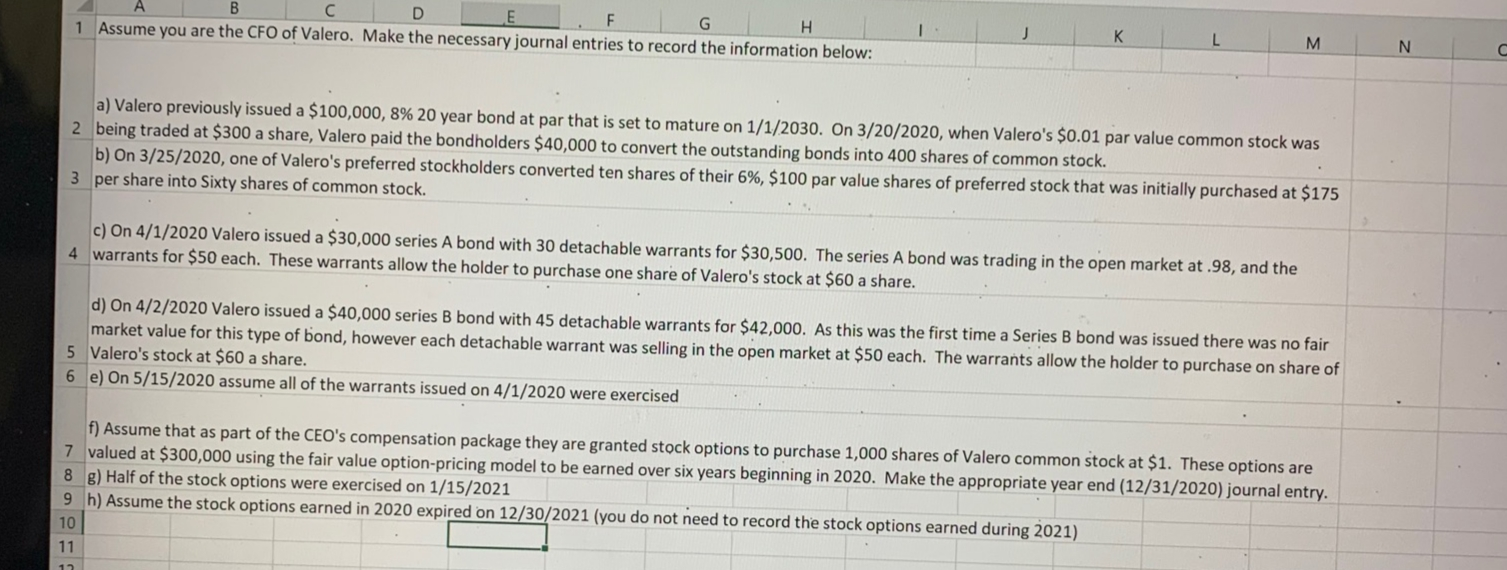

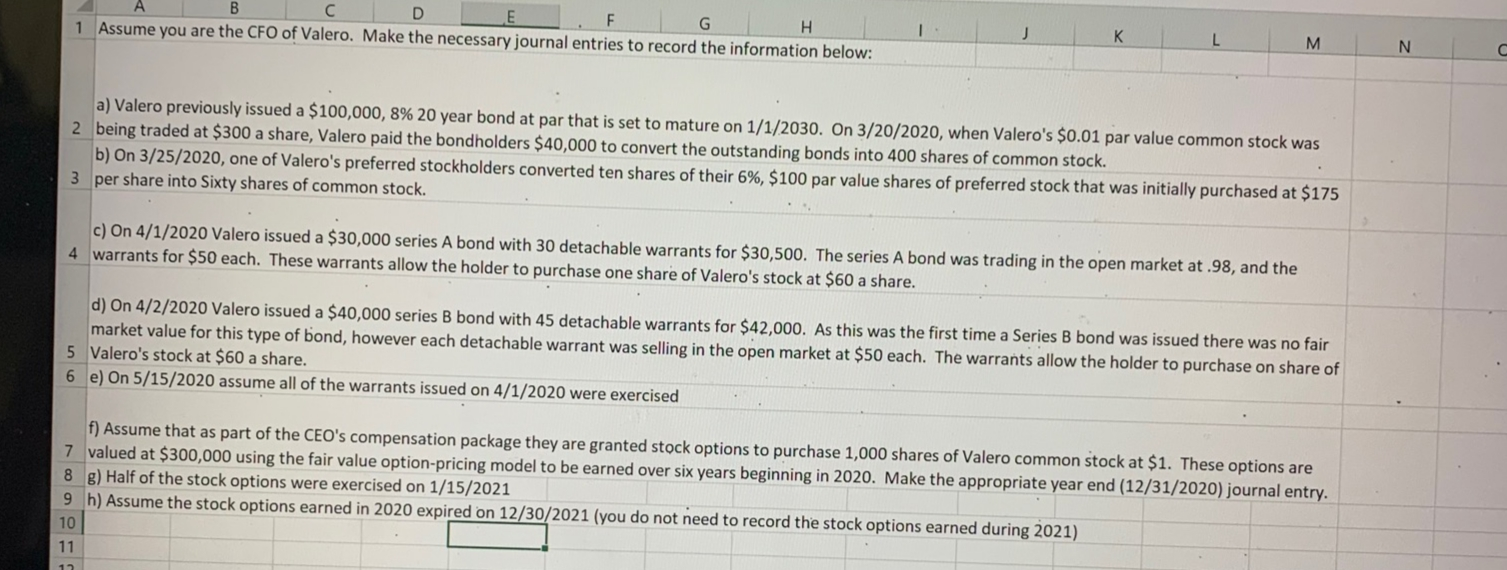

I J K L M N O A B C D E F G H 1 Assume you are the CFO of Valero. Make the necessary journal entries to record the information below: a) Valero previously issued a $100,000, 8% 20 year bond at par that is set to mature on 1/1/2030. On 3/20/2020, when Valero's $0.01 par value common stock was 2 being traded at $300 a share, Valero paid the bondholders $40,000 to convert the outstanding bonds into 400 shares of common stock. b) On 3/25/2020, one of Valero's preferred stockholders converted ten shares of their 6%, $100 par value shares of preferred stock that was initially purchased at $175 3 per share into Sixty shares of common stock. c) On 4/1/2020 Valero issued a $30,000 series A bond with 30 detachable warrants for $30,500. The series A bond was trading in the open market at .98, and the 4 warrants for $50 each. These warrants allow the holder to purchase one share of Valero's stock at $60 a share. d) On 4/2/2020 Valero issued a $40,000 series B bond with 45 detachable warrants for $42,000. As this was the first time a Series B bond was issued there was no fair market value for this type of bond, however each detachable warrant was selling in the open market at $50 each. The warrants allow the holder to purchase on share of 5 Valero's stock at $60 a share. 6 e) On 5/15/2020 assume all of the warrants issued on 4/1/2020 were exercised f) Assume that as part of the CEO's compensation package they are granted stock options to purchase 1,000 shares of Valero common stock at $1. These options are 7 valued at $300,000 using the fair value option-pricing model to be earned over six years beginning in 2020. Make the appropriate year end (12/31/2020) journal entry. 