i just need the adjusting entries ill rate you high!

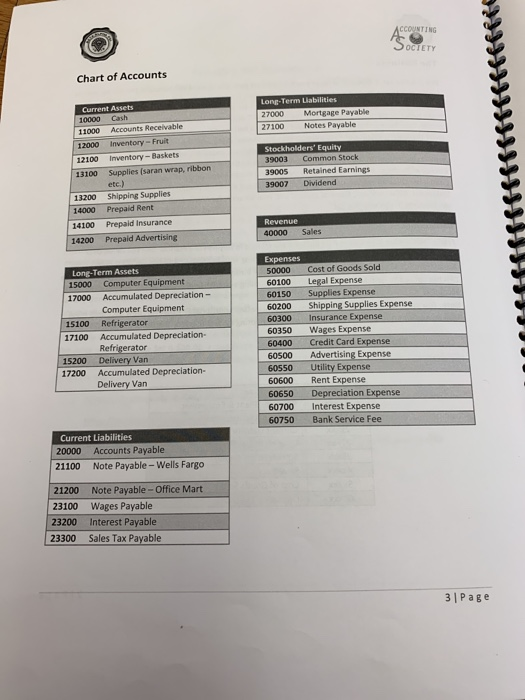

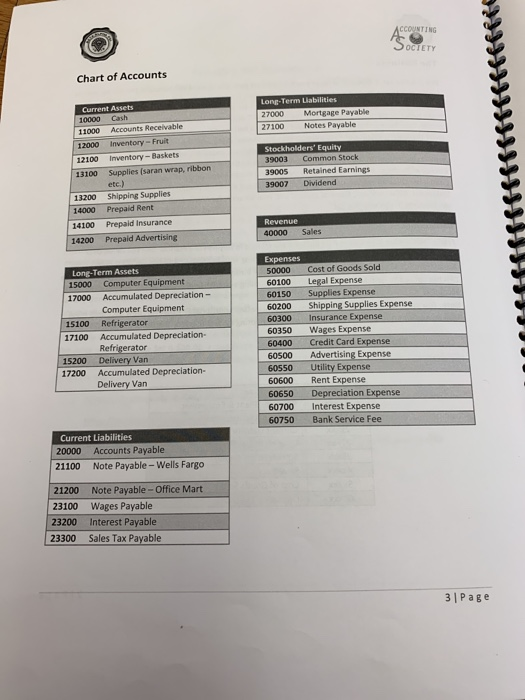

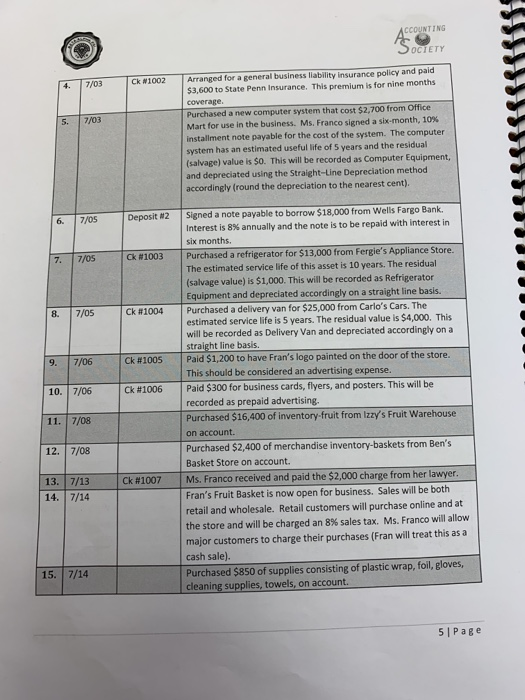

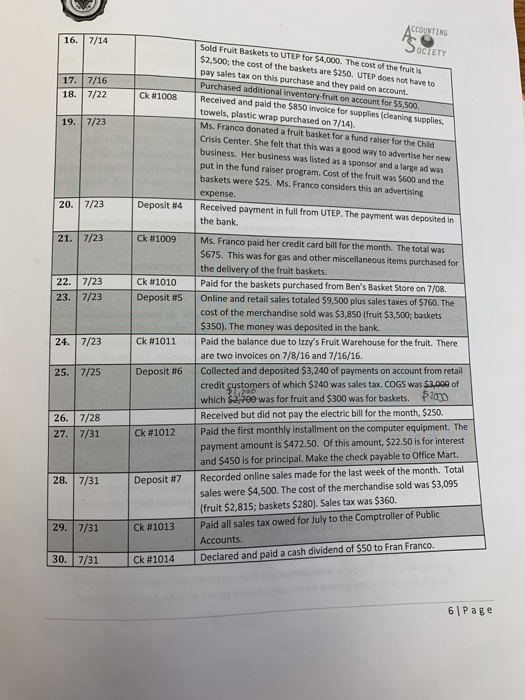

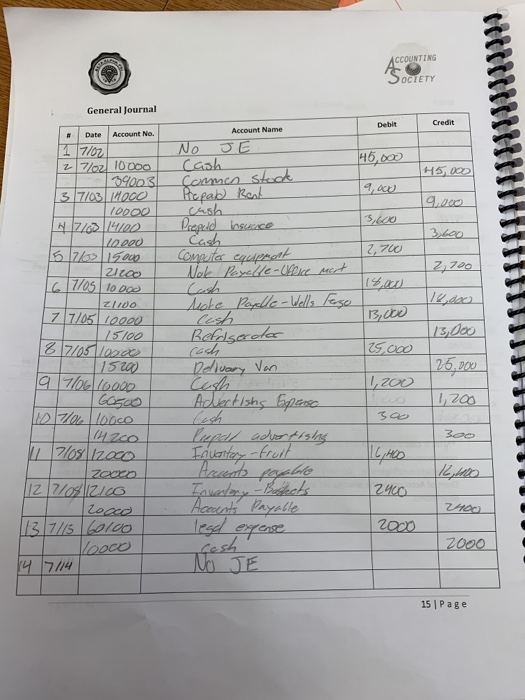

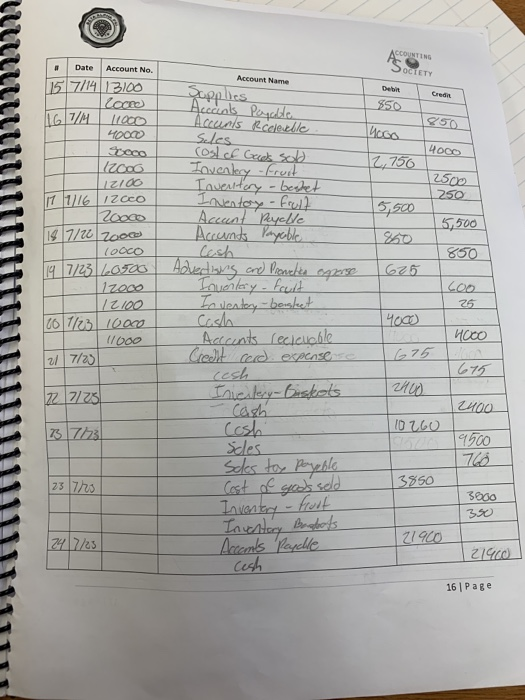

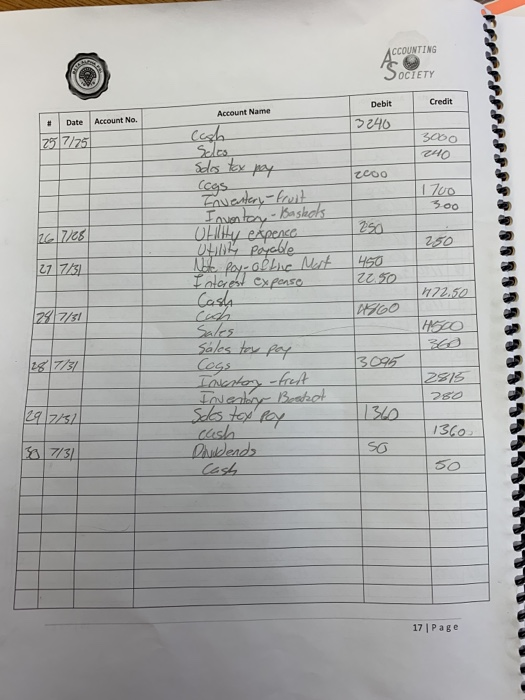

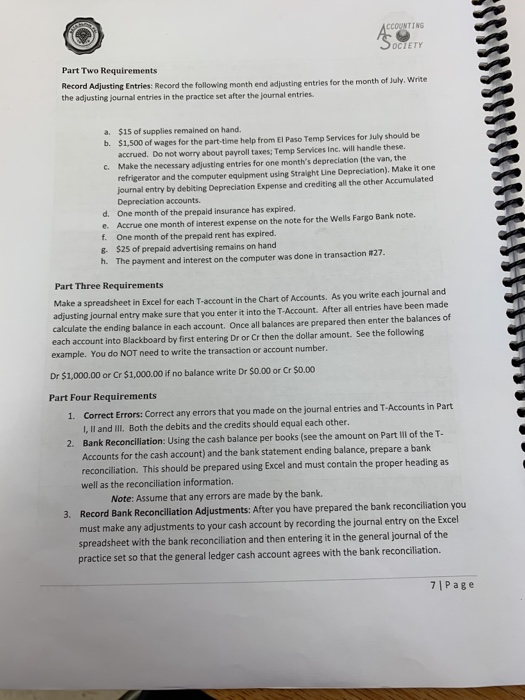

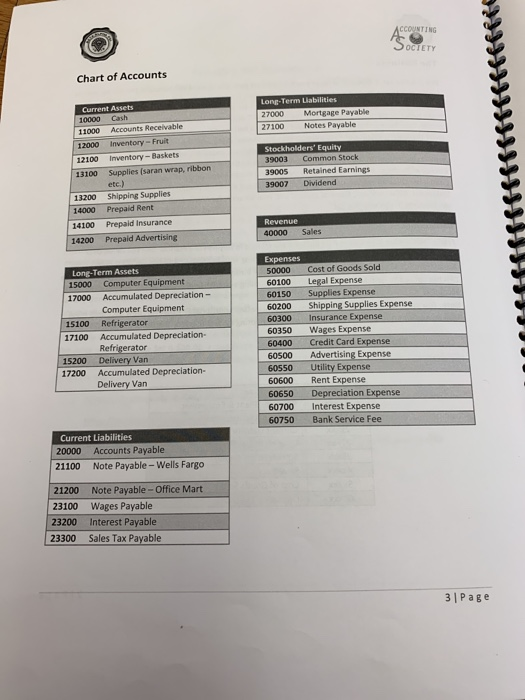

ACCOUNTING SOCIETY Chart of Accounts Long-Term Liabilities 27000 Mortgage Payable 27100 Notes Payable Current Assets 10000 Cash 11000 Accounts Receivable 12000 inventory-Fruit 12100 Inventory - Baskets 13100 Supplies (saran wrap, ribbon etc.) 13200 Shipping Supplies 14000 Prepaid Rent 14100 Prepaid Insurance 14200 Prepaid Advertising Stockholders' Equity 39003 Common Stock 39005 Retained Earnings 39007 Dividend Revenue 40000 Sales Long-Term Assets 15000 Computer Equipment 17000 Accumulated Depreciation - Computer Equipment 15100 Refrigerator 17100 Accumulated Depreciation- Refrigerator 15200 Delivery Van 17200 Accumulated Depreciation- Delivery Van Expenses 50000 60100 60150 60200 60300 60350 60400 60500 60550 60600 60650 60700 60750 Cost of Goods Sold Legal Expense Supplies Expense Shipping Supplies Expense Insurance Expense Wages Expense Credit Card Expense Advertising Expense Utility Expense Rent Expense Depreciation Expense Interest Expense Bank Service Fee Current Liabilities 20000 Accounts Payable 21100 Note Payable - Wells Fargo 21200 23100 23200 23300 Note Payable-Office Mart Wages Payable Interest Payable Sales Tax Payable 3 Page HO SOCIETY 7/03 Ck 1002 5. 7/03 Arranged for a general business liability Insurance policy and paid $3,600 to State Penn Insurance. This premium is for nine months coverage. Purchased a new computer system that cost $2,700 from Office Mart for use in the business. Ms. Franco signed a six-month, 10% installment note payable for the cost of the system. The computer system has an estimated useful life of 5 years and the residual (salvage) value is $0. This will be recorded as Computer Equipment, and depreciated using the Straight-Line Depreciation method accordingly (round the depreciation to the nearest cent). 