Answered step by step

Verified Expert Solution

Question

1 Approved Answer

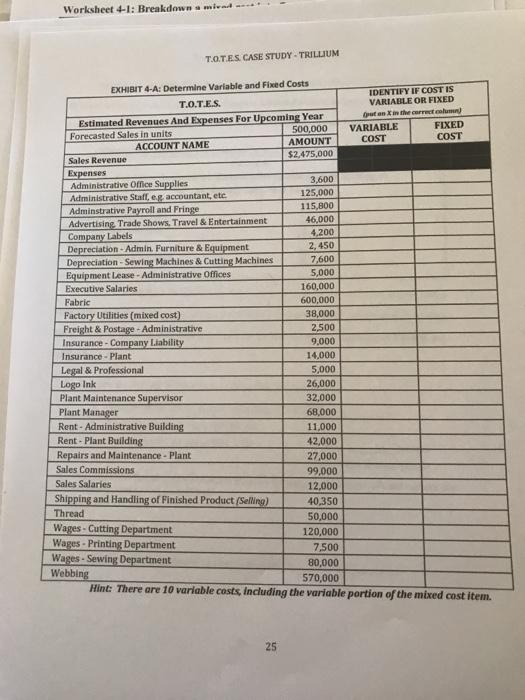

i just need help with exhibit 4-A the cost the exhibit 4-A just need a x to show it its a variable or fixed cost.

i just need help with exhibit 4-A

the cost the exhibit 4-A just need a x to show it its a variable or fixed cost. At the bottom it give a hint that there is 10 variable cost including the mixed cost

