Answered step by step

Verified Expert Solution

Question

1 Approved Answer

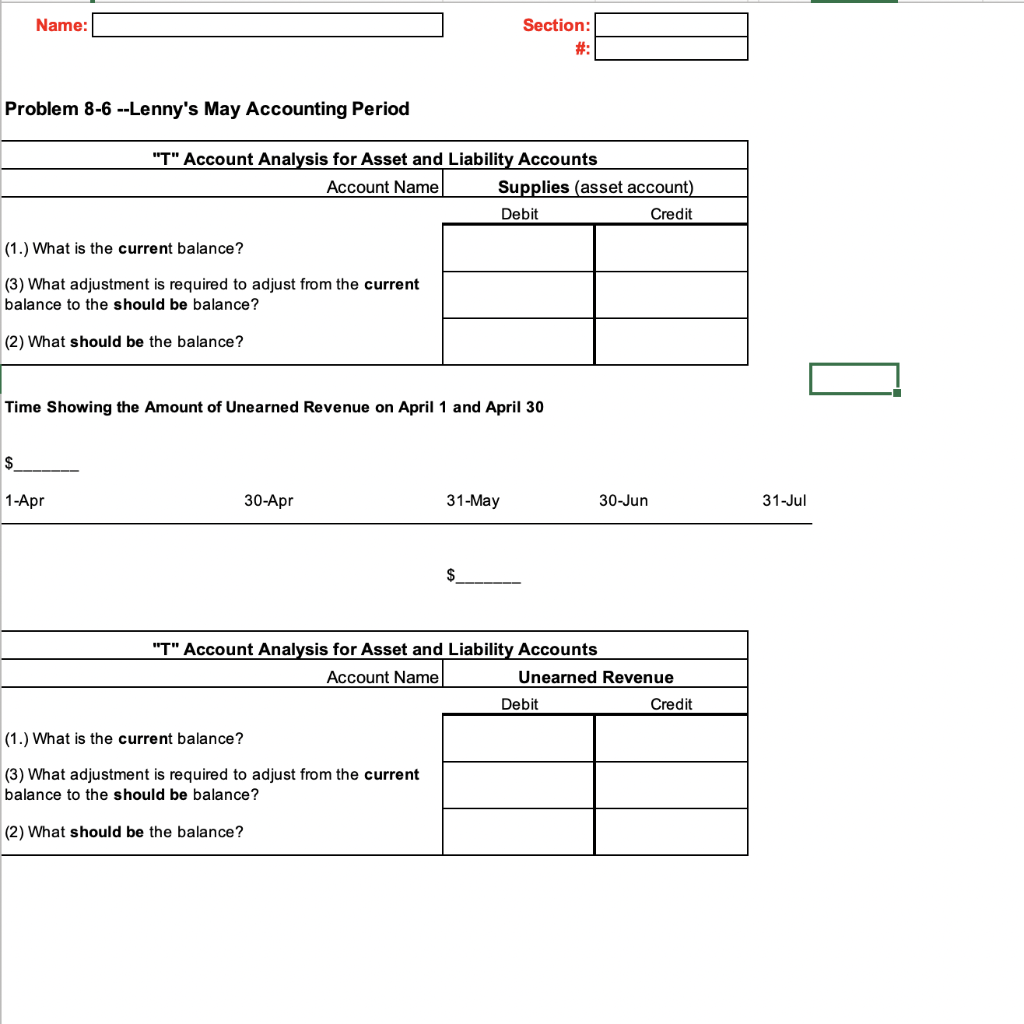

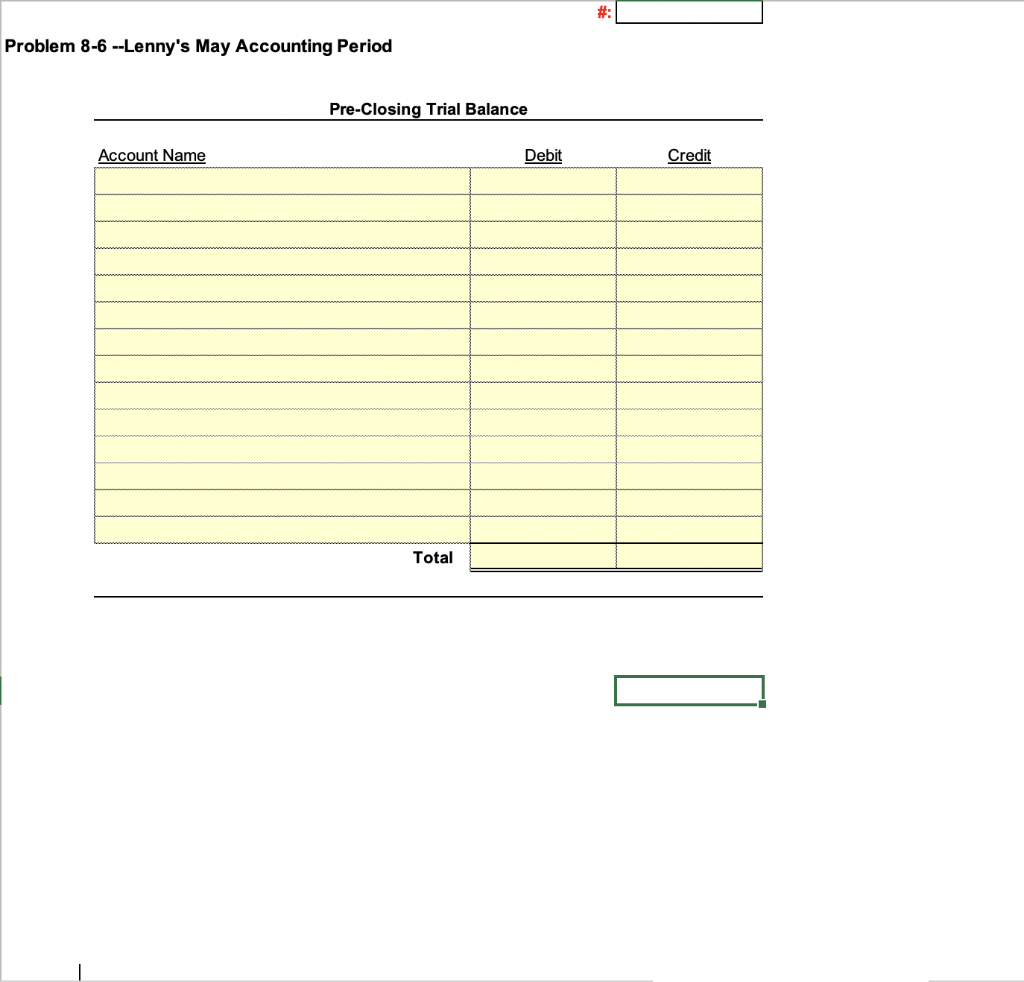

I just need the answers to these last two forms. thank you. 102 SOLID FOOTING Chapter 8 - Adjusting Entries Continued LENNY'S MAY TRANSACTIONS You

I just need the answers to these last two forms. thank you.