17/05 Deposit #2 7. 7/05 ck #1003 8. 7/05 Ck #1004 9. 7/06 Ck #1005 10.7/06 Ck 1006 Signed a note payable to borrow $18,000 from Wells Fargo Bank. Interest is 8% annually and the note is to be repaid with interest in six months. Purchased a refrigerator for $13,000 from Fergie's Appliance Store. The estimated service life of this asset is 10 years. The residual (salvage value) is $1,000. This will be recorded as Refrigerator Equipment and depreciated accordingly on a straight line basis. Purchased a delivery van for $25,000 from Carlo's Cars. The estimated service life is 5 years. The residual value is $4,000. This will be recorded as Delivery Van and depreciated accordingly on a straight line basis. Paid $1,200 to have Fran's logo painted on the door of the store. This should be considered an advertising expense. Paid $300 for business cards, flyers, and posters. This will be recorded as prepaid advertising Purchased $16,400 of inventory fruit from Izzy's Fruit Warehouse on account. Purchased $2,400 of merchandise inventory-baskets from Ben's Basket Store on account. Ms. Franco received and paid the $2,000 charge from her lawyer. Fran's Fruit Basket is now open for business. Sales will be both retail and wholesale. Retail customers will purchase online and at the store and will be charged an 8% sales tax. Ms. Franco will allow major customers to charge their purchases (Fran will treat this as a cash sale). Purchased $850 of supplies consisting of plastic wrap, foil, gloves, cleaning supplies, towels, on account. 11. 7/08 12.7/08 Ck #1007 13. 7/13 14. 7/14 15. 7/14 5 Page 16. 7/14 17. 7/16 18. 7/22 Ck #1008 ACCOUNTING Sold Fruit Baskets to UTEP for $4,000. The cost of the fruit is SOCIETY $2,500; the cost of the baskets are $250. UTEP does not have to pay sales tax on this purchase and they paid on account. Purchased additional inventory fruit on account for $5,500 Received and paid the $850 invoice for supplies (cleaning supplies, towels, plastic