I just need help with #3 & #4 thanks

Happy holidays!

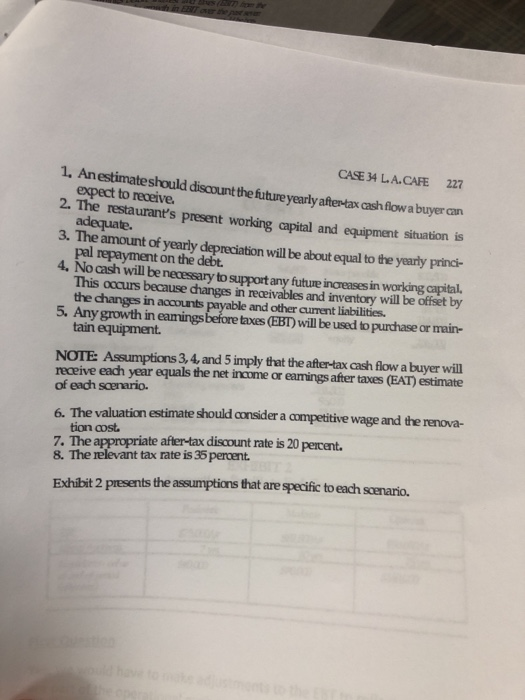

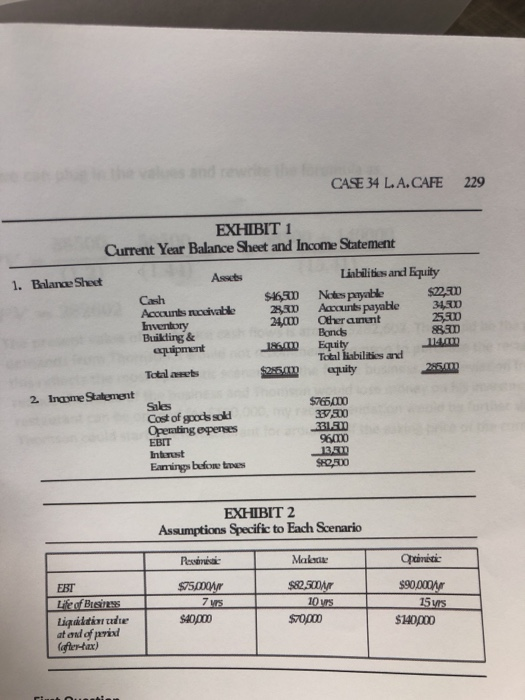

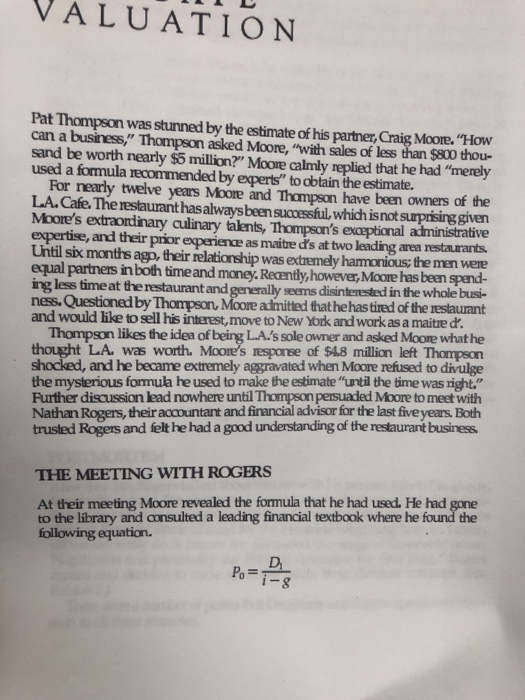

VALU ATION Pat Thompson was stunned by the estimate of his partner, Craig Moore. "How can a business," Thompson asked Moore, "with sales of less than $800 thou- sand be worth nearly $5 million?" Moore calmly replied that he had "merely used a formula recommended by experts" to obtain the estimate. For nearly twelve years Moore and Thampson have been owners of the LACafe. The restaurant has always ben sucessful which isnot surprising given Moore's extraordinary culinary talents, Thompson's exceptional administrative expertise, and their prior experience as maitre d's at two leading area restaurants Until six months agp, their relationship was extremely hamonious; the men were equal partners in both time and money. Recently,however,Moore has been spend- ing less time at the restaurant and ness. Questioned by Thompson, Moore admitted that he has tired of the restaurant and would like to sell his interest, move to New York and work as a maitre d. seems disinterested in the whole busi- Thompson likes the idea of beirg LA.'s sole owner and asked Moore what he thought LA was worth. Moore's response of $4.8 million left Thompson shocked, and he became extremely aggravated when Moore refused to divulge the mysterious formua he used to make the estimate "until the time was right." Further discussion lead nowhere until Thompson persuaded Moore to meet with Nathan Rogers, their accountant and financial advisor for the last fiveyears. Both trusted Rogers and felt he had a good understanding of the restaurant business THE MEETING WITH ROGERS At their meeting Moore revealed the formula that he had used. He had to the library and consulted a leading financial textbook where he found the following equation. D was the company's eamings before interest and taves (EBIT) from the cument year ($96,000), g was the yearly gowth in EBIT over the past seven years, 10 percent; and i was the rate at which he thought maney would be bor- rowed, 12 percent. Thompson was quick to point out that the restaurant busi- ness is highly competitive and nisky; therefore it is unlikely past growth rates can be maintained. As evidence he cited the 4 percent per year growth of the last two years, which is far below the yearly increases during the previous five years Thompson also asked Moore if he considered the $40,000 after-tax cost of remodelirg, or hat most area nstaurants last about 15 to 20 years before out of business and that he would have to assume the outstanding debt of the restaurant. Moore admitted he wasn't sure "the formula has considered all this" and then dryly mentioned that he might insist on dividing the restau- rant's liquid assets Rogers also pointed out that both of them have been taking minimum salaries out of the gong That is, they have been taking about 525,000 each in salaries (a total of $50,000),. But experienced restaurant manage- rial help would be 50 percent more than this Rogers then attempted to calm an obviously emotional out as tactfully as possible that he is confident the restaurant is worth "some- what less"than what Moore estimates. "One rule of thumb," Rogers continued that is sometimes used by business brokers in pricing restaurants is fair mar- ket value for assets plus 20 percent for a goodwill factor, less the amount of interest-bearing debt."He quickly pointed out, however, that any rule of is at best only an approximation It cant't be expected to apply to a wide range of situations, each involving diffenent conditions and circumstances."In other words," he summed up, "the restaurant could be worth more or less than this." Finally, he emphasized that there is no magic number of value that "we are searching for, It is best to think of a range of values; that is, the business is worth between A and B...I see my job as trying to namow that range as much as pos- sible." After further discussion, Moore and Thompson agneed that more analy- sis is called