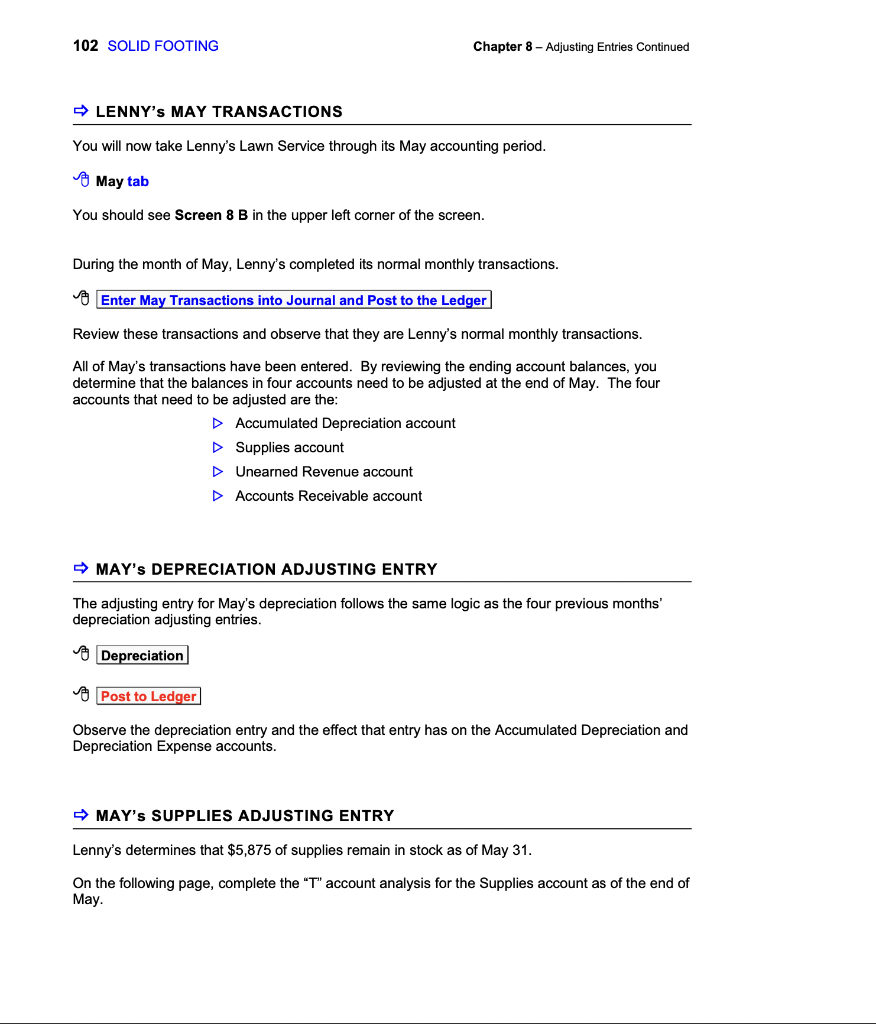

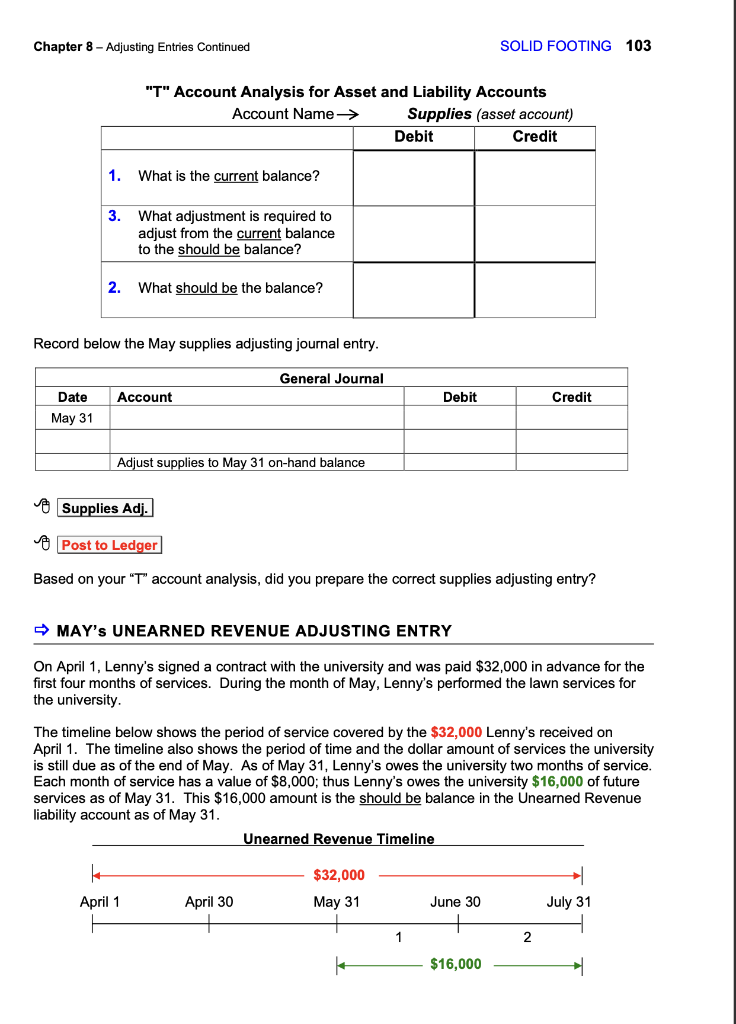

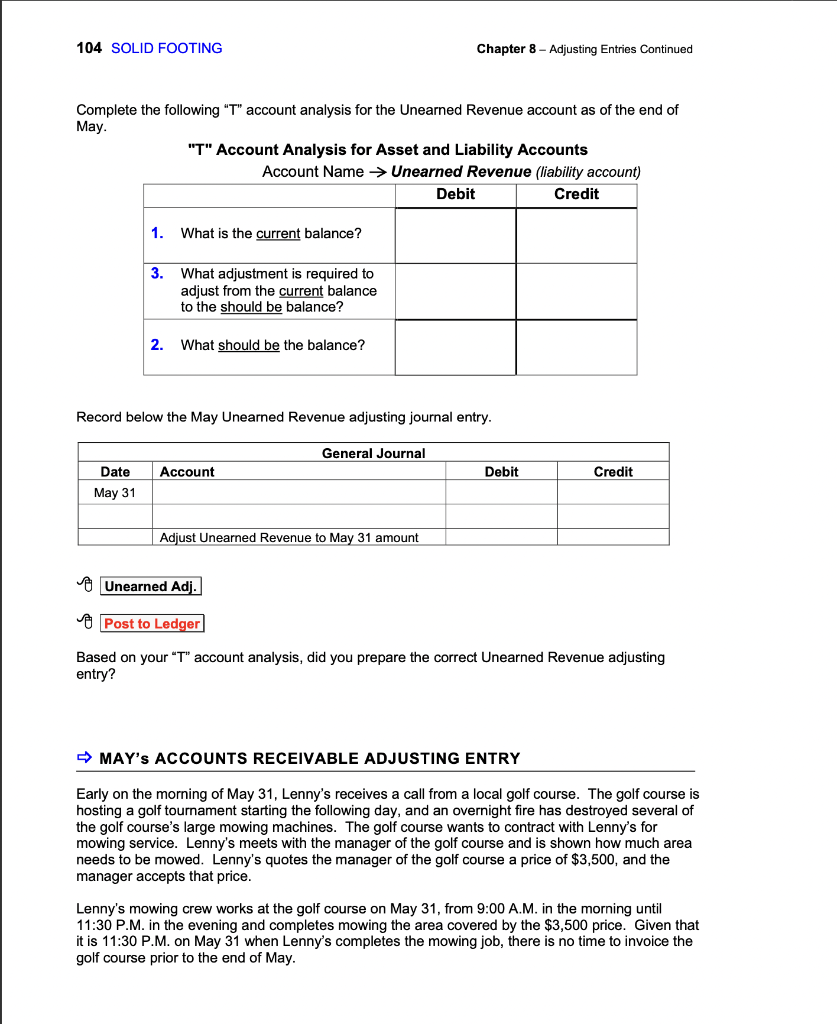

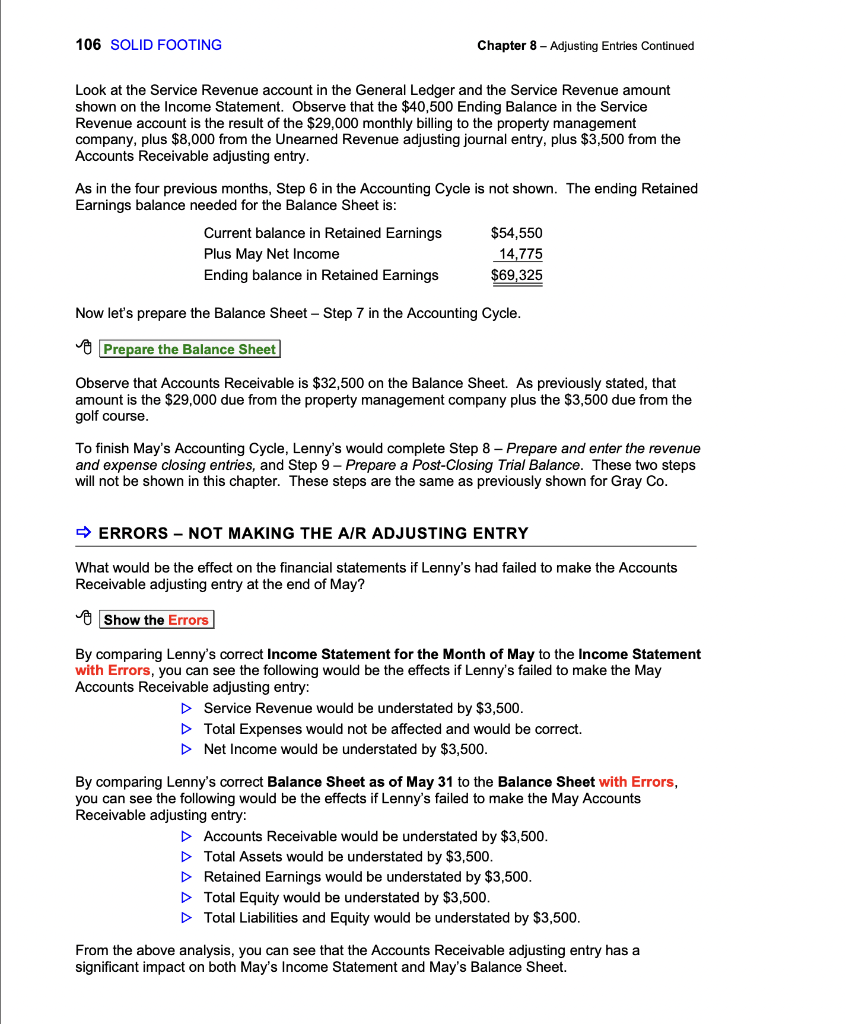

102 SOLID FOOTING Chapter 8 - Adjusting Entries Continued LENNY'S MAY TRANSACTIONS You will now take Lenny's Lawn Service through its May accounting period. May tab You should see Screen 8 B in the upper left corner of the screen. During the month of May, Lenny's completed its normal monthly transactions. Enter May Transactions into Journal and Post to the Ledger Review these transactions and observe that they are Lenny's normal monthly transactions. All of May's transactions have been entered. By reviewing the ending account balances, you determine that the balances in four accounts need to be adjusted at the end of May. The four accounts that need to be adjusted are the: Accumulated Depreciation account Supplies account Unearned Revenue account Accounts Receivable account MAY'S DEPRECIATION ADJUSTING ENTRY The adjusting entry for May's depreciation follows the same logic as the four previous months' depreciation adjusting entries. Depreciation Post to Ledger Observe the depreciation entry and the effect that entry has on the Accumulated Depreciation and Depreciation Expense accounts. MAY'S SUPPLIES ADJUSTING ENTRY Lenny's determines that $5,875 of supplies remain in stock as of May 31. On the following page, complete the "T" account analysis for the Supplies account as of the end of May. Chapter 8 - Adjusting Entries Continued Date May 31 1. What is the current balance? "T" Account Analysis for Asset and Liability Accounts Account Name Supplies (asset account) Debit Credit 3. What adjustment is required to adjust from the current balance to the should be balance? 2. What should be the balance? Record below the May supplies adjusting journal entry. General Journal Account Adjust supplies to May 31 on-hand balance 4 April 1 Supplies Adj. Post to Ledger Based on your "T" account analysis, did you prepare the correct supplies adjusting entry? MAY'S UNEARNED REVENUE ADJUSTING ENTRY On April 1, Lenny's signed a contract with the university and was paid $32,000 in advance for the first four months of services. During the month of May, Lenny's performed the lawn services for the university. April 30 Debit The timeline below shows the period of service covered by the $32,000 Lenny's received on April 1. The timeline also shows the period of time and the dollar amount of services the university is still due as of the end of May. As of May 31, Lenny's owes the university