Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I just need help with Part 1.b and Part 2.a &.b please & thank you! Assume that you write a column for a very widely

I just need help with Part 1.b and Part 2.a &.b please & thank you!

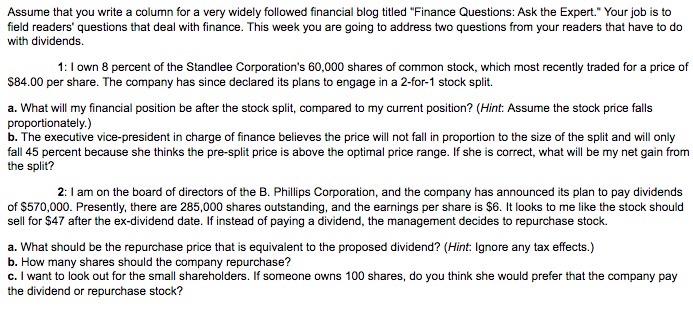

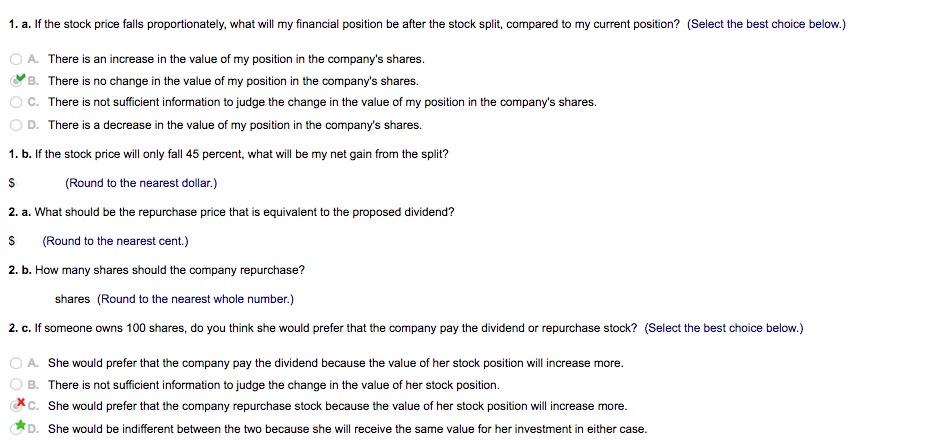

Assume that you write a column for a very widely followed financial blog titled "Finance Questions: Ask the Expert." Your job is to field readers' questions that deal with finance. This week you are going to address two questions from your readers that have to do with dividends. 1:1 own 8 percent of the Standlee Corporation's 60,000 shares of common stock, which most recently traded for a price of $84.00 per share. The company has since declared its plans to engage in a 2-for-1 stock split. a. What will my financial position be after the stock split, compared to my current position? (Hint: Assume the stock price falls proportionately.) b. The executive vice-president in charge of finance believes the price will not fall in proportion to the size of the split and will only fall 45 percent because she thinks the pre-split price is above the optimal price range. If she is correct, what will be my net gain from the split? 2:1 am on the board of directors of the B. Phillips Corporation, and the company has announced its plan to pay dividends of $570,000. Presently, there are 285,000 shares outstanding, and the earnings per share is $6. It looks to me like the stock should sell for $47 after the ex-dividend date. If instead of paying a dividend, the management decides to repurchase stock. a. What should be the repurchase price that is equivalent to the proposed dividend? (Hint: Ignore any tax effects.) b. How many shares should the company repurchase? c. I want to look out for the small shareholders. If someone owns 100 shares, do you think she would prefer that the company pay the dividend or repurchase stock? 1. a. If the stock price fails proportionately, what will my financial position be after the stock split, compared to my current position? (Select the best choice below.) $ A. There is an increase in the value of my position in the company's shares. B. There is no change in the value of my position in the company's shares. C. There is not sufficient information to judge the change in the value of my position in the company's shares. D. There is a decrease in the value of my position in the company's shares. 1. b. If the stock price will only fall 45 percent, what will be my net gain from the split? (Round to the nearest dollar.) 2. a. What should be the repurchase price that is equivalent to the proposed dividend? (Round to the nearest cent.) 2. b. How many shares should the company repurchase? shares (Round to the nearest whole number.) 2. c. If someone owns 100 shares, do you think she would prefer that the company pay the dividend or repurchase stock? (Select the best choice below.) S She would prefer that the company pay the dividend because the value of her stock position will increase more. B. There is not sufficient information to judge the change in the value of her stock position. C. She would prefer that the company repurchase stock because the value of her stock position will increase more. *. She would be indifferent between the two because she will receive the same value for her investment in either caseStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started