for and asked Rogers for a detailed report. and soften Moore's firm position by pointing POSTMORTEM After they left, Rogers talked about the case with his partner, Edwin Daugherty for nearly an hour. Daugherty said it was a good idea for Rogens to have men- tioned that there is no magic number for the value of the business. "This gets them in the right frame of mind for the inevitable bargaining later on. I mean, all we can really do is narrow the discussion to a range of reasonable values Negotiation and agreed and Exhibit 2.) tomale estimates urder three different soraris. There were a number of points that Daugherty and Rogers agneed were com- mon to all three scenarios. CASE 34 L.A.CAFE 227 1. An estimateshould discount the future yearly aftertax cash flow a buyer can expect to receive. 2. The restaurant's present working capital and equipment situation is adequate. 3. The amount of yearly depreciation will be about equal to the yearly princi- pal repayment on the debt. 4. No cash will be necessary to support any future increases in working capital. This occurs because dhanges in receivables and inventory will be offset by the changes in accounts 5. Any growth in eamingsbefore taxes (EBT) will be used to purchase or main- and other current liabilities. tain equipment NOTE: Assumptions 3,4, and 5 imply that the after-tax cash flow a buyer will receive eadh year equals the net income or eanings after taxes (EAT) estimate of each scenario. 6. The valuation estimate should consider a competitive wage and the renova- tion cost. 7. The appropriate after-tax discount rate is 20 percent. 8. The relevant tax rate is 35 percent. Exhibit 2 presents the assumptions that are specific to each soenario. CASE 34 LA.CAFE 229 EXHIBIT1 Current Year Balance Sheet and Income Statement 1. Balance Sheet Assets Liabilitios and Equity $4650 Notes payable 24000 Otheramunt Acccunts ncivable2830 Accunts payable 340 Buikting & aquipment Total arcts 2:5aquity 2 Ingome Statement Cost of gpods sol Openting eperses 337,500 13.30 EXHIBIT 2 Assumptions Specific to Each Scenario Cpimistic $90000M Br $40000 140000 at and of parix fer-tax) VALU ATION Pat Thompson was stunned by the estimate of his partner, Craig Moore. "How can a business," Thompson asked Moore, "with sales of less than $800 thou- sand be worth nearly $5 million?" Moore calmly replied that he had "merely used a formula recommended by experts" to obtain the estimate. For nearly twelve years Moore and Thampson have been owners of the LACafe. The restaurant has always ben sucessful which isnot surprising given Moore's extraordinary culinary talents, Thompson's exceptional administrative expertise, and their prior experience as maitre d's at two leading area restaurants Until six months agp, their relationship was extremely hamonious; the men were equal partners in both time and money. Recently,however,Moore has been spend- ing less time at the restaurant and ness. Questioned by Thompson, Moore admitted that he has tired of the restaurant and would like to sell his interest, move to New York and work as a maitre d. seems disinterested in the whole busi- Thompson likes the idea of beirg LA.'s sole owner and asked Moore what he thought LA was worth. Moore's response of $4.8 million left Thompson shocked, and he became extremely aggravated when Moore refused to divulge the mysterious formua he used to make the estimate "until the time was right." Further discussion lead nowhere until Thompson persuaded Moore to meet with Nathan Rogers, their accountant and financial advisor for the last fiveyears. Both trusted Rogers and felt he had a good understanding of the restaurant business THE MEETING WITH ROGERS At their meeting Moore revealed the formula that he had used. He had to the library and consulted a leading financial textbook where he found the following equation. D was the company's eamings before interest and taves (EBIT) from the cument year ($96,000), g was the yearly gowth in EBIT over the past seven years, 10 percent; and i was the rate at which he thought maney would be bor- rowed, 12 percent. Thompson