Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I just need the answer immediately for 5.5 B 2. FICF b. Prepare a single-step income statement. Calculate gross profit margin and profit the results.

I just need the answer immediately for 5.5 B

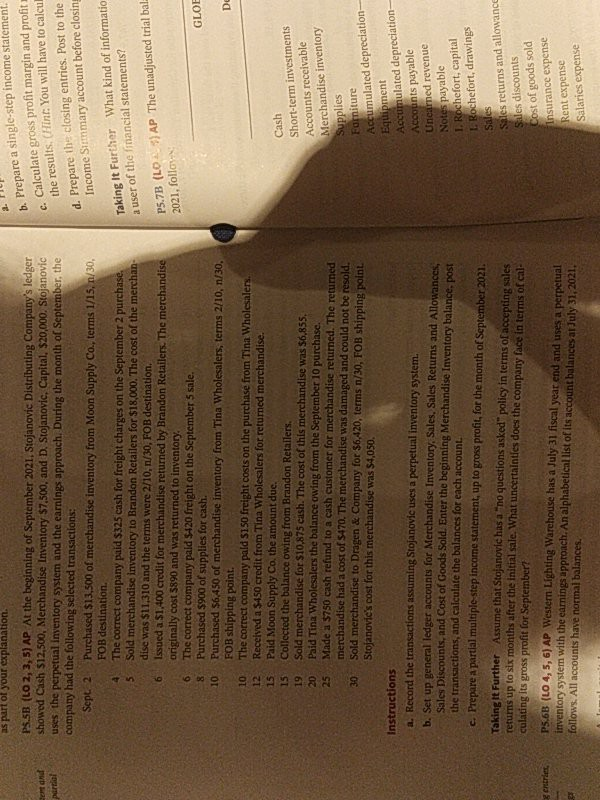

2. FICF b. Prepare a single-step income statement. Calculate gross profit margin and profit the results. (Hint: You will have to calcul d. Prepare the closing entries. Post to the Income Summary account before closing Bert and partial Taking It Further What kind of informatio a user of the mancial statements? P5.7B (L043) AP The unadjusted trial bal. 2021, follow GLOE as part of your explanation P5.5B (LO 2, 3, 5) AP At the beginning of September 2021. Stojanovic Distributing Company's ledger showed Cash $12.500, Merchandise Inventory $7.500, and D. Stojanovic, Capital, $20,000. Stojanovic uses the perpetual inventory system and the earnings approach. During the month of September, the company had the following selected transactions: Sept.2 Purchased $13.500 of merchandise inventory from Moon Supply Co., terms 1/15, n/30, FOB destination. The correct company paid $325 cash for freight charges on the September 2 purchase. 5 Sold merchandise inventory to Brandon Retailers for $18,000. The cost of the merchan dise was $11.310 and the terms were 2/10,n/30, FOB destination. Issued a $1.400 credit for merchandise returned by Brandon Retailers. The merchandise originally cost 3890 and was returned to inventory. 6 The correct company paid 5420 freight on the September 5 sale. 8 Purchased $900 of supplies for cash. 10 Purchased $6,450 of merchandise inventory from Tina Wholesalers, terms 2/10, n/30. FOB shipping point 10 The correct company pald 5150 freight costs on the purchase from Tina Wholesalers. 12 Received a $450 credit from Tina Wholesalers for returned merchandise. 15 Paid Moon Supply Co the amount due. 15 Collected the balance owing from Brandon Retailers. 19 Sold merchandise for $10,875 cash. The cost of this merchandise was 56,855. 20 Paid Tina Wholesalers the balance owing from the September 10 purchase. 25 Made a 3750 cash refund to a cash customer for merchandise returned. The returned merchandise had a cost of 5470. The merchandise was damaged and could not be resold. 30 Sold merchandise to Dragen & Company for $6.420, terms n/30, FOB shipping point Stojanovic's cost for this merchandise was $4,050. Instructions a. Record the transactions assuming Stojanovic uses a perpetual inventory system. b. Set up general ledger accounts for Merchandise Inventory, Sales, Sales Returns and Allowances, Sales Discounts, and cost of Goods Sold. Enter the beginning Merchandise Inventory balance, post the transactions, and calculate the balances for each account. c. Prepare a partial multiple step income statement, up to gross profit, for the month of September 2021. Taking it. Further Assume that Stojanovic has a "no questions asked" policy in terms of accepting sales returns up to six months after the initial sale. What uncertainties does the company face in terms of cal- culating its gross profit for September? Cash Short-term investments Accounts receivable Merchandise inventory Supplies Forniture Accumulated depreciation- Equipment Accumulated depreciation- Accounts payable Unearned revenue Notes payable I. Rochefort, capital 1. Rochefort, drawings Sales Sales returns and allowance Sales discounts Cost of goods sold Insurance expense Rent expense Salaries expense genere. P5.6B (L04, 5, 6) AP Western Lighting Warehouse has a July 31 fiscal year end and uses a perpetual inventory system with the earnings approach. An alphabetical list of its account balances al July 31, 2021 follows. All accounts have normal balancesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started