I included all of the information the book provided. I found the textbook solution but I need help determining which numbers get plugged in to populate the answer. If I can understand how the return on equity, return on assets, ect is computed on one I can solve the remaining years/companies. I keep getting answers one over.

Question a- Compete key liquidity, solvency, and return on investment ratios for 1998 (current ratio, total debt to equity, long-term debt to equity, times interests earned, return on assets, return on equity).

I cannot determine which numbers are used to complete the equation.

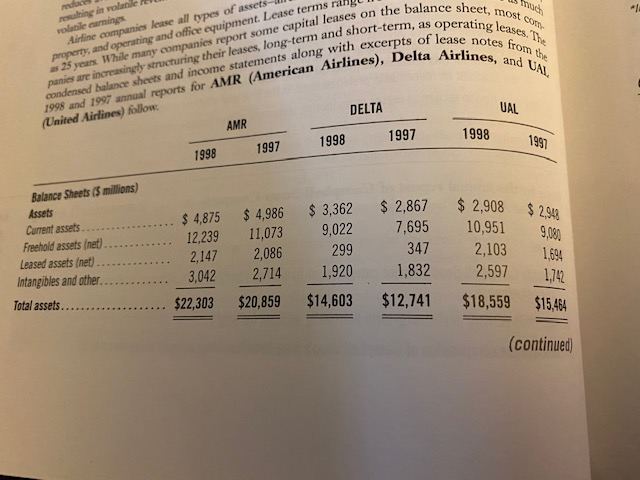

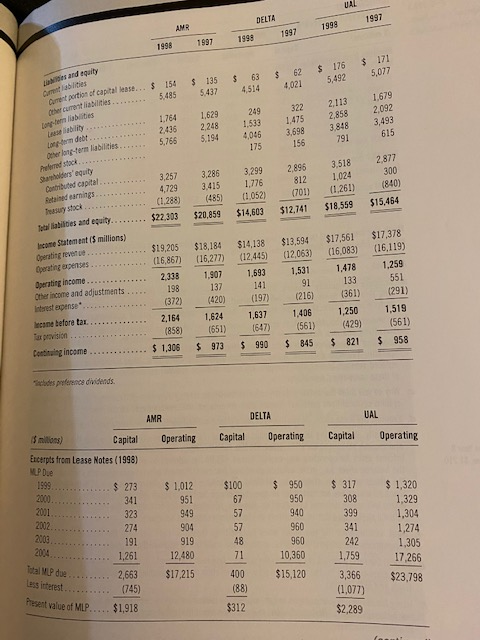

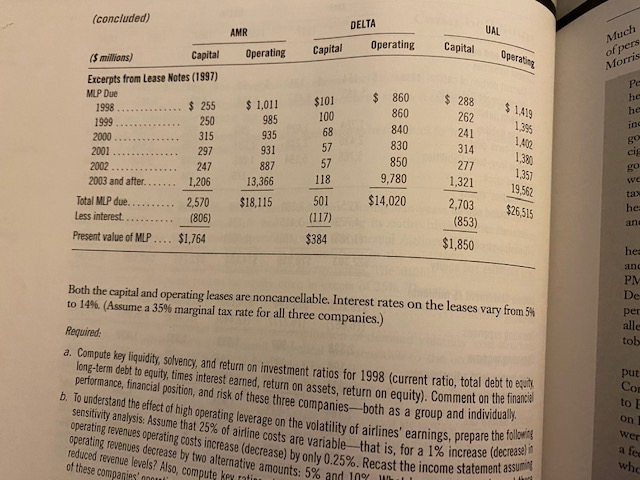

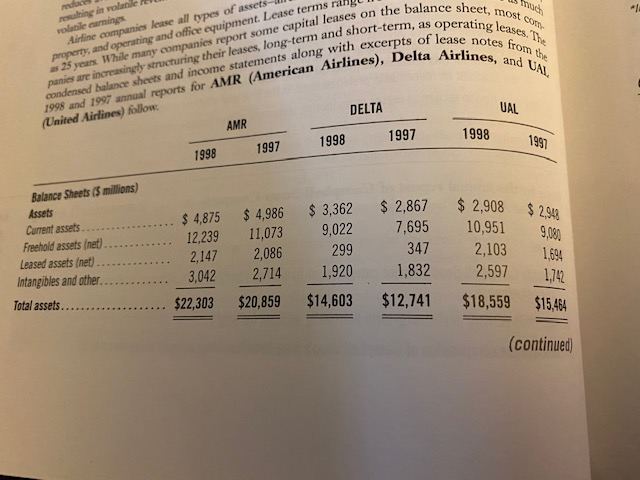

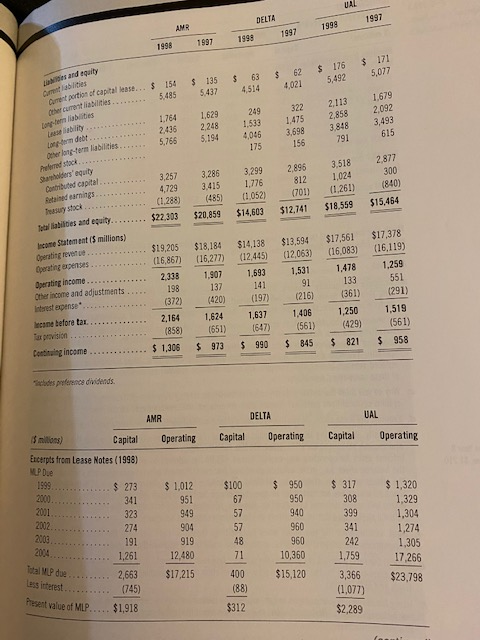

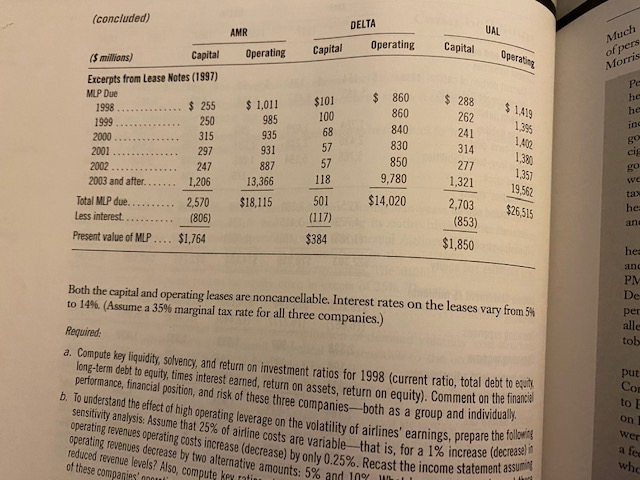

on the balance sheet, mos erm, as operating leases most leases. The md rowing in allere volatile carmings Airline companies lease all types of assets- property, and operating and office equipment. Lease terms all 25 years. While many companies report some capital leases on the bal. panies are increasingly structuring their leases, long-term and short-term a condensed balance sheets and income statements along with excerpts of 1998 and 1997 annual reports for AMR (American Airlines), Delta (United Airlines) follow property, and ople many companies ir leases, long-tern with excerpts of lease notes fro the 25 years. Whangly structuring the statements alon Airlines), Delta Airlines, and oth UAL AMR DELTA 1997 1998 1998 1997 1997 1998 Balance Sheets ($ millions) Assets $ 4875 Current assets..... Freehold assets (net)............. 12,239 2147 Leased assets (net).............. Intangibles and other ......... 3.042 Total assets.... $22,303 $ 4.986 11,073 2,086 2 .714 $20,859 $ 3,362 9,022 299 1 ,9ZU $ 2,867 7,695 347 1,832 $ 2,908 10,951 2,103 2.597 1602 17 $14,603 $12,741 $18,559 $15,484 (continued UAB DELTA 1997 AMR 1998 1998 1997 1998 1997 $ 1 $ $ 5,077 Dies and equity $ 176 5,492 $ 62 4021 $ 4.514 154 5.485 135 5.437 et portion of capital ease... $ 249 1.764 2.436 5,766 1629 2.248 5.154 322 1,475 3,698 156 1,533 4045 175 1.679 2,092 3,493 615 2,113 2.858 3.848 791 Londoor Dela-term labilities 2.896 2,877 300 812 3.257 4,729 (1.288) 3.518 1,024 (1.261) 3.299 1,776 (1.052) $14,603 3.286 3415 (485) $20,859 polders' equity Qu ad capital... Renderings Teasury stick o labildies and equity....... Income Statement (millions) (840) $15.454 (701) $12.741 $18.559 $22,303 $19,205 (16.867) $14.138 (12.445) $13,594 (12.063) $17,561 (16.083) 1531 2338 Operating penses Operating income........ Other income and adjustments ..... 91 $18,184 16.277) 1.907 137 (420) 1,624 (651) $ 973 1.478 133 (361) 198 (372) $17,378 (16.119) 1.259 551 (291) 1,519 (561) $ 958 1,693 141 (197) 1.637 (647) 990 (216) ne before tal............. 1.406 (561) 2,164 (858) $ 1,306 1,250 (429) 821 $ $ 845 $ Combining income .............. ades perence dividends. AMR VAL DELTA Capital Operating Operating Capital Operating $100 $ 950 950 $ 317 308 399 Sitions) Capital Excerpts from Lease Notes (1998) MLP Due 1999 ... $ 273 2000.... 341 323 2002. 2003 1.261 2,663 Less interest ........... (745) Present value of MLP..... $1,918 274 $ 1,012 951 949 904 919 12,480 $17,215 57 57 48 71 940 960 960 10,360 $15,120 341 242 $ 1,320 1,329 1,304 1,274 1,305 17,266 $23,798 2014 400 1,759 3,366 (1,077) $2,289 (88) $312 (concluded) DELTA AMR VAL Operating Capital Operating Capital Opera Operating Much of pers Morris $101 $ 288 $ 1,011 985 $ 1419 262 241 935 (5 millions) Capital Excerpts from Lease Notes (1997) MLP Due 1998 ..... .........$ 255 1999.............. 250 2000.............. 315 2001 297 2002 247 2003 and after....... 1,206 Total MLP due. ......... 2,570 Less interest........... (806) Present value of MLP.... $1,764 1.399 1.402 931 $ 860 860 840 830 850 9,780 $14,020 314 1.380 277 118 1,321 13,366 $18,115 1,357 19,562 501 $26.515 (117) $384 2,703 (853) $1,850 he ang PM Both the capital and operating leases are noncancellable. Interest rates on the leases vary from 54 to 14%. (Assume a 35% marginal tax rate for all three companies. De Per Required: alle tob Put a. Compute key liquidity, solvency and return on investment ratios for 1998 (current ratio, total debt toeg. long-term debt to equity, times interest earned. return on assets, return on equity). Comment on the mom performance, financial position, and risk of these three companies both as a group and indiviu b. lo understand the effect of high operating leverage on the volatility of airlines' earnings, prepar sensitivity analysis: Assume that 25% of airline costs are variable that is, for a 1% increa operating revenues operating costs increase (decrease) by only 0.25% Recast the income su operating revenues decrease by two alternative amounts, 5% and 107 reduced revenue levels? Also, compute key at of these companies Cor to E On Wer a fed Searnings, prepare the following for a 1% increase (decrease in the income statement assuming who