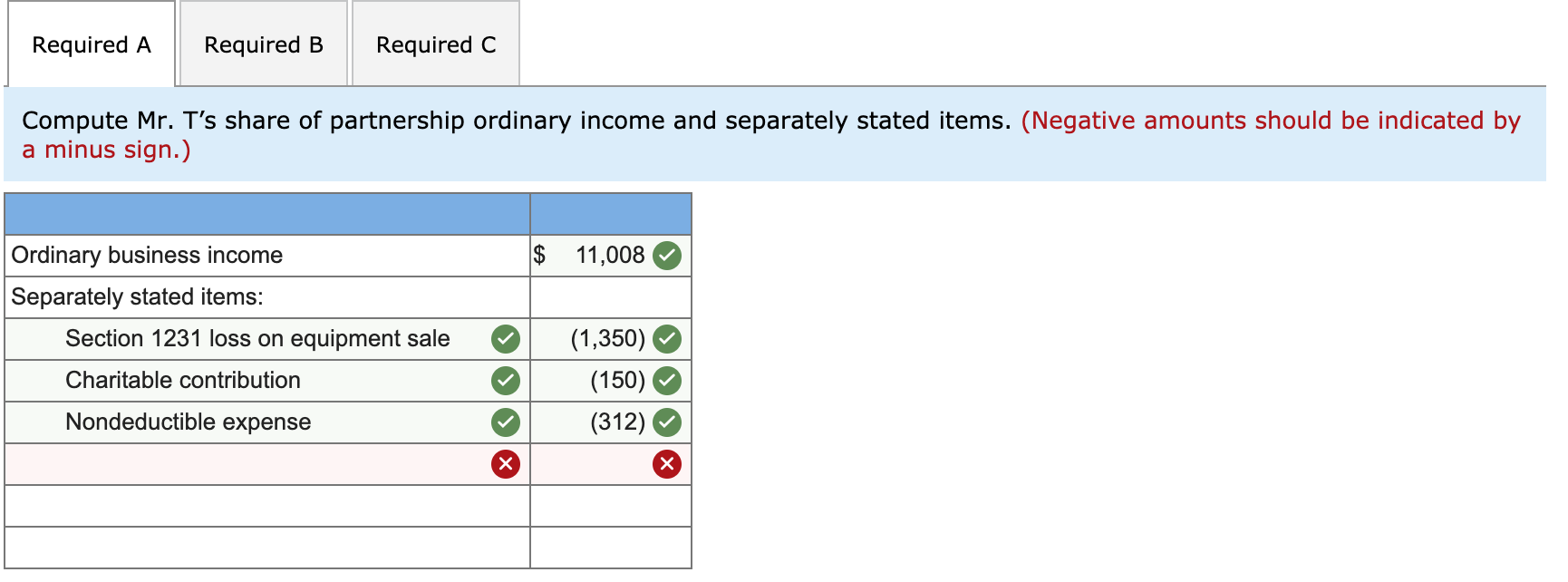

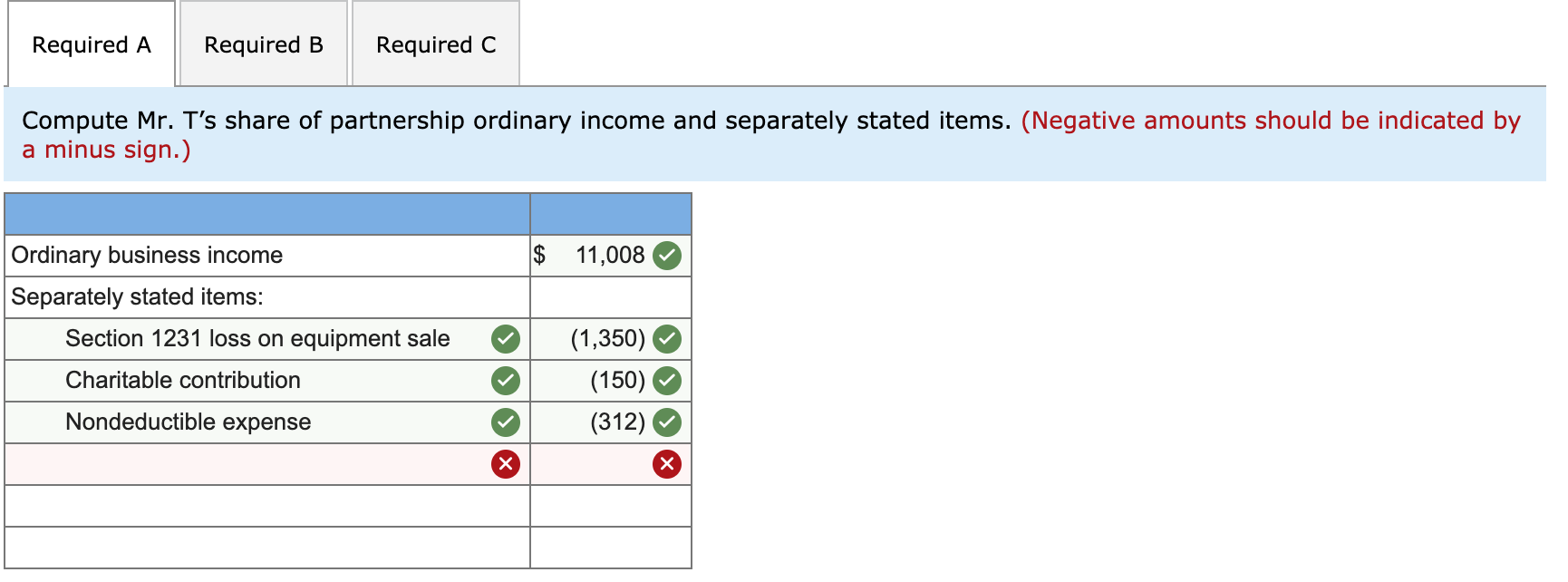

I just need help with A. - I dont know why it is wrong

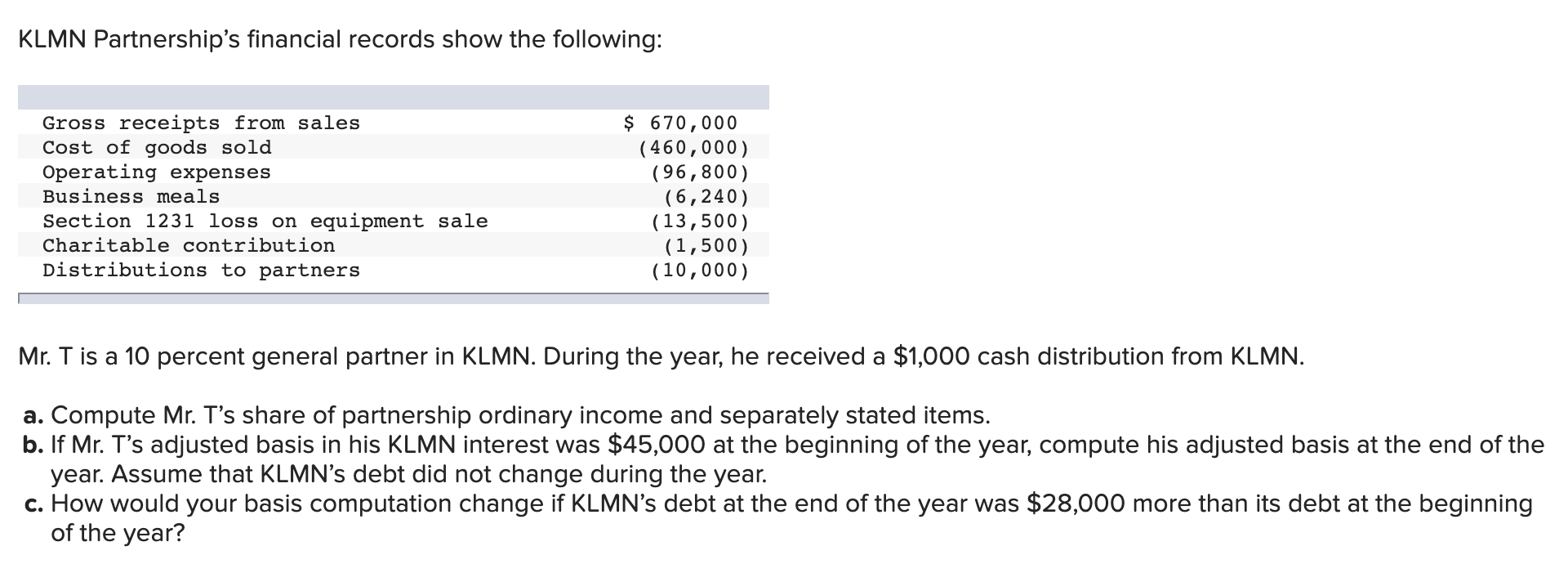

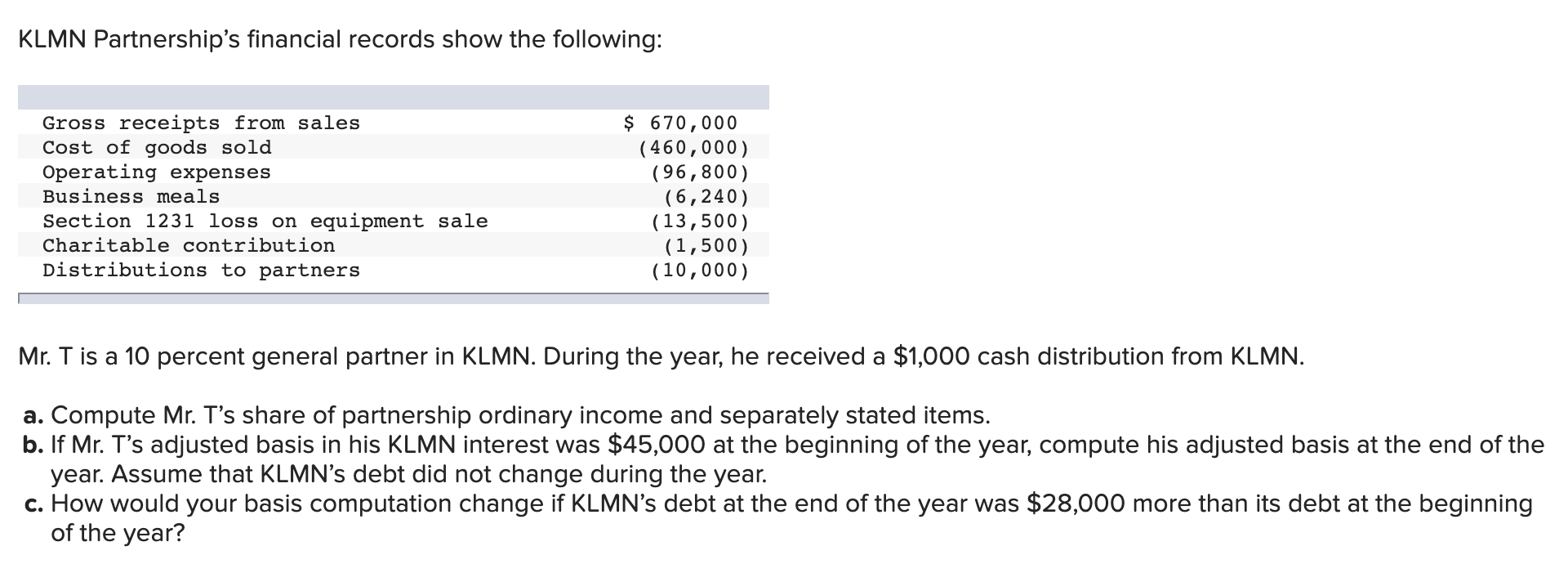

Required A Required B Required C Compute Mr. T's share of partnership ordinary income and separately stated items. (Negative amounts should be indicated by a minus sign.) 11,008 Ordinary business income Separately stated items: Section 1231 loss on equipment sale Charitable contribution (1,350) (150) (312) Nondeductible expense KLMN Partnerships financial records show the following: Gross receipts from sales Cost of goods sold Operating expenses Business meals Section 1231 loss on equipment sale Charitable contribution Distributions to partners $ 670,000 (460,000) (96,800) (6,240) (13,500) (1,500) (10,000) Mr. T