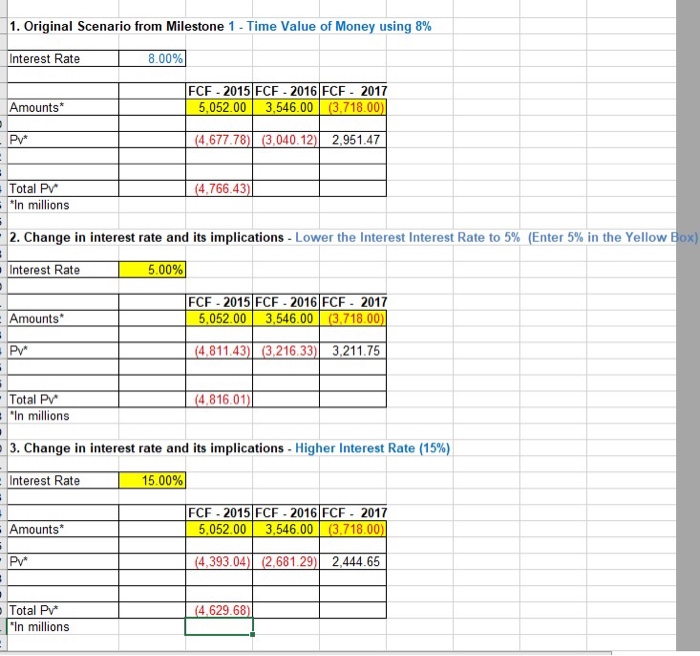

I inputed the numbers in the excel speadsheet from the two documents below.

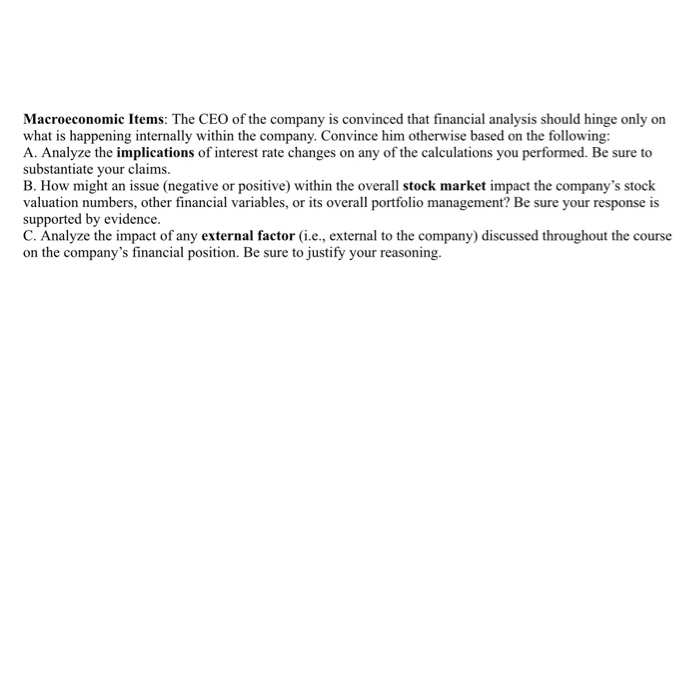

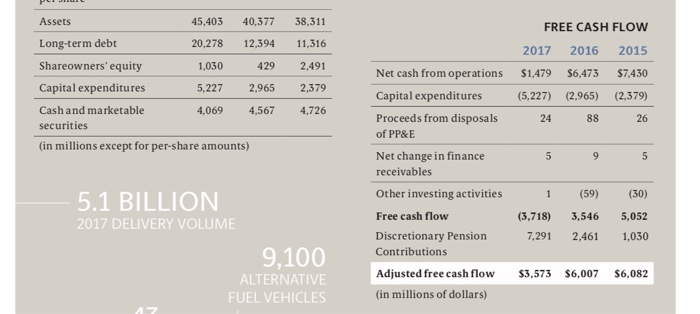

1. Original Scenario from Milestone 1- Time Value of Money using 8% Interest Rate 8.00% FCF - 2015 FCF - 2016 FCF - 2017 5,052.00 Amounts 3,546.00 (3,718.00) Pv (4,677.78) (3,040.12) 2,951.47 Total Pv (4.766.43) In millions 2. Change in inte rest rate and its implications -Lower the Interest Interest Rate to 5% (Enter 5% in the Yellow Box) 5.00% Interest Rate FCF-2015 FCF-2016 FCF- 2017 5,052.00 3,546.00 (3,718.00) Amounts (4,811.43) (3,216.33) 3,211.75 Pv Total Pv "In millions (4,816.01) 3. Change in interest rate and its implications-Higher Interest Rate (15%) 15.00% Interest Rate FCF - 2015 FCF- 2016 FCF - 2017 3.546.00 (3.718.00) Amounts 5,052.00 (4,393.04) (2,681.29) 2,444.65 Pv* Total Pv "In millions (4,629.68) Macroeconomic Items: The CEO of the company is convinced that financial analysis should hinge only on what is happening internally within the company. Convince him otherwise based on the following: A. Analyze the implications of interest rate changes on any of the calculations you performed. Be sure to substantiate your claims. B. How might an issue (negative or positive) within the overall stock market impact the company's stock valuation numbers, other financial variables, or its overall portfolio management? Be sure your response is supported by evidence C. Analyze the impact of any external factor (i.e., external to the company) discussed throughout the cou on the company's financial position. Be sure to justify your reasoning ourse Use the Milestone 1 Free Cash Flows (Time Value of Money) for Milestone 4 analysis . Enter the FCFS from Milestone 1 in the FCFS Yellow Boxes in 1., 2., and 3. Three cases will be analyzed: 1. Original Scenario from Milestone 1- Time Value of Money using 8% Interest Rate 2. Lower the Interest Rate from 8% to 5%. 3. Increase the Interest Rate from 8% to 15%. 45,403 40,377 38,311 Assets FREE CASH FLOW Long-term debt 20,278 12,394 11,316 2017 2016 2015 Shareowners' equity 1,030 429 2,491 $1,479 Net cash from operations $6,473 $7,430 Capital expenditures 5,227 2,379 2,965 Capital expenditures (2,965) (5,227) (2,379) Cash and marketable 4,069 4,567 4,726 Proceeds from disposals 24 88 26 securities of PP&E (in millions except for per-share amounts Net change in finance 9 5 receivables Other investing activities 1 (59) (30) 5.1 BILLION 5,052 Free cash flow (3,718) 3,546 2017 DELIVERY VOLUME Discretionary Pension 7,291 2,461 1,030 9,100 Contributions $6,082 Adjusted free cash flow $3,573 $6,007 ALTERNATIVE (in millions of dollars) FUEL VEHICLES