Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I. Instructions: This case is designed to be an excel spreadsheet case. Please show your work by using formulas and cell references in excel. Use

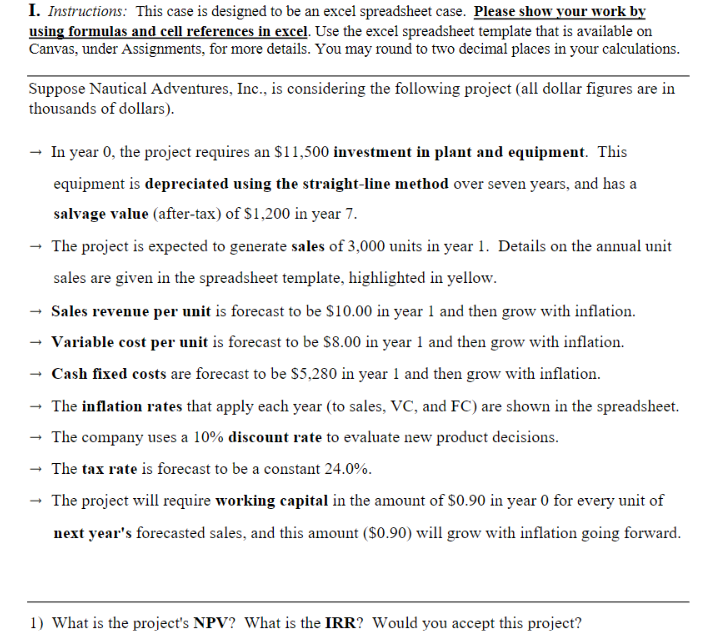

I. Instructions: This case is designed to be an excel spreadsheet case. Please show your work by using formulas and cell references in excel. Use the excel spreadsheet template that is available on Canvas, under Assignments, for more details. You may round to two decimal places in your calculations. Suppose Nautical Adventures, Inc., is considering the following project all dollar figures are in thousands of dollars In year the project requires an $ investment in plant and equipment. This equipment is depreciated using the straightline method over seven years, and has a salvage value aftertax of $ in year The project is expected to generate sales of units in year Details on the annual unit sales are given in the spreadsheet template, highlighted in yellow. Sales revenue per unit is forecast to be $ in year and then grow with inflation. Variable cost per unit is forecast to be $ in year and then grow with inflation. Cash fixed costs are forecast to be $ in year and then grow with inflation. The inflation rates that apply each year to sales, VC and FC are shown in the spreadsheet. The company uses a discount rate to evaluate new product decisions. The tax rate is forecast to be a constant The project will require working capital in the amount of $ in year for every unit of next year's forecasted sales, and this amount will grow with inflation going forward.

I. Instructions: This case is designed to be an excel spreadsheet case. Please show your work by

using formulas and cell references in excel. Use the excel spreadsheet template that is available on

Canvas, under Assignments, for more details. You may round to two decimal places in your calculations.

Suppose Nautical Adventures, Inc., is considering the following project all dollar figures are in

thousands of dollars

In year the project requires an $ investment in plant and equipment. This

equipment is depreciated using the straightline method over seven years, and has a

salvage value aftertax of $ in year

The project is expected to generate sales of units in year Details on the annual unit

sales are given in the spreadsheet template, highlighted in yellow.

Sales revenue per unit is forecast to be $ in year and then grow with inflation.

Variable cost per unit is forecast to be $ in year and then grow with inflation.

Cash fixed costs are forecast to be $ in year and then grow with inflation.

The inflation rates that apply each year to sales, VC and FC are shown in the spreadsheet.

The company uses a discount rate to evaluate new product decisions.

The tax rate is forecast to be a constant

The project will require working capital in the amount of $ in year for every unit of

next year's forecasted sales, and this amount will grow with inflation going forward.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started