Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I just need help with the ones that are wrong. Thank you Koontz Company manufactures to models of Industrial components Basic model and an Advanced

I just need help with the ones that are wrong. Thank you

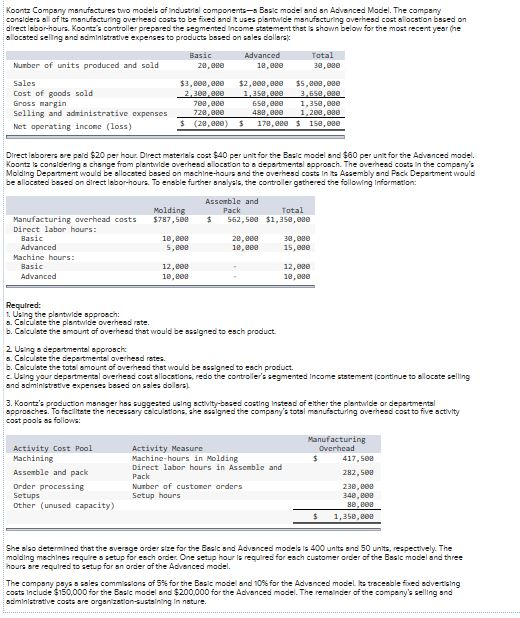

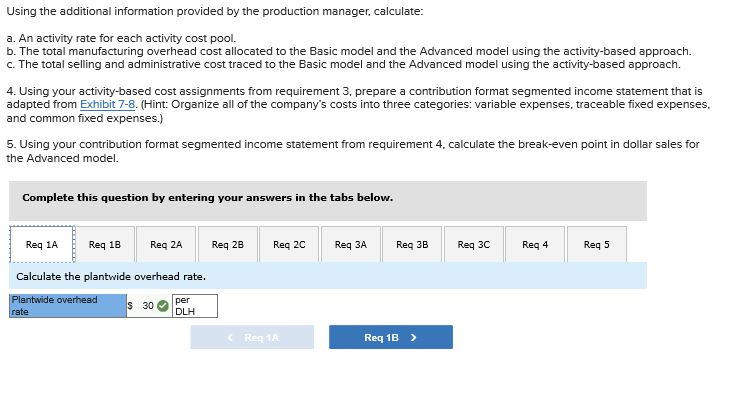

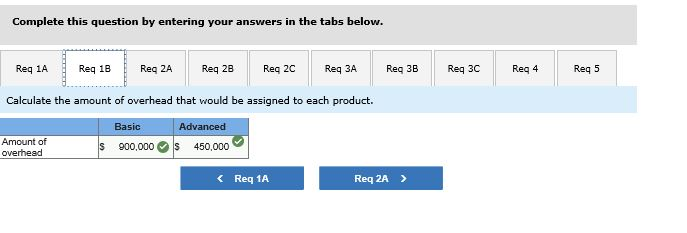

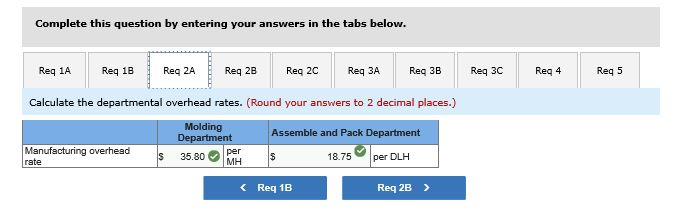

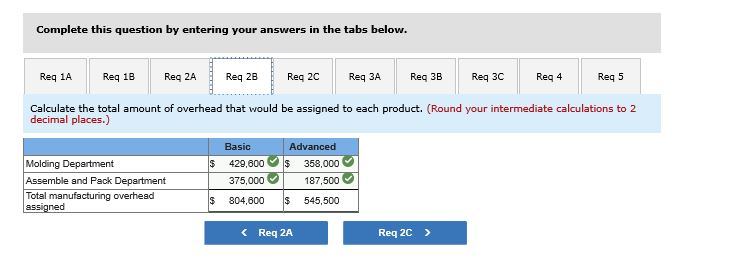

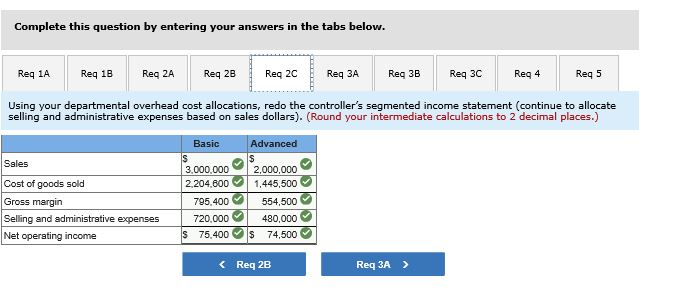

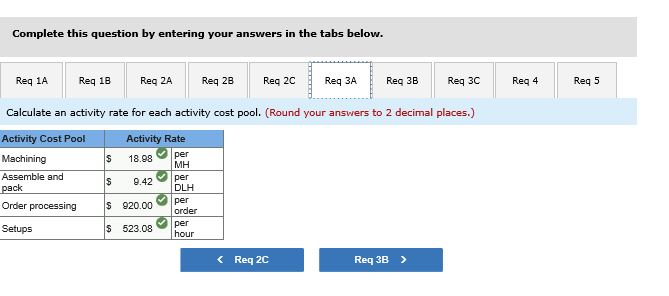

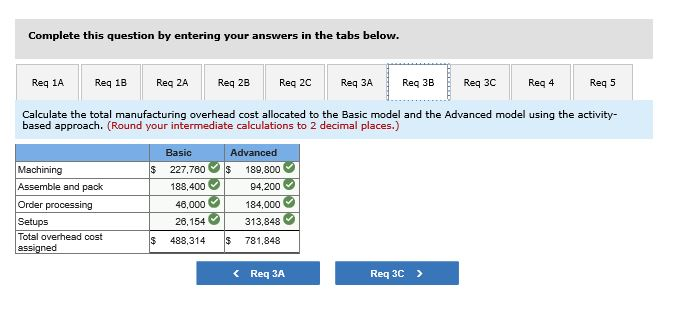

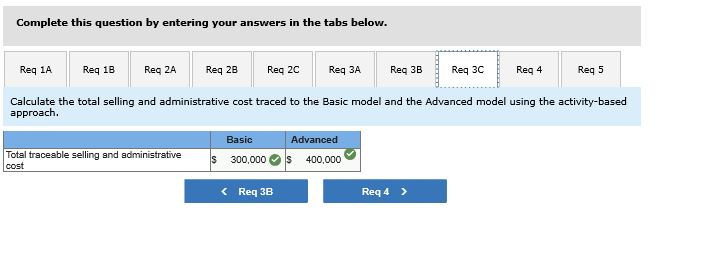

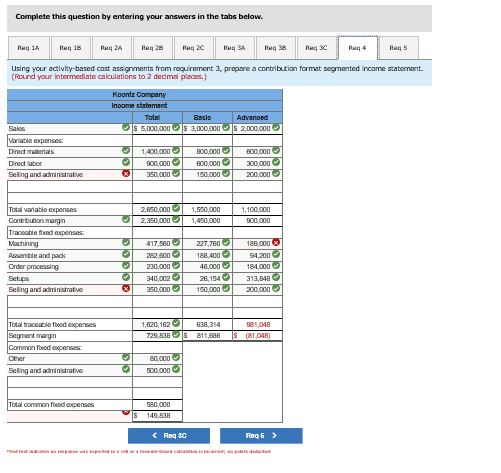

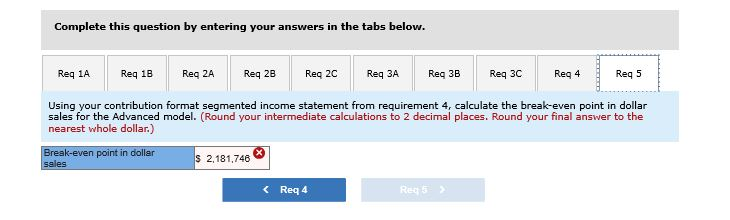

Koontz Company manufactures to models of Industrial components Basic model and an Advanced Model. The company considers al f oncturing overhead costs to be fixed and uses pide manufacturing overhead cost loston based on directe s . Koos controler prepared the segmented income statement the shown below for the most recent year the located selling and s t rative expenses to products based on es do Basic 20.00 Advanced 18. Bee Number of units produced and sold Total 38. Bee $3,eee, eee 2.382.ee Sales Cost of goods sold Gross margin Selling and administrative expenses Net operating income (loss) $2.000.000 $5.eeeeee 1.358, Bee 3.65e,ese 3,00 1.350.oe 488, Bee 1.200, e $ 170, se $ 150, e $ 28, e) Direct laborers are paid $20 per hour Direct materials cost $40 per or the Best model and $60 per un for the Advanced model Koont is considering a change from planuvide overhead allocation to departmental approch. The overhead coats in the company's Molding Department would be allocated based on machine-hours and the overhead costs in Assembly and Pack Department would be allocated besed on direct laborehours. To enable further analysis, the controler gathered the following information: Molding $787,500 Assemble and Pack Total $ 562, see $1.358,00 Manufacturing overhead costs Direct labor hours: 10.ee 5.B 20.ee 10,000 30, e 15,000 Machine hours: 12, eee 10, Bea 12, ege 10,000 Advanced Required: 1 Using the plantwide approach: a. Calculate the plantwice overhead rate, b. Calculate the amount of overhead that would be assigned to esch product 