wrap purchased on 7/14). Ms. Franco donated a fruit basket for a fundraiser for the Child Crisis Center. She felt that this was a good way to advertise her new business. Her business was listed as a sponsor and a large ad was put in the fundraiser program. Cost of the fruit was $600 and the baskets were $25. Ms. Franco considers this an advertising 19. 7/23 20. 7/23 Deposit #4 21. 7/23 Ck #1009 Ck #1010 22. 7/23 23. 7/23 Deposit #5 24. 7/23 Ck #1011 25. 7/25 Deposit #6 expense. Received payment in full from UTEP. The payment was deposited in the bank. Ms. Franco paid her credit card bill for the month. The total was $675. This was for gas and other miscellaneous items purchased for the delivery of the fruit baskets Paid for the baskets purchased from Ben's Basket Store on 7/08. Online and retail sales totaled $9,500 plus sales taxes of $760. The cost of the merchandise sold was $3,850 (fruit $3,500, baskets $350). The money was deposited in the bank. Paid the balance due to Izzy's Fruit Warehouse for the fruit. There are two invoices on 7/8/16 and 7/16/16. Collected and deposited $3,240 of payments on account from retail credit customers of which $240 was sales tax, COGS was $3,000 of which $2,700 was for fruit and $300 was for baskets. Promo Received but did not pay the electric bill for the month, $250. Paid the first monthly installment on the computer equipment. The payment amount is $472.50. Of this amount, $22.50 is for interest and $450 is for principal. Make the check payable to Office Mart. Recorded online sales made for the last week of the month. Total sales were $4,500. The cost of the merchandise sold was $3,095 (fruit $2,815; baskets $280). Sales tax was $360. Paid all sales tax owed for July to the Comptroller of Public Accounts. Declared and paid a cash dividend of $50 to Fran Franco 26. 7/28 27. 7/31 Ck #1012 28. 7/31 Deposit #7 29.7/31 Ck #1013 30. 