i just need answers to accounts receivable turnover, days in inventory, and return on assets

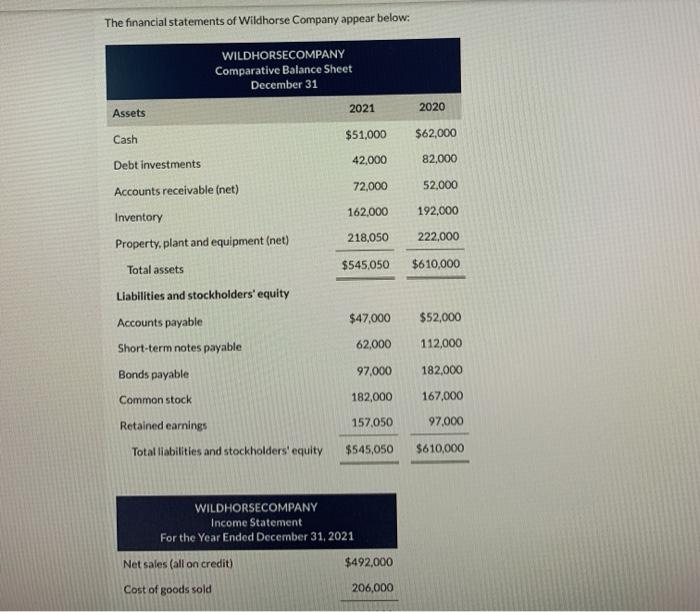

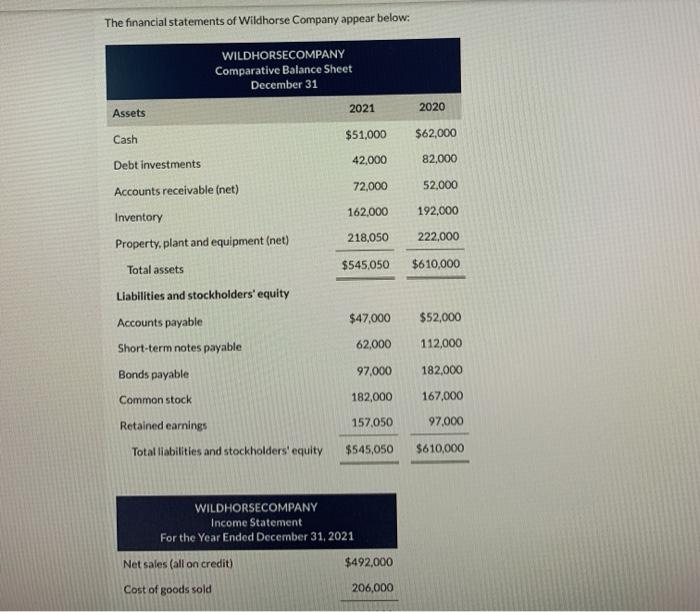

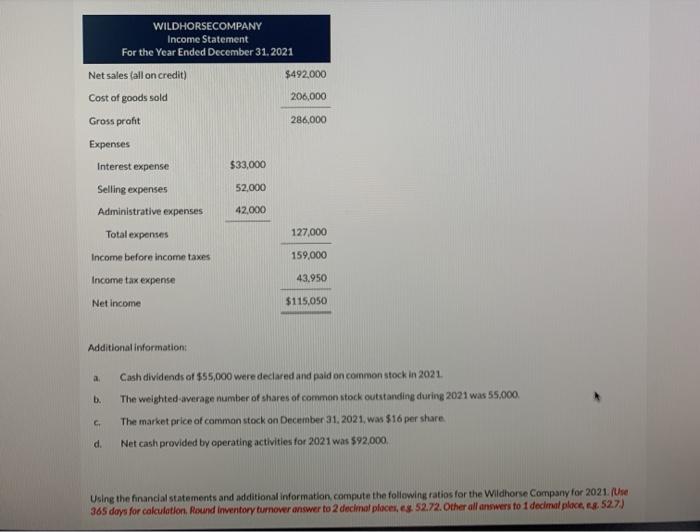

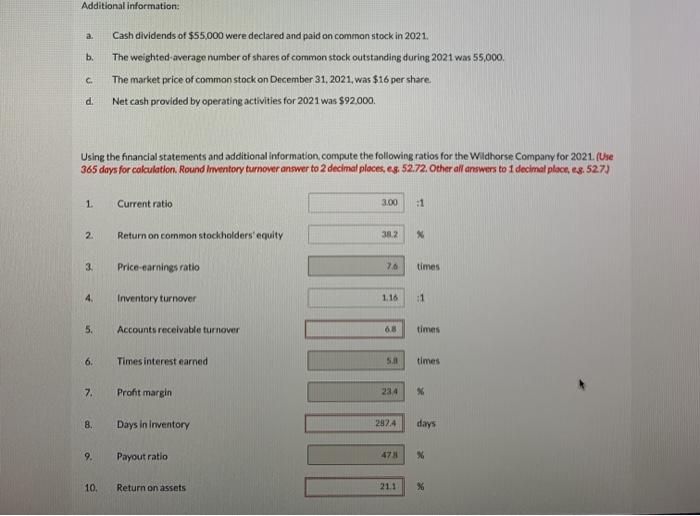

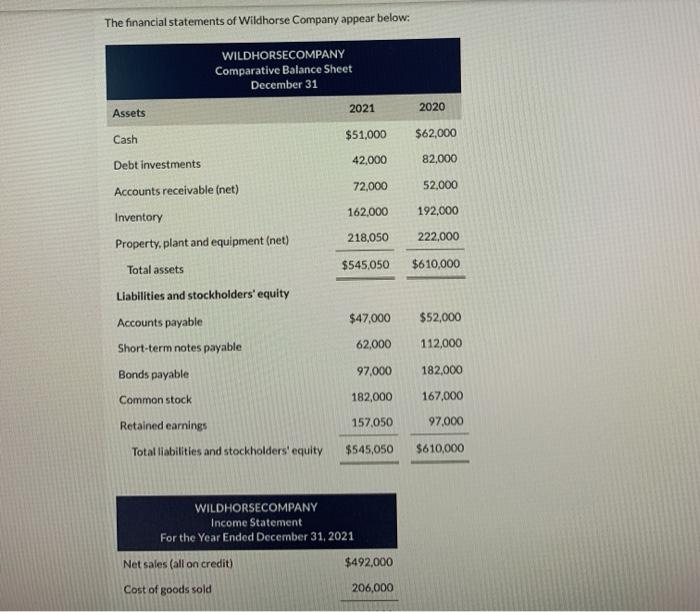

The financial statements of Wildhorse Company appear below: WILDHORSECOMPANY Comparative Balance Sheet December 31 2021 2020 Assets Cash $51,000 $62,000 42,000 82,000 Debt Investments Accounts receivable (net) 72,000 52,000 162.000 192,000 Inventory 218,050 222,000 Property, plant and equipment (net) $545,050 $610,000 Total assets Liabilities and stockholders' equity Accounts payable $47,000 $52,000 Short-term notes payable 62,000 112,000 Bonds payable 97,000 182,000 Common stock 182,000 167,000 Retained earnings 157,050 97.000 Total liabilities and stockholders' equity $545,050 $610,000 WILDHORSECOMPANY Income Statement For the Year Ended December 31, 2021 Net sales (all on credit) $492,000 Cost of goods sold 206,000 WILDHORSECOMPANY Income Statement For the Year Ended December 31, 2021 Net sales (all on credit) $492.000 Cost of goods sold 206,000 Gross profit 286,000 Expenses Interest expense $33,000 Selling expenses 52.000 Administrative expenses 42.000 Total expenses 127,000 Income before income taxes 159.000 Income tax expense 43.950 Net income $115,050 Additional information Cash dividends of $55,000 were declared