I included the answers to the prior questions so that you can help me complete the other parts. Thank you.

a. What is the amount of down payment?

Cost of computer = 5991.64

Down payment is 40%

Down payment amount = Cost of computer * down payment

=5991.64*40%

=$2396.66

b. What is the amount financed (amount of loan)?

Amount financed = Cost of computer - down payment

=5991.64 -2396.66

=$3594.98

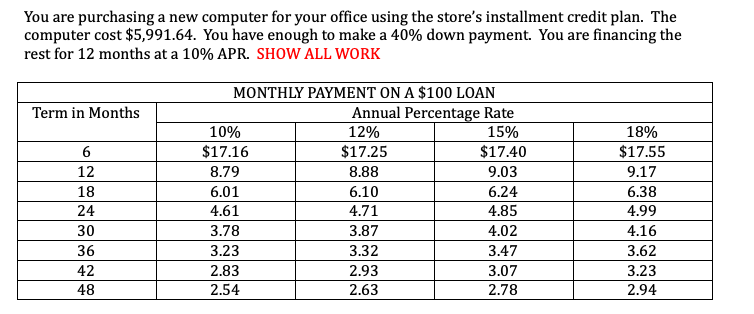

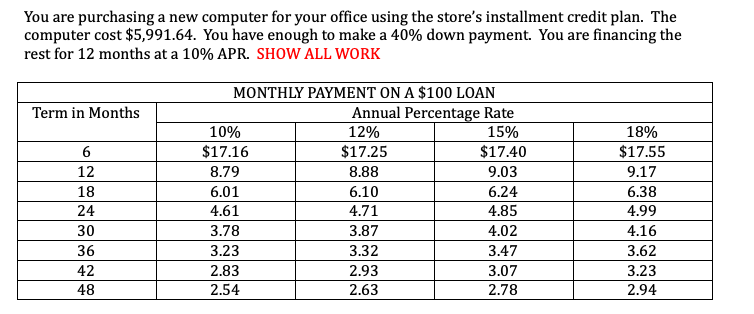

c. Use the chart above to find your monthly payment

Interes rate is 10%

Months of payment are 12

Loan payment on $100 @10% for 12 months (from table) is =8.79

Monthly payment on loan financed = Amount of loan/100*Table factor

=3594.98/100*8.79

=315.998742

= $316.00

d. After 12 months, how much will you have paid back?

Total amount paid back = Monthly payment *number of monthhs

=316.00*12

=$3792

e. What is the total finance charge?

