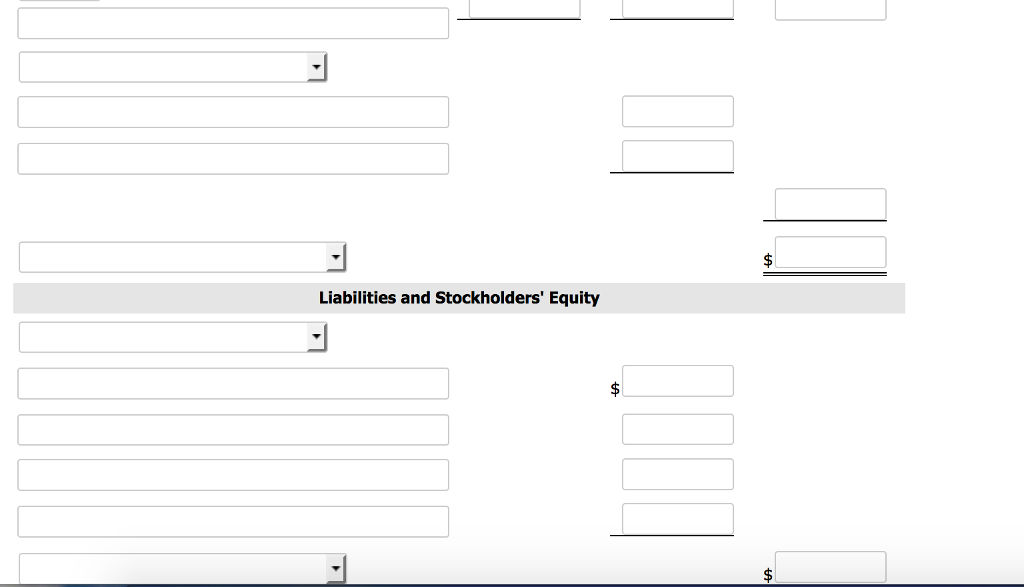

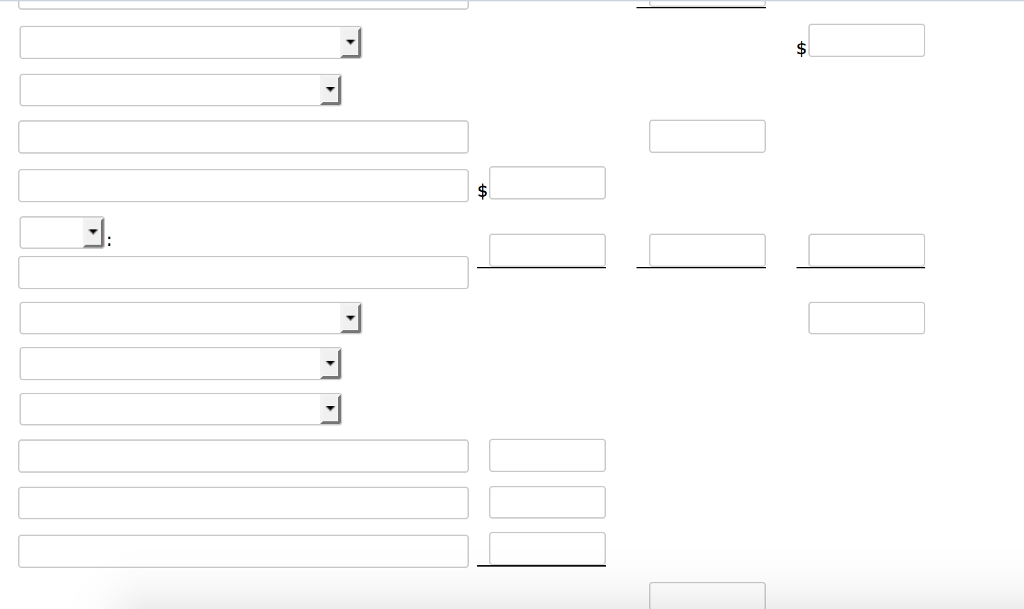

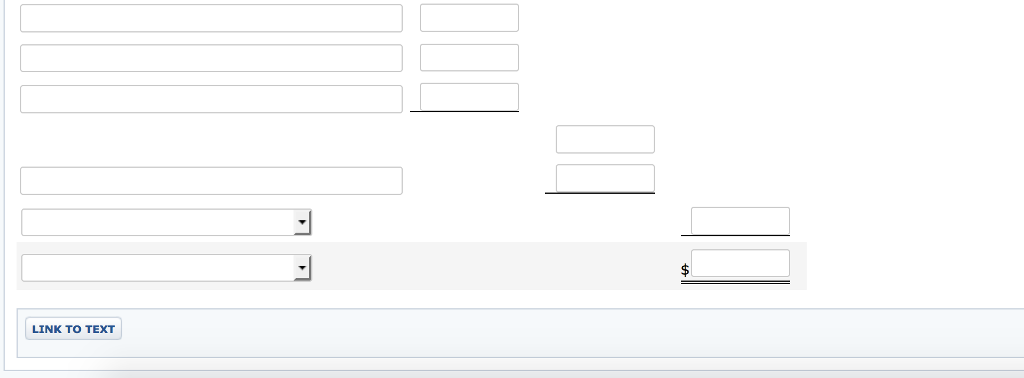

I I need help solving this problem please BUFFALO CORPORATION BALANCE SHEET DECEMBER 31, 2017 Current assets 486,600 Current liabilities 641,600 