two months of service. Each month of service has value of $8,000; thus Lenny's owes the university $16,000 of future services as of May 31. This $16,000 amount is the should be balance in the Unearned Revenue liability account as of May 31. Unearned Revenue Timeline $32,000 May 31 SOLID FOOTING 103 1 June 30 Credit $16,000 2 July 31 104 SOLID FOOTING Complete the following "T" account analysis for the Unearned Revenue account as of the end of May. Date May 31 "T" Account Analysis for Asset and Liability Accounts 1. What is the current balance? Account Name Unearned Revenue (liability account) Debit Credit 3. What adjustment is required to adjust from the current balance to the should be balance? 2. What should be the balance? Chapter 8 - Adjusting Entries Continued Record below the May Unearned Revenue adjusting journal entry. Account General Journal Adjust Unearned Revenue to May 31 amount Debit Credit Unearned Adj. Post to Ledger Based on your "T" account analysis, did you prepare the correct Unearned Revenue adjusting entry? MAY'S ACCOUNTS RECEIVABLE ADJUSTING ENTRY Early on the morning of May 31, Lenny's receives a call from a local golf course. The golf course is hosting a golf tournament starting the following day, and an overnight fire has destroyed several of the golf course's large mowing machines. The golf course wants to contract with Lenny's for mowing service. Lenny's meets with the manager of the golf course and is shown how much area needs to be mowed. Lenny's quotes the manager of the golf course a price of $3,500, and the manager accepts that price. Lenny's mowing crew works at the golf course on May 31, from 9:00 A.M. in the morning until 11:30 P.M. in the evening and completes mowing the area covered by the $3,500 price. Given that it is 11:30 P.M. on May 31 when Lenny's completes the mowing job, there is no time to invoice the golf course prior to the end of May. 106 SOLID FOOTING Chapter 8 - Adjusting Entries Continued Look at the Service Revenue account in the General Ledger and the Service Revenue amount shown on the Income Statement. Observe that the $40,500 Ending Balance in the Service Revenue account is the result of the $29,000 monthly billing to the property management company, plus $8,000 from the Unearned Revenue adjusting journal entry, plus $3,500 from the Accounts Receivable adjusting entry. As in the four previous months, Step 6 in the Accounting Cycle is not shown. The ending Retained Earnings balance needed for the Balance Sheet is: Current balance in Retained Earnings Plus May Net Income