Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I just need 7-9 no other previous questions Sunwick Product matus producenter Marine Toivat you with actions primary for machine person and Anby Departments 6.000

I just need 7-9 no other previous questions

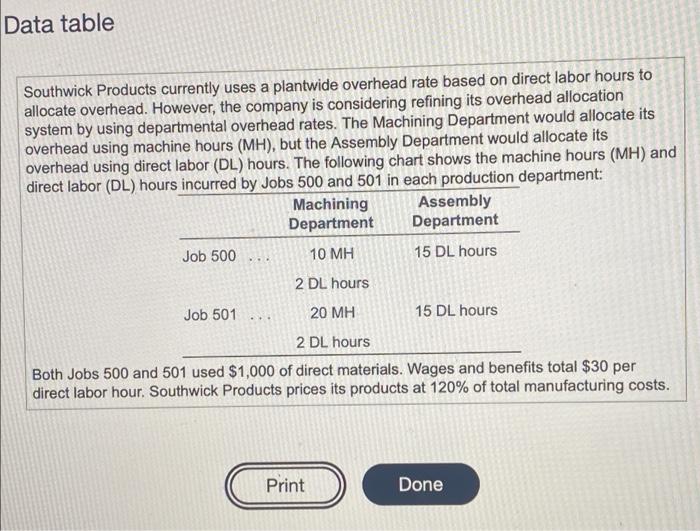

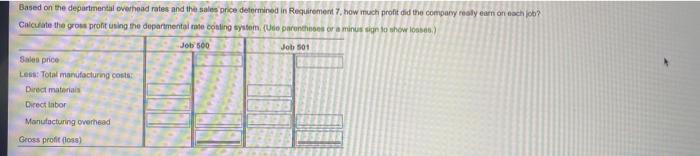

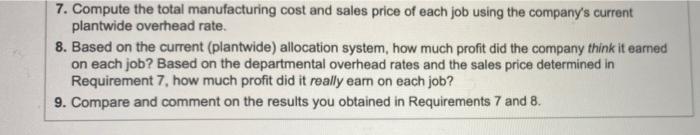

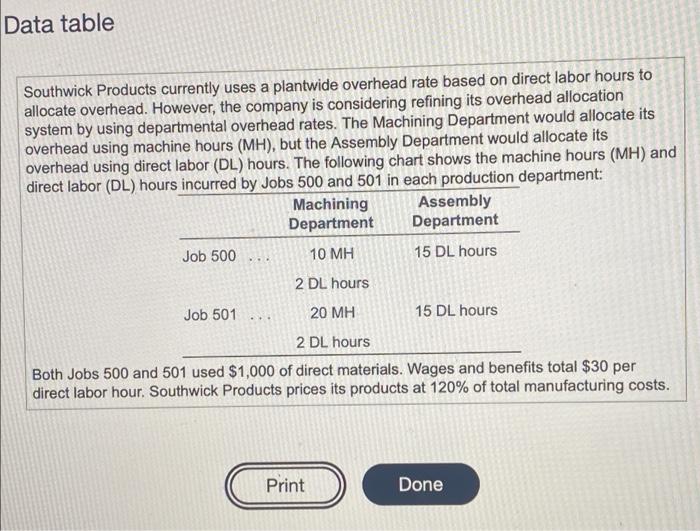

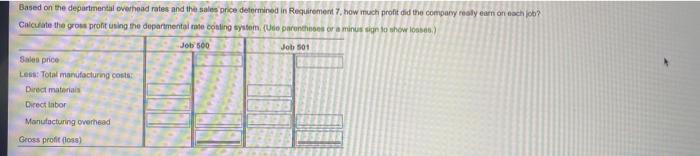

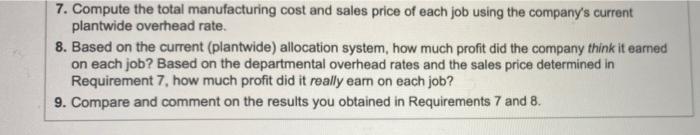

Sunwick Product matus producenter Marine Toivat you with actions primary for machine person and Anby Departments 6.000 The company 2.000 macho.. Machining Department and 6000 in the my writing to you Click the icon Bow the additional woon Read the regulament Data table Southwick Products currently uses a plantwide overhead rate based on direct labor hours to allocate overhead. However, the company is considering refining its overhead allocation system by using departmental overhead rates. The Machining Department would allocate its overhead using machine hours (MH), but the Assembly Department would allocate its overhead using direct labor (DL) hours. The following chart shows the machine hours (MH) and direct labor (DL) hours incurred by Jobs 500 and 501 in each production department: Machining Assembly Department Department Job 500 10 MH 15 DL hours 2 DL hours Job 501 20 MH 15 DL hours 2 DL hours Both Jobs 500 and 501 used $1,000 of direct materials. Wages and benefits total $30 per direct labor hour. Southwick Products prices its products at 120% of total manufacturing costs. Print Done Based on the departmental overhead rates and the sale price determined in Requirement 7. how much profit did the company really can on each b? Calculate the grous protsing the departmental rate couling system (Ute parents or a minus sign to show) Job 500 Job 501 Sale price Los: Total manufacturing costs Direct materials Direct labor Manufacturing overhead Gross profit (los) 7. Compute the total manufacturing cost and sales price of each job using the company's current plantwide overhead rate. 8. Based on the current (plantwide) allocation system, how much profit did the company think it earned on each job? Based on the departmental overhead rates and the sales price determined in Requirement 7, how much profit did it really earn on each job? 9. Compare and comment on the results you obtained in Requirements 7 and 8. Sunwick Product matus producenter Marine Toivat you with actions primary for machine person and Anby Departments 6.000 The company 2.000 macho.. Machining Department and 6000 in the my writing to you Click the icon Bow the additional woon Read the regulament Data table Southwick Products currently uses a plantwide overhead rate based on direct labor hours to allocate overhead. However, the company is considering refining its overhead allocation system by using departmental overhead rates. The Machining Department would allocate its overhead using machine hours (MH), but the Assembly Department would allocate its overhead using direct labor (DL) hours. The following chart shows the machine hours (MH) and direct labor (DL) hours incurred by Jobs 500 and 501 in each production department: Machining Assembly Department Department Job 500 10 MH 15 DL hours 2 DL hours Job 501 20 MH 15 DL hours 2 DL hours Both Jobs 500 and 501 used $1,000 of direct materials. Wages and benefits total $30 per direct labor hour. Southwick Products prices its products at 120% of total manufacturing costs. Print Done Based on the departmental overhead rates and the sale price determined in Requirement 7. how much profit did the company really can on each b? Calculate the grous protsing the departmental rate couling system (Ute parents or a minus sign to show) Job 500 Job 501 Sale price Los: Total manufacturing costs Direct materials Direct labor Manufacturing overhead Gross profit (los) 7. Compute the total manufacturing cost and sales price of each job using the company's current plantwide overhead rate. 8. Based on the current (plantwide) allocation system, how much profit did the company think it earned on each job? Based on the departmental overhead rates and the sales price determined in Requirement 7, how much profit did it really earn on each job? 9. Compare and comment on the results you obtained in Requirements 7 and 8

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started