Long-term liabilities 1,721,600 Stockholders'

I I need help solving this problem please

I I need help solving this problem please

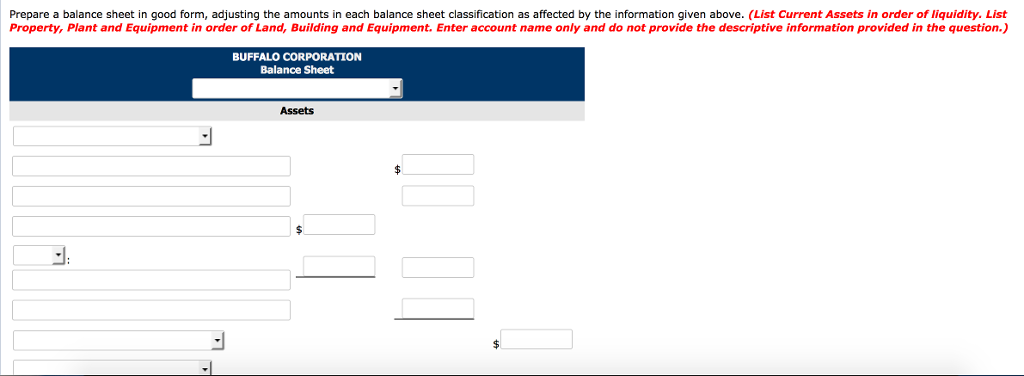

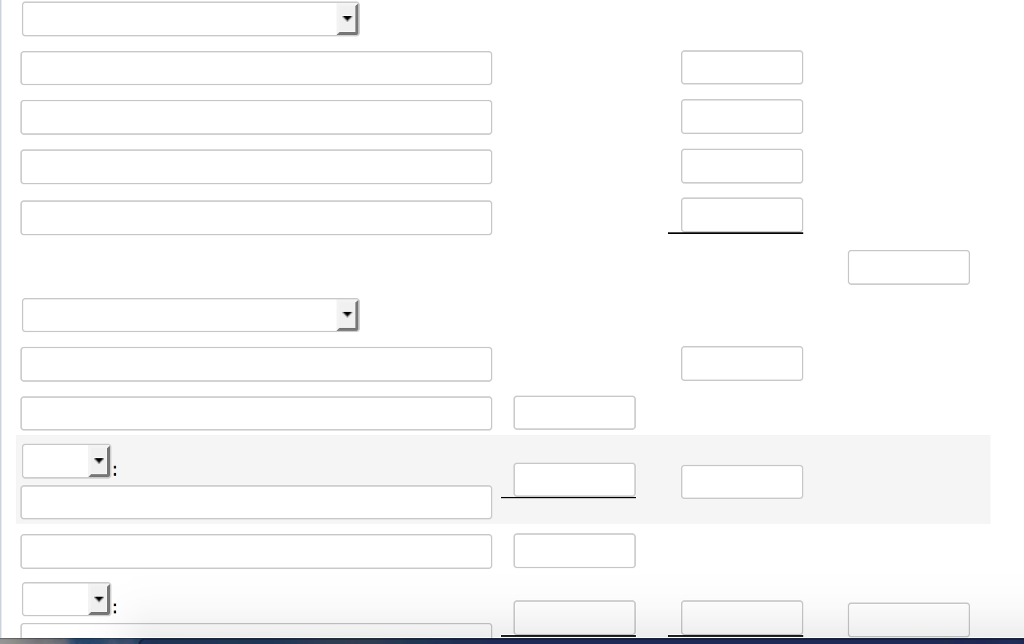

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started