Ending balance in Retained Earnings $54,550 14,775 $69,325 Now let's prepare the Balance Sheet - Step 7 in the Accounting Cycle. Prepare the Balance Sheet Observe that Accounts Receivable is $32,500 on the Balance Sheet. As previously stated, that amount is the $29,000 due from the property management company plus the $3,500 due from the golf course. To finish May's Accounting Cycle, Lenny's would complete Step 8 - Prepare and enter the revenue and expense closing entries, and Step 9 - Prepare a Post-Closing Trial Balance. These two steps will not be shown in this chapter. These steps are the same as previously shown for Gray Co. ERRORS - NOT MAKING THE A/R ADJUSTING ENTRY What would be the effect on the financial statements if Lenny's had failed to make the Accounts Receivable adjusting entry at the end of May? Show the Errors By comparing Lenny's correct Income Statement for the Month of May to the Income Statement with Errors, you can see the following would be the effects if Lenny's failed to make the May Accounts Receivable adjusting entry: Service Revenue would be understated by $3,500. Total Expenses would not be affected and would be correct. Net Income would be understated by $3,500. By comparing Lenny's correct Balance Sheet as of May 31 to the Balance Sheet with Errors, you can see the following would be the effects if Lenny's failed to make the May Accounts Receivable adjusting entry: Accounts Receivable would be understated by $3,500. Total Assets would be understated by $3,500. Retained Earnings would be understated by $3,500. Total Equity would be understated by $3,500. Total Liabilities and Equity would be understated by $3,500. From the above analysis, you can see that the Accounts Receivable adjusting entry has a significant impact on both May's Income Statement and May's Balance Sheet. Name: Problem 8-6--Lenny's May Accounting Period (1.) What is the current balance? (3) What adjustment is required to adjust from the current balance to the should be balance? (2) What should be the balance? "T" Account Analysis for Asset and Liability Accounts Account Name 1-Apr Time Showing the Amount of Unearned Revenue on April 1 and April 30 30-Apr Section: #: (1.) What is the current balance? (3) What adjustment is required to adjust from the current balance to the should be balance? (2) What should be the balance? Supplies (asset account) Credit Debit 31-May $ "T" Account Analysis for Asset and Liability Accounts Account Name 30-Jun Unearned Revenue Debit Credit 31-Jul Problem 8-6 --Lenny's May Accounting Period