Answered step by step

Verified Expert Solution

Question

1 Approved Answer

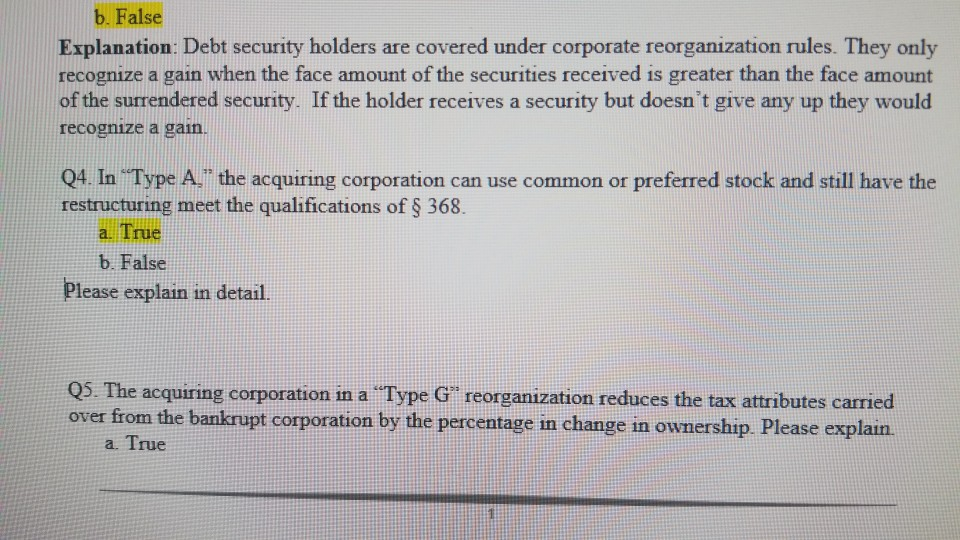

I just need question 4. I couldn't find an answer in my book so I went looking online. I think its true but dont know.

I just need question 4. I couldn't find an answer in my book so I went looking online. I think its true but dont know. Can someone confirm it's true and give me an explanation? Thanks in advance!

b. False Explanation: Debt security holders are covered under corporate reorganization rules. They only recognize a gain when the face amount of the securities received is greater than the face amount of the surrendered security. If the holder receives a security but doesn't give any up they would recognize a gain. Q4. In "Type A, the acquiring corporation can use common or preferred stock and still have the restructuring meet the qualifications of 368. a. True b. False Please explain in detail. Q5. The acquiring corporation in a "Type G reorganization reduces the tax attributes carried over from the bankrupt corporation by the percentage in change in ownership. Please explain a. TrueStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started