Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i. ii. b) Robeck Bank seeks interest rate protection on a borrowing for a nine-month period beginning three months' time. The amount of proposed

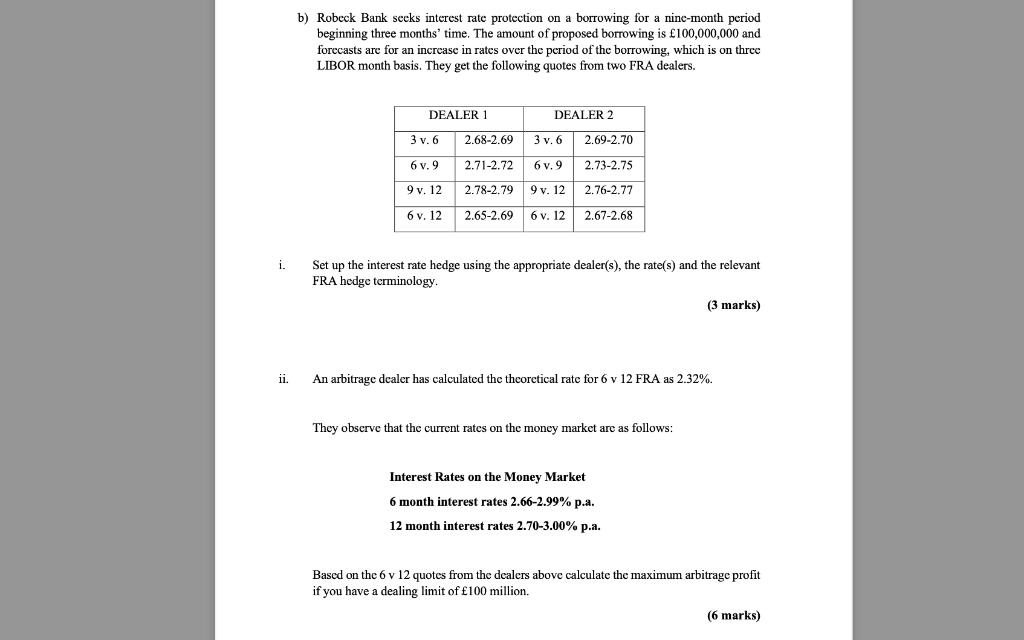

i. ii. b) Robeck Bank seeks interest rate protection on a borrowing for a nine-month period beginning three months' time. The amount of proposed borrowing is 100,000,000 and forecasts are for an increase in rates over the period of the borrowing, which is on three LIBOR month basis. They get the following quotes from two FRA dealers. DEALER 1 3 v. 6 6 v. 9 9 v. 12 6 v. 12 2.68-2.69 2.71-2.72 2.78-2.79 2.65-2.69 DEALER 2 3 v. 6 6 v.9 9 v. 12 6 v. 12 2.69-2.70 2.73-2.75 2.76-2.77 2.67-2.68 Set up the interest rate hedge using the appropriate dealer(s), the rate(s) and the relevant FRA hedge terminology. An arbitrage dealer has calculated the theoretical rate for 6 v 12 FRA as 2.32%. They observe that the current rates on the money market are as follows: (3 marks) Interest Rates on the Money Market 6 month interest rates 2.66-2.99% p.a. 12 month interest rates 2.70-3.00% p.a. Based on the 6 v 12 quotes from the dealers above calculate the maximum arbitrage profit if you have a dealing limit of 100 million. (6 marks)

Step by Step Solution

★★★★★

3.54 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

i Robe c k Bank would set up the interest rate hedge using Deale...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started