Account Name Pre-Closing Trial Balance Total Debit Credit 102 SOLID FOOTING Chapter 8 - Adjusting Entries Continued LENNY'S MAY TRANSACTIONS You will now take Lenny's Lawn Service through its May accounting period. May tab You should see Screen 8 B in the upper left corner of the screen. During the month of May, Lenny's completed its normal monthly transactions. Enter May Transactions into Journal and Post to the Ledger Review these transactions and observe that they are Lenny's normal monthly transactions. All of May's transactions have been entered. By reviewing the ending account balances, you determine that the balances in four accounts need to be adjusted at the end of May. The four accounts that need to be adjusted are the: Accumulated Depreciation account Supplies account Unearned Revenue account Accounts Receivable account MAY'S DEPRECIATION ADJUSTING ENTRY The adjusting entry for May's depreciation follows the same logic as the four previous months' depreciation adjusting entries. Depreciation Post to Ledger Observe the depreciation entry and the effect that entry has on the Accumulated Depreciation and Depreciation Expense accounts. MAY'S SUPPLIES ADJUSTING ENTRY Lenny's determines that $5,875 of supplies remain in stock as of May 31. On the following page, complete the "T" account analysis for the Supplies account as of the end of May. Chapter 8 - Adjusting Entries Continued Date May 31 1. What is the current balance? "T" Account Analysis for Asset and Liability Accounts Account Name Supplies (asset account) Debit Credit 3. What adjustment is required to adjust from the current balance to the should be balance? 2. What should be the balance? Record below the May supplies adjusting journal entry. General Journal Account Adjust supplies to May 31 on-hand balance 4 April 1 Supplies Adj. Post to Ledger Based on your "T" account analysis, did you prepare the correct supplies adjusting entry? MAY'S UNEARNED REVENUE ADJUSTING ENTRY On April 1, Lenny's signed a contract with the university and was paid $32,000 in advance for the first four months of services. During the month of May, Lenny's performed the lawn services for the university. April 30 Debit The timeline below shows the period of service covered by the $32,000 Lenny's received on April 1. The timeline also shows the period of time and the dollar amount of services the university is still due as of the end of May. As of May 31, Lenny's owes the university two months of service. Each month of service has value of $8,000; thus Lenny's owes the university $16,000 of