7/31 ck 1014 6 | Page ACCOUNTING SOCTETY General Journal Debit Credit H5.000 45,000 Account Name NO JE Cash formes stood Mepal Rest cash Presedd bounce 9 3,00 2,700 Date Account No. 1 7702 z oz 10 000 09003 3 7703 Moco 10000 17/03 14100 110.000 15 17olisous Ulico 1617/05 | 10 000 21100 7 7/05 10000 75 100 18 17/05/1000 115200 976 10000 Comuita entisett Nole Payelle-cheve mert |B,00 Make Paple-Wells Fargo cesh Befalseroter Caddy Delivery Van Die 25.000 26.100 11,200 Advertishs Speec I 200 110 70 locco 300 114200 | 16 MOD W 2108 1zoco Zeoco iz zlosizico |zocco 13 7/1560100 Vooco 14 17/14 Kiepe adrotisla Inventory-fruit Inventory - Bestecks Accents Payable lesd expense NO JE ZA 2000 cesh Z02 15 Page ACCOUNTING "SOCIETY Account Name gorras Ecoles Debit Credit Uca 14000 # Date Account No. 15 7/1413100 Iloco IG T/M 11000 4000 Seco fico L12100 IT 1/16 12cco 20000 14 7/10 200 (OOCO 197/23 60500 12000 12100 10 1/3 10000 11 000 7/251 12,750. 12500 250 ,500 opplies Accoints Payable Accuels Raleille Seles cost cf Gees sod Invertery-Fruit Inventory - besket Inventory - frull 5 - Accunt Reyelle Accounts Payable Cash Advertising and Promelies exerse Inventory. Fruit to ventory-basket Cr. Accounts rectenoble Creant card. expense 5,500 850 1625 400 25 4000 nooo 675 z 7/25 - Invertery-Gaskets 2400 Cash ID 260 23 722 T 111III L 23 770 3850 Cosh scles scles toy payable C ost of gods seld Inventory - troit Inventory Bardots Accounts Paycle 21900 247/25 121900 cesh 161 Page ACCOUNTING A SOCIETY Credit . Date Account No. 257/75. Account Name ccah Debit 3240 3.00 Soos by pat (cgs Enventery-fruit Inventor - Baskets OHHy expence Utility poyable Not Pays Glue Mert Interght expense Cash 12617/28 reprrrrrrF888::88888989995 250 250 277/31 450 Z250 172.50 1247/31 4860 HO Sales tey pey Investor-frest Inventory Bostot Soles tax pay cash Doudends 17 Page ACCOUNTING OCTETY Part Two Requirements Record Adjusting Entries: Record the following month end adjusting entries for the month of July. Write the adjusting journal entries in the practice set after the journal entries. a. $15 of supplies remained on hand. b. $1,500 of wages for the part-time help from El Paso Temp Services for July should be accrued. Do not worry about payroll taxes; Temp Services Inc. will