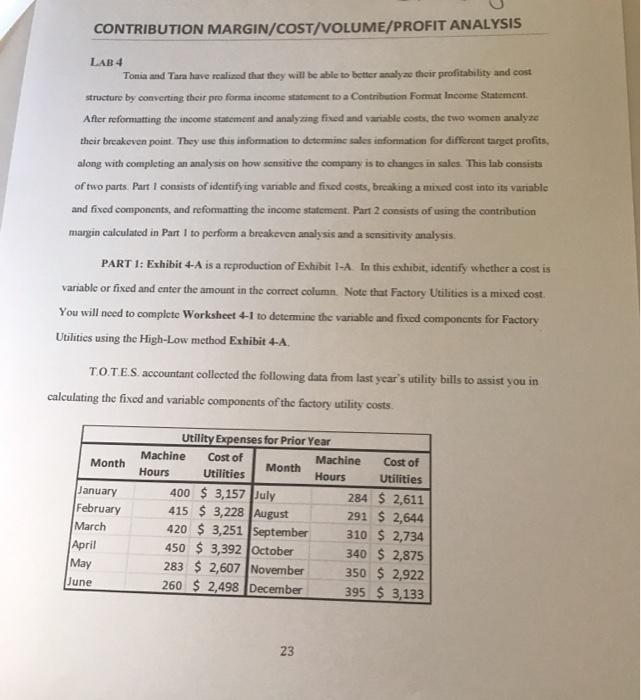

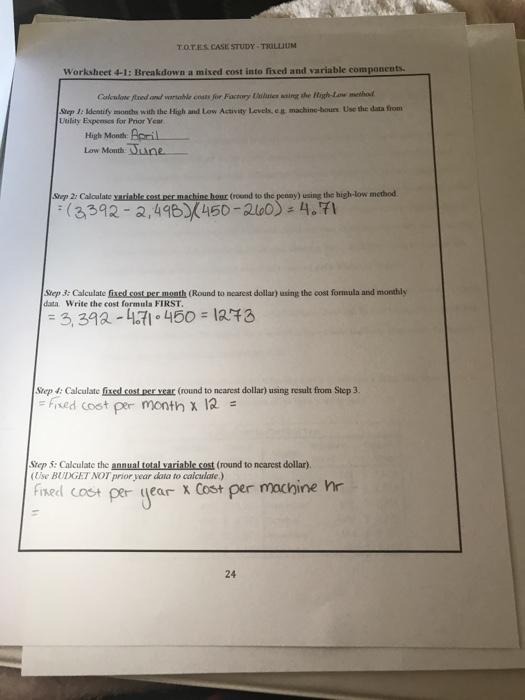

CONTRIBUTION MARGIN/COST/VOLUME/PROFIT ANALYSIS LAB 4 Tonia and Tara huve realized that they will be able to better analyze their profitability and cost structure by converting their pro forma income statement to a Contribution Format Income Statement After reformatting the income statement and analyzing fired and variable costs, the two women analyze theit breakeven point. They use this information to determinc sales information for different target profits, along with completing an analysis on how sensitive the company is to changes in sales. This lab consists of two parts. Part I consists of identifying variable and fixed costs, breaking a mixed cost into its variable and fixed components, and reformatting the income statement. Part 2 consists of using the contribution margin calculated in Part I to perform a breakeven analysis and a sensitivity analysis. PART 1: Exhibit 4-A is a reproduction of Exhibit 1-4. In this exhibit, identify whether a cost is variable or fixed and enter the amount in the correct column. Note that Factory Utilities is a mixed cost You will need to complete Worksheet 4-1 to determine the variable and fixed components for Factory Utilities using the High-Low method Exhibit 4-A. TOT.E.S. accountant collected the following data from last year's utility bills to assist you in calculating the fixed and variable components of the factory utility costs Month January February March April May June Utility Expenses for Prior Year Machine Cost of Machine Cost of Month Hours Utilities Hours Utilities 400 $ 3,157 July 284 $ 2,611 415 $ 3,228 August 291 $ 2,644 420 $ 3,251 September 310 $ 2,734 450 $ 3,392 October 340 $ 2,875 283 $ 2,607 November 350 $ 2,922 260 $ 2,498 December 395 $ 3,133 23 TOTIES CASE STUDY-TRILLIUM Worksheet 4-1: Breakdown a mixed cost inte fixed and variable components. Collowed and writes for Factory Les are the High-low the Step 1: Identify month with the High and low Activity levelse machine-bou Use the data from Utility Expenses for Prior Yea High Month Acril Low Month June Step 2Calculate yariable.cost per machine hour (roond to the peony) using the high-low method (3392-2,498.3(450-260) - 4.71 Step 3: Calculate fixed cost per month (Round to nearest dollar) using the cost formula and monthly data Write the cost formula FIRST. = 3,392-4.71.450 = 1273 Step 4: Calculate fixed cost per vear (round to nearest dollar) using result from Step 3. = Fred cost per month x 12 = Step 5: Calculate the annual total variable cost (round to nearest dollar), (Use BUDGET NOT prior pear data to calculate) x Cost per machine hr Fixed cost per year 24 Worksheet 4-1: Breakdown a miwa --- T.O.T.ES CASE STUDY-TRILLIUM EXHIBIT 4-A: Determine Variable and Fixed Costs IDENTIFY IF COST IS T.O.T.E.S. VARIABLE OR FIXED Grutan in the correo Estimated Revenues And Expenses For Upcoming Year 500,000 VARIABLE FIXED Forecasted Sales in units COST COST AMOUNT ACCOUNT NAME Sales Revenue $2.475,000 Expenses Administrative Office Supplies 3,600 Administrative Staff, eg accountant, etc. 125,000 Adminstrative Payroll and Fringe 115,800 Advertising Trade Shows. Travel & Entertainment 46,000 Company Labels 4,200 Depreciation - Admin Furniture & Equipment 2,450 Depreciation - Sewing Machines & Cutting Machines 7,600 Equipment Lease - Administrative Offices 5,000 Executive Salaries 160,000 Fabric 600,000 Factory Utilities (mixed cost) 38,000 Freight & Postage - Administrative 2,500 Insurance - Company Liability 9,000 Insurance - Plant 14.000 Legal & Professional 5,000 Logo Ink 26,000 Plant Maintenance Supervisor 32,000 Plant Manager 68,000 Rent - Administrative Building 11,000 Rent - Plant Building 42,000 Repairs and Maintenance - Plant 27,000 Sales Commissions 99,000 Sales Salaries 12.000 Shipping and Handling of Finished Product/Selling) 40,350 Thread 50,000 Wages. Cutting Department 120,000 Wages - Printing Department 7,500 Wages - Sewing Department 80,000 Webbing 570,000 Hint: There are 10 variable costs, including the variable portion of the mixed cost item. 25 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started