future services as of May 31. This $16,000 amount is the should be balance in the Unearned Revenue liability account as of May 31. Unearned Revenue Timeline $32,000 May 31 SOLID FOOTING 103 1 June 30 Credit $16,000 2 July 31 104 SOLID FOOTING Complete the following "T" account analysis for the Unearned Revenue account as of the end of May. Date May 31 "T" Account Analysis for Asset and Liability Accounts 1. What is the current balance? Account Name Unearned Revenue (liability account) Debit Credit 3. What adjustment is required to adjust from the current balance to the should be balance? 2. What should be the balance? Chapter 8 - Adjusting Entries Continued Record below the May Unearned Revenue adjusting journal entry. Account General Journal Adjust Unearned Revenue to May 31 amount Debit Credit Unearned Adj. Post to Ledger Based on your "T" account analysis, did you prepare the correct Unearned Revenue adjusting entry? MAY'S ACCOUNTS RECEIVABLE ADJUSTING ENTRY Early on the morning of May 31, Lenny's receives a call from a local golf course. The golf course is hosting a golf tournament starting the following day, and an overnight fire has destroyed several of the golf course's large mowing machines. The golf course wants to contract with Lenny's for mowing service. Lenny's meets with the manager of the golf course and is shown how much area needs to be mowed. Lenny's quotes the manager of the golf course a price of $3,500, and the manager accepts that price. Lenny's mowing crew works at the golf course on May 31, from 9:00 A.M. in the morning until 11:30 P.M. in the evening and completes mowing the area covered by the $3,500 price. Given that it is 11:30 P.M. on May 31 when Lenny's completes the mowing job, there is no time to invoice the golf course prior to the end of May. 106 SOLID FOOTING Chapter 8 - Adjusting Entries Continued Look at the Service Revenue account in the General Ledger and the Service Revenue amount shown on the Income Statement. Observe that the $40,500 Ending Balance in the Service Revenue account is the result of the $29,000 monthly billing to the property management company, plus $8,000 from the Unearned Revenue adjusting journal entry, plus $3,500 from the Accounts Receivable adjusting entry. As in the four previous months, Step 6 in the Accounting Cycle is not shown. The ending Retained Earnings balance needed for the Balance Sheet is: Current balance in Retained Earnings Plus May Net Income Ending balance in Retained Earnings $54,550 14,775 $69,325 Now let's prepare the Balance Sheet - Step 7 in the