Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I just need answer of Q5. Q1 is just for your help. please answer all parts of Q5 as soon as possible $865 = My

I just need answer of Q5. Q1 is just for your help. please answer all parts of Q5 as soon as possible

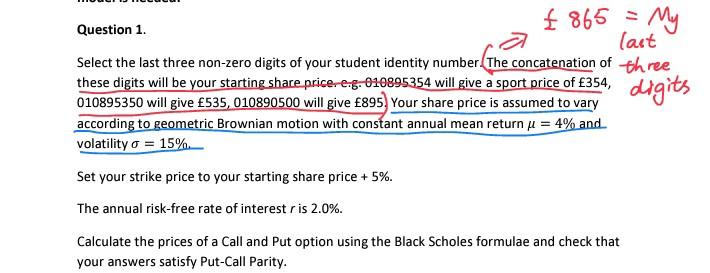

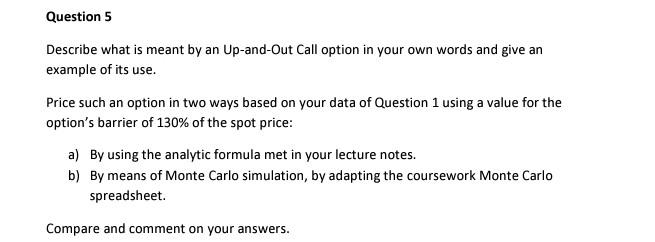

$865 = My Question 1. last Select the last three non-zero digits of your student identity number. The concatenation of three these digits will be your starting share.pricerers01:9895354 will give a sport price of 354, digits will give 895vary according to geometric Brownian motion with constant annual mean return u = 4% and volatility o = 15% Set your strike price to your starting share price + 5%. The annual risk-free rate of interest r is 2.0%. Calculate the prices of a Call and Put option using the Black Scholes formulae and check that your answers satisfy Put-Call Parity. Question 5 Describe what is meant by an Up-and-Out Call option in your own words and give an example of its use. Price such an option in two ways based on your data of Question 1 using a value for the option's barrier of 130% of the spot price: a) By using the analytic formula met in your lecture notes. b) By means of Monte Carlo simulation, by adapting the coursework Monte Carlo spreadsheet. Compare and comment on your answersStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started