Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I. In 2016, Jenny (age 25) had income of $365 which she earned from selling magazine subscriptions. She did not receive a Form 1099-MISC. Because

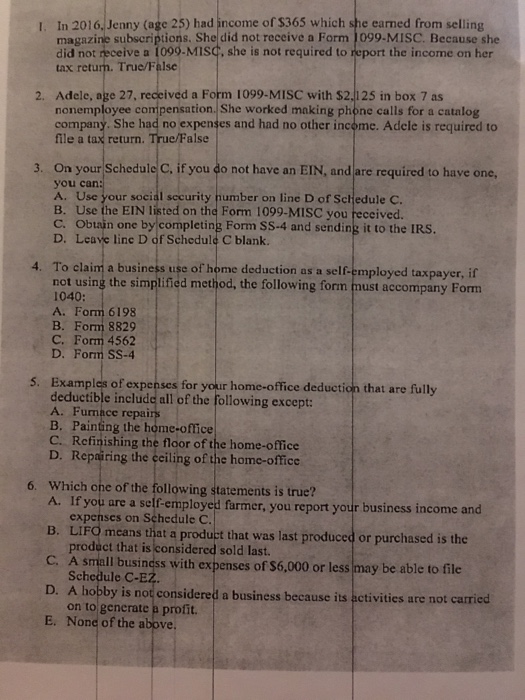

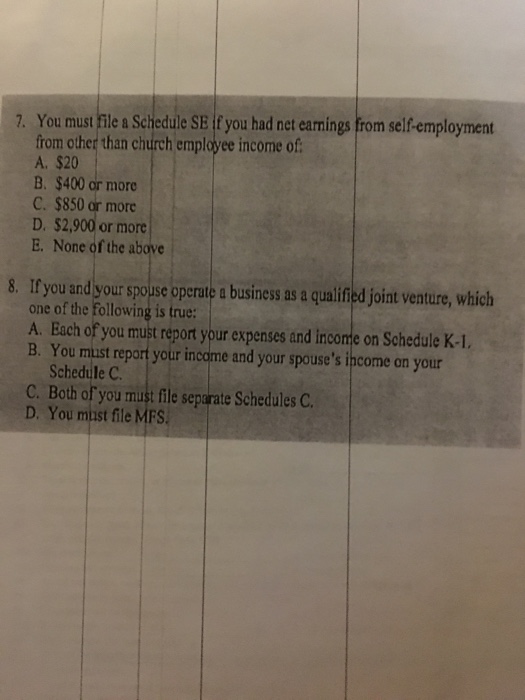

I. In 2016, Jenny (age 25) had income of $365 which she earned from selling magazine subscriptions. She did not receive a Form 1099-MISC. Because she did not receive a 1090-MiSG, she is not required to report the income on her tax retum. True/False 2. Adele, age 27, received a Form 1099-MISC with $2,125 in box 7 as nonemployee compensation. She worked making phone calls for a catalog company. She had no expenses and had no other income. Adele is required to file a tax return. True/False 3. On your Schedule C, if you do not have an EIN, and are required to have one, you can: A. Use your social security number on line D of Schedule C B. Use the EIN listed on the Form 1099-MISC you received C. Obtain one by completing Form SS-4 and sending it to the IRS. D. Leave line D of Schedulo C blank 4. To claim a business use of home deduction as a self-employed taxpayer, if not using the simplified method, the following form must accompany Form 1040: A. Form 6198 B. Form 8829 C. Form 4562 D. Form SS-4 deductible include all of the following except: A. Furmace repairs B. Painting the home-office C. Refinishing the floor of the home-office D. Repairing the cciling of the home-office 6. Which one of the following statements is true? If you are a self employed farmer, you report your business income and expenses on Schedule C. B. LIFO means that a product that was last produced or purchased is t C. A small business with expenses of $6,000 or less may be able to file D. E. None of the above he product that is considered sold last. Schedule C-E A hobby is not considered a business because its activities are not carried on to generate a profit

I. In 2016, Jenny (age 25) had income of $365 which she earned from selling magazine subscriptions. She did not receive a Form 1099-MISC. Because she did not receive a 1090-MiSG, she is not required to report the income on her tax retum. True/False 2. Adele, age 27, received a Form 1099-MISC with $2,125 in box 7 as nonemployee compensation. She worked making phone calls for a catalog company. She had no expenses and had no other income. Adele is required to file a tax return. True/False 3. On your Schedule C, if you do not have an EIN, and are required to have one, you can: A. Use your social security number on line D of Schedule C B. Use the EIN listed on the Form 1099-MISC you received C. Obtain one by completing Form SS-4 and sending it to the IRS. D. Leave line D of Schedulo C blank 4. To claim a business use of home deduction as a self-employed taxpayer, if not using the simplified method, the following form must accompany Form 1040: A. Form 6198 B. Form 8829 C. Form 4562 D. Form SS-4 deductible include all of the following except: A. Furmace repairs B. Painting the home-office C. Refinishing the floor of the home-office D. Repairing the cciling of the home-office 6. Which one of the following statements is true? If you are a self employed farmer, you report your business income and expenses on Schedule C. B. LIFO means that a product that was last produced or purchased is t C. A small business with expenses of $6,000 or less may be able to file D. E. None of the above he product that is considered sold last. Schedule C-E A hobby is not considered a business because its activities are not carried on to generate a profit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started