handle these. c. Make the necessary adjusting entries for one month's depreciation (the van, the refrigerator and the computer equipment using Straight Line Depreciation). Make it one journal entry by debiting Depreciation Expense and crediting all the other Accumulated Depreciation accounts d. One month of the prepaid insurance has expired. e Accrue one month of interest expense on the note for the Wells Fargo Bank note. f. One month of the prepaid rent has expired & $25 of prepaid advertising remains on hand h. The payment and interest on the computer was done in transaction 127. Part Three Requirements Make a spreadsheet in Excel for each T-account in the Chart of Accounts. As you write each journal and adjusting journal entry make sure that you enter it into the T-Account. After all entries have been made calculate the ending balance in each account. Once all balances are prepared then enter the balances of each account into Blackboard by first entering Dror Cr then the dollar amount. See the following example. You do NOT need to write the transaction or account number. Dr $1,000.00 or Cr $1,000.00 if no balance write Dr $0.00 or Cr$0.00 Part Four Requirements 1. Correct Errors: Correct any errors that you made on the journal entries and T-Accounts in Part I, I and III Both the debits and the credits should equal each other. 2. Bank Reconciliation: Using the cash balance per books (see the amount on Part Ill of the T- Accounts for the cash account) and the bank statement ending balance, prepare a bank reconciliation. This should be prepared using Excel and must contain the proper heading as well as the reconciliation information. Note: Assume that any errors are made by the bank. 3. Record Bank Reconciliation Adjustments: After you have prepared the bank reconciliation you must make any adjustments to your cash account by recording the journal entry on the Excel spreadsheet with the bank reconciliation and then entering it in the general journal of the practice set so that the general ledger cash account agrees with the bank reconciliation. 7 Page