Total amount paid back = Monthly payment *number of monthhs

=316.00*12

=$3792

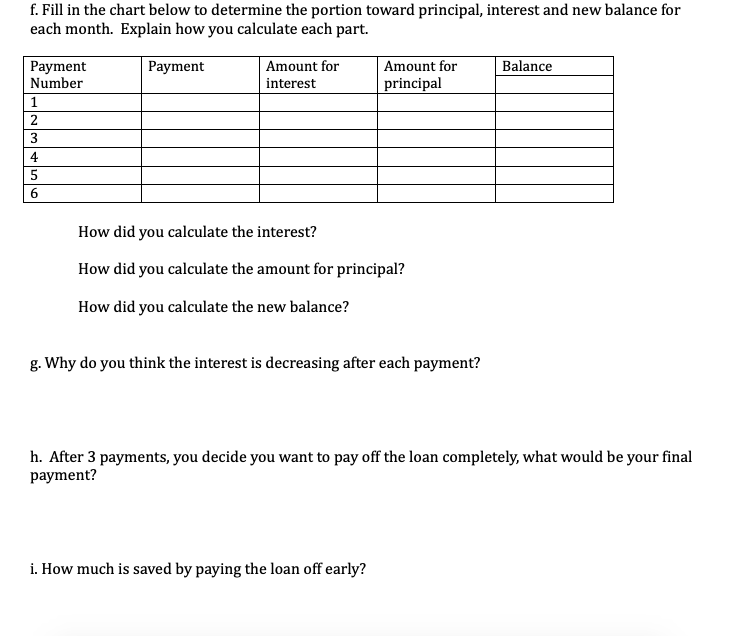

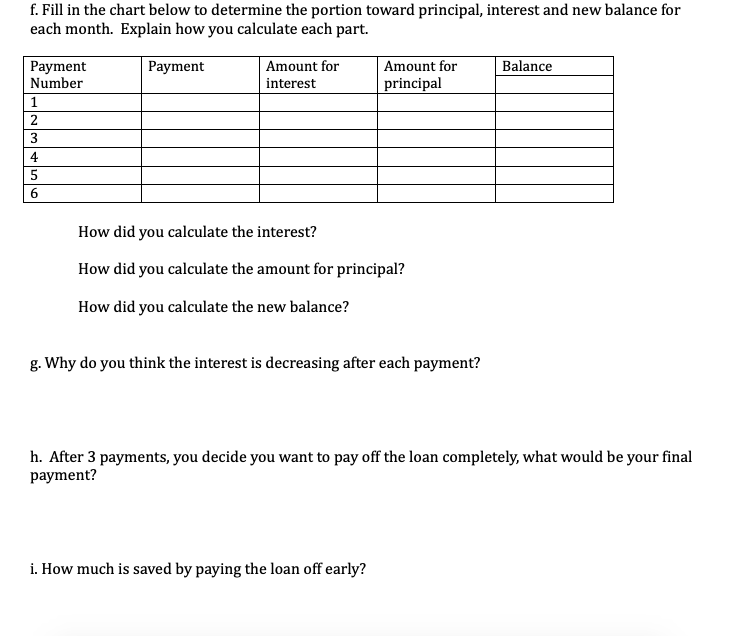

f. Fill in the chart below to determine the portion toward principal, interest and new balance for each month. Explain how you calculate each part. Payment Balance Amount for interest Amount for principal Payment Number 1 2 3 4 5 6 How did you calculate the interest? How did you calculate the amount for principal? How did you calculate the new balance? g. Why do you think the interest is decreasing after each payment? h. After 3 payments, you decide you want to pay off the loan completely, what would be your final payment? i. How much is saved by paying the loan off early? You are purchasing a new computer for your office using the store's installment credit plan. The computer cost $5,991.64. You have enough to make a 40% down payment. You are financing the rest for 12 months at a 10% APR. SHOW ALL WORK Term in Months 6 12 18 24 30 MONTHLY PAYMENT ON A $100 LOAN Annual Percentage Rate 10% 12% 15% $17.16 $17.25 $17.40 8.79 8.88 9.03 6.01 6.10 6.24 4.61 4.71 4.85 3.78 3.87 4.02 3.23 3.32 3.47 2.83 2.93 3.07 2.54 2.63 2.78 18% $17.55 9.17 6.38 4.99 4.16 3.62 3.23 2.94 36 42 48 f. Fill in the chart below to determine the portion toward principal, interest and new balance for each month. Explain how you calculate each part. Payment Balance Amount for interest Amount for principal Payment Number 1 2 3 4 5 6 How did you calculate the interest? How did you calculate the amount for principal? How did you calculate the new balance? g. Why do you think the interest is decreasing after each payment? h. After 3 payments, you decide you want to pay off the loan completely, what would be your final payment? i. How much is saved by paying the loan off early? You are purchasing a new computer for your office using the store's installment credit plan. The computer cost $5,991.64. You have enough to make a 40% down payment. You are financing the rest for 12 months at a 10% APR. SHOW ALL WORK Term in Months 6 12 18 24 30 MONTHLY PAYMENT ON A $100 LOAN Annual Percentage Rate 10% 12% 15% $17.16 $17.25 $17.40 8.79 8.88 9.03 6.01 6.10 6.24 4.61 4.71 4.85 3.78 3.87 4.02 3.23 3.32 3.47 2.83 2.93 3.07 2.54 2.63 2.78 18% $17.55 9.17 6.38 4.99 4.16 3.62 3.23 2.94 36 42 48