is a 10 percent general partner in KLMN. During the year, he received a $1,000 cash distribution from KLMN. a. Compute Mr. T's share of partnership ordinary income and separately stated items. b. If Mr. T's adjusted basis in his KLMN interest was $45,000 at the beginning of the year, compute his adjusted basis at the end of the year. Assume that KLMN's debt did not change during the year. c. How would your basis computation change if KLMN's debt at the end of the year was $28,000 more than its debt at the beginning of the year? Required A Required B Required C Compute Mr. T's share of partnership ordinary income and separately stated items. (Negative amounts should be indicated by a minus sign.) 11,008 Ordinary business income Separately stated items: Section 1231 loss on equipment sale Charitable contribution (1,350) (150) (312) Nondeductible expense KLMN Partnerships financial records show the following: Gross receipts from sales Cost of goods sold Operating expenses Business meals Section 1231 loss on equipment sale Charitable contribution Distributions to partners $ 670,000 (460,000) (96,800) (6,240) (13,500) (1,500) (10,000) Mr. T is a 10 percent general partner in KLMN. During the year, he received a $1,000 cash distribution from KLMN. a. Compute Mr. T's share of partnership ordinary income and separately stated items. b. If Mr. T's adjusted basis in his KLMN interest was $45,000 at the beginning of the year, compute his adjusted basis at the end of the year. Assume that KLMN's debt did not change during the year. c. How would your basis computation change if KLMN's debt at the end of the year was $28,000 more than its debt at the beginning of the year