2. Using a departmental approach 6. Calculate the departmental overhead rates b. Calculate the total amount of overhead that would be assigned to each product. Using your departmental overhead cost allocations, redo the controler's segmented income statement continue to allocate selling and administrative expenses based on sales de las 3. Koontz's production manager hos suggested using activity-based costing Instead of either the plantwide or departmental approaches. To facilitate the necessary calculations, the assigned the company's totalmenufacturing overhead cost to five activity cost pools as follows: Activity Measure Machine-hours in Molding Direct labor hours in Assemble and Activity Cost Pool Machining Assemble and pack Order processing Setups Other (unused capacity) Manufacturing Overhead 417. see 282, see 230,00 340,00 Pack Number of customer orders Setup hours $ 1.350. She se determined that the average ordersize for the Basic and Advanced models 400 and 50 respectively. The molding chines require a setup for each order Onest hours required for each customer order of the Best model and three hours are required to setup for an order of the Advanced model C The company pas common of 5% for the Basic model and for the Advanced models trebleed veg inde $150.000 for the Basic model and $200.000 for the Advanced model. The remainder of the companys seng and r tive core organizationsteining in mature a Using the additional information provided by the production manager, calculate: a. An activity rate for each activity cost pool. b. The total manufacturing overhead cost allocated to the Basic model and the Advanced model using the activity-based approach. c. The total selling and administrative cost traced to the Basic model and the Advanced model using the activity-based approach. 4. Using your activity-based cost assignments from requirement 3, prepare a contribution format segmented income statement that is adapted from Exhibit 7-8. (Hint: Organize all of the company's costs into three categories: variable expenses, traceable fixed expenses. and common fixed expenses.) 