Accounting Cycle. Prepare the Balance Sheet Observe that Accounts Receivable is $32,500 on the Balance Sheet. As previously stated, that amount is the $29,000 due from the property management company plus the $3,500 due from the golf course. To finish May's Accounting Cycle, Lenny's would complete Step 8 - Prepare and enter the revenue and expense closing entries, and Step 9 - Prepare a Post-Closing Trial Balance. These two steps will not be shown in this chapter. These steps are the same as previously shown for Gray Co. ERRORS - NOT MAKING THE A/R ADJUSTING ENTRY What would be the effect on the financial statements if Lenny's had failed to make the Accounts Receivable adjusting entry at the end of May? Show the Errors By comparing Lenny's correct Income Statement for the Month of May to the Income Statement with Errors, you can see the following would be the effects if Lenny's failed to make the May Accounts Receivable adjusting entry: Service Revenue would be understated by $3,500. Total Expenses would not be affected and would be correct. Net Income would be understated by $3,500. By comparing Lenny's correct Balance Sheet as of May 31 to the Balance Sheet with Errors, you can see the following would be the effects if Lenny's failed to make the May Accounts Receivable adjusting entry: Accounts Receivable would be understated by $3,500. Total Assets would be understated by $3,500. Retained Earnings would be understated by $3,500. Total Equity would be understated by $3,500. Total Liabilities and Equity would be understated by $3,500. From the above analysis, you can see that the Accounts Receivable adjusting entry has a significant impact on both May's Income Statement and May's Balance Sheet. Name: Problem 8-6--Lenny's May Accounting Period (1.) What is the current balance? (3) What adjustment is required to adjust from the current balance to the should be balance? (2) What should be the balance? "T" Account Analysis for Asset and Liability Accounts Account Name 1-Apr Time Showing the Amount of Unearned Revenue on April 1 and April 30 30-Apr Section: #: (1.) What is the current balance? (3) What adjustment is required to adjust from the current balance to the should be balance? (2) What should be the balance? Supplies (asset account) Credit Debit 31-May $ "T" Account Analysis for Asset and Liability Accounts Account Name 30-Jun Unearned Revenue Debit Credit 31-Jul Problem 8-6 --Lenny's May Accounting Period Account Name Pre-Closing Trial Balance Total Debit CreditStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started