Answered step by step

Verified Expert Solution

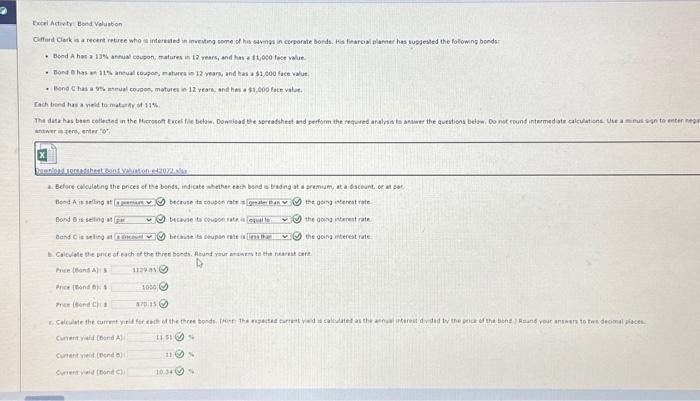

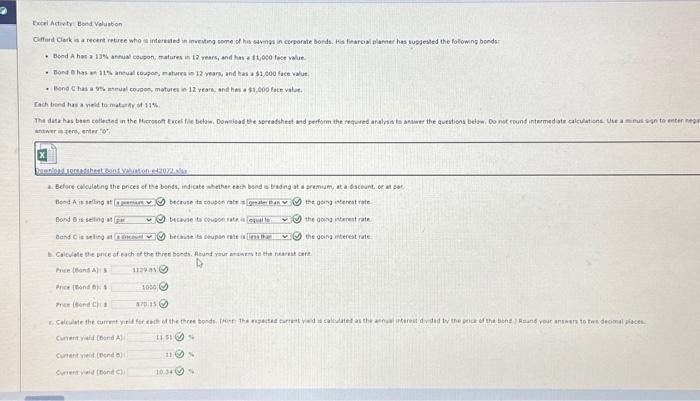

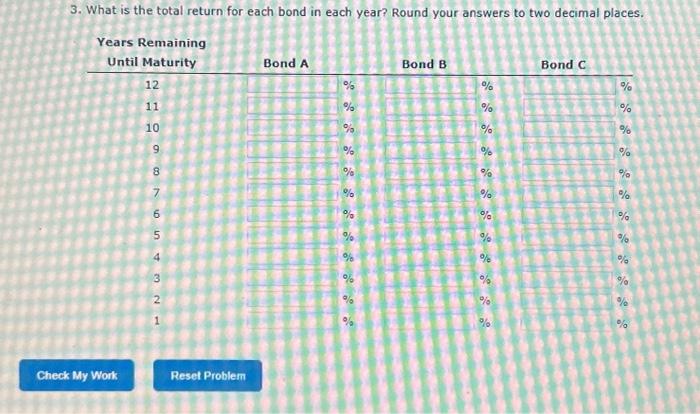

Question

1 Approved Answer

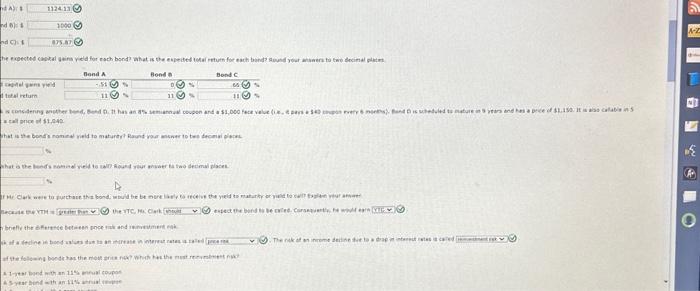

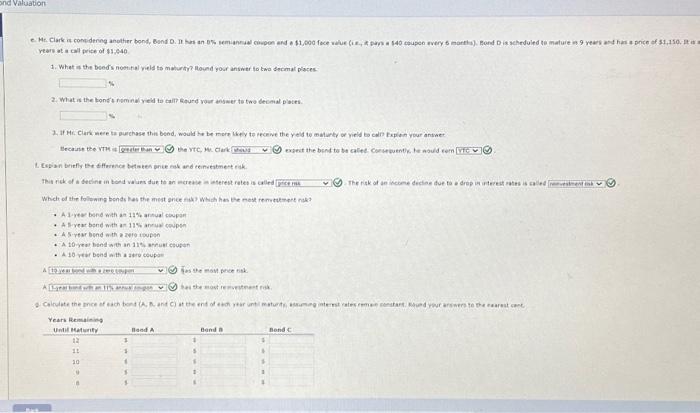

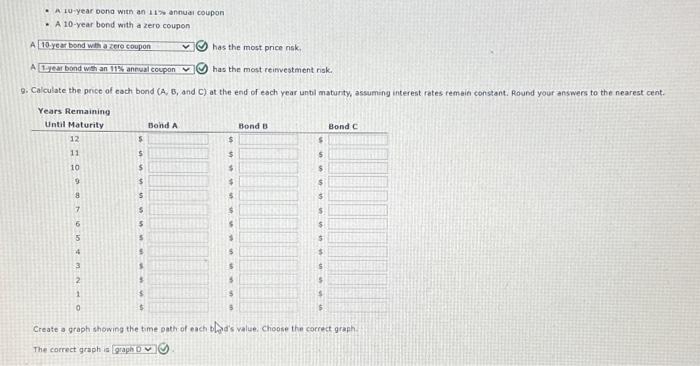

I included the whole problem because ive been told not enough info. I asked for E and G in another problem so the only thing

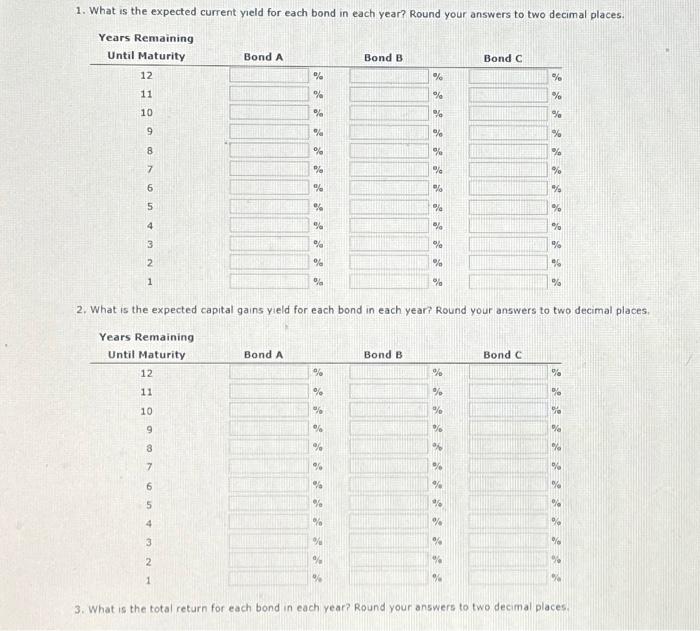

I included the whole problem because ive been told not enough info. I asked for E and G in another problem so the only thing I need is the last 2 pictures, or 1. 2. and 3. which comes after part 3.

Thank you so much!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started