5. Using your contribution format segmented income statement from requirement 4. calculate the break-even point in dollar sales for the Advanced model. Complete this question by entering your answers in the tabs below. Req IA Req 18 Reg 2A Reg ze Reg 2C Reg 3A Reg 38 Reg 3C Reg 4 Req5 Calculate the plantwide overhead rate. Plantwide overheads 30 PM rate Regia Req 1B > Complete this question by entering your answers in the tabs below. | Req 14 Req 18 Reg 2A Req2B Req 2c Req 3A Req3B Req3c Reg4 Reg 5 Calculate the amount of overhead that would be assigned to each product. Amount of overhead Basic 900,000 Advanced $450,000 $ Complete this question by entering your answers in the tabs below. Reg 1A Reg 1B Reg 2A Req 2B Reg 20 Req 3A Reg 3B Reg 30 Reg 4 Req 5 Calculate the departmental overhead rates. (Round your answers to 2 decimal places.) Molding Department 35.80 per Manufacturing overhead Assemble and Pack Department $ 18.75 per DLH s rate Complete this question by entering your answers in the tabs below. Req 1A Reg 1B Reg 1B Reg 2A Reg za Req 2B Req 28 Req 2C Reg 2C Req 3A Reg BA Reg 3B Reg ae Reg 3C Reg 3C Reg 4 Rega Reg 5 Req5 Calculate the total amount of overhead that would be assigned to each product. (Round your intermediate calculations to 2 decimal places.) $ Molding Department Assemble and Pack Department Total manufacturing overhead assigned Basic 429,600 375,000 804,600 Advanced $ 358,000 187,500 $ 545,500 $ Complete this question by entering your answers in the tabs below. Reg 1A Reg 1B Req 2A Req 2B - Req 2c Req 3A Reg 3B Req 36 Req3c Reg4 Reg 5 Using your departmental overhead cost allocations, redo the controller's segmented income statement continue to allocate selling and administrative expenses based on sales dollars). (Round your intermediate calculations to 2 decimal places.) Basic Advanced Sales Cost of goods sold Gross margin Selling and administrative expenses Net operating income 3.000.000 2,204.600 795.400 720.000 $ 75,400 2,000,000 1,445,500 554,500 480,000 $ 74,500 Complete this question by entering your answers in the tabs below. Reg 1A Req 18 Reg 2A Req ZA Req 2B Req 28 Req 20 Reg 2C Req 3A Reg BA Req 3B Reg 38 Req 30 Req3c Reg 4 Rega Req 5 Reg 5 Calculate an activity rate for each activity cost pool. (Round your answers to 2 decimal places.) $ Activity Cost Pool Machining Assemble and pack Order processing $ Activity Rate 18.98 per 9.42 per DLH 920.00 per order per s Setups $ 