and paid on common stock in 2021 b. The weighted werage number of shares of common stock outstanding during 2021 was 55.000 5 The market price of common stock on December 31, 2021, was $16 per share d. Net cash provided by operating activities for 2021 was $92,000 Using the financial statements and additional information, compute the following ratios for the Wildhorse Company for 2021. (Use 365 days for calculation. Round Inventory turnover answer to 2 decimal places, s. 52.72. Other all answers to 1 decimal place 52.7.) Additional information: a. Cash dividends of $55,000 were declared and paid on common stock in 2021. b. The weighted average number of shares of common stock outstanding during 2021 was 55.000 c. The market price of common stock on December 31, 2021, was $16 per share d Net cash provided by operating activities for 2021 was $92,000 Using the financial statements and additional information, compute the following ratios for the Wildhorse Company for 2021. (Use 365 days for calculation. Round Inventory turnover answer to 2 decimal places, eg. 52.72. Other all answers to 1 decimal place, e8.527) 1. Current ratio 3.00 :1 2 Return on common stockholders'equity 38.2 3 Price earnings ratio 7.6 times 4. Inventory turnover 1.16 11 5. Accounts receivable turnover 0.8 times 6. Times interest earned 5. times 7. Profit margin 234 X 8. Days In Inventory 2924 days 9. Payout ratio 47 % 10. Return on assets 21.1 %