was quick to point out that the restaurant busi- ness is highly competitive and nisky; therefore it is unlikely past growth rates can be maintained. As evidence he cited the 4 percent per year growth of the last two years, which is far below the yearly increases during the previous five years Thompson also asked Moore if he considered the $40,000 after-tax cost of remodelirg, or hat most area nstaurants last about 15 to 20 years before out of business and that he would have to assume the outstanding debt of the restaurant. Moore admitted he wasn't sure "the formula has considered all this" and then dryly mentioned that he might insist on dividing the restau- rant's liquid assets Rogers also pointed out that both of them have been taking minimum salaries out of the gong That is, they have been taking about 525,000 each in salaries (a total of $50,000),. But experienced restaurant manage- rial help would be 50 percent more than this Rogers then attempted to calm an obviously emotional out as tactfully as possible that he is confident the restaurant is worth "some- what less"than what Moore estimates. "One rule of thumb," Rogers continued that is sometimes used by business brokers in pricing restaurants is fair mar- ket value for assets plus 20 percent for a goodwill factor, less the amount of interest-bearing debt."He quickly pointed out, however, that any rule of is at best only an approximation It cant't be expected to apply to a wide range of situations, each involving diffenent conditions and circumstances."In other words," he summed up, "the restaurant could be worth more or less than this." Finally, he emphasized that there is no magic number of value that "we are searching for, It is best to think of a range of values; that is, the business is worth between A and B...I see my job as trying to namow that range as much as pos- sible." After further discussion, Moore and Thompson agneed that more analy- sis is called for and asked Rogers for a detailed report. and soften Moore's firm position by pointing POSTMORTEM After they left, Rogers talked about the case with his partner, Edwin Daugherty for nearly an hour. Daugherty said it was a good idea for Rogens to have men- tioned that there is no magic number for the value of the business. "This gets them in the right frame of mind for the inevitable bargaining later on. I mean, all we can really do is narrow the discussion to a range of reasonable values Negotiation and agreed and Exhibit 2.) tomale estimates urder three different soraris. There were a number of points that Daugherty and Rogers agneed were com- mon to all three scenarios. CASE 34 L.A.CAFE 227 1. An estimateshould discount the future yearly aftertax cash flow a buyer can expect to receive. 2. The restaurant's present working capital and equipment situation is adequate. 3. The amount of yearly depreciation will be about equal to the yearly princi- pal repayment on the debt. 4. No cash will be necessary to support any future increases in working capital. This occurs because dhanges in receivables and inventory will be offset by the changes in accounts 5. Any growth in eamingsbefore taxes (EBT) will be used to purchase or main- and other current liabilities. tain equipment NOTE: Assumptions 3,4, and 5 imply that the after-tax cash flow a buyer will receive eadh year equals the net income or eanings after taxes (EAT) estimate of each scenario. 6. The valuation estimate should consider a competitive wage and the renova- tion cost. 7. The appropriate after-tax discount rate is 20 percent. 8. The relevant tax rate is 35 percent. Exhibit 2 presents the assumptions that are specific to each soenario. CASE 34 LA.CAFE 229 EXHIBIT1 Current Year Balance Sheet and Income Statement 1. Balance Sheet Assets Liabilitios and Equity $4650 Notes payable 24000 Otheramunt Acccunts ncivable2830 Accunts payable 340 Buikting & aquipment Total arcts 2:5aquity 2 Ingome Statement Cost of gpods sol Openting eperses 337,500 13.30 EXHIBIT 2 Assumptions Specific to Each Scenario Cpimistic $90000M Br $40000 140000 at and of parix fer-tax)