523.08 hour Reg 2C Reg 33 ) Complete this question by entering your answers in the tabs below. Req 1A Reg 1B Reg 2A Reg 2B Reg 20 Req 3A Req 3B Req 30 Reg 4 Reg 5 Calculate the total manufacturing overhead cost allocated to the Basic model and the Advanced model using the activity- based approach. (Round your intermediate calculations to 2 decimal places.) $ Machining Assemble and pack Order processing Setups Total overhead cost assigned Basic 227,760 188,400 48,000 28,154 488,314 Advanced $ 189,800 94,200 184,000 313,848 $ 781,848 $ Complete this question by entering your answers in the tabs below. Req IA ReqI8 REGZA REQ 2B ReqzC Req3A Req3B Reque Reg4 Req5 Calculate the total selling and administrative cost traced to the Basic model and the Advanced model using the activity-based approach. Total traceable selling and administrative cost $ Basic 300,000 Advanced $ 400,000 Complete this question by entering your answers in the tabs below. HA 18 R2 R28 2C 34 using your activity-based costassionments from requirement 3 prepare a contribution format segmented income statement (round your intermediate cautions to 2 decimal places Hoonte Company Inactment Tot US 5,000000 B acio 3,000,000S Advanced 2.000.000 ex Direct of 12000OOOO OO800.000 200.000 200.000 200.000 150.000 200.000 seling and administrative 2,050,000 2,350,000 1,550,000 1,450,000 1,100,000 900,000 Total variable expenses Canirbution margin Trebi dexpenses Machining An andpark Onder processing 417. 230.000 30000 .000 227.700 18 400 46.000 26.154 150.000 189.000 94.200 184.000 13.48 200.000 3 Being and administrative 0 1,100,182 720 B 38,314 81.826 381,048 (104) IS S Total traceable experts Segment margin Commandexpenses Cher Seling and t rave Totalmeno permes S 149 838 RAC Race > Complete this question by entering your answers in the tabs below. Req 1A Reg 1B Req 2A Req 2B Req 2c Req 3A Reg 3B Req 3C Reg 4 Reg 5 Using your contribution format segmented income statement from requirement 4, calculate the break-even point in dollar sales for the Advanced model. (Round your intermediate calculations to 2 decimal places. Round your final answer to the nearest whole dollar.) Break-even point in dollar 2,181,748 sales & Reg4 Reg 5Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started