Question

I JUST NEED ANS 3 and 4 ONLYYYY plzzz Date Ending Inventory at current year cost $ Conversion factor (current----Base) Ending Inventory at base year

I JUST NEED ANS 3 and 4 ONLYYYY plzzz

| Date | Ending Inventory at current year cost $ | Conversion factor (current----Base) | Ending Inventory at base year cost$ | Increase (Decrease) | Inventory Layers$ | Year | Conversion Factor (base and added) | InVentory layers at added year cost$ | Ending Inventory $ |

| 1/1/year2 | 240000 | 1.00/1.00 | 240000 | 240000 | Base Layer | 1 | 240000 | 240000 | |

| 12/31/year3 | 275000 | 1.00/1.10 | 250000 | 10000 | 240000 | Base Layer | 1 | 240000 | |

| 10000 | Year 2 | 1.1 | 11000 | 251000 | |||||

| 12/31/year3 | 300000 | 1.00/1.20 | 250000 | 10000 | 240000 | Base Layer | 1 | 240000 | |

| 10000 | Year2 | 1.1 | 11000 | ||||||

| 10000 | Year3 | 1.2 | 12000 | 263000 | |||||

1. What was the rate of inflation in year 2 in percentage terms? (Year 2 index / Year 1 index) 1

Ans:

| Rate of Inflation in year 2 | (1.1/1)-1=10% |

2. What was the rate of inflation in year 3?

| Rate of Inflation in year 3 | (1.2/1)-1=20% |

3. Suppose the inventory from year 1 remained unchanged in year 2 (i.e the company did not purchase nor sell any inventory in year 2), what would be the market value of the inventory by the end of year 2?

4. What was the actual market value of the inventory at the end of year 2? (simple question, from the table)

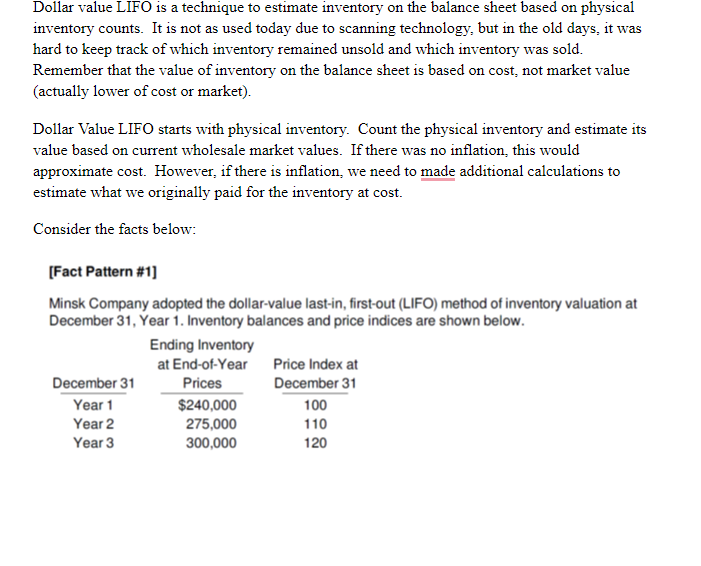

Dollar value LIFO is a technique to estimate inventory on the balance sheet based on physical inventory counts. It is not as used today due to scanning technology, but in the old days, it was hard to keep track of which inventory remained unsold and which inventory was sold. Remember that the value of inventory on the balance sheet is based on cost, not market value (actually lower of cost or market). Dollar Value LIFO starts with physical inventory. Count the physical inventory and estimate its value based on current wholesale market values. If there was no inflation, this would approximate cost. However, if there is inflation, we need to made additional calculations to estimate what we originally paid for the inventory at cost. Consider the facts below: [Fact Pattern #1] Minsk Company adopted the dollar-value last-in, first-out (LIFO) method of inventory valuation at December 31, Year 1. Inventory balances and price indices are shown below. Ending Inventory at End-of-Year Price Index at December 31 Prices December 31 Year 1 $240,000 100 Year 2 275,000 110 Year 3 300,000 120Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started