i just need help with requirement 5

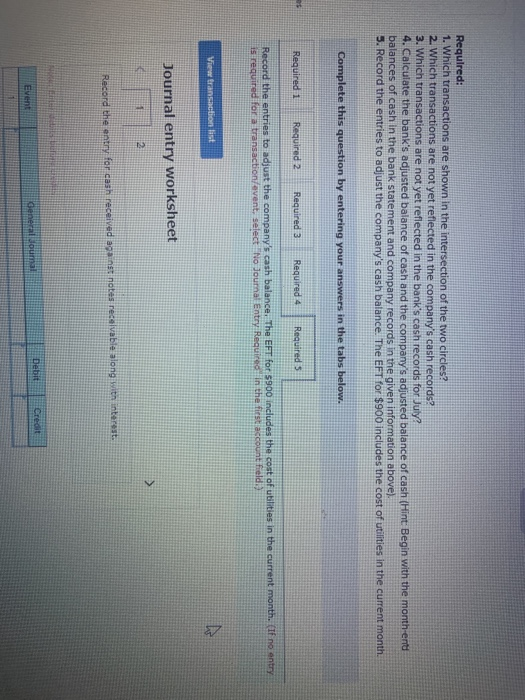

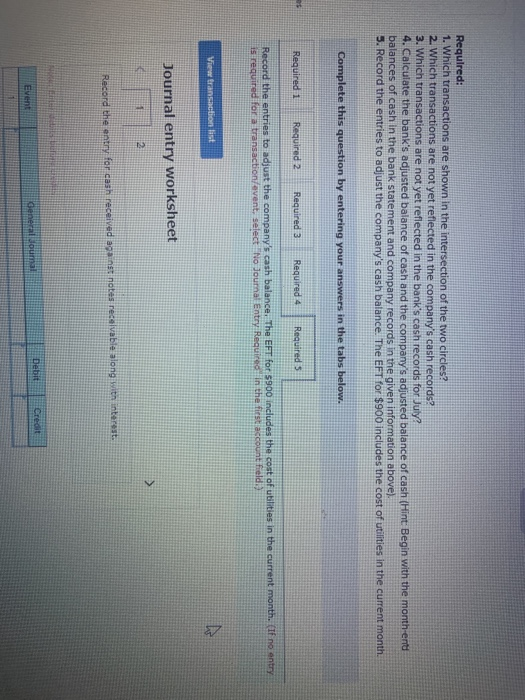

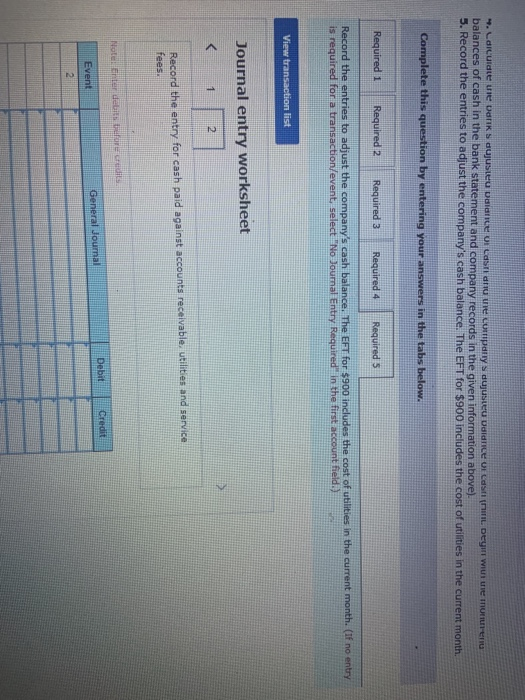

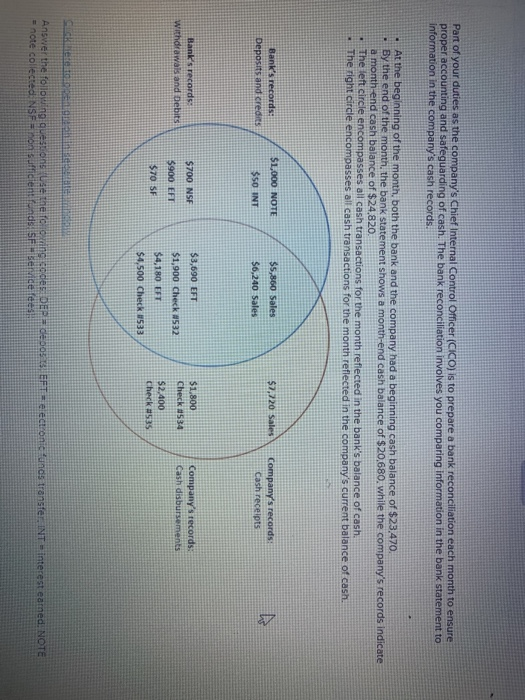

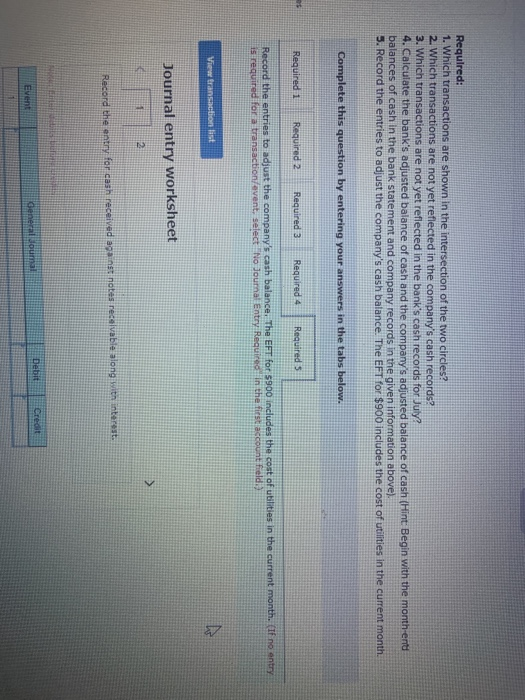

Required: 1. Which transactions are shown in the intersection of the two circles? 2. Which transactions are not yet reflected in the company's cash records? 3. Which transactions are not yet reflected in the bank's cash records for July? 4. Calculate the bank's adjusted balance of cash and the company's adjusted balance of cash (Hint: Begin with the month-ent balances of cash in the bank statement and company records in the given information above). 5. Record the entries to adjust the company's cash balance. The EFT for $900 includes the cost of utilities in the current month. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Required Record the entries to adjust the company's cash balance. The EFT for $900 includes the cost of utilities in the current month. (If no entry is required for a transaction/event, select No Journal Entry Required in the first account field.) View transaction list Journal entry worksheet > 2 Record the entry for cash received against notes receivable along with interest. Debit Credit Event General Boumal . Lai uidte uie batik s djusteu Date of Lasti anume corripanys dujusieu Udince of Cast Dey Weinen balances of cash in the bank statement and company records in the given information above). 5. Record the entries to adjust the company's cash balance. The EFT for $900 includes the cost of utilities in the current month. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Required 5 Record the entries to adjust the company's cash balance. The EFT for $900 includes the cost of utilities in the current month. (If no entry is required for a transaction/event select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet 1 2 Record the entry for cash paid against accounts receivable, utilities and service fees Notenter de credits Debit Credit Event General Journal 2 Oscar's Red Carpet Store maintains a checking account with Academy Bank. Oscar's sells carpet each day but makes bank deposits only once per week. The following provides information from the company's cash ledger for the month ending February 28, 2021. bate Deposits : Date 2/4 2/11 2/18 2725 2/26-2/28 Amount $ 1,800 Checks: 1,400 2,300 3,200 780 $ 9,400 NO 321 322 323 324 2/2 278 2712 Amount $3,800 650 1,6ee 1,300 450 2/19 Cash receipts: 325 2722 326 2728 958 327 2728 1.ee $9.750 Balance on February 1 Receipts Disbursements Balance on February 28 $ 5,900 9,48 (9,750) $ 5,550 Information from February's bank statement and company reisords reveals the following additional Information: a. The ending cash balance recorded in the bank statement is $8.160. b. Cash receipts of $700 from 2 26-2128 are outstanding c. Checks 325 and 327 are outstanding, d. The deposit on 2/11 Includes a customer's check for $450 that did not clear the bank NSF check) e. Check 323 was written for $2.500 for advertising in February. The bank properly recorded the check for this amount An automatic withdrawa for Oscars Februarytent was made on February 4 for $1.200. g. Oscar's checking account earns Interest based on the average dally balance. The amount of interest earned for February is $110 hIn January one of Oscar's suppliers. Titanic Fores, borrowed $4.200 from Oscar on February 24. Titanic paid $4400 ($4 200 borrowed amount plus S200 interest are ty to Academy Bank in payment for January's borrowing Academy Bank charged service fees of stoo to Oscar's for the month Part of your duties as the company's Chief Internal Control Officer (CICO) is to prepare a bank reconciliation each month to ensure proper accounting and safeguarding of cash. The bank reconciliation involves you comparing information in the bank statement to information in the company's cash records. At the beginning of the month, both the bank and the company had a beginning cash balance of $23,470. . By the end of the month, the bank statement shows a month-end cash balance of $20,680, while the company's records indicate a month-end cash balance of $24,820 The left circle encompasses all cash transactions for the month reflected in the bank's balance of cash. The right circle encompasses all cash transactions for the month reflected in the company's current balance of cash. $1,000 NOTE $7,720 Sales Bank's records: Deposits and credits $5,860 Sales $6,240 Sales Company's records $50 INT cash receipts $700 NSF Bank's records withdrawals and Debits $3,690 EFT $1,900 Check 532 $4,180 EFT $1,800 Check 0534 Company's records Cash disbursements $900 EFT $70 SF $2.400 Check 535 $4,500 Check 533 GRAD Answer the following questions use the following codes DEP de 005 EFT-electronic funds transfer INT - interest earned: NOTE = note collected NSF on sufficiented SFBende fees