8 8) Half of the stock options were exercised on 1/15/2021 9 h) Assume the stock options earned in 2020 expired on 12/30/2021 (you do not need to record the stock options earned during 2021) 10 11 I J K L M N O A B C D E F G H 1 Assume you are the CFO of Valero. Make the necessary journal entries to record the information below: a) Valero previously issued a $100,000, 8% 20 year bond at par that is set to mature on 1/1/2030. On 3/20/2020, when Valero's $0.01 par value common stock was 2 being traded at $300 a share, Valero paid the bondholders $40,000 to convert the outstanding bonds into 400 shares of common stock. b) On 3/25/2020, one of Valero's preferred stockholders converted ten shares of their 6%, $100 par value shares of preferred stock that was initially purchased at $175 3 per share into Sixty shares of common stock. c) On 4/1/2020 Valero issued a $30,000 series A bond with 30 detachable warrants for $30,500. The series A bond was trading in the open market at .98, and the 4 warrants for $50 each. These warrants allow the holder to purchase one share of Valero's stock at $60 a share. d) On 4/2/2020 Valero issued a $40,000 series B bond with 45 detachable warrants for $42,000. As this was the first time a Series B bond was issued there was no fair market value for this type of bond, however each detachable warrant was selling in the open market at $50 each. The warrants allow the holder to purchase on share of 5 Valero's stock at $60 a share. 6 e) On 5/15/2020 assume all of the warrants issued on 4/1/2020 were exercised f) Assume that as part of the CEO's compensation package they are granted stock options to purchase 1,000 shares of Valero common stock at $1. These options are 7 valued at $300,000 using the fair value option-pricing model to be earned over six years beginning in 2020. Make the appropriate year end (12/31/2020) journal entry. 8 8) Half of the stock options were exercised on 1/15/2021 9 h) Assume the stock options earned in 2020 expired on 12/30/2021 (you